Global Geotechnical Services Market Size, Trends & Analysis - Forecasts to 2027 By Type (Underground City Space, Slope & Excavation, Ground & Foundation), By End-User (Bridge & Tunnel, Building Construction, Marine, Mining, Municipal, Oil & Gas), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

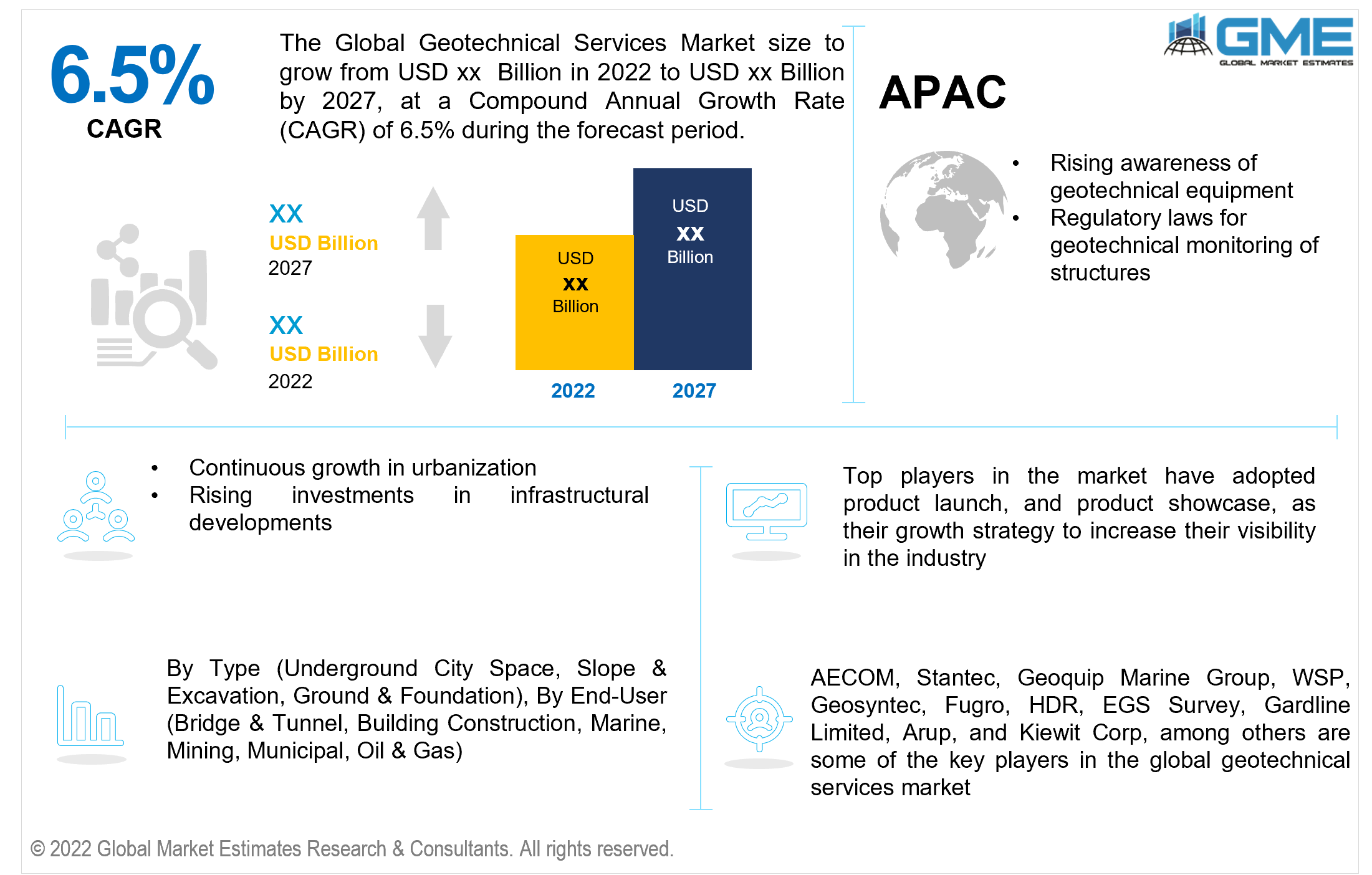

The Global Geotechnical Services Market is projected to grow at a CAGR value of 6.5% from 2022 to 2027.

Geotechnical services are becoming popular during the forecast period as they are significantly being used to determine the heat resilience of backfill resources necessary for transmission lines and pipelines, as well as sewage disposal and subterranean warehousing facilities.

Geotechnical services aid in the identification of issues and the avoidance of costly delays in construction, redevelopment, and engineering projects. Additionally, their significant use in extractive sectors like open cast and underground mining, as well as petroleum extraction, along with their deployment for assessing natural risks like earthquakes and landslides are contributing to market growth.

Continuous growth in urbanization, a breakthrough in green building materials, rising investments in infrastructural developments, particularly in developing countries, and the relevance of geotechnical services in planning and lowering the risk associated with project development and long-term investment is fueling market expansion.

Furthermore, a widespread desire to avoid structural breakdowns, rising environmental consciousness, and the adoption of government-backed environmental policies and initiatives for long-term structures are also significantly contributing to market expansion.

Rising infrastructure improvements, increased usage of geotechnical instruments to minimize mechanical problems, burdensome regulations for sustainable structures, and expanding awareness of the importance of measurement and monitoring equipment are all contributing to global market growth.

Market expansion is also being fueled by factors such as historic restoration and preservation, seismic risk analysis and risk mitigation, site rehabilitation and ecological enrichment, as well as research & innovation in cold environments such as the ocean depths and space.

Wind power utilization has increased in most nations throughout the world in recent years which is also a major factor contributing to market growth. The rate of increase varies greatly among countries including Denmark, Portugal, Ireland, Spain, Cyprus, Germany, China, the United States, and Canada, ranging from 5.5 percent to 40%. By the middle of 2019, over 5500 offshore wind turbines had been linked to the grid in 17 nations.

Owing to the imposition of lockdowns in several places, an imbalance in demand and supply was seen, resulting in enterprises not operating at full capacity. Lockdowns were implemented in various places, causing supply chain disruptions. Throughout the first two quarters of 2020, key producers of geotechnical instruments and software suppliers were badly impacted.

However, the market has been steadily recovering since the third quarter of 2020, when many regions' lockdowns were removed. Many infrastructure improvements have been restarted during the third quarter, and the growing number of new infrastructure projects will generate new growth prospects for market players in the foreseeing years.

The Ukraine-Russia war will harm the energy & power sector for an extended period. With Russia as the world's second-largest oil producer and Europe as one of its greatest customers, one of the significant consequences of Russia's conflict with Ukraine has been a surge in oil prices, which has pushed the price of oil to nearly $140 per barrel for the first time in over a decade.

Another possible consequence of the ongoing war is supply chain interruption. Imports of components for batteries, microchips, auto parts, and petrochemical manufacture, in particular, may be jeopardized. Russia is the world's third-largest producer of aluminum and nickel, both of which are essential components in the creation of lithium-ion batteries for electric vehicles and other applications.

Ukraine is a major producer of rare gases such as neon, argon, krypton, and xenon, which are required in the manufacture of microchips. Disruptions in these markets might worsen the 'chip crisis,' which is already wreaking havoc as a consequence of the coronavirus outbreak. In addition, disruptions in imports and supply chains always raise demand and prices, which may influence production.

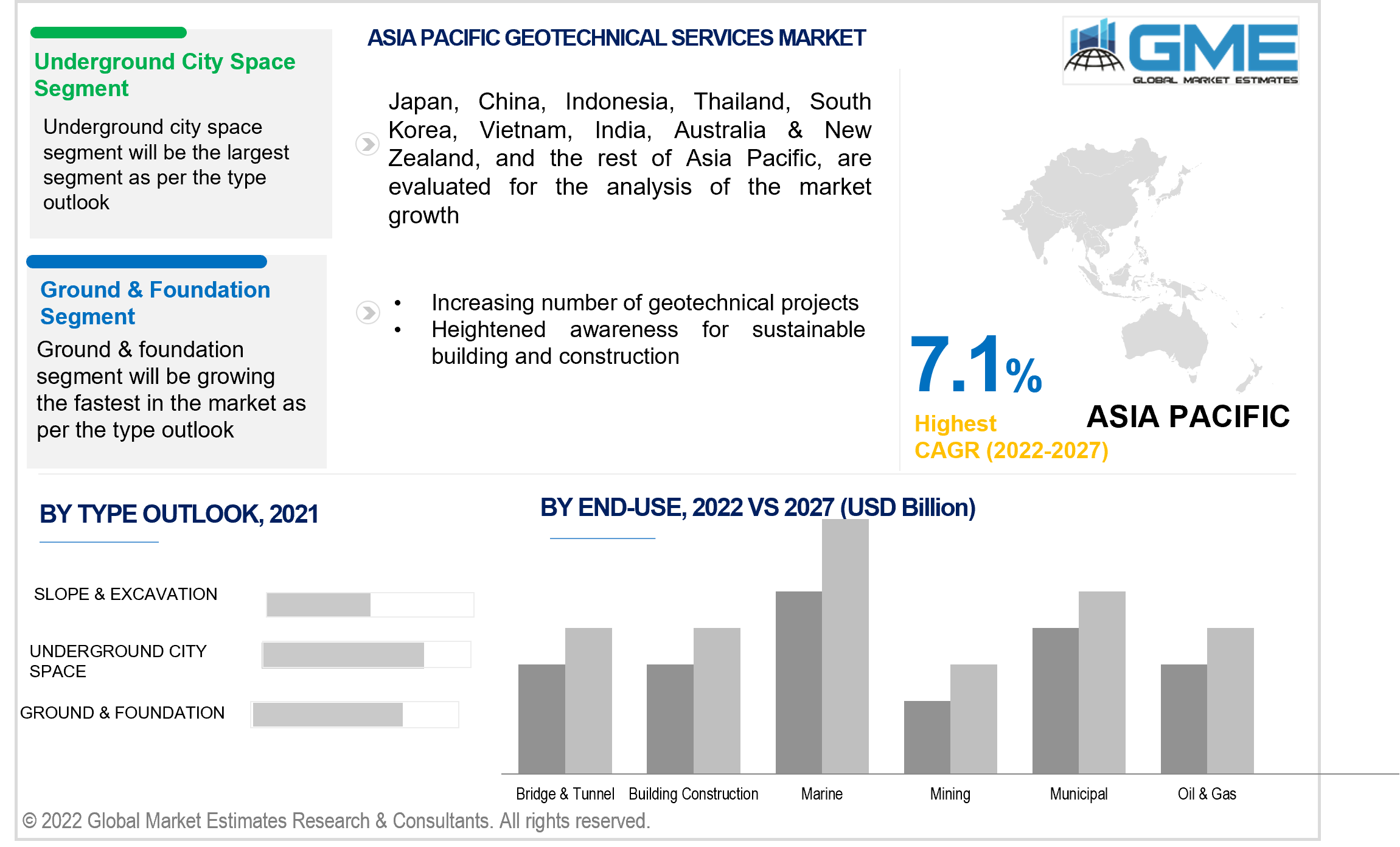

Underground city space is expected to be the most prominent geotechnical services market segment from 2022 to 2027. The utilization of underground space has additional environmental benefits in terms of visual effects, air quality by eliminating automobiles from streets, reduced traffic, and a diminution in noise and vibration. The use of underground space also aids in the provision of safe, ecologically friendly, quick, and unobtrusive urban mass transit networks. Many cities are planning or are currently constructing urban road tunnels to substitute elevated highways. The Alaskan Highway near Seattle, for instance, will be the world's greatest diameter bored tunnel when constructed.

On the other hand, the ground & foundation is expected to be the fastest-growing segment in the market. Ground and foundation advantages include transferring weight superstructure to ground, equally distributing load to ground basement, maintaining interior structure free of dust, rainwater, and flood, and playing a 30% part in producing earthquake-resistant buildings (ground beam).

Municipal is expected to be the most prominent geotechnical services market segment from 2022 to 2027. Geotechnical engineering is significant because it aids in the prevention of problems before they occur. Buildings could sustain considerable damage as a result of an earthquake, slope stability shifting, continuous settlement, and other factors without the extensive computations and assessment given by a Geotech.

Building construction is expected to be the fastest-growing segment in the market. Geotechnical investigations are carried out by geotechnical engineers and engineering geologists to learn about the physical qualities of the soil and rock beneath a location. Geotechnical services in construction aid in the design, construction, operation, and maintenance of public and private sector construction projects, such as roads and buildings.

North America (the United States, Canada, and Mexico) will dominate the geotechnical services market from 2022 to 2027. Regional market expansion is fueled by an increase in demand for sustainable constructions as a result of increased environmental consciousness. Also, the availability of abundant natural gas reserves and other oil and gas activities in this region are contributing to additional growth.

The United States is expected to have the lion's share in the North American geotechnical services market. This is mostly due to the region's strong penetration of geotechnical services and the start of a huge number of infrastructure and substructure projects.

Moreover, the Asia-Pacific region is expected to be the fastest-growing geotechnical services market segment during the forecast period. Growing awareness and understanding of geotechnical equipment and monitoring, as well as regulatory laws for geotechnical monitoring of structures, are some of the key causes driving this market's rise in this region.

China is expected to hold the largest share of the Asia Pacific geotechnical services market. China's dense population has made rapid urbanization possible resulting in growing infrastructural investments and a major increase in the creation of geotechnical structures such as dams, bridges, and tunnels. An increasing number of geotechnical projects, as well as a heightened awareness of sustainable building and construction, are all contributing to regional growth.

AECOM, Stantec, Geoquip Marine Group, WSP, Geosyntec, Fugro, HDR, EGS Survey, Gardline Limited, Arup, and Kiewit Corp among others, are some of the key players in the global geotechnical services market.

Please note: This is not an exhaustive list of companies profiled in the report.

The global geotechnical services market has observed several strategic alliances between key players to launch new products with added functionalities and maintain revenue share & profitability. Organic and inorganic growth strategies adopted by small players have been the highlight of this market.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary International Society for Soil Mechanics and Geotechnical Engineering (ISSMGE),Russian Society of Soil Mechanics and Geotechnical, and Foundation Engineering (RSSMGFE), Geoprofessional Business Association (GBA), Association of Environmental & Engineering Geologists (AEG)

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.6.1 Model Details

1.6.1.1 Top-Down Approach

1.6.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Type Outlook

2.3 End-User Outlook

2.4 Regional Outlook

Chapter 3 Global Geotechnical Services Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Geotechnical Services Market

3.4 Metric Data on Geotechnical Services Industry

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Geotechnical Services Market: Type Trend Analysis

4.1 Type: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Underground City Space

4.2.1 Market Estimates & Forecast Analysis of Underground City Space Segment, By Region, 2019-2027 (USD Billion)

4.3 Slope & Excavation

4.3.1 Market Estimates & Forecast Analysis of Slope & Excavation Segment, By Region, 2019-2027 (USD Billion)

4.4 Slope & Excavation

4.4.1 Market Estimates & Forecast Analysis of Slope & Excavation Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Geotechnical Services Market: End-User Trend Analysis

5.1 End-User: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Bridge & Tunnel

5.2.1 Market Estimates & Forecast Analysis of Bridge & Tunnel Segment, By Region, 2019-2027 (USD Billion)

5.3 Building Construction

5.3.1 Market Estimates & Forecast Analysis of Building Construction Segment, By Region, 2019-2027 (USD Billion)

5.4 Marine

5.4.1 Market Estimates & Forecast Analysis of Marine Segment, By Region, 2019-2027 (USD Billion)

5.5 Mining

5.5.1 Market Estimates & Forecast Analysis of Mining Segment, By Region, 2019-2027 (USD Billion)

5.6 Municipal

5.6.1 Market Estimates & Forecast Analysis of Municipal Segment, By Region, 2019-2027 (USD Billion)

5.6 Oil and Gas

5.6.1 Market Estimates & Forecast Analysis of Oil and Gas Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Geotechnical Services Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.5 U.S.

6.2.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.6 Canada

6.2.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.7 Mexico

6.5.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.3 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.5 Germany

6.3.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.6 UK

6.3.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.7 France

6.3.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.8 Russia

6.3.8.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.9 Italy

6.3.9.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.10 Spain

6.3.10.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.11 Rest of Europe

6.3.11.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.11.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.5 China

6.4.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.6 India

6.4.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.7 Japan

6.4.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.8 Australia

6.4.8.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.9 South Korea

6.4.9.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.4.9.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.10 Rest of Asia Pacific

6.3.10.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.5 Brazil

6.5.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.6 Rest of Central & South America

6.5.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.5 Saudi Arabia

6.6.5.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.6 United Arab Emirates

6.6.6.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.7 South Africa

6.6.7.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.6.67.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.8 Rest of Middle East & Africa

6.5.8.1 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

6.5.8.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 End-User Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 AECOM

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Product Benchmarking

8.2 Stantec

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Product Benchmarking

8.3 Geoquip

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Product Benchmarking

8.4 Marine Group

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Product Benchmarking

8.5 WSP

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Product Benchmarking

8.6 Geosyntec.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.7 Fugro.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.8 HDR

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Product Benchmarking

8.9 EGS Survey

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Product Benchmarking

8.10 Gardline Limited

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Product Benchmarking

8.11 Arup, and Kiewit Corp

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Initiatives

8.11.4 Product Benchmarking

8.11 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Initiatives

8.12.4 Product Benchmarking

List of Tables

1 Technological Advancements In Geotechnical Services Market

2 Global Geotechnical Services Market: Key Market Drivers

3 Global Geotechnical Services Market: Key Market Challenges

4 Global Geotechnical Services Market: Key Market Opportunities

5 Global Geotechnical Services Market: Key Market Restraints

6 Global Geotechnical Services Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

8 Underground City Space: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

9 Slope & Excavation: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

10 Ground & Foundation: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

11 Global Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

12 Bridge & Tunnel, Building Construction, Marine, Mining, Electric Works, and Auxiliary Services

13 Building Construction: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

14 Marine: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

15 Mining: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

16 Municipal: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

17 Oil and Gas: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

18 Regional Analysis: Global Geotechnical Services Market, By Region, 2019-2027 (USD Billion)

19 North America: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

20 North America: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

21 North America: Geotechnical Services Market, By Country, 2019-2027 (USD Billion)

22 U.S: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

23 U.S: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

24 Canada: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

25 Canada: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

26 Mexico: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

27 Mexico: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

28 Europe: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

29 Europe: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

30 Europe: Geotechnical Services Market, By Country, 2019-2027 (USD Billion)

31 Germany: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

32 Germany: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

33 UK: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

34 UK: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

35 France: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

36 France: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

37 Italy: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

38 Italy: Geotechnical Services Market, By End-User Ype, 2019-2027 (USD Billion)

39 Spain: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

40 Spain: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

41 Rest Of Europe: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

42 Rest Of Europe: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

43 Asia Pacific: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

44 Asia Pacific: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

45 Asia Pacific: Geotechnical Services Market, By Country, 2019-2027 (USD Billion)

46 China: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

47 China: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

48 India: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

49 India: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

50 Japan: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

51 Japan: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

52 South Korea: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

53 South Korea: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

54 Middle East & Africa: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

55 Middle East & Africa: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

56 Middle East & Africa: Geotechnical Services Market, By Country, 2019-2027 (USD Billion)

57 Saudi Arabia: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

58 Saudi Arabia: Geotechnical Services Market, By Platform, 2019-2027 (USD Billion)

59 UAE: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

60 UAE: Geotechnical Services Market, By Platform, 2019-2027 (USD Billion)

61 Central & South America: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

62 Central & South America: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

63 Central & South America: Geotechnical Services Market, By Country, 2019-2027 (USD Billion)

64 Brazil: Geotechnical Services Market, By Type, 2019-2027 (USD Billion)

65 Brazil: Geotechnical Services Market, By End-User, 2019-2027 (USD Billion)

66 AECOM: Products Offered

67 Stantec: Products Offered

68 Geoquip Marine Group: Products Offered

69 WSP: Products Offered

70 Geosyntec.: Products Offered

71 Fugro.: Products Offered

72 HDR Products Offered

73 EGS Survey: Products Offered

74 Gardline Limited: Products Offered

75 Arup, and Kiewit Corp: Products Offered

76 Other Companies: Products Offered

List of Figures

1. Global Geotechnical Services Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Geotechnical Services Market: Penetration & Growth Prospect Mapping

7. Global Geotechnical Services Market: Value Chain Analysis

8. Global Geotechnical Services Market Drivers

9. Global Geotechnical Services Market Restraints

10. Global Geotechnical Services Market Opportunities

11. Global Geotechnical Services Market Challenges

12. Key Geotechnical Services Market Manufacturer Analysis

13. Global Geotechnical Services Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. AECOM: Company Snapshot

16. AECOM: Swot Analysis

17. Stantec: Company Snapshot

18. Stantec: Swot Analysis

19. Geoquip Marine Group: Company Snapshot

20. Geoquip Marine Group: Swot Analysis

21. Marine Group: Company Snapshot

22. Marine Group: Swot Analysis

23. Geosyntec.: Company Snapshot

24. Geosyntec.: Swot Analysis

25. Fugro.: Company Snapshot

26. Fugro.: Swot Analysis

27. HDR Company Snapshot

28. HDR Swot Analysis

29. EGS Survey: Company Snapshot

30. EGS Survey: Swot Analysis

31. Gardline Limited: Company Snapshot

32. Gardline Limited: Swot Analysis

33. Arup, and Kiewit Corp: Company Snapshot

34. Arup, and Kiewit Corp: Swot Analysis

35. Other Companies: Company Snapshot

36. Other Companies: Swot Analysis

The Global Geotechnical Services Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Geotechnical Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS