Global Generative AI in Insurance Market Size, Trends & Analysis - Forecasts to 2029 By Application (Underwriting Automation, Risk Assessment and Management, Fraud Detection, Customer Service and Engagement, and Claim Processing), By End User (Insurance Carriers, Brokers and Agents, and Third-Party Administrators), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

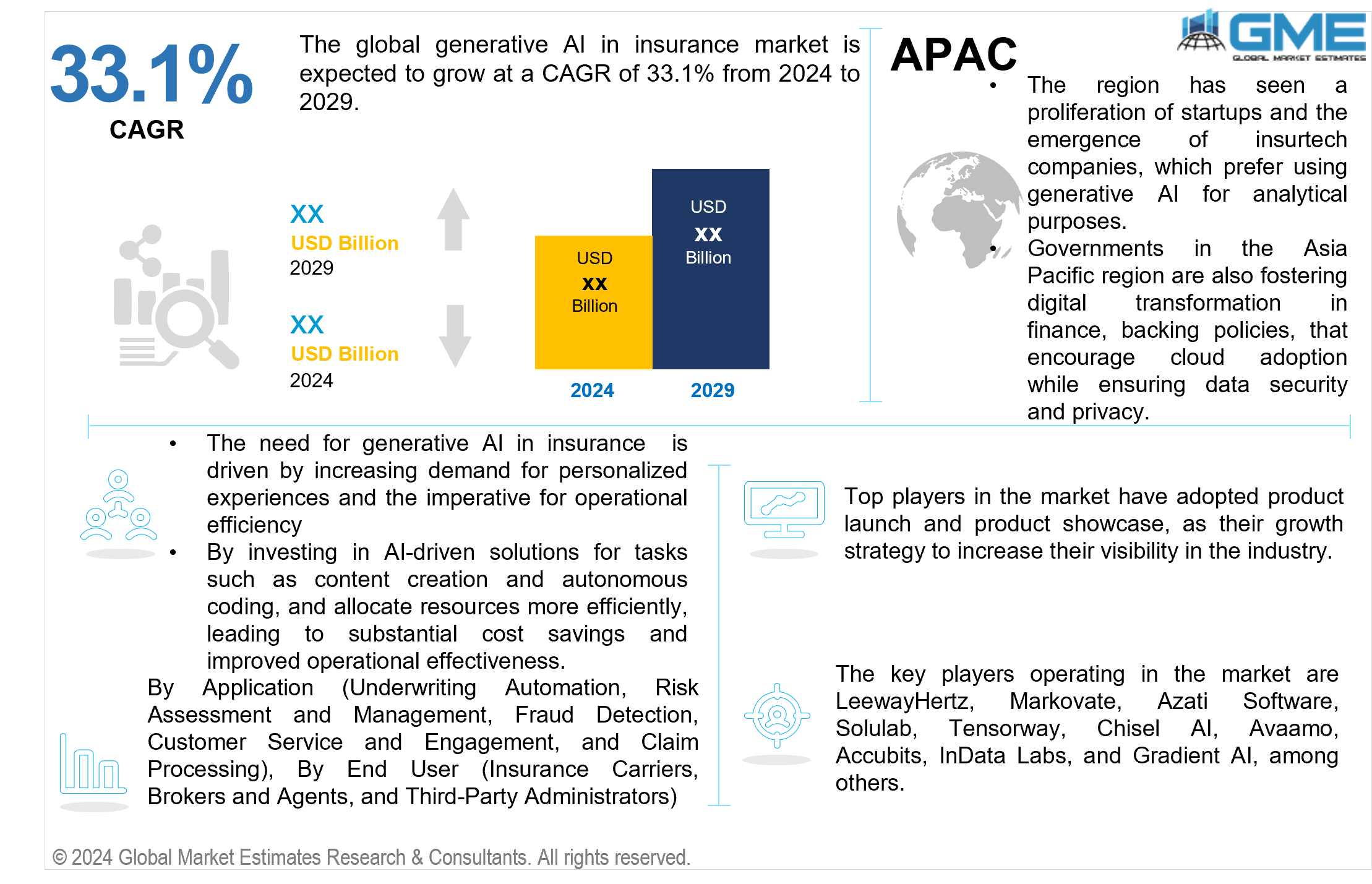

The global generative AI in insurance market is expected to grow at a CAGR of 33.1% from 2024 to 2029. Generative AI in insurance refers to the application of advanced machine learning models to create personalized recommendations, customized products, and synthetic data for improved decision-making and operational efficiency. Generative AI can generate new content and insights from unlabelled data, enabling insurers to make faster and more informed decisions, streamline processes like underwriting and claims processing, and enhance customer experiences through tailored products and interactions.

The driving factors of the market include increasing demand for personalized experiences and the imperative for operational efficiency. Customers seek tailored insurance solutions that cater to their unique needs and preferences, driving insurers to adopt AI technologies capable of delivering personalized recommendations and products. Simultaneously, insurers are driven by the imperative to streamline processes, reduce costs, and enhance productivity, leading them to leverage generative AI for automation and decision-making optimization. By investing in AI-driven solutions for tasks such as content creation and autonomous coding, insurers can streamline operations, reduce manual interventions, and allocate resources more efficiently, leading to substantial cost savings and improved operational effectiveness.

A significant restraint of the market is the potential for ethical and regulatory challenges. Generative AI models can mimic biases and discriminatory behavior if not implemented with proper guidelines and continuous monitoring.

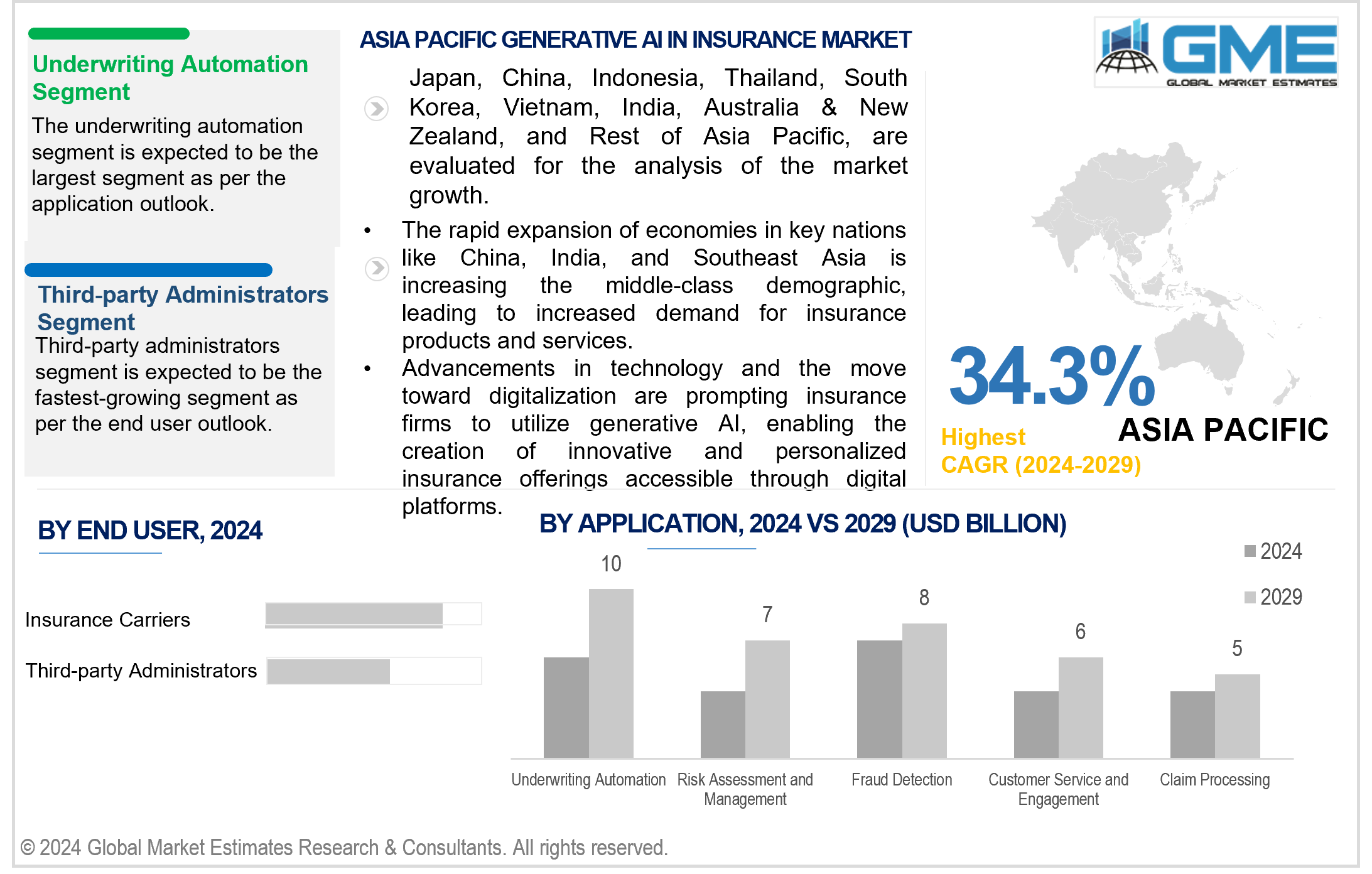

Based on application, the market is segmented into underwriting automation, risk assessment and management, fraud detection, customer service and engagement, and claim processing. The underwriting automation segment is expected to dominate the market over the forecast period. Generative AI enables insurers to automate tasks such as risk assessment, policy pricing, and eligibility determination, leading to faster decision-making and enhanced accuracy. By leveraging advanced machine learning models, insurers can optimize underwriting processes, reduce manual interventions, and improve overall efficiency, making underwriting automation the largest segment in the market.

The customer service and engagement segment is projected to grow fastest during the forecast period. This can be attributed to the increasing focus on personalized experiences and enhanced customer interactions. Generative AI enables insurers to deliver tailored recommendations, personalized products, and seamless customer interactions, thereby driving customer satisfaction and loyalty.

Based on end user, the market is segmented into insurance carriers, brokers and agents, and third-party administrators. The insurance carriers segment is expected to hold the largest share of the market during the forecast period. It is directly involved in underwriting policies and processing claims. Insurance carriers have significant resources and a vested interest in leveraging AI technologies to enhance decision-making, improve risk assessment, and personalize offerings for policyholders.

The third-party administrators segment is projected to witness the fastest growth during the forecast period. Third-party administrators play a crucial role in managing various administrative tasks for insurance companies, including claims processing, policy administration, and customer service. As Third-party administrators increasingly adopt generative AI solutions to streamline these processes, improve efficiency, and enhance customer experiences, they are expected to contribute significantly to the overall market growth during the forecast period.

North America is analyzed to be the largest region in the global generative AI in insurance market during the forecast period. In this region, the insurance sector is well-established, exhibiting major insurance carriers and a tech-savvy consumer base, which sets the stage for robust digital transformation initiatives. Businesses, including insurers, are rapidly embracing cutting-edge technologies like generative AI, big data analytics, and cloud computing to enhance operational efficiency and deliver superior customer service. This widespread adoption of advanced technologies underscores the region's commitment to innovation and modernization within the insurance industry.

Asia Pacific is analyzed to be the fastest-growing region in the global generative AI in insurance market during the forecast period. The rapid expansion of economies in key nations like China, India, and Southeast Asia is driving a rise in the middle-class demographic, leading to increased demand for insurance products and services. Concurrently, advancements in technology and the move toward digitalization are prompting insurance firms to utilize generative AI, enabling the creation of innovative and personalized insurance offerings accessible through digital platforms. Moreover, the region has seen a proliferation of startups and the emergence of insurtech companies, which, being digital-first and cloud-native, prefer using generative AI for analytical purposes. Governments in the Asia Pacific region are also fostering digital transformation in finance, backing policies, investing in digital infrastructure, and implementing regulations that encourage cloud adoption while ensuring data security and privacy.

LeewayHertz, Markovate, Azati Software, Solulab, Tensorway, Chisel AI, Avaamo, Accubits, InData Labs, and Gradient AI are some of the market players operating in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL GENERATIVE AI IN INSURANCE MARKET, BY APPLICATION

4.1 Introduction

4.2 Generative AI in Insurance Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Underwritng Automation

4.4.1 Underwritng Automation Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Risk Assessment and Management

4.5.1 Risk Assessment and Management Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Fraud Detection

4.6.1 Fraud Detection Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Customer Service and Engagement

4.7.1 Customer Service and Engagement Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Claim Processing

4.8.1 Claim Processing Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL GENERATIVE AI IN INSURANCE MARKET, BY END USER

5.1 Introduction

5.2 Generative AI in Insurance Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Insurance Carriers

5.4.1 Insurance Carriers Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Brokers and Agents

5.5.1 Brokers and Agents Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Third-Party Administrators

5.6.1 Third-Party Administrators Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL GENERATIVE AI IN INSURANCE MARKET, BY REGION

6.1 Introduction

6.2 North America Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Application

6.2.3.1.2 By End User

6.2.3.2 Canada Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Application

6.2.3.2.2 By End User

6.2.3.3 Mexico Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Application

6.2.3.3.2 By End User

6.3 Europe Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Application

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Application

6.3.3.1.2 By End User

6.3.3.2 U.K. Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Application

6.3.3.2.2 By End User

6.3.3.3 France Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Application

6.3.3.3.2 By End User

6.3.3.4 Italy Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Application

6.3.3.4.2 By End User

6.3.3.5 Spain Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Application

6.3.3.5.2 By End User

6.3.3.6 Netherlands Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By End User

6.4 Asia Pacific Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Application

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Application

6.4.3.1.2 By End User

6.4.3.2 Japan Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Application

6.4.3.2.2 By End User

6.4.3.3 India Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Application

6.4.3.3.2 By End User

6.4.3.4 South Korea Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Application

6.4.3.4.2 By End User

6.4.3.5 Singapore Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Application

6.4.3.5.2 By End User

6.4.3.6 Malaysia Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By End User

6.4.3.7 Thailand Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By End User

6.4.3.8 Indonesia Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Application

6.4.3.7.2 By End User

6.4.3.9 Vietnam Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Application

6.4.3.8.2 By End User

6.4.3.10 Taiwan Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Application

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Application

6.4.3.11.2 By End User

6.5 Middle East and Africa Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Application

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Application

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Application

6.5.3.2.2 By End User

6.5.3.3 Israel Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Application

6.5.3.3.2 By End User

6.5.3.4 South Africa Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Application

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Application

6.5.3.5.2 By End User

6.6 Central & South America Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Application

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Application

6.6.3.1.2 By End User

6.6.3.2 Argentina Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Application

6.6.3.2.2 By End User

6.6.3.3 Chile Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By End User

6.6.3.3 Rest of Central & South America Generative AI in Insurance Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 LeewayHertz

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Markovate

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Azati Software

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Solulab

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Tensorway

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 CHISEL AI

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Avaamo

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Accubits

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 InData Labs

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Gradient AI

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

2 Underwritng Automation Market, By Region, 2021-2029 (USD Million)

3 Risk Assessment and Management Market, By Region, 2021-2029 (USD Million)

4 Fraud Detection Market, By Region, 2021-2029 (USD Million)

5 Customer Service and Engagement Market, By Region, 2021-2029 (USD Million)

6 Claim Processing Market, By Region, 2021-2029 (USD Million)

7 Global Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

8 Insurance Carriers Market, By Region, 2021-2029 (USD Million)

9 Brokers and Agents Market, By Region, 2021-2029 (USD Million)

10 Third-Party Administrators Market, By Region, 2021-2029 (USD Million)

11 Regional Analysis, 2021-2029 (USD Million)

12 North America Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

13 North America Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

14 North America Generative AI in Insurance Market, By Country, 2021-2029 (USD Million)

15 U.S. Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

16 U.S. Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

17 Canada Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

18 Canada Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

19 Mexico Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

20 Mexico Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

21 Europe Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

22 Europe Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

23 Europe Generative AI in Insurance Market, By Country, 2021-2029 (USD Million)

24 Germany Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

25 Germany Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

26 U.K. Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

27 U.K. Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

28 France Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

29 France Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

30 Italy Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

31 Italy Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

32 Spain Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

33 Spain Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

34 Netherlands Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

35 Netherlands Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

36 Rest Of Europe Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

37 Rest Of Europe Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

38 Asia Pacific Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

39 Asia Pacific Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

40 Asia Pacific Generative AI in Insurance Market, By Country, 2021-2029 (USD Million)

41 China Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

42 China Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

43 Japan Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

44 Japan Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

45 India Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

46 India Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

47 South Korea Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

48 South Korea Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

49 Singapore Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

50 Singapore Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

51 Thailand Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

52 Thailand Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

53 Malaysia Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

54 Malaysia Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

55 Indonesia Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

56 Indonesia Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

57 Vietnam Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

58 Vietnam Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

59 Taiwan Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

60 Taiwan Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

61 Rest of APAC Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

62 Rest of APAC Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

63 Middle East and Africa Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

64 Middle East and Africa Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

65 Middle East and Africa Generative AI in Insurance Market, By country, 2021-2029 (USD Million)

66 Saudi Arabia Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

67 Saudi Arabia Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

68 UAE Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

69 UAE Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

70 Israel Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

71 Israel Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

72 South Africa Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

73 South Africa Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

74 Rest Of Middle East and Africa Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

75 Rest Of Middle East and Africa Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

76 Central & South America Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

77 Central & South America Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

78 Central & South America Generative AI in Insurance Market, By Country, 2021-2029 (USD Million)

79 Brazil Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

80 Brazil Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

81 Chile Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

82 Chile Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

83 Argentina Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

84 Argentina Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

85 Rest Of Central & South America Generative AI in Insurance Market, By Application, 2021-2029 (USD Million)

86 Rest Of Central & South America Generative AI in Insurance Market, By End User, 2021-2029 (USD Million)

87 LeewayHertz: Products & Services Offering

88 Markovate: Products & Services Offering

89 Azati Software: Products & Services Offering

90 Solulab: Products & Services Offering

91 Tensorway: Products & Services Offering

92 CHISEL AI: Products & Services Offering

93 Avaamo: Products & Services Offering

94 Accubits: Products & Services Offering

95 InData Labs: Products & Services Offering

96 Gradient AI: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Generative AI in Insurance Market Overview

2 Global Generative AI in Insurance Market Value From 2021-2029 (USD Million)

3 Global Generative AI in Insurance Market Share, By Application (2023)

4 Global Generative AI in Insurance Market Share, By End User (2023)

5 Global Generative AI in Insurance Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Generative AI in Insurance Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Generative AI in Insurance Market

10 Impact Of Challenges On The Global Generative AI in Insurance Market

11 Porter’s Five Forces Analysis

12 Global Generative AI in Insurance Market: By Application Scope Key Takeaways

13 Global Generative AI in Insurance Market, By Application Segment: Revenue Growth Analysis

14 Underwritng Automation Market, By Region, 2021-2029 (USD Million)

15 Risk Assessment and Management Market, By Region, 2021-2029 (USD Million)

16 Fraud Detection Market, By Region, 2021-2029 (USD Million)

17 Customer Service and Engagement Market, By Region, 2021-2029 (USD Million)

18 Claim Processing Market, By Region, 2021-2029 (USD Million)

19 Global Generative AI in Insurance Market: By End User Scope Key Takeaways

20 Global Generative AI in Insurance Market, By End User Segment: Revenue Growth Analysis

21 Insurance Carriers Market, By Region, 2021-2029 (USD Million)

22 Brokers and Agents Market, By Region, 2021-2029 (USD Million)

23 Third-Party Administrators Market, By Region, 2021-2029 (USD Million)

24 Regional Segment: Revenue Growth Analysis

25 Global Generative AI in Insurance Market: Regional Analysis

26 North America Generative AI in Insurance Market Overview

27 North America Generative AI in Insurance Market, By Application

28 North America Generative AI in Insurance Market, By End User

29 North America Generative AI in Insurance Market, By Country

30 U.S. Generative AI in Insurance Market, By Application

31 U.S. Generative AI in Insurance Market, By End User

32 Canada Generative AI in Insurance Market, By Application

33 Canada Generative AI in Insurance Market, By End User

34 Mexico Generative AI in Insurance Market, By Application

35 Mexico Generative AI in Insurance Market, By End User

36 Four Quadrant Positioning Matrix

37 Company Market Share Analysis

38 LeewayHertz: Company Snapshot

39 LeewayHertz: SWOT Analysis

40 LeewayHertz: Geographic Presence

41 Markovate: Company Snapshot

42 Markovate: SWOT Analysis

43 Markovate: Geographic Presence

44 Azati Software: Company Snapshot

45 Azati Software: SWOT Analysis

46 Azati Software: Geographic Presence

47 Solulab: Company Snapshot

48 Solulab: Swot Analysis

49 Solulab: Geographic Presence

50 Tensorway: Company Snapshot

51 Tensorway: SWOT Analysis

52 Tensorway: Geographic Presence

53 CHISEL AI: Company Snapshot

54 CHISEL AI: SWOT Analysis

55 CHISEL AI: Geographic Presence

56 Avaamo: Company Snapshot

57 Avaamo: SWOT Analysis

58 Avaamo: Geographic Presence

59 Accubits: Company Snapshot

60 Accubits: SWOT Analysis

61 Accubits: Geographic Presence

62 InData Labs.: Company Snapshot

63 InData Labs.: SWOT Analysis

64 InData Labs.: Geographic Presence

65 Gradient AI: Company Snapshot

66 Gradient AI: SWOT Analysis

67 Gradient AI: Geographic Presence

68 Other Companies: Company Snapshot

69 Other Companies: SWOT Analysis

70 Other Companies: Geographic Presence

The Global Generative AI in Insurance Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Generative AI in Insurance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS