Global Freight Matching Platform Market Size, Trends & Analysis - Forecasts to 2027 By Application (Multiple Drop-Offs Management, Non-Revenue Miles Management, Real-time Price Tracking, Supplier and Vendor Management, Digital Payment Management, and Others), By Mode (Rail Freight, Road Freight, Ocean Freight, and Air Freight), By End-Users (3PLs, Forwarders, Brokers, Shippers, and Carriers), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

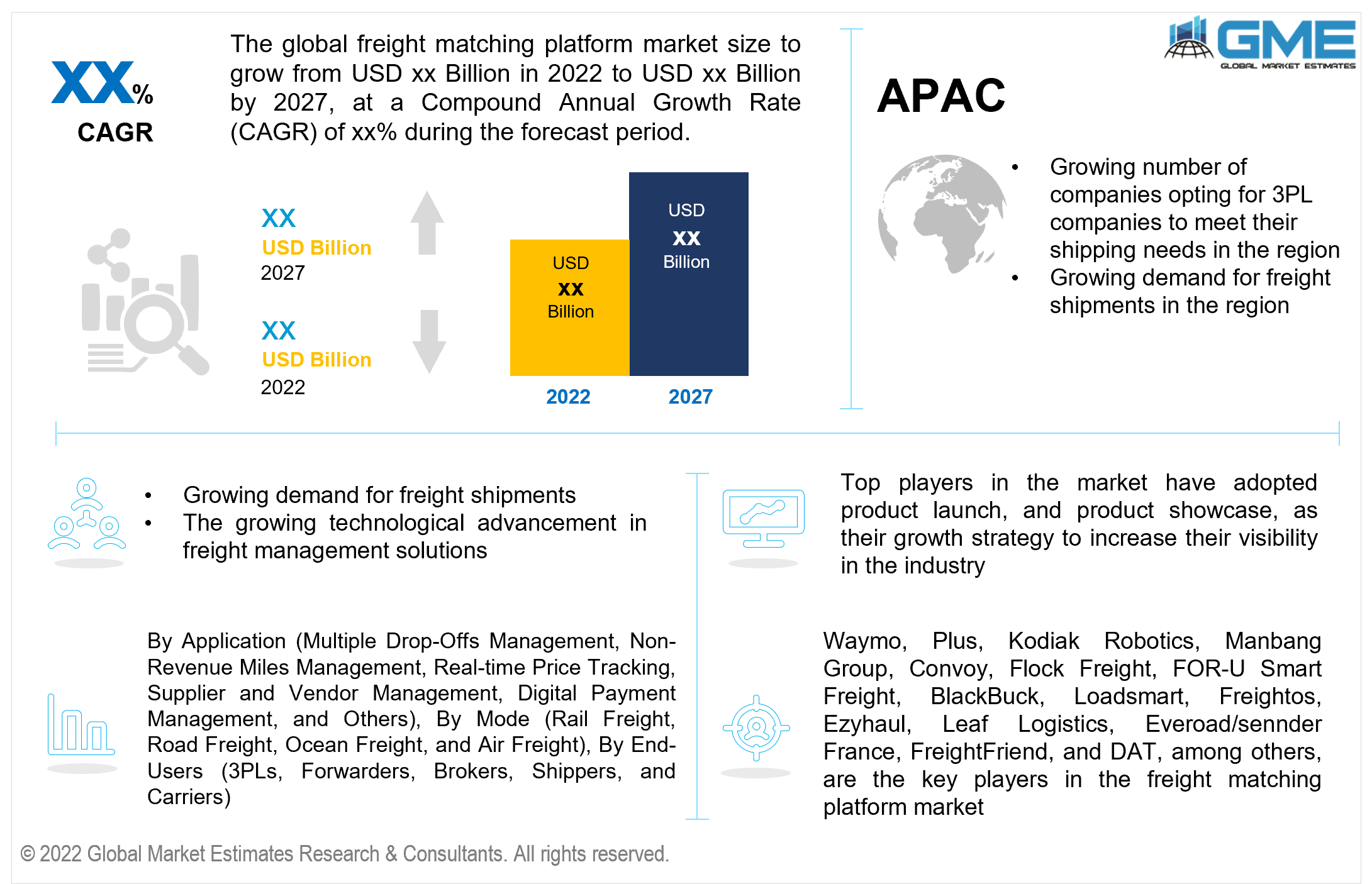

The global freight matching platform market is projected to grow at a high CAGR value from 2022 to 2027. The growing demand for efficient shipping in supply chains is one of the major drivers of the freight matching platform. These platforms facilitate companies in supply chain logistics and decision-making.

Freight matching software is used to connect the consigner with third-party shippers. This software analyzes data across multiple third-party service providers to find the best possible service provider for the user. The growing amount of data being generated by companies regarding their supply chain and shipping activities owing to the growing adoption of GPS-enables tracking systems are also responsible for the growing market. This software allows companies to scale up production without increasing their overhead expenses, improve workflow, improve operational efficiency, and increased resilience to volatility in the marketplace, among other advantages.

The U.S government's bureau of transportation statistics estimates that the U.S.-International freight trade is worth upwards of USD 4.14 trillion annually. Seaways are the most common mode of transportation for freights in the United States followed by airways.

The growing volume of international trade has increased the demand for freight services. With greater volume to be transported through freights, companies are turning to innovative digital solutions to improve their efficiency. Delays in shipping and supply chain can result in sales losses as it cascades with delays in other services to create massive losses for the company. Various freight management solutions like freight matching platforms are being increasingly adopted to improve efficiency and prevent delays.

The growing e-commerce industry has also played a part in the increase in freight shipment volume in recent years. To meet the increased shipping volume, companies have begun turning to third-party logistic companies. Through freight matching platforms, companies are better equipped to find their ideal shipping partner to ensure their specific delivery goals are met and at a reasonable cost to the company.

The market’s growth is restrained by the high cost of such software, lack of skilled professionals for the adoption of such solutions, and concerns regarding privacy and data theft.

The COVID-19 pandemic has caused various delays in the transportation of goods, supply chains have been restricted, manufacturing had to be shut down, storage issues and other constraints arising from measures taken to prevent the spread of COVID have restrained the growth of the market. As the economy opens up, the market is expected to bounce back as delays and backorders are processed. With increased freight shipments, companies are expected to increasingly adopt freight matching platform software during the forecast period.

The freight matching platform market is largely driven by the growing demand for freight shipments, increased adoption of cloud-based solutions, adoption of GPS-enabled tracking systems, adoption of data analytics in freight transportation, and the growing volume of international trade.

Based on the application, the freight matching platform market is segmented into multiple drop-offs management, non-revenue miles management, real-time price tracking, supplier and vendor management, digital payment management, and others segments. The supplier and vendor management segment is expected to hold the largest piece of the market during the forecast period. Growing demand for freight shipments from SMEs arising from increased e-commerce sales has been a major driver of the segment.

The growing demand for risk assessment and regulatory and auditory compliance management is expected to result in the supplier and vendor management segment becoming the fastest-growing segment during the forecast period.

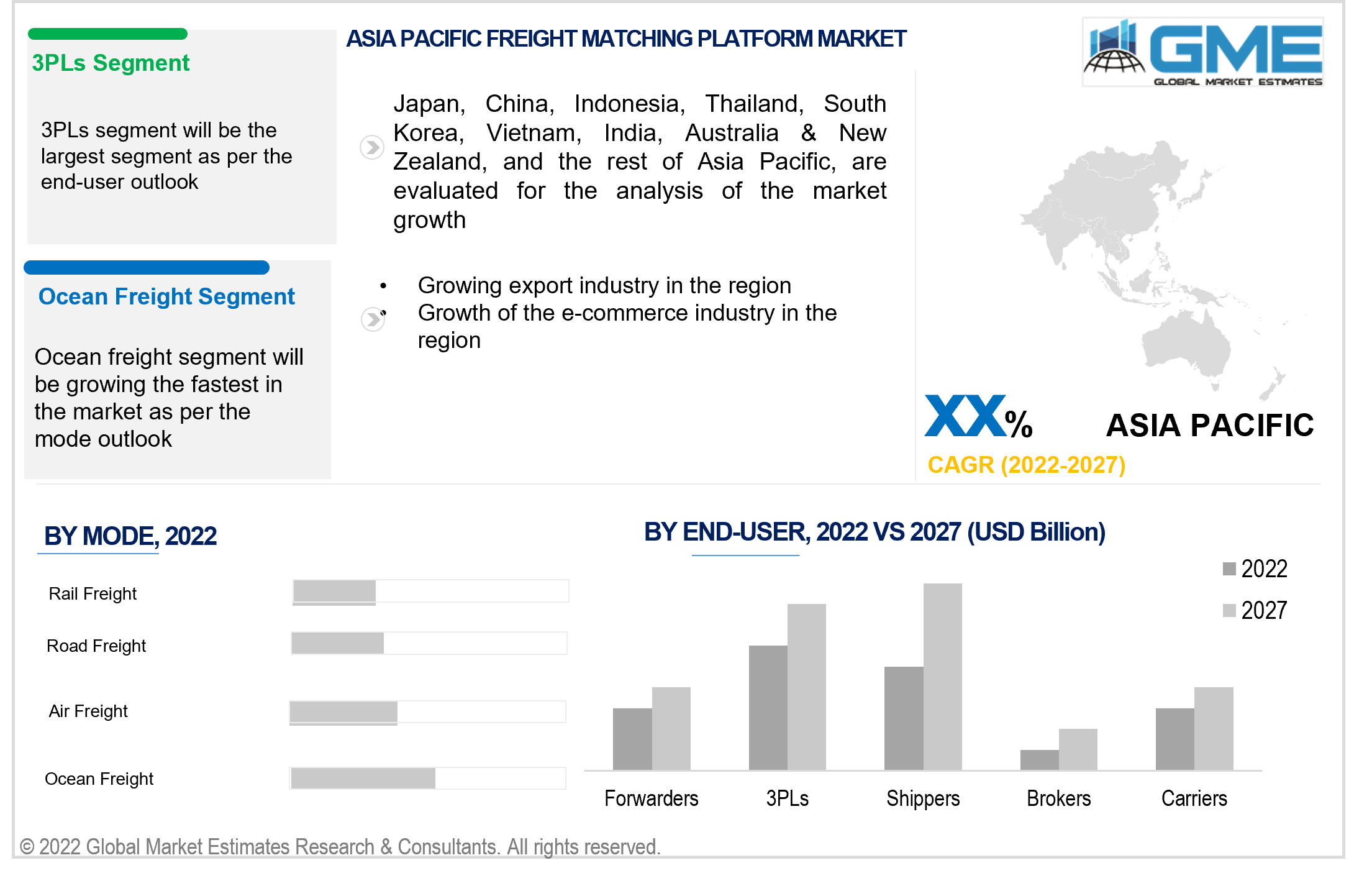

Based on the various modes of the freight matching platform, the market is segmented into rail freight, road freight, ocean freight, and air freight. The ocean freight segment held the lion’s share of the market. Seaways have become the most common form of freight shipment across the globe. The ability of ships to transport large volumes of shipment over large distances at efficient fuel costs has been the major driver of the mode of freight shipment.

Based on the various end-users, the market is segmented into 3PLs, forwarders, brokers, shippers, and carriers. The 3PLs segment held the lion’s share of the market. The growing demand for third-party logistics companies from SMEs looking to expand their business without increasing their overhead expenses is the major driver of the 3PLs segment.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The region’s high GDP, large consumer bases, and increased purchasing power of individuals have resulted in the dominance of the region. The growth of the e-commerce industry, increase in international trade between countries in North America and outside have resulted in larger sales revenue from the region.

The APAC region is envisaged to log significantly greater growth rates than the other regions during the forecast period. The growing e-commerce industry owing to the growing use of smartphones and the internet in the region, strong manufacturing base, and growth of the exports in the region is expected to increase freight transportation volume in the region. The growth in freight transportation is expected to increase the demand for freight matching software during the forecast period.

Waymo, Plus, Kodiak Robotics, Manbang Group, Convoy, Flock Freight, FOR-U Smart Freight, BlackBuck, Loadsmart, Freightos, Ezyhaul, Leaf Logistics, Everoad/sennder France, FreightFriend, and DAT, among others are the key players in the freight matching platform market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Freight Matching Platform Industry Overview, 2020-2027

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Mode Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Freight Matching Platform Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of 3PL service vendors

3.3.2 Industry Challenges

3.3.2.1 Lack of skilled professionals and high cost of freight matching software

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Mode Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Freight Matching Platform Market, By Application

4.1 Application Outlook

4.2 Multiple Drop-Offs Management

4.2.1 Market Size, By Region, 2020-2027 (USD Million)

4.3 Non-Revenue Miles Management

4.3.1 Market Size, By Region, 2020-2027 (USD Million)

4.4 Real-time Price Tracking

4.4.1 Market Size, By Region, 2020-2027 (USD Million)

4.5 Supplier and Vendor Management

4.5.1 Market Size, By Region, 2020-2027 (USD Million)

4.6 Digital Payment Management

4.6.1 Market Size, By Region, 2020-2027 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2020-2027 (USD Million)

Chapter 5 Freight Matching Platform Market, By Mode

5.1 Mode Outlook

5.2 Rail Freight

5.2.1 Market Size, By Region, 2020-2027 (USD Million)

5.3 Road Freight

5.3.1 Market Size, By Region, 2020-2027 (USD Million)

5.4 Ocean Freight

5.4.1 Market Size, By Region, 2020-2027 (USD Million)

5.5 Air Freight

5.5.1 Market Size, By Region, 2020-2027 (USD Million)

Chapter 6 Freight Matching Platform Market, By End-User

6.1 3PLs

6.1.1 Market Size, By Region, 2020-2027 (USD Million)

6.2 Forwarders

6.2.1 Market Size, By Region, 2020-2027 (USD Million)

6.3 Brokers

6.3.1 Market Size, By Region, 2020-2027 (USD Million)

6.4 Shippers

6.4.1 Market Size, By Region, 2020-2027 (USD Million)

6.5 Carriers

6.5.1 Market Size, By Region, 2020-2027 (USD Million)

Chapter 7 Freight Matching Platform Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2027 (USD Million)

7.2.2 Market Size, By Application, 2020-2027 (USD Million)

7.2.3 Market Size, By Mode, 2020-2027 (USD Million)

7.2.4 Market Size, By End-User, 2020-2027 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Application, 2020-2027 (USD Million)

7.2.4.2 Market Size, By Mode, 2020-2027 (USD Million)

7.2.4.3 Market Size, By End-User, 2020-2027 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.2.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.2.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2027 (USD Million)

7.3.2 Market Size, By Application, 2020-2027 (USD Million)

7.3.3 Market Size, By Mode, 2020-2027 (USD Million)

7.3.4 Market Size, By End-User, 2020-2027 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Application, 2020-2027 (USD Million)

7.3.6.2 Market Size, By Mode, 2020-2027 (USD Million)

7.3.6.3 Market Size, By End-User, 2020-2027 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.3.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.3.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.3.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Application, 2020-2027 (USD Million)

7.3.9.2 Market Size, By Mode, 2020-2027 (USD Million)

7.3.9.3 Market Size, By End-User, 2020-2027 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Application, 2020-2027 (USD Million)

7.3.10.2 Market Size, By Mode, 2020-2027 (USD Million)

7.3.10.3 Market Size, By End-User, 2020-2027 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Application, 2020-2027 (USD Million)

7.3.11.2 Market Size, By Mode, 2020-2027 (USD Million)

7.3.11.3 Market Size, By End-User, 2020-2027 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2027 (USD Million)

7.4.2 Market Size, By Application, 2020-2027 (USD Million)

7.4.3 Market Size, By Mode, 2020-2027 (USD Million)

7.4.4 Market Size, By End-User, 2020-2027 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Application, 2020-2027 (USD Million)

7.4.6.2 Market Size, By Mode, 2020-2027 (USD Million)

7.4.6.3 Market Size, By End-User, 2020-2027 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.4.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.4.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.4.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Application, 2020-2027 (USD Million)

7.4.9.2 Market size, By Mode, 2020-2027 (USD Million)

7.4.9.3 Market Size, By End-User, 2020-2027 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Application, 2020-2027 (USD Million)

7.4.10.2 Market Size, By Mode, 2020-2027 (USD Million)

7.4.10.3 Market Size, By End-User, 2020-2027 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2027 (USD Million)

7.5.2 Market Size, By Application, 2020-2027 (USD Million)

7.5.3 Market Size, By Mode, 2020-2027 (USD Million)

7.5.4 Market Size, By End-User, 2020-2027 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Application, 2020-2027 (USD Million)

7.5.6.2 Market Size, By Mode, 2020-2027 (USD Million)

7.5.6.3 Market Size, By End-User, 2020-2027 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.5.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.5.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.5.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2027 (USD Million)

7.6.2 Market Size, By Application, 2020-2027 (USD Million)

7.6.3 Market Size, By Mode, 2020-2027 (USD Million)

7.6.4 Market Size, By End-User, 2020-2027 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Application, 2020-2027 (USD Million)

7.6.6.2 Market Size, By Mode, 2020-2027 (USD Million)

7.6.6.3 Market Size, By End-User, 2020-2027 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.6.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2027 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Application, 2020-2027 (USD Million)

7.6.7.2 Market Size, By Mode, 2020-2027 (USD Million)

7.6.7.3 Market Size, By End-User, 2020-2027 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Waymo

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Plus

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Kodiak Robotics

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Manbang Group

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Convoy

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Flock Freight

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 FOR-U Smart Freight

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 BlackBuck

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Loadsmart

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Freight Matching Platform Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Freight Matching Platform Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS