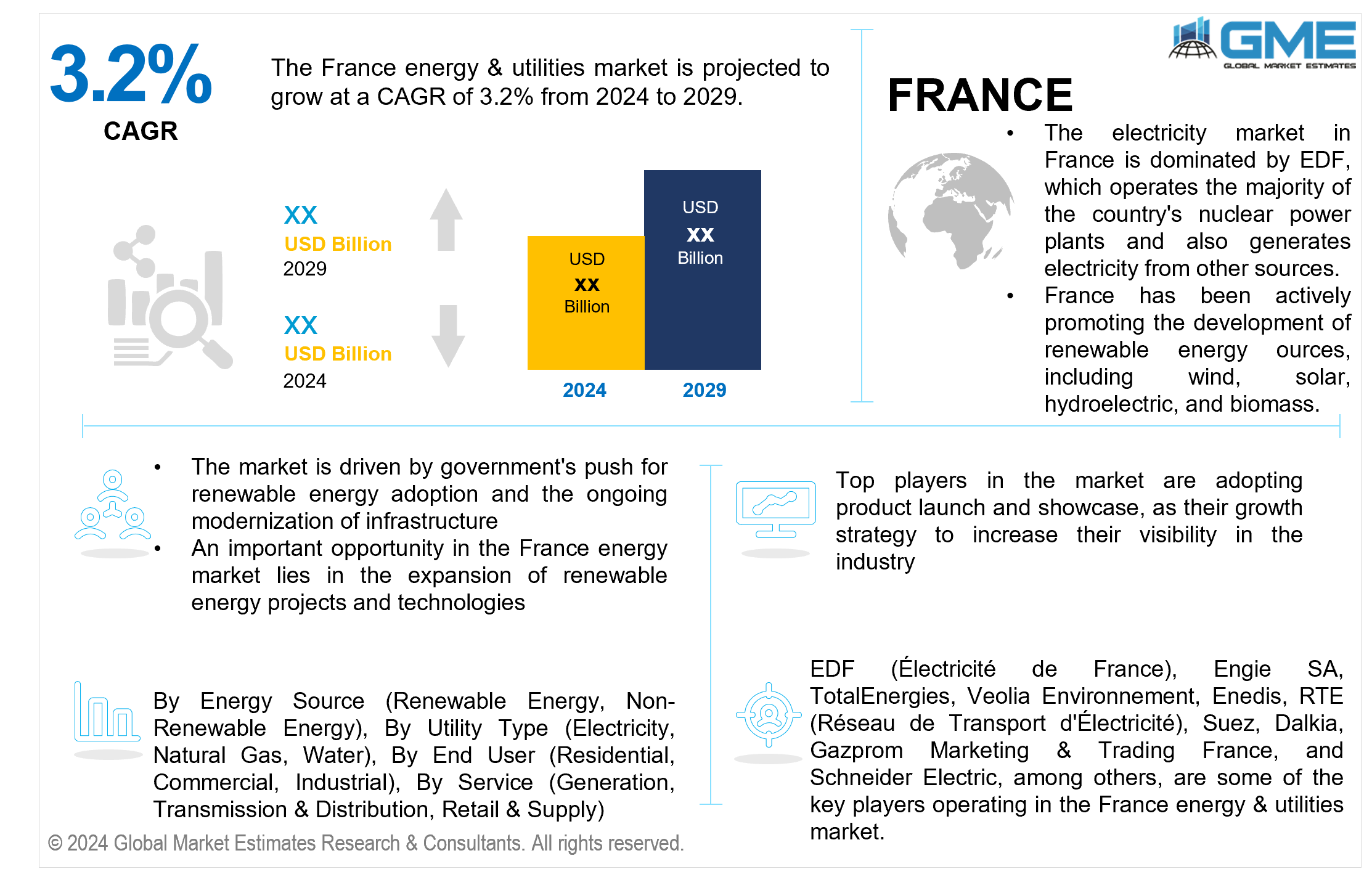

France Energy & Utilities Market Size, Trends & Analysis - Forecasts to 2029 By Energy Source (Renewable Energy and Non-Renewable Energy), By Utility Type (Electricity, Natural Gas, and Water), By End User (Residential, Commercial, and Industrial), By Service (Generation, Transmission & Distribution, and Retail & Supply), Competitive Landscape, Company Market Share Analysis, and End User Analysis

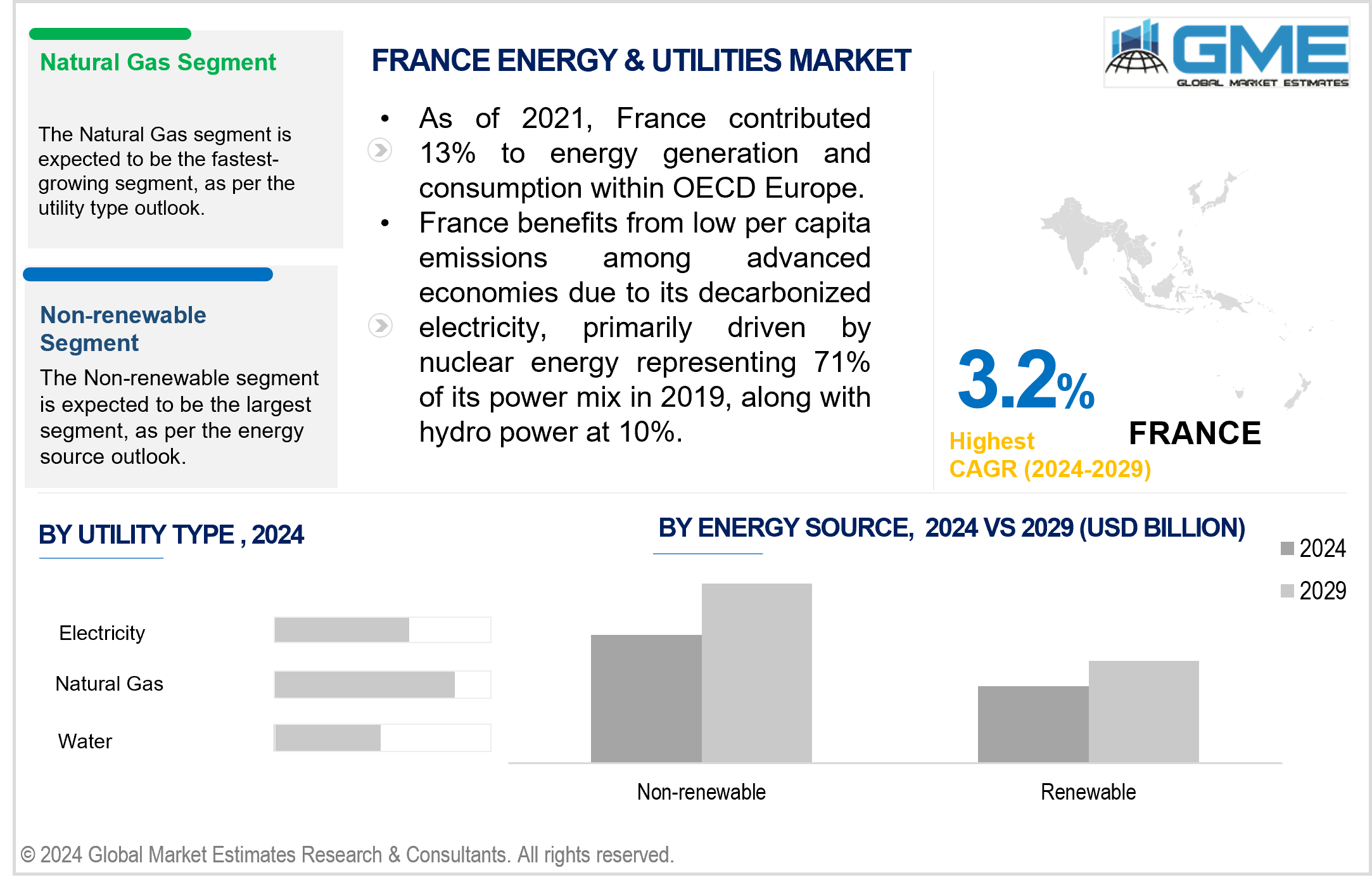

The France energy & utilities market is projected to grow at a CAGR of 3.2% from 2024 to 2029. France has a varied energy portfolio, emphasizing nuclear power, renewables, and natural gas. As of 2021, France contributed 13% to energy generation and consumption within OECD Europe. France benefits from low per capita emissions among advanced economies due to its decarbonized electricity, primarily driven by nuclear energy, which represented 71% of its power mix in 2019, along with hydropower, at 10%.

The market is driven by the government's push for renewable energy adoption and the ongoing modernization of infrastructure. The French government aims to accelerate the transition towards renewables like wind, solar, hydroelectric, and biomass through various policies, incentives, and regulatory measures. Infrastructure upgrades encompass various aspects, including grid enhancements, smart meter installations, and the development of energy storage solutions. These efforts are essential for optimizing the efficiency, reliability, and resilience of the energy system, thus meeting evolving consumer needs and accommodating the integration of renewable energy sources into the grid. An important opportunity in the France energy market lies in expanding renewable energy projects and technologies. As the country aims to reduce its dependence on fossil fuels and nuclear power, there is a growing demand for investments in renewable energy infrastructure.

A notable restraint in this transition is balancing energy security with the shift towards cleaner sources, particularly considering France's significant reliance on nuclear power. While nuclear energy has helped France achieve a relatively low-carbon electricity sector, concerns about safety, nuclear waste management, and reactor lifespan pose challenges.

Based on energy source, the market is segmented into renewable energy and non-renewable energy. The non-renewable segment is expected to hold the largest share of the market over the forecast period. France has historically relied heavily on nuclear power for electricity generation, with nuclear energy accounting for a significant portion of its energy mix. The non-renewable segment encompasses traditional energy sources such as coal and oil, which still play a role in certain industries and applications despite efforts to phase them out due to environmental concerns.

The renewable segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The government has implemented various policies, incentives, and regulations to promote the development and deployment of renewable energy technologies. This includes subsidies, feed-in tariffs, tax incentives, and renewable energy targets, all aimed at accelerating the transition away from fossil fuels and nuclear power towards cleaner and more sustainable energy sources.

Based on utility type, the market is segmented into electricity, natural gas, and water. The electricity segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The electricity market in France is dominated by EDF (Électricité de France S.A.), which operates the majority of the country's nuclear power plants and also generates electricity from other sources. However, there have been efforts to liberalize the market and introduce more competition. This has led to the emergence of alternative electricity providers and greater opportunities for consumers to choose their electricity suppliers.

The natural gas segment is expected to hold the largest share of the market. Natural gas plays a significant role in France's energy supply, both for electricity generation and heating. The country imports a substantial portion of its natural gas, with pipelines from neighbouring countries and liquefied natural gas (LNG) terminals facilitating supply. Engie, one of the largest energy companies in France, is heavily involved in the natural gas sector.

Based on end user, the market is segmented into residential, commercial, and industrial. The residential segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This can be attributed to its size, encompassing many households nationwide. With households relying on energy for essential daily activities such as heating, cooling, cooking, and lighting, the demand for energy in the residential sector remains consistently high. This consistent energy consumption for fundamental living needs solidifies the residential segment's position as the dominant force in the market.

The commercial segment is expected to hold the largest share of the market. This surge is fueled by escalating energy requirements from businesses as they expand their operations. Moreover, the adoption of energy-efficient technologies within commercial establishments further accelerates this trend. These factors collectively contribute to the commercial sector emerging as the fastest-growing segment in the market.

Based on service, the market is segmented into generation, transmission & distribution, and retail & supply. The transmission & distribution segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This segment comprises the extensive infrastructure and networks responsible for efficiently transmitting electricity from power generation facilities to various locations and distributing it to end-users such as residential, commercial, and industrial consumers throughout the country. This infrastructure is critical for ensuring a reliable and stable electricity supply to meet the diverse energy needs of consumers and businesses across different regions of France.

The retail & supply segment is expected to hold the largest share of the market. Consumers' increasing adoption of renewable energy options, driven by environmental concerns and government incentives, further fuels the growth of this segment. As consumers seek more sustainable and eco-friendly energy solutions, retailers are diversifying their offerings to include renewable energy products and services, thus driving the expansion of the retail & supply segment.

EDF (Électricité de France), Engie SA, TotalEnergies, Veolia Environnement, Enedis, RTE (Réseau de Transport d'Électricité), Suez, Dalkia, Gazprom Marketing & Trading France, and Schneider Electric, among others, are some of the key players operating in the France energy & utilities market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, EDF Group and Morrison formed a strategic partnership to invest in the development of ultra-fast charging for electric vehicles. This platform aims to invest up to 450 million euros (USD 487 million) to build and deploy nearly 8,000 ultra-fast charging points across France by 2030.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 FRANCE MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 FRANCE ENERGY & UTILITIES MARKET, BY ENERGY SOURCE

4.1 Introduction

4.2 Energy & Utilities Market: Energy Source Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Renewable Resourcess

4.4.1 Renewable Resourcess Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Non-renewable Resources

4.5.1 Non-renewable Resources Market Estimates and Forecast, 2021-2029 (USD Million)

5 FRANCE ENERGY & UTILITIES MARKET, BY UTILITY TYPE

5.1 Introduction

5.2 Energy & Utilities Market: Utility Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Electricity

5.4.1 Electricity Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Natural Gas

5.5.1 Natural Gas Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Water

5.6.1 Water Market Estimates and Forecast, 2021-2029 (USD Million)

6 FRANCE ENERGY & UTILITIES MARKET, BY END USER

6.1 Introduction

6.2 Energy & Utilities Market: End User Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Residential

6.4.1 Residential Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Commercial

6.5.1 Commercial Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Industrial

6.6.1 Industrial Market Estimates and Forecast, 2021-2029 (USD Million)

7 FRANCE ENERGY & UTILITIES MARKET, BY SERVICE

7.1 Introduction

7.2 Energy & Utilities Market: Service Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Generation

7.4.1 Generation Market Estimates and Forecast, 2021-2029 (USD Million)

7.5 Transmission & Distribution

7.5.1 Transmission & Distribution Market Estimates and Forecast, 2021-2029 (USD Million)

7.6 Retail & Supply

7.6.1 Retail & Supply Market Estimates and Forecast, 2021-2029 (USD Million)

8 FRANCE ENERGY & UTILITIES MARKET, BY COUNTRY

8.1 Introduction

8.2 France Energy & Utilities Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.1 By Energy Source

8.2.2 By Utility Type

8.2.3 By End User

8.2.4 By Service

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 France

9.4 Company Profiles

9.4.1 EDF (Électricité de France)

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 ENGIE SA

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 TotalEnergies

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Veolia Environnement

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Enedis

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 RTE (RÉSEAU DE TRANSPORT D’ÉLECTRICITÉ)

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Suez

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Dalkia

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 GAZPROM MARKETING & TRADING FRANCE

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Schneider Electric

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Cognizantmation Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 France Energy & Utilities Market, By Energy Source, 2021-2029 (USD Million)

2 Renewable Resourcess Market, By Region, 2021-2029 (USD Million)

3 Non-renewable Resources Market, By Region, 2021-2029 (USD Million)

4 France Energy & Utilities Market, By Utility Type, 2021-2029 (USD Million)

5 Electricity Market, By Region, 2021-2029 (USD Million)

6 Natural Gas Market, By Region, 2021-2029 (USD Million)

7 Water Market, By Region, 2021-2029 (USD Million)

8 France Energy & Utilities Market, By End User, 2021-2029 (USD Million)

9 Residential Market, By Region, 2021-2029 (USD Million)

10 Commercial Market, By Region, 2021-2029 (USD Million)

11 Industrial Market, By Region, 2021-2029 (USD Million)

12 France Energy & Utilities Market, By Service, 2021-2029 (USD Million)

13 Generation Market, By Region, 2021-2029 (USD Million)

14 TRANSMISSION & DISTRIBUTION Market, By Region, 2021-2029 (USD Million)

15 Retail & Supply Market, By Region, 2021-2029 (USD Million)

16 Regional Analysis, 2021-2029 (USD Million)

17 France Energy & Utilities Market, By Energy Source, 2021-2029 (USD Million)

18 France Energy & Utilities Market, By Utility Type, 2021-2029 (USD Million)

19 France Energy & Utilities Market, By End User, 2021-2029 (USD Million)

20 France Energy & Utilities Market, By Service, 2021-2029 (USD Million)

21 EDF (Électricité de France): Products & Services Offering

22 ENGIE SA: Products & Services Offering

23 TotalEnergies: Products & Services Offering

24 Veolia Environnement: Products & Services Offering

25 Enedis: Products & Services Offering

26 RTE (RÉSEAU DE TRANSPORT D’ÉLECTRICITÉ): Products & Services Offering

27 Suez: Products & Services Offering

28 Dalkia: Products & Services Offering

29 GAZPROM MARKETING & TRADING FRANCE: Products & Services Offering

30 Schneider Electric: Products & Services Offering

LIST OF FIGURES

1 France Energy & Utilities Market Overview

2 France Energy & Utilities Market Value From 2021-2029 (USD Million)

3 France Energy & Utilities Market Share, By Energy Source (2023)

4 France Energy & Utilities Market Share, By Utility Type (2023)

5 France Energy & Utilities Market Share, By End User (2023)

6 France Energy & Utilities Market Share, By Service (2023)

7 France Energy & Utilities Market, By Region (Asia Pacific Market)

8 Technological Trends In France Energy & Utilities Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The France Energy & Utilities Market

12 Impact Of Challenges On The France Energy & Utilities Market

13 Porter’s Five Forces Analysis

14 France Energy & Utilities Market: By Energy Source Scope Key Takeaways

15 France Energy & Utilities Market, By Energy Source Segment: Revenue Growth Analysis

16 Renewable Resourcess Market, By Region, 2021-2029 (USD Million)

17 Non-renewable Resources Market, By Region, 2021-2029 (USD Million)

18 France Energy & Utilities Market: By Utility Type Scope Key Takeaways

19 France Energy & Utilities Market, By Utility Type Segment: Revenue Growth Analysis

20 Electricity Market, By Region, 2021-2029 (USD Million)

21 Natural Gas Market, By Region, 2021-2029 (USD Million)

22 Water Market, By Region, 2021-2029 (USD Million)

23 France Energy & Utilities Market: By End User Scope Key Takeaways

24 France Energy & Utilities Market, By End User Segment: Revenue Growth Analysis

25 Residential Market, By Region, 2021-2029 (USD Million)

26 Commercial Market, By Region, 2021-2029 (USD Million)

27 Industrial Market, By Region, 2021-2029 (USD Million)

28 Portable Medical Devices Market, By Region, 2021-2029 (USD Million)

29 France Energy & Utilities Market: By Service Scope Key Takeaways

30 France Energy & Utilities Market, By Service Segment: Revenue Growth Analysis

31 Generation Market, By Region, 2021-2029 (USD Million)

32 Transmission & Distribution Market, By Region, 2021-2029 (USD Million)

33 Retail & Supply Market, By Region, 2021-2029 (USD Million)

34 Regional Segment: Revenue Growth Analysis

35 France Energy & Utilities Market: Country Analysis

36 France Energy & Utilities Market Overview

37 France Energy & Utilities Market, By Energy Source

38 France Energy & Utilities Market, By Utility Type

39 France Energy & Utilities Market, By End User

40 France Energy & Utilities Market, By Service

41 Four Quadrant Positioning Matrix

42 Company Market Share Analysis

43 EDF (Électricité de France): Company Snapshot

44 EDF (Électricité de France): SWOT Analysis

45 EDF (Électricité de France): Geographic Presence

46 ENGIE SA: Company Snapshot

47 ENGIE SA: SWOT Analysis

48 ENGIE SA: Geographic Presence

49 TotalEnergies: Company Snapshot

50 TotalEnergies: SWOT Analysis

51 TotalEnergies: Geographic Presence

52 Veolia Environnement: Company Snapshot

53 Veolia Environnement: Swot Analysis

54 Veolia Environnement: Geographic Presence

55 Enedis: Company Snapshot

56 Enedis: SWOT Analysis

57 Enedis: Geographic Presence

58 RTE (RÉSEAU DE TRANSPORT D’ÉLECTRICITÉ): Company Snapshot

59 RTE (RÉSEAU DE TRANSPORT D’ÉLECTRICITÉ): SWOT Analysis

60 RTE (RÉSEAU DE TRANSPORT D’ÉLECTRICITÉ): Geographic Presence

61 Suez: Company Snapshot

62 Suez: SWOT Analysis

63 Suez: Geographic Presence

64 Dalkia: Company Snapshot

65 Dalkia: SWOT Analysis

66 Dalkia: Geographic Presence

67 GAZPROM MARKETING & TRADING FRANCE.: Company Snapshot

68 GAZPROM MARKETING & TRADING FRANCE.: SWOT Analysis

69 GAZPROM MARKETING & TRADING FRANCE.: Geographic Presence

70 Schneider Electric: Company Snapshot

71 Schneider Electric: SWOT Analysis

72 Schneider Electric: Geographic Presence

The France Energy & Utilities Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the France Energy & Utilities Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS