Global Gaming as a Service Market Size, Trends & Analysis - Forecasts to 2029 By Streaming Type (File Streaming and Video Streaming), By Device Type (PC, Mobile-based, and Console-based), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

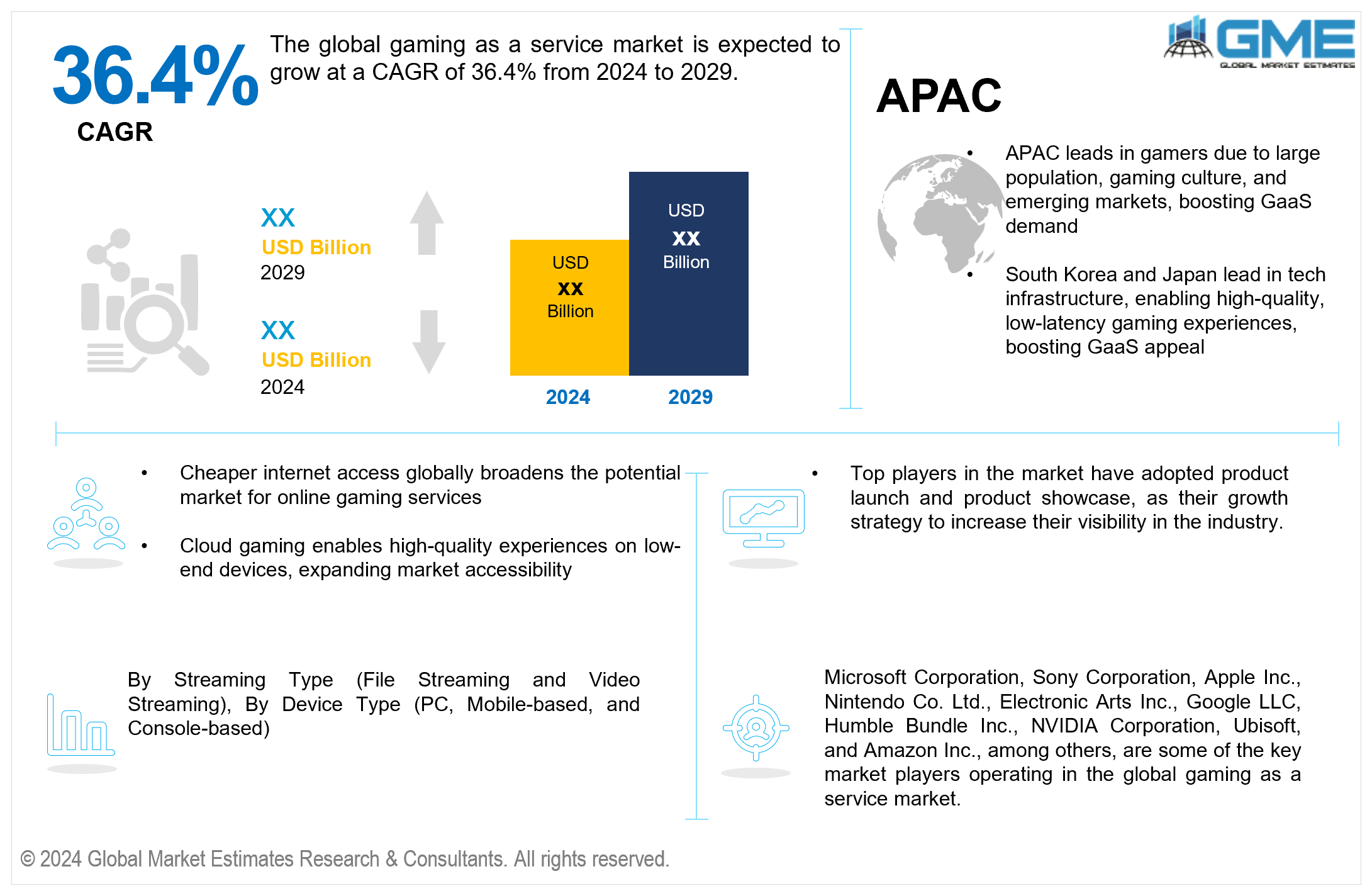

The global gaming as a service market is estimated to exhibit a CAGR of 36.4% from 2024 to 2029. Gaming as a service (GaaS) is a model where video games are provided to users on a subscription or pay-per-use basis, often through cloud-based platforms. It allows gamers to access a diverse library of games without the need for expensive hardware or physical copies. GaaS offers benefits such as frequent updates, multiplayer functionality, and cross-platform support. Developers can continuously improve games and tailor experiences based on user feedback. This model fosters a more flexible and accessible gaming ecosystem, enhancing convenience and affordability for players while promoting ongoing revenue streams for developers.

Several factors drive the growth of the global gaming as a service market. As internet accessibility reaches more regions worldwide, the potential market for online gaming services expands significantly. High-speed internet is becoming more affordable and widespread, allowing users from various locations to engage in online gaming, thus broadening the audience base for GaaS. Cloud gaming technology has revolutionized the distribution and consumption of interactive entertainment, transforming the global gaming as a service market. It allows seamless game streaming to diverse devices, eliminating the need for high-end hardware. This accessibility enhances the gaming experience, promoting instantaneous updates and patches and driving the evolution and expansion of the global gaming sector. The popularity of live game streaming and esports has brought about a significant audience interested in gaming content. GaaS platforms integrate with these trends, offering features like live streaming capabilities and access to multiplayer games and tournaments, which attract an engaged and competitive user base.

Despite the various growth factors, several restraints hinder the growth of the global gaming as a service market. The growing gaming industry has raised concerns about privacy and security due to the accumulation of extensive user data. Recent data breaches have heightened these concerns, leading to a reluctance among users to share personal information. GaaS providers face a challenge in establishing robust data protection protocols and fostering trust with their user base, balancing data use for service delivery with users' commitment to data integrity and confidentiality.

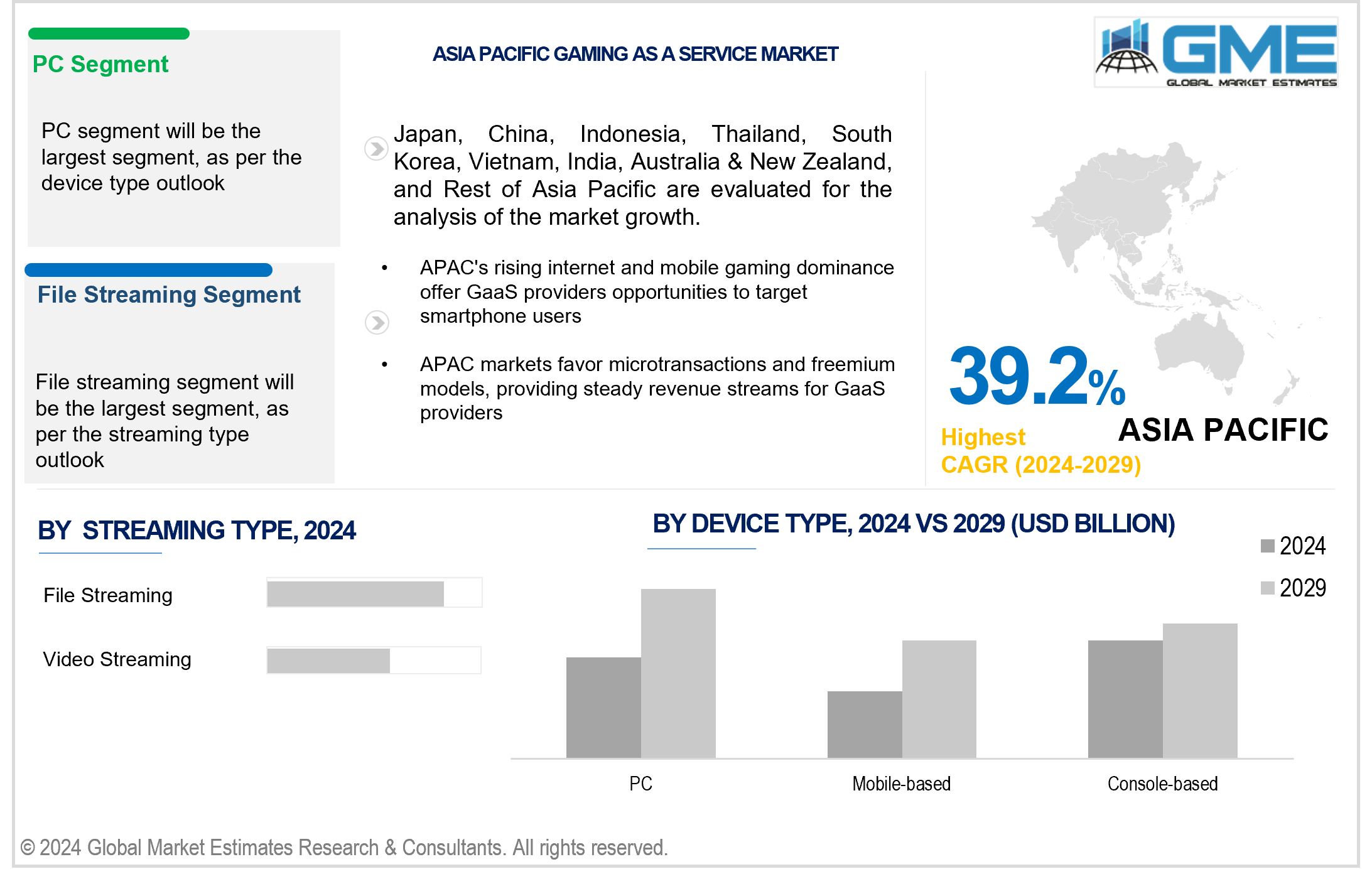

On the basis of streaming type, the market is segmented into file streaming and video streaming. File streaming is expected to be the largest segment during the forecast period. File streaming is a cloud-based method that allows users to download and play games without needing high-performance hardware or physical storage. This approach is popular among gamers, including casual ones, as it offers immediate access to a wide range of titles without installation or maintenance. Advancements in streaming technology have minimized latency, making it a preferred choice for many gamers and solidifying its dominance in the GaaS market.

The video streaming segment is expected to be the fastest-growing segment in the global gaming as a service market. Advancements in streaming technology have notably enhanced the caliber and reliability of cloud-based gaming encounters, rendering them increasingly accessible to a broader spectrum of users. Subscription-oriented models furnish an extensive repertoire of games at a fixed monthly rate, garnering interest from casual enthusiasts and committed gamers alike. The proliferation of high-speed internet and streaming apparatus has propelled the growth of video game streaming services, allowing consumers to relish top-tier gaming experiences sans the necessity for expensive hardware enhancements.

On the basis of device type, the market is segmented into PC, mobile-based, and console-based. The PC segment is expected to hold the largest share of the market during the forecast period. PCs or personal computers offer versatile hardware for various gaming experiences, providing flexibility and scalability. They are a primary gaming platform with a vast library of games on digital distribution platforms like Steam and Epic Games Store. The open PC ecosystem allows easy integration of GaaS services, making PC gaming highly accessible, customizable, and preferred by the gaming community, contributing to its dominance in the GaaS market.

The mobile-based segment is anticipated to be the fastest-growing in the global gaming as a service market during the forecast period. The proliferation of smartphones and tablets has notably expanded the reach of gaming, appealing to a more extensive demographic on a global scale. Progressions in mobile technology, marked by faster processors and enhanced graphics capabilities, have empowered developers to craft immersive gaming encounters of superior quality. The inherent convenience of mobile gaming, facilitating gameplay at any time and in any place, synergizes seamlessly with the subscription-based and on-demand attributes inherent in GaaS offerings.

North America is expected to be the largest region in the global gaming as a service market. North America is home to major market players like Microsoft, NVIDIA, and Electronic Arts, who provide some of the most famous gaming services, such as Xbox consoles, GeForce graphic cards, and EA Play services. The market in North America is characterized by its openness to adopting new technologies. Consumers are keen to try out the latest innovations, including GaaS. This tendency towards early adoption helps in quickly building a user base for new services, which cements the dominance of the region in the market.

Asia Pacific is anticipated to be the fastest-growing region in the global gaming as a service during the forecast period. APAC has the world's largest population of gamers due to its vast population and deep cultural integration of gaming. Countries like China, South Korea, and Japan have long-standing gaming cultures while emerging markets such as India and Southeast Asia are witnessing rapid growth in their gaming populations. This extensive base of potential customers drives demand for GaaS offerings. The region has seen a significant increase in internet penetration rates and a mobile-first approach to internet access. Mobile gaming is dominant in APAC, with many consumers using smartphones as their primary gaming devices. The region is home to a thriving community of game developers and publishers, producing content that resonates with local tastes and cultural preferences. GaaS platforms that offer localized content have a competitive edge, appealing to regional preferences and driving adoption. Countries like South Korea and Japan are at the forefront of technological infrastructure, including some of the world's fastest internet speeds and widespread 5G deployment, which leads to rapid market growth in the region.

Microsoft Corporation, Sony Corporation, Apple Inc., Nintendo Co. Ltd., Electronic Arts Inc., Google LLC, Humble Bundle Inc., NVIDIA Corporation, Ubisoft, and Amazon Inc., among others, are some of the key players operating in the global gaming as a service market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, Ubisoft renamed Ubisoft Plus to Ubisoft Plus Premium to offer early access to games like Prince of Persia: The Lost Crown, premium editions of Far Cry 6, Avatar: Frontiers of Pandora, and Assassin's Creed Mirage.

In October 2023, Sony announced that it is launching cloud streaming for PlayStation Plus subscribers, allowing them to stream popular gaming titles like "Spider-Man: Miles Morales" and "Resident Evil 4" directly to their consoles.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL GAMING AS A SERVICE MARKET, BY DEVICE TYPE

4.1 Introduction

4.2 Gaming as a Service Market: Device Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Console-based

4.4.1 Console-based Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Mobile-based

4.5.1 Mobile-based Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 PC

4.6.1 PC Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL GAMING AS A SERVICE MARKET, BY STREAMING TYPE

5.1 Introduction

5.2 Gaming as a Service Market: Streaming Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 File Streaming

5.4.1 File Streaming Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Video Streaming

5.5.1 Video Streaming Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL GAMING AS A SERVICE MARKET, BY REGION

6.1 Introduction

6.2 North America Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Device Type

6.2.2 By Streaming Type

6.2.3 By Country

6.2.3.1 U.S. Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Device Type

6.2.3.1.2 By Streaming Type

6.2.3.2 Canada Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Device Type

6.2.3.2.2 By Streaming Type

6.2.3.3 Mexico Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Device Type

6.2.3.3.2 By Streaming Type

6.3 Europe Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Device Type

6.3.2 By Streaming Type

6.3.3 By Country

6.3.3.1 Germany Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Device Type

6.3.3.1.2 By Streaming Type

6.3.3.2 U.K. Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Device Type

6.3.3.2.2 By Streaming Type

6.3.3.3 France Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Device Type

6.3.3.3.2 By Streaming Type

6.3.3.4 Italy Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Device Type

6.3.3.4.2 By Streaming Type

6.3.3.5 Spain Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Device Type

6.3.3.5.2 By Streaming Type

6.3.3.6 Netherlands Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Device Type

6.3.3.6.2 By Streaming Type

6.3.3.7 Rest of Europe Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Device Type

6.3.3.6.2 By Streaming Type

6.4 Asia Pacific Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Device Type

6.4.2 By Streaming Type

6.4.3 By Country

6.4.3.1 China Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Device Type

6.4.3.1.2 By Streaming Type

6.4.3.2 Japan Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Device Type

6.4.3.2.2 By Streaming Type

6.4.3.3 India Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Device Type

6.4.3.3.2 By Streaming Type

6.4.3.4 South Korea Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Device Type

6.4.3.4.2 By Streaming Type

6.4.3.5 Singapore Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Device Type

6.4.3.5.2 By Streaming Type

6.4.3.6 Malaysia Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Device Type

6.4.3.6.2 By Streaming Type

6.4.3.7 Thailand Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Device Type

6.4.3.6.2 By Streaming Type

6.4.3.8 Indonesia Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Device Type

6.4.3.7.2 By Streaming Type

6.4.3.9 Vietnam Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Device Type

6.4.3.8.2 By Streaming Type

6.4.3.10 Taiwan Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Device Type

6.4.3.10.2 By Streaming Type

6.4.3.11 Rest of Asia Pacific Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Device Type

6.4.3.11.2 By Streaming Type

6.5 Middle East and Africa Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Device Type

6.5.2 By Streaming Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Device Type

6.5.3.1.2 By Streaming Type

6.5.3.2 U.A.E. Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Device Type

6.5.3.2.2 By Streaming Type

6.5.3.3 Israel Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Device Type

6.5.3.3.2 By Streaming Type

6.5.3.4 South Africa Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Device Type

6.5.3.4.2 By Streaming Type

6.5.3.5 Rest of Middle East and Africa Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Device Type

6.5.3.5.2 By Streaming Type

6.6 Central & South America Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Device Type

6.6.2 By Streaming Type

6.6.3 By Country

6.6.3.1 Brazil Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Device Type

6.6.3.1.2 By Streaming Type

6.6.3.2 Argentina Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Device Type

6.6.3.2.2 By Streaming Type

6.6.3.3 Chile Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Device Type

6.6.3.3.2 By Streaming Type

6.6.3.3 Rest of Central & South America Gaming as a Service Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Device Type

6.6.3.3.2 By Streaming Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Microsoft Corporation

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Sony Corporation

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Nintendo Co. Ltd.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Electronic Arts Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Humble Bundle Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Google LLC

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 NVIDIA Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Amazon Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Ubisoft

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Apple Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

2 Console-based Market, By Region, 2021-2029 (USD Million)

3 Mobile-based Market, By Region, 2021-2029 (USD Million)

4 PC Market, By Region, 2021-2029 (USD Million)

5 Global Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

6 File Streaming Market, By Region, 2021-2029 (USD Million)

7 Video Streaming Market, By Region, 2021-2029 (USD Million)

8 Regional Analysis, 2021-2029 (USD Million)

9 North America Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

10 North America Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

11 North America Gaming as a Service Market, By Country, 2021-2029 (USD Million)

12 U.S. Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

13 U.S. Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

14 Canada Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

15 Canada Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

16 Mexico Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

17 Mexico Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

18 Europe Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

19 Europe Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

20 Europe Gaming as a Service Market, By Country, 2021-2029 (USD Million)

21 Germany Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

22 Germany Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

23 U.K. Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

24 U.K. Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

25 France Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

26 France Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

27 Italy Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

28 Italy Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

29 Spain Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

30 Spain Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

31 Netherlands Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

32 Netherlands Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

33 Rest Of Europe Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

34 Rest Of Europe Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

35 Asia Pacific Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

36 Asia Pacific Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

37 Asia Pacific Gaming as a Service Market, By Country, 2021-2029 (USD Million)

38 China Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

39 China Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

40 Japan Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

41 Japan Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

42 India Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

43 India Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

44 South Korea Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

45 South Korea Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

46 Singapore Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

47 Singapore Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

48 Thailand Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

49 Thailand Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

50 Malaysia Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

51 Malaysia Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

52 Indonesia Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

53 Indonesia Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

54 Vietnam Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

55 Vietnam Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

56 Taiwan Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

57 Taiwan Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

58 Rest of APAC Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

59 Rest of APAC Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

60 Middle East and Africa Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

61 Middle East and Africa Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

62 Middle East and Africa Gaming as a Service Market, By Country, 2021-2029 (USD Million)

63 Saudi Arabia Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

64 Saudi Arabia Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

65 UAE Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

66 UAE Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

67 Israel Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

68 Israel Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

69 South Africa Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

70 South Africa Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

71 Rest Of Middle East and Africa Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

72 Rest Of Middle East and Africa Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

73 Central & South America Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

74 Central & South America Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

75 Central & South America Gaming as a Service Market, By Country, 2021-2029 (USD Million)

76 Brazil Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

77 Brazil Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

78 Chile Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

79 Chile Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

80 Argentina Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

81 Argentina Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

82 Rest Of Central & South America Gaming as a Service Market, By Device Type, 2021-2029 (USD Million)

83 Rest Of Central & South America Gaming as a Service Market, By Streaming Type, 2021-2029 (USD Million)

84 microsoft Corporation: Products & Services Offering

85 Sony Corporation: Products & Services Offering

86 Nintendo Co. Ltd.: Products & Services Offering

87 Electronic Arts Inc.: Products & Services Offering

88 Humble Bundle Inc.: Products & Services Offering

89 Google LLC: Products & Services Offering

90 NVIDIA Corporation : Products & Services Offering

91 Amazon Inc.: Products & Services Offering

92 Ubisoft, Inc: Products & Services Offering

93 Apple Inc.: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Gaming as a Service Market Overview

2 Global Gaming as a Service Market Value From 2021-2029 (USD Million)

3 Global Gaming as a Service Market Share, By Device Type (2023)

4 Global Gaming as a Service Market Share, By Streaming Type (2023)

5 Global Gaming as a Service Market, By Region (Global Market)

6 Technological Trends In Global Gaming as a Service Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Gaming as a Service Market

10 Impact Of Challenges On The Global Gaming as a Service Market

11 Porter’s Five Forces Analysis

12 Global Gaming as a Service Market: By Device Type Scope Key Takeaways

13 Global Gaming as a Service Market, By Device Type Segment: Revenue Growth Analysis

14 Console-based Market, By Region, 2021-2029 (USD Million)

15 Mobile-based Market, By Region, 2021-2029 (USD Million)

16 PC Market, By Region, 2021-2029 (USD Million)

17 Global Gaming as a Service Market: By Streaming Type Scope Key Takeaways

18 Global Gaming as a Service Market, By Streaming Type Segment: Revenue Growth Analysis

19 File Streaming Market, By Region, 2021-2029 (USD Million)

20 Video Streaming Market, By Region, 2021-2029 (USD Million)

21 Regional Segment: Revenue Growth Analysis

22 Global Gaming as a Service Market: Regional Analysis

23 North America Gaming as a Service Market Overview

24 North America Gaming as a Service Market, By Device Type

25 North America Gaming as a Service Market, By Streaming Type

26 North America Gaming as a Service Market, By Country

27 U.S. Gaming as a Service Market, By Device Type

28 U.S. Gaming as a Service Market, By Streaming Type

29 Canada Gaming as a Service Market, By Device Type

30 Canada Gaming as a Service Market, By Streaming Type

31 Mexico Gaming as a Service Market, By Device Type

32 Mexico Gaming as a Service Market, By Streaming Type

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 Microsoft Corporation: Company Snapshot

36 Microsoft Corporation: SWOT Analysis

37 Microsoft Corporation: Geographic Presence

38 Sony Corporation: Company Snapshot

39 Sony Corporation: SWOT Analysis

40 Sony Corporation: Geographic Presence

41 Nintendo Co. Ltd.: Company Snapshot

42 Nintendo Co. Ltd.: SWOT Analysis

43 Nintendo Co. Ltd.: Geographic Presence

44 Electronic Arts Inc.: Company Snapshot

45 Electronic Arts Inc.: Swot Analysis

46 Electronic Arts Inc.: Geographic Presence

47 Humble Bundle Inc.: Company Snapshot

48 Humble Bundle Inc.: SWOT Analysis

49 Humble Bundle Inc.: Geographic Presence

50 Google LLC: Company Snapshot

51 Google LLC: SWOT Analysis

52 Google LLC: Geographic Presence

53 NVIDIA Corporation : Company Snapshot

54 NVIDIA Corporation : SWOT Analysis

55 NVIDIA Corporation : Geographic Presence

56 Amazon Inc.: Company Snapshot

57 Amazon Inc.: SWOT Analysis

58 Amazon Inc.: Geographic Presence

59 Ubisoft, Inc.: Company Snapshot

60 Ubisoft, Inc.: SWOT Analysis

61 Ubisoft, Inc.: Geographic Presence

62 Apple Inc.: Company Snapshot

63 Apple Inc.: SWOT Analysis

64 Apple Inc.: Geographic Presence

65 Other Companies: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

The Global Gaming as a Service Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Gaming as a Service Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS