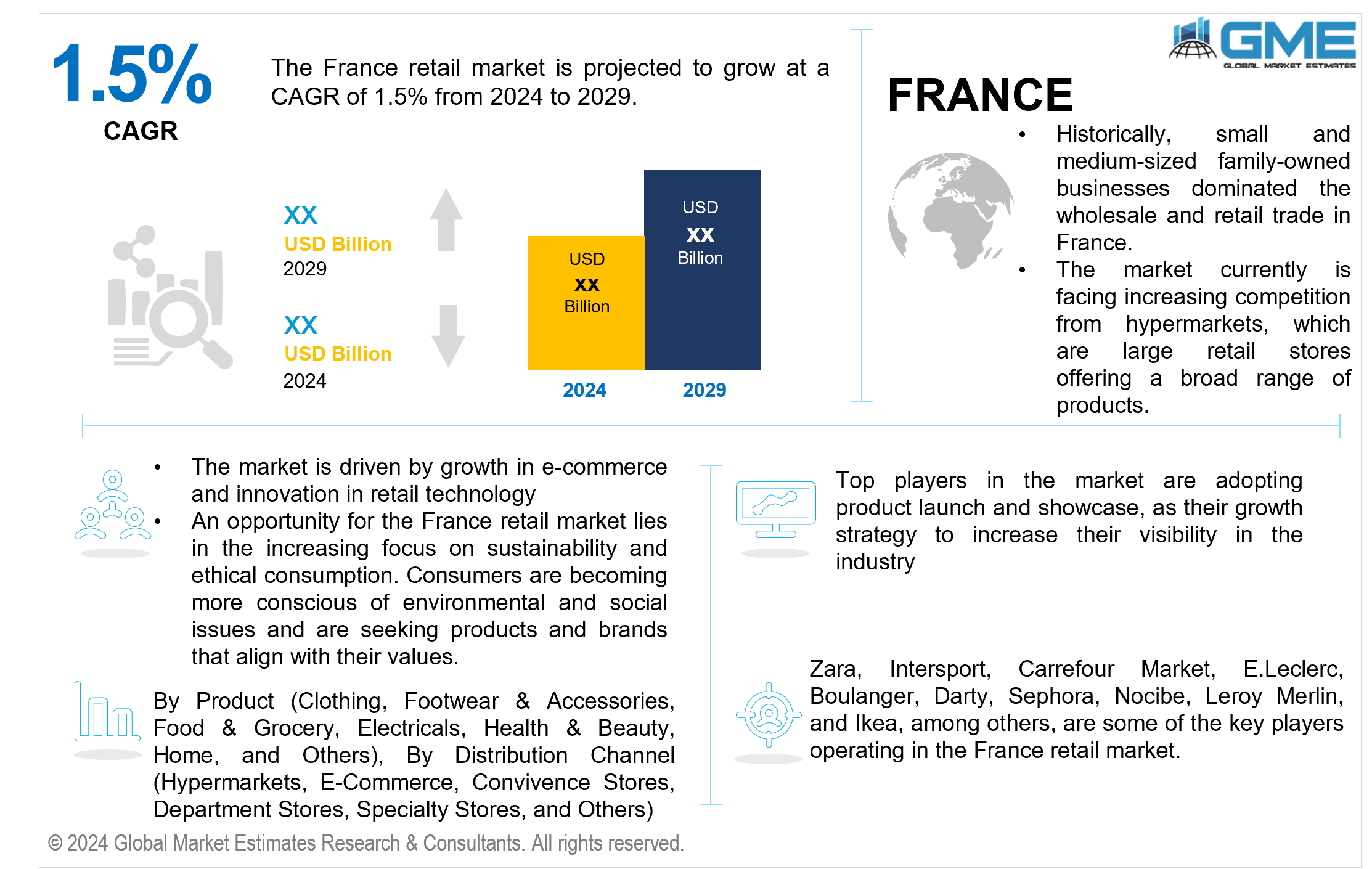

France Retail Market Size, Trends & Analysis - Forecasts to 2029 By Product (Clothing, Footwear & Accessories, Food & Grocery, Electricals, Health & Beauty, Home, and Others), By Distribution Channel (Hypermarkets, E-commerce, Convenience Stores, Department Stores, Specialty Stores, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

France's retail market is projected to grow at a CAGR of 1.5% from 2024 to 2029. France has a varied and extensive retail landscape. Historically, small and medium-sized family-owned businesses dominated the wholesale and retail trade in France. However, they are now facing increasing competition from hypermarkets, which are large retail stores offering a broad range of products at discounted rates, as well as numerous convenience stores.

The market is driven by growth in e-commerce and innovation in retail technology. With the increasing adoption of digital technologies and changing consumer preferences, online shopping has experienced substantial growth. This trend is driven by factors such as convenience, a wide range of product offerings, and competitive pricing. Retailers in France are leveraging advanced technologies such as artificial intelligence, augmented reality, and data analytics to enhance the customer experience, optimize operations, and drive sales. Innovations such as personalized recommendations, virtual try-on experiences, and efficient supply chain management systems contribute to the competitiveness and growth of the retail market. An opportunity for the France retail market lies in the increasing focus on sustainability and ethical consumption. Consumers are becoming more conscious of environmental and social issues and are seeking products and brands that align with their values.

One restraint the France retail market is facing include regulatory compliance challenges. Retailers must navigate complex and evolving regulations related to taxation, labor laws, data privacy, and environmental standards.

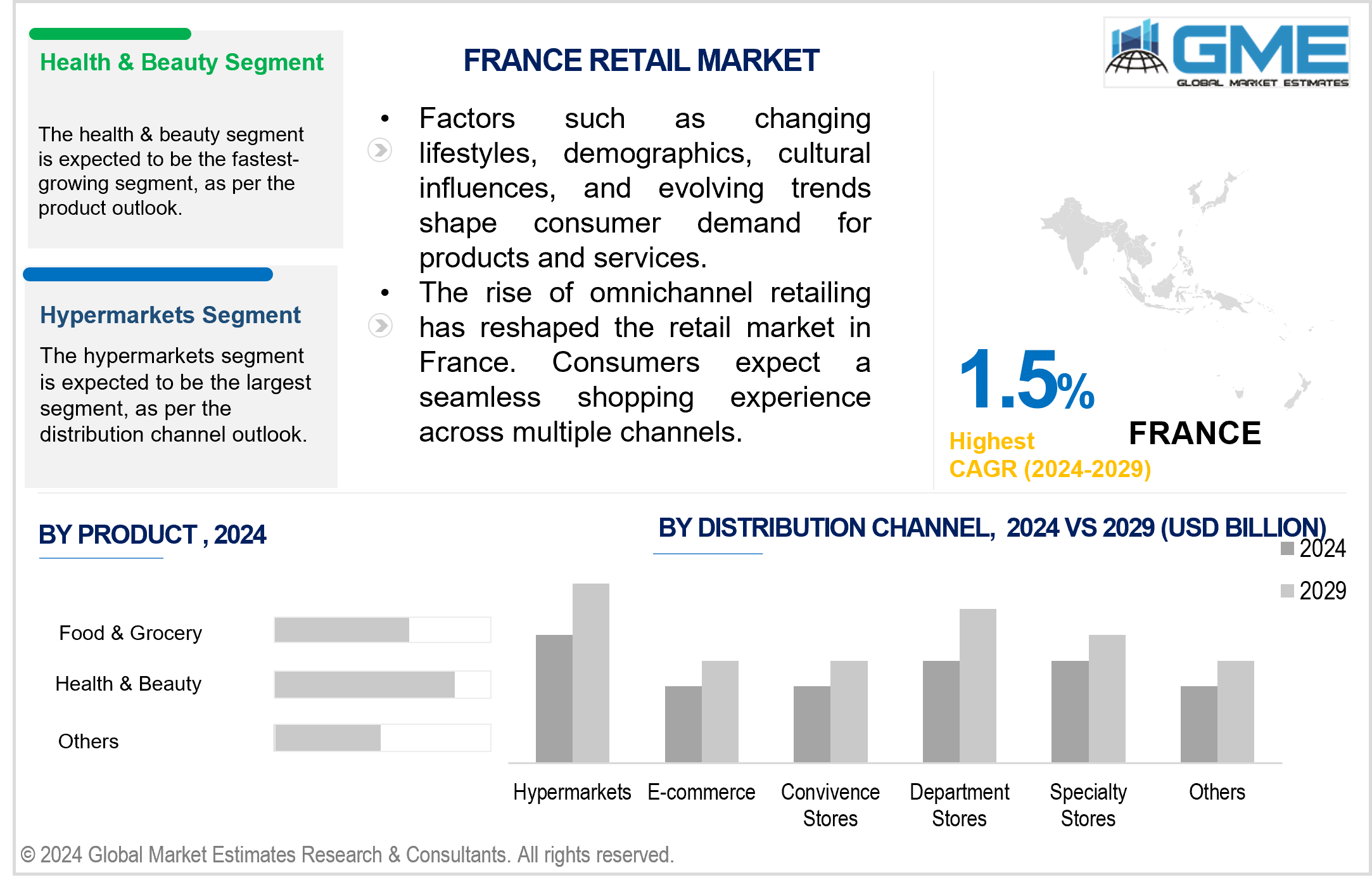

Based on product, the market is segmented into clothing, footwear & accessories, food & grocery, electricals, health & beauty, home, and others. The food & grocery segment is expected to hold the largest share of the market. Food and grocery items are essential commodities that fulfill basic human needs and ensure consistent and widespread demand across various demographic segments. Factors such as population growth, urbanization, and changing lifestyles have further bolstered the demand for convenient and accessible food and grocery shopping options, including supermarkets, hypermarkets, and online grocery platforms.

The health & beauty segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Consumers are becoming more conscious of the ingredients used in beauty and healthcare products, opting for natural and organic alternatives, which are often found in this segment. France has a significant aging population, leading to a greater focus on anti-aging and skincare products. As people age, there is a higher demand for products that address age-related concerns such as wrinkles, fine lines, and age spots, driving growth in the health & beauty segment. This drives the demand for such products in the retail sector.

Based on distribution channel, the market is segmented into hypermarkets, e-commerce, convenience stores, department stores, specialty stores, and others. The hypermarkets segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Hypermarkets typically offer a vast array of products under one roof, ranging from groceries and household essentials to electronics, clothing, and home goods. They also offer competitive prices on a wide range of products. By leveraging economies of scale and bulk purchasing power, they can negotiate lower prices from suppliers and pass on the cost savings to consumers.

The e-commerce segment is expected to hold the largest share of the market. E-commerce offers unparalleled convenience to consumers, allowing them to shop anytime, anywhere, without the constraints of physical store hours or locations. Consumers from remote areas or those with limited access to brick-and-mortar stores can easily access a wide range of products through online channels. The proliferation of smartphones and mobile apps has further fuelled the growth of e-commerce. France ranked third, following Germany and the United Kingdom, with an estimated e-commerce user base exceeding 51 million in 2023.

Zara, Intersport, Carrefour Market, E.Leclerc, Boulanger, Darty, Sephora, Nocibe, Leroy Merlin, and Ikea, among others, are some of the key players operating in the France retail market.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2023, Spanish fashion retailer Zara expanded its service to sell, repair, or donate second-hand clothes in France. The service, which will be available through Zara's stores, its website, and a mobile app, already exists for its British customers since October 2022.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 FRANCE MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 FRANCE RETAIL MARKET, BY PRODUCT

4.1 Introduction

4.2 Retail Market: Application Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Clothing, Footwear & Accessories

4.4.1 Clothing, Footwear & Accessories Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Food & Grocery

4.5.1 Food & GroceryMarket Estimates and Forecast, 2021-2029 (USD Million)

4.6 Electricals

4.6.1 Electricals Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Health & Beauty

4.7.1 Health & Beauty Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Home

4.8.1 Home Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 FRANCE RETAIL MARKET, BY DISTRIBUTION CHANNEL

5.1 Introduction

5.2 Retail Market: Distribution Channel Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Hypermarkets

5.4.1 Hypermarkets Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 E-commerce

5.5.1 E-commerce Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Convenience Stores

5.6.1 Convenience Stores Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Department Stores

5.7.1 Department Stores Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Specialty Stores

5.8.1 Specialty Stores Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 France

7.4 Company Profiles

7.4.1 Zara

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Intersport

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Leroy Merlin

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Carrefour Market

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 E.Leclerc

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Boulanger

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Darty

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Sephora

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Nocibe

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Ikea

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.7.1 Research Assumptions

8.7.2 Research Limitations

LIST OF TABLES

1 France Retail Market, By Product, 2021-2029 (USD Million)

2 Clothing, Footwear & Accessories Market, By Country, 2021-2029 (USD Million)

3 Food & GroceryMarket, By Country, 2021-2029 (USD Million)

4 Electricals Market, By Country, 2021-2029 (USD Million)

5 Health & Beauty Market, By Country, 2021-2029 (USD Million)

6 Home Market, By Country, 2021-2029 (USD Million)

7 Others Market, By Country, 2021-2029 (USD Million)

8 France Retail Market, By Distribution Channel, 2021-2029 (USD Million)

9 Hypermarkets Market, By Country, 2021-2029 (USD Million)

10 E-COMMERCE Market, By Country, 2021-2029 (USD Million)

11 Convenience Stores Market, By Country, 2021-2029 (USD Million)

12 Department Stores Market, By Country, 2021-2029 (USD Million)

13 Specialty Stores Market, By Country, 2021-2029 (USD Million)

14 Others Market, By Country, 2021-2029 (USD Million)

15 Zara: Products & Services Offering

16 Intersport: Products & Services Offering

17 Leroy Merlin: Products & Services Offering

18 Carrefour Market: Products & Services Offering

19 E.Leclerc: Products & Services Offering

20 BOULANGER: Products & Services Offering

21 Darty: Products & Services Offering

22 Sephora: Products & Services Offering

23 Nocibe: Products & Services Offering

24 Ikea: Products & Services Offering

25 Other Companies: Products & Services Offering

LIST OF FIGURES

1 France Retail Market Overview

2 France Retail Market Value From 2021-2029 (USD Million)

3 France Retail Market Share, By Product (2023)

4 France Retail Market Share, By Distribution Channel (2023)

5 Technological Trends In France Retail Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The France Retail Market

9 Impact Of Challenges On The France Retail Market

10 Porter’s Five Forces Analysis

11 France Retail Market: By Product Scope Key Takeaways

12 France Retail Market, By Product Segment: Revenue Growth Analysis

13 Clothing, Footwear & Accessories Market, By Country, 2021-2029 (USD Million)

14 Food & GroceryMarket, By Country, 2021-2029 (USD Million)

15 Electricals Market, By Country, 2021-2029 (USD Million)

16 Health & Beauty Market, By Country, 2021-2029 (USD Million)

17 Home Market, By Country, 2021-2029 (USD Million)

18 Others Market, By Country, 2021-2029 (USD Million)

19 France Retail Market: By Distribution Channel Scope Key Takeaways

20 France Retail Market, By Distribution Channel Segment: Revenue Growth Analysis

21 Hypermarkets Market, By Country, 2021-2029 (USD Million)

22 E-commerce Market, By Country, 2021-2029 (USD Million)

23 Convenience Stores Market, By Country, 2021-2029 (USD Million)

24 Department Stores Market, By Country, 2021-2029 (USD Million)

25 Specialty Stores Market, By Country, 2021-2029 (USD Million)

26 Others Market, By Country, 2021-2029 (USD Million)

27 Four Quadrant Positioning Matrix

28 Company Market Share Analysis

29 Zara: Company Snapshot

30 Zara: SWOT Analysis

31 Zara: Geographic Presence

32 Intersport: Company Snapshot

33 Intersport: SWOT Analysis

34 Intersport: Geographic Presence

35 Leroy Merlin: Company Snapshot

36 Leroy Merlin: SWOT Analysis

37 Leroy Merlin: Geographic Presence

38 Carrefour Market: Company Snapshot

39 Carrefour Market: Swot Analysis

40 Carrefour Market: Geographic Presence

41 E.Leclerc: Company Snapshot

42 E.Leclerc: SWOT Analysis

43 E.Leclerc: Geographic Presence

44 Boulanger: Company Snapshot

45 Boulanger: SWOT Analysis

46 Boulanger: Geographic Presence

47 Darty: Company Snapshot

48 Darty: SWOT Analysis

49 Darty: Geographic Presence

50 Sephora: Company Snapshot

51 Sephora: SWOT Analysis

52 Sephora: Geographic Presence

53 Nocibe.: Company Snapshot

54 Nocibe.: SWOT Analysis

55 Nocibe.: Geographic Presence

56 Ikea: Company Snapshot

57 Ikea: SWOT Analysis

58 Ikea: Geographic Presence

59 Other Companies: Company Snapshot

60 Other Companies: SWOT Analysis

61 Other Companies: Geographic Presence

The France Retail Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the France Retail Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS