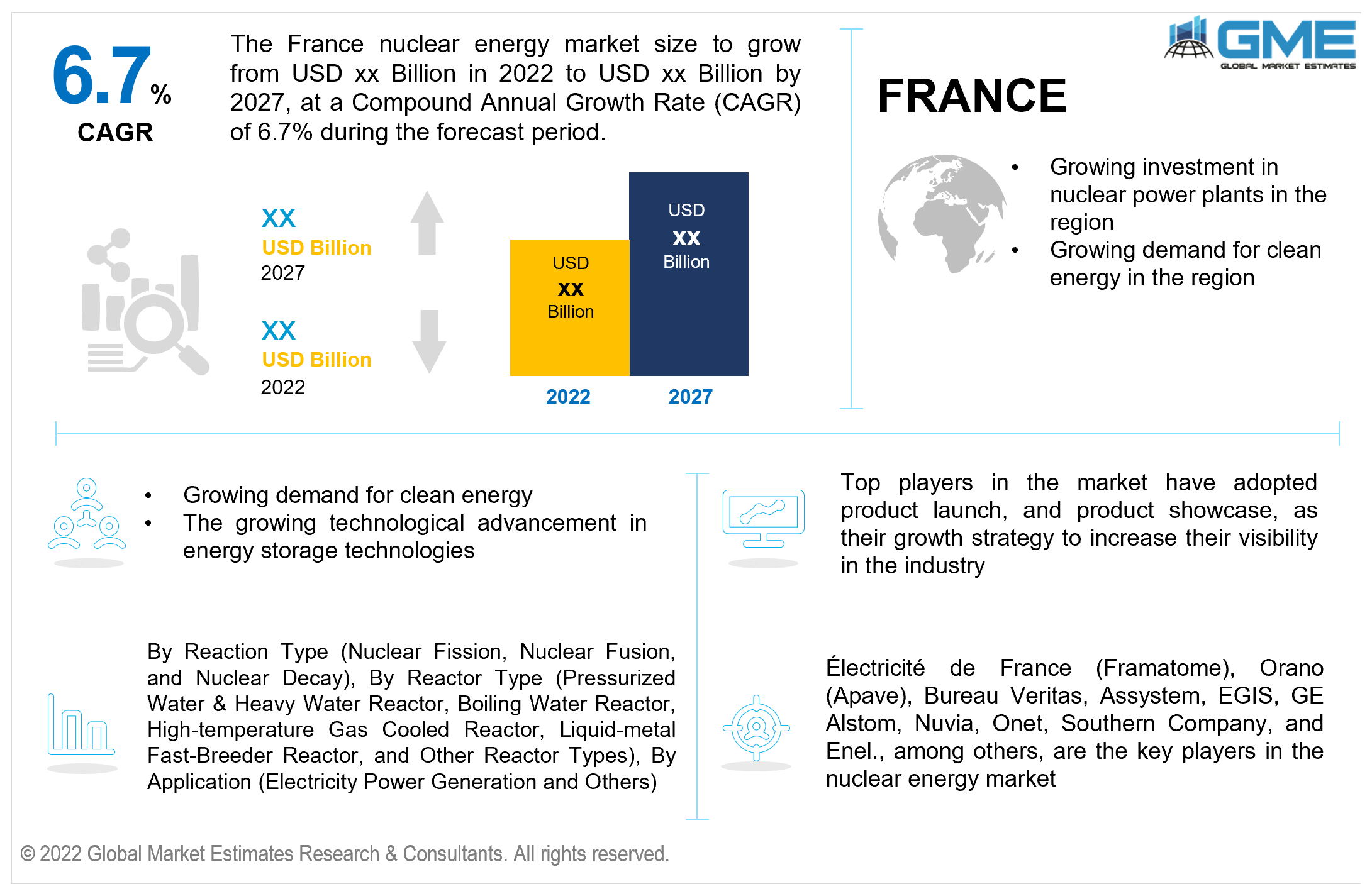

France Nuclear Energy Market Size, Trends & Analysis - Forecasts to 2027 By Reaction Type (Nuclear Fission, Nuclear Fusion, and Nuclear Decay), By Reactor Type (Pressurized Water & Heavy Water Reactor, Boiling Water Reactor, High-temperature Gas Cooled Reactor, Liquid-metal Fast-Breeder Reactor, and Other Reactor Types), By Application (Electricity Power Generation and Others), Company Market Share Analysis, and Competitor Analysis

The France Nuclear Energy Market is projected to grow at a CAGR value of 6.7% from 2022 to 2027. The nuclear energy market in France is largely driven by the increasing pressure on the French government to reduce its reliance on non-renewable sources of fuel like petroleum, gas, and coal. Technological advancements in reactors, energy storage devices, nuclear fusion reactions, and other technologies, are expected to further enhance the demand for nuclear energy in the French market.

The French government began investing in nuclear energy since the inception of the Atomic Energy Commission in 1945, responsible for research and development of nuclear energy technology and nuclear policy research. Nuclear energy has become the world’s second-largest source of low-carbon emission power source. Currently, France has over fifty nuclear reactors in operation across the country. These reactors are capable of providing 61,370 Mwe and account for 70% of France’s total electricity generation. France’s comparatively large nuclear energy generation has resulted in the country exporting almost 70 TWh each year.

In 2021, France was the largest exporter of electricity, mainly exporting to the United Kingdom and Italy. The high carbon emission profile of coal-powered generators is expected to cause countries to turn to nuclear energy to meet their growing energy demands. The nuclear energy market is driven by the government’s need to prevent France from being dependent on foreign oil for electricity generation. Planned proposals to build six new reactors and plans for more power plants in the near future are expected to result in further growth of the nuclear energy market in France. Increasing demand for energy self-sustainability among countries will also play a crucial role in the development of the market.

Technological advancements such as small modular reactors, and light water reactors, among others, are expected to further enhance the demand for nuclear energy. The investment into the research and development of novel nuclear energy reactors and reactor technologies is expected to further enhance the growth of the market. The development of new energy storage technologies will allow for more efficient storage of energy. Increasing investment into the adoption of nuclear energy for space exploration, submarine engines, and other technologies is another factor for the growth of the market.

The COVID-19 pandemic has resulted in supply chain restrictions and resulted in various manufacturing and energy shortage issues across the globe. The dependence of countries for energy on nuclear power plants saw nuclear power plants maintain operations. Falling energy consumption owing to shutdowns did reduce the demand for nuclear energy during the pandemic. The market is expected to bounce back as companies return to full operations.

The nuclear energy market is largely driven by the need to reduce carbon emission from energy generation, growing energy demand, increased focus on improving energy self-sustainability, increased investment in nuclear energy technology, and growing technological advancements in the industry.

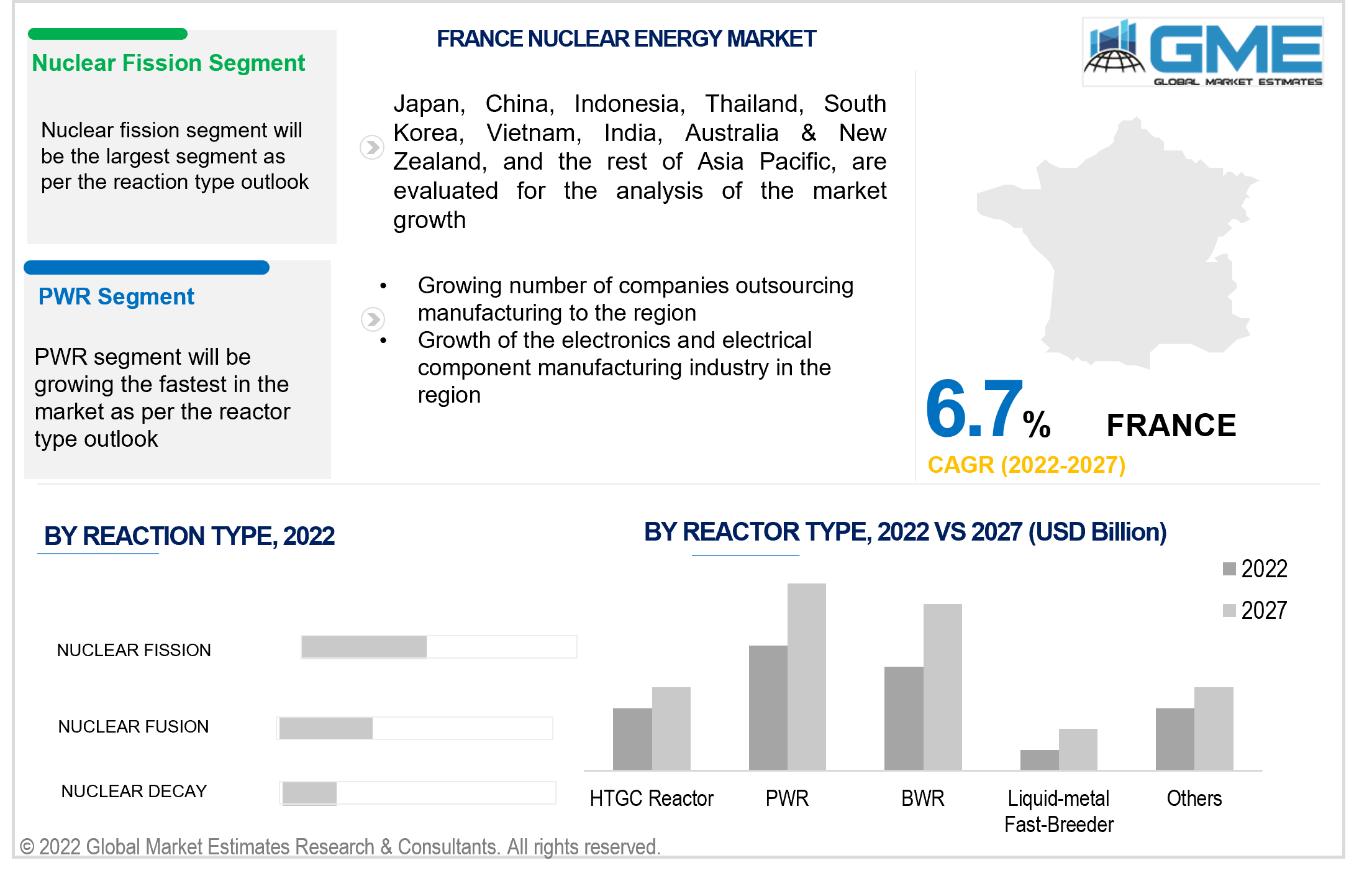

Based on the type of reaction, the nuclear energy market is segmented into nuclear fission, nuclear fusion, and nuclear decay. The nuclear fission segment is expected to hold the largest piece of the market during the forecast period. The ease of generating electricity through nuclear fission, more suited to current technology, and greater control over the process have resulted in the dominance of the nuclear fission segment.

The nuclear fusion reaction is expected to showcase better growth rates during the forecast period owing to increased investment in R&D of nuclear fusion reactors and technological advancements.

Based on the type of reactor, the nuclear energy market is segmented into pressurized water & heavy water reactor, boiling water reactor, high-temperature gas-cooled reactor, liquid-metal fast-breeder reactor, and other reactor types. Pressurized water and heavy water segment is expected to hold the largest piece of the market during the forecast period. These reactors are increasingly stable, lower chance of contamination, have greater control over the reaction, and greater technology maturity have led to the dominance of the pressurized water and heavy water segment. Nuclear fusion reactors are being increasingly researched in collaboration with other countries to develop nuclear fusion reactors.

Based on the applications, the nuclear energy market is segmented into electricity power generation and others. The electricity power generation segment is expected to hold the largest piece of the market during the forecast period. The growing energy demands and increased demand for clean energy have led to the dominance of the electricity power generation segment. Heavy investment into improving the energy self-sufficiency of France after the 1973 oil crisis has been the major driver of the electricity power generation segment

Électricité de France (Framatome), Orano (Apave), Bureau Veritas, Assystem, EGIS, GE Alstom, Nuvia, Onet, Southern Company, and Enel, among others, are the key players in the nuclear energy market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 France Nuclear Energy Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Reaction Type Overview

2.1.3 Reactor Type Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 France Nuclear Energy Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for clean energy

3.3.2 Industry Challenges

3.3.2.1 High cost of adoption

3.4 Prospective Growth Scenario

3.4.1 Reaction Type Growth Scenario

3.4.2 Reactor Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 France Nuclear Energy Market, By Reaction Type

4.1 Reaction Type Outlook

4.2 Nuclear Fission

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Nuclear Fusion

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Nuclear Decay

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 France Nuclear Energy Market, By Reactor Type

5.1 Reactor Type Outlook

5.2 Pressurized Water & Heavy Water Reactor

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Boiling Water Reactor

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 High-temperature Gas Cooled Reactor

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Liquid-metal Fast-Breeder Reactor

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Other Reactor Types

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 France Nuclear Energy Market, By Application

6.1 Electricity Power Generation

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Others

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Électricité de France (Framatome)

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Orano (Apave)

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Bureau Veritas

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Assystem

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 EGIS

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 GE Alstom

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.7 Nuvia

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.9 Onet

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.10 Enel

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The France Nuclear Energy Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the France Nuclear Energy Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS