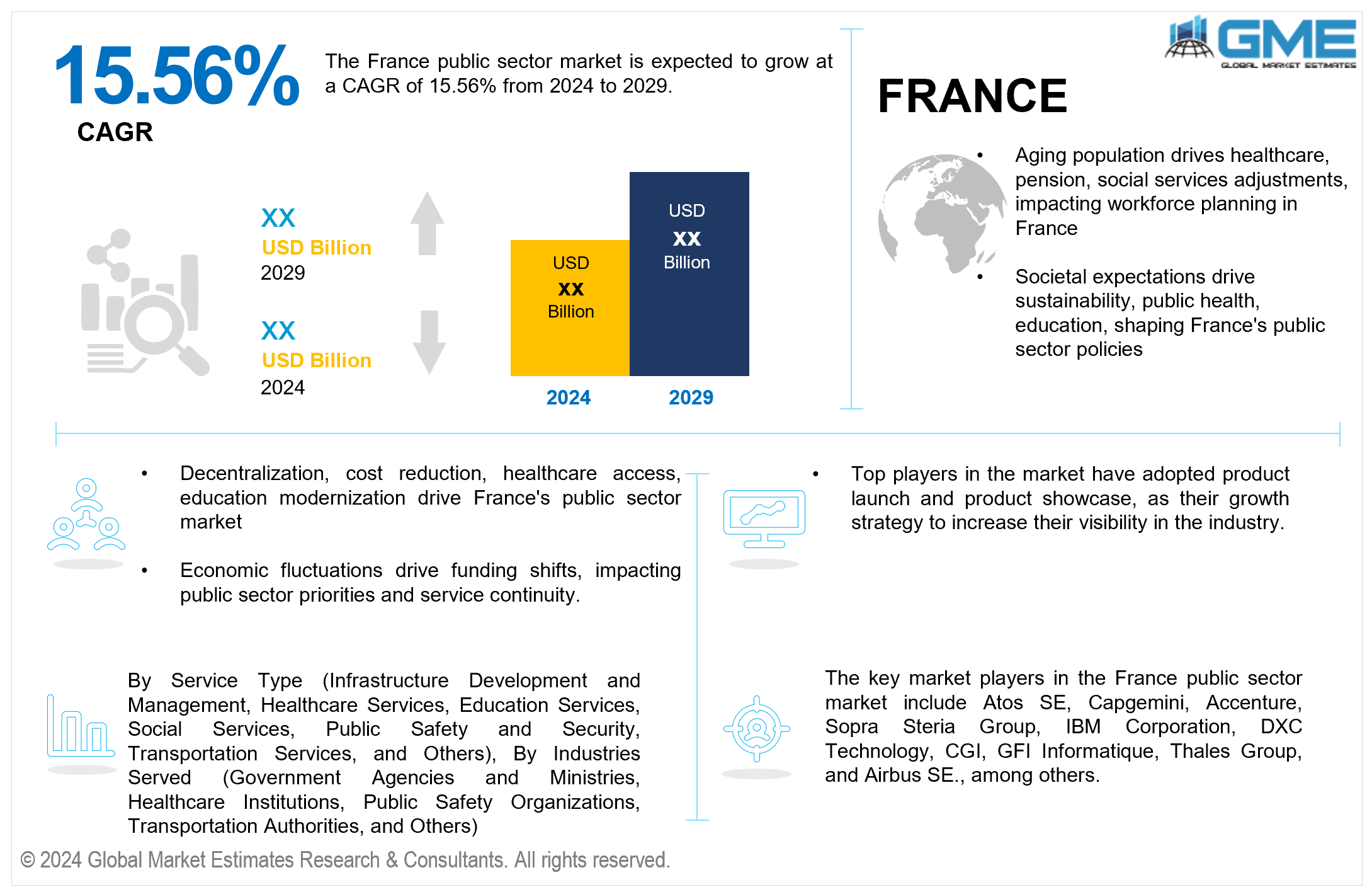

France Public Sector Market Size, Trends & Analysis - Forecasts to 2029 By Service Type (Infrastructure Development and Management, Healthcare Services, Education Services, Social Services, Public Safety and Security, Transportation Services, and Others), By Industries Served (Government Agencies and Ministries, Healthcare Institutions, Educational Institutions, Municipalities and Local Authorities, Public Safety Organizations, Transportation Authorities, and Others), and, Competitive Landscape, Company Market Share Analysis, and End User Analysis

The France public sector market is estimated to exhibit a CAGR of 15.56% from 2024 to 2029. A country's public sector encompasses a broad array of government-owned and operated entities, providing essential services and administration across various levels, including national, regional, and local. It is crucial in managing public administration, healthcare, education, public safety, and infrastructure development. Characterized by a significant workforce, the sector operates under principles of public accountability, aiming to ensure efficient service delivery and promote the general welfare.

Several factors drive the growth of the France public sector market. France's government is enhancing public services through decentralization, streamlining operations, and modernizing curricula, aiming to improve efficiency and effectiveness, which drive market dynamics and foster a more responsive and adaptive public sector. Like many developed nations, France is grappling with demographic shifts, such as an aging population, which necessitates adjustments in healthcare, pension schemes, and social services and also influences labor market dynamics in the public sector. France's commitments to the European Union and international agreements influence public sector priorities, particularly in trade, environmental standards, and security. Compliance with EU regulations drives policy reforms and investments in environmental protection and the digital economy, while international collaboration and aid programs shape global public sector activities. The public sector utilizes Public-Private Partnerships (PPPs) to leverage private industry expertise and investment in public services and infrastructure projects, enhancing service delivery, reducing costs, and accelerating project timelines, thus combining public objectives with private efficiency.

Despite the various growth factors, several restraints hinder France's public sector market growth. The public sector faces challenges in long-term planning and execution due to polarization and opposition, often influenced by socio-political debates and changes in government or public opinion.

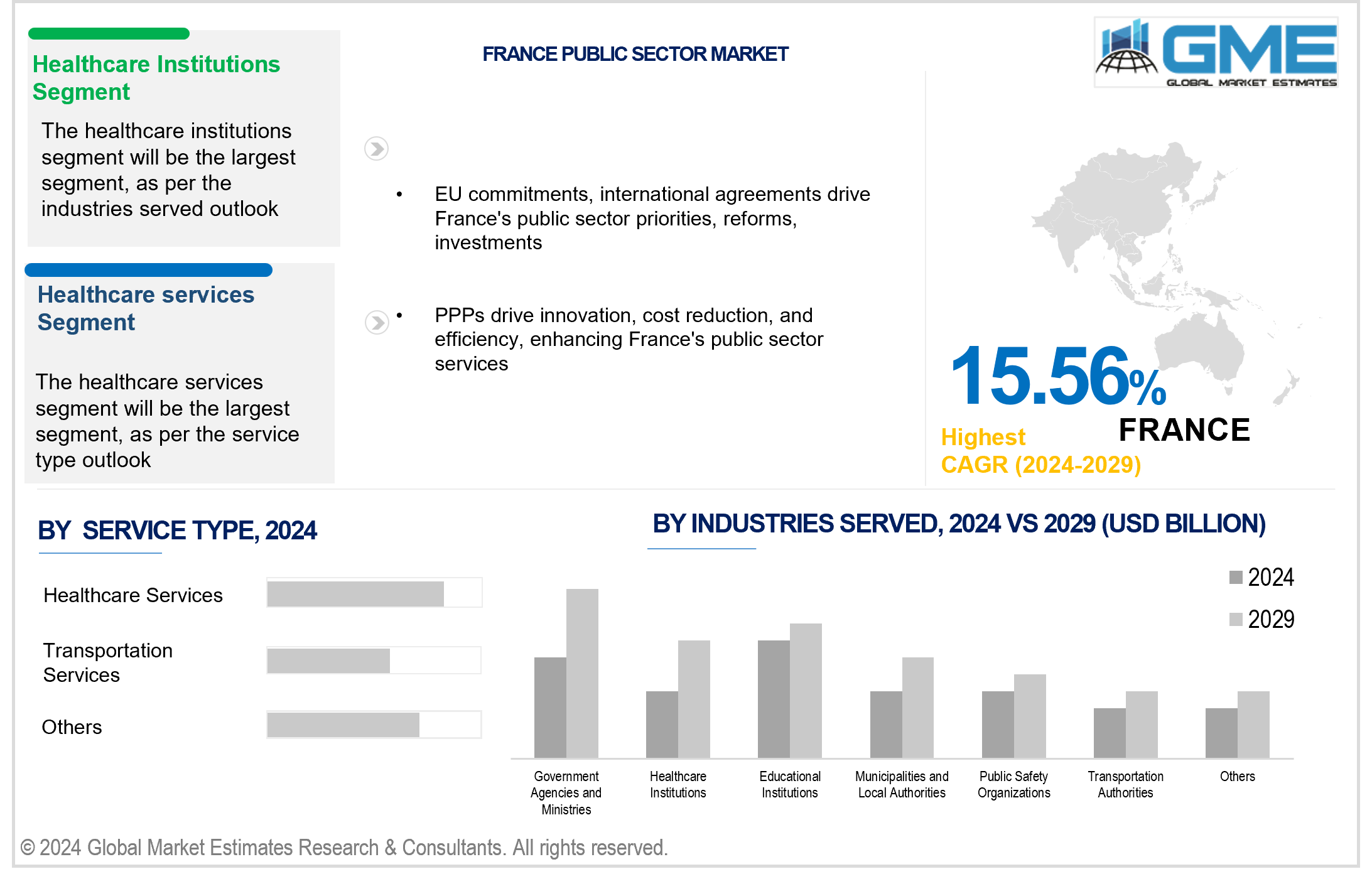

On the basis of service type, the market is segmented into infrastructure development and management, healthcare services, education services, social services, public safety and security, transportation services, and others. The healthcare services segment is expected to be the largest segment during the forecast period. France's healthcare system, financed by National Health Insurance, is renowned for its comprehensive services. The aging population and rising demand, driven by public health challenges like COVID-19, have fueled significant investment in this sector. The sector's extensive infrastructure, workforce, and critical nature contribute to its dominance.

The infrastructure development and management segment is expected to be the fastest-growing segment in the France public sector market during the forecast period. The growth is attributed to the need for modernizing infrastructure and investing in sustainable and smart projects. The European Union's focus on green and digital transitions and France's commitment to sustainability and innovation support substantial investments in projects reducing carbon emissions and improving energy efficiency.

On the basis of industries served, the market is segmented into government agencies and ministries, healthcare institutions, educational institutions, municipalities and local authorities, public safety organizations, transportation authorities, and others. The healthcare institutions segment is expected to hold the largest share of the market during the forecast period. France's commitment to providing high-quality, accessible healthcare is a significant factor in its significant government funding and public impact. This is due to the extensive infrastructure needed, the significant workforce, and substantial budget allocations for population health and well-being.

The government agencies and ministries segment is anticipated to be the fastest-growing in the France public sector market during the forecast period. Government agencies and ministries are crucial in a country's administration and governance, overseeing various functions such as economic policy, social welfare, education, infrastructure development, and environmental regulation. They command a significant portion of public sector resources and workforce due to their diverse functions, resource allocation, regulatory oversight, and service delivery, which require extensive organizational capacity and infrastructure.

The key market players in the France public sector market include Atos SE, Capgemini, Accenture, Sopra Steria Group, IBM Corporation, DXC Technology, CGI, GFI Informatique, Thales Group, and Airbus SE., among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, Atos, Open, and Sopra Steria, a consortium led by Atos, were selected by the Union des Groupements d'Achats Publics (UGAP) to provide project management assistance and third-party application maintenance services under UGAP's new IT Intellectual Services contract. The consortium's UGAP Central Unit ensures efficient service execution and knowledge utilization.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3 FRANCE MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 FRANCE PUBLIC SECTOR MARKET, BY SERVICE TYPE

4.1 Introduction

4.2 Public Sector Market: Service Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Infrastructure Development and Management

4.4.1 Infrastructure Development and Management Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Healthcare Services

4.5.1 Healthcare Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Education Services

4.6.1 Education Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Social Services

4.7.1 Social Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Public Safety and Security

4.8.1 Public Safety and Security Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Transportation Services

4.9.1 Transportation Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Others

4.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 FRANCE PUBLIC SECTOR MARKET, BY INDUSTRIES SERVED

5.1 Introduction

5.2 Public Sector Market: Industries Served Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Government Agencies and Ministries

5.4.1 Government Agencies and Ministries Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Healthcare Institutions

5.5.1 Healthcare Institutions Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Educational Institutions

5.6.1 Educational Institutions Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Municipalities and Local Authorities

5.8.1 Municipalities and Local Authorities Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Public Safety Organizations

5.9.1 Public Safety Organizations Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Transportation Authorities

5.10.1 Transportation Authorities Market Estimates and Forecast, 2021-2029 (USD Million)

5.11 Others

5.11.1 Municipalities and Local Authorities Market Estimates and Forecast, 2021-2029 (USD Million)

6 FRANCE PUBLIC SECTOR MARKET, BY REGION

6.1 Introduction

6.2 France Public Sector Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Service Type

6.2.2 By Industries Served

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 France

7.4 Company Profiles

7.4.1 Atos

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Capgemini

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Accenture

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Sopra Steria Group

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 IBM

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 DXC Technology

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 CGI

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 GFI Informatique

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Thales Group

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Airbus SE

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 France Public Sector Market, By Service Type, 2021-2029 (USD Million)

2 Infrastructure Development and Management Market, By Region, 2021-2029 (USD Million)

3 Healthcare Services Market, By Region, 2021-2029 (USD Million)

4 Education Services Market, By Region, 2021-2029 (USD Million)

5 Social Services Market, By Region, 2021-2029 (USD Million)

6 Public Safety and Security Market, By Region, 2021-2029 (USD Million)

7 Transportation Services Market, By Region, 2021-2029 (USD Million)

8 Others Market, By Region, 2021-2029 (USD Million)

9 France Public Sector Market, By Industries Served, 2021-2029 (USD Million)

10 Government Agencies and Ministries Market, By Region, 2021-2029 (USD Million)

11 Healthcare Institutions Market, By Region, 2021-2029 (USD Million)

12 Educational Institutions Market, By Region, 2021-2029 (USD Million)

13 Municipalities and Local Authorities Market, By Region, 2021-2029 (USD Million)

14 Public Safety Organizations Market, By Region, 2021-2029 (USD Million)

15 Transportation Authorities Market, By Region, 2021-2029 (USD Million)

16 Others Market, By Region, 2021-2029 (USD Million)

17 Regional Analysis, 2021-2029 (USD Million)

18 Atos: Products & Services Offering

19 Capgemini: Products & Services Offering

20 Accenture: Products & Services Offering

21 Sopra Steria Group: Products & Services Offering

22 IBM: Products & Services Offering

23 DXC Technology: Products & Services Offering

24 CGI : Products & Services Offering

25 GFI Informatique: Products & Services Offering

26 Thales Group, Inc: Products & Services Offering

27 Airbus SE: Products & Services Offering

28 Other Companies: Products & Services Offering

LIST OF FIGURES

1 France Public Sector Market Overview

2 France Public Sector Market Value From 2021-2029 (USD Million)

3 France Public Sector Market Share, By Service Type (2023)

4 France Public Sector Market Share, By Industries Served (2023)

5 France Public Sector Market, By Region (Global Market)

6 Technological Trends In France Public Sector Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The France Public Sector Market

10 Impact Of Challenges On The France Public Sector Market

11 Porter’s Five Forces Analysis

12 France Public Sector Market: By Service Type Scope Key Takeaways

13 France Public Sector Market, By Service Type Segment: Revenue Growth Analysis

14 Infrastructure Development and Management Market, By Region, 2021-2029 (USD Million)

15 Healthcare Services Market, By Region, 2021-2029 (USD Million)

16 Education Services Market, By Region, 2021-2029 (USD Million)

17 Social Services Market, By Region, 2021-2029 (USD Million)

18 Public Safety and Security Market, By Region, 2021-2029 (USD Million)

19 Transportation Services Market, By Region, 2021-2029 (USD Million)

20 Others Market, By Region, 2021-2029 (USD Million)

21 France Public Sector Market: By Industries Served Scope Key Takeaways

22 France Public Sector Market, By Industries Served Segment: Revenue Growth Analysis

23 Government Agencies and Ministries Market, By Region, 2021-2029 (USD Million)

24 Healthcare Institutions Market, By Region, 2021-2029 (USD Million)

25 Educational Institutions Market, By Region, 2021-2029 (USD Million)

26 Municipalities and Local Authorities Market, By Region, 2021-2029 (USD Million)

27 Public Safety Organizations Market, By Region, 2021-2029 (USD Million)

28 Transportation Authorities Market, By Region, 2021-2029 (USD Million)

29 Others Market, By Region, 2021-2029 (USD Million)

30 Regional Segment: Revenue Growth Analysis

31 France Public Sector Market: Regional Analysis

32 France Public Sector Market Overview

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 Atos: Company Snapshot

36 Atos: SWOT Analysis

37 Atos: Geographic Presence

38 Capgemini: Company Snapshot

39 Capgemini: SWOT Analysis

40 Capgemini: Geographic Presence

41 Accenture: Company Snapshot

42 Accenture: SWOT Analysis

43 Accenture: Geographic Presence

44 Sopra Steria Group: Company Snapshot

45 Sopra Steria Group: Swot Analysis

46 Sopra Steria Group: Geographic Presence

47 IBM: Company Snapshot

48 IBM: SWOT Analysis

49 IBM: Geographic Presence

50 DXC Technology: Company Snapshot

51 DXC Technology: SWOT Analysis

52 DXC Technology: Geographic Presence

53 CGI : Company Snapshot

54 CGI : SWOT Analysis

55 CGI : Geographic Presence

56 GFI Informatique: Company Snapshot

57 GFI Informatique: SWOT Analysis

58 GFI Informatique: Geographic Presence

59 Thales Group, Inc.: Company Snapshot

60 Thales Group, Inc.: SWOT Analysis

61 Thales Group, Inc.: Geographic Presence

62 Airbus SE: Company Snapshot

63 Airbus SE: SWOT Analysis

64 Airbus SE: Geographic Presence

65 Other Companies: Company Snapshot

66 Other Companies: SWOT Analysis

67 Other Companies: Geographic Presence

The Global France Public Sector Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the France Public Sector Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS