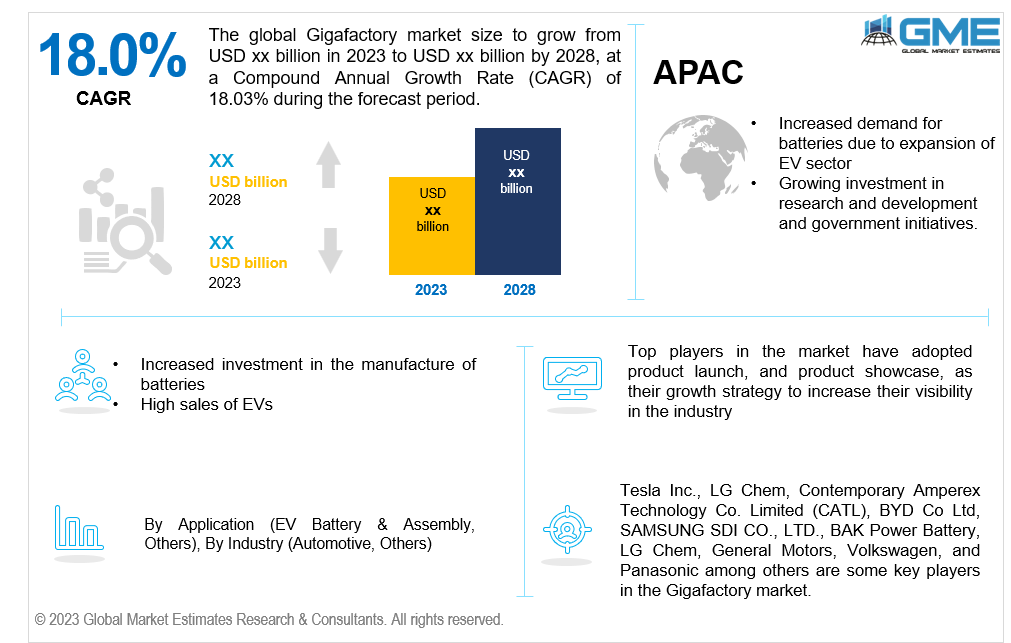

Global Gigafactory Market Size, Trends & Analysis - Forecasts to 2028 By Application (EV Battery & Assembly, Others), By Industry (Automotive, Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

The global gigafactory market size is projected to grow at a CAGR of 18.03% from 2023 to 2028.

With the EV revolution well underway, news of gigafactories being constructed all over the world is becoming more prevalent. This is mostly due to Giga factories’ ability to produce batteries at Giga Watt hour (GWh) levels; a 1GWh factory can produce enough batteries for 17,000 automobiles. Given that global capacity is expected to expand by ten times from its 2020 level by 2030, competition for gigafactory investment is expected to intensify at a significant rate.

Numerous possibilities exist across the entire global value and supply chains in the rapidly expanding battery manufacturing business. Battery production is accelerating quickly due to the switch to EVs, creating enormous development potential throughout the value chain. The Department of Energy estimates that 13 new battery cell gigafactories will be operational in the U.S. by 2025.

In the U.S., the manufacture of batteries is entering a new age thanks to these plants. The U.S. has only produced a small amount of battery cells, with the exception of Tesla and Panasonic's Gigafactory Nevada, which provides battery cells for the manufacture of Tesla Model 3 and Model Y automobiles.

However, significant expenditures will be needed to seize the potential. Players in the automotive and battery industries who take action in three critical areas may embrace the opportunity to increase their revenues and profitability while meeting EV demand from vehicle owners.

Furthermore, key car manufacturers are technically and financially backing many of the major ongoing gigafactory projects in Europe and the rest of the globe because of the anticipated demand for electric vehicles in the upcoming years. For instance, Elon Musk claimed Tesla may construct 10 or 12 more Gigafactories to meet his target of producing 20 million vehicles annually by 2030. In July 2022, Tesla announced the filing with the city of Austin for the expansion of Gigafactory Texas with a new 500,000-square-foot building at the site.

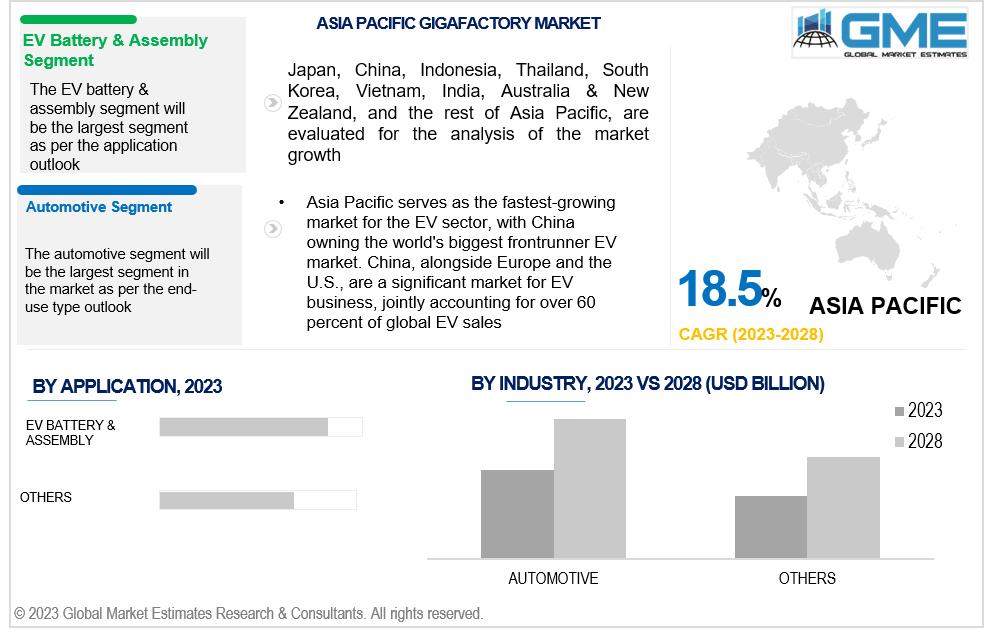

Gigafactory growth is majorly fuelled by EV manufacturing plans, resulting in the maximum share of EV battery & assembly market segment. In 2021, more than 466,000 units were sold, double the amount in 2020. These trends are even more obvious outside of the United States, where sales have increased by an average of 2% year since 2010, reaching approximately 4.2 million devices in 2021. Sales growth has been particularly strong in China. The majority of battery manufacturers and original equipment manufacturers (OEMs) have constructed or planned to develop gigafactories to develop lithium-ion batteries at scale, either through joint ventures or independently. Successful construction and fulfilling scheduled start-of-production dates depend on detailed governance procedures and performance management.

The gigafactory investments are majorly supported by the government and the auto industry. Major automobile industries in Europe and the U.S. have seen a sharp increase in demand for batteries as the globe accelerates the switch to electric vehicles. The battery supply chain is now experiencing a challenging era of uncertainty, and many automotive and battery manufacturers are looking to create their own battery gigafactories or establish joint ventures to manage the tight supply. Between 2020 and 2030, the battery value chain is anticipated to grow up to 10 times. Industry participants may advance by making notable initiatives in gigafactory building, supply chain planning, and talent acquisition.

In June, Envision Group of China announced to invest of up to U.S.D 2.4 billion in a battery facility in northern France to supply a variety of Renault SA electric automobiles at competitive prices. Similarly, in July, Nissan announced an investment of nearly U.S.D 514.46 million as part of the U.S.D 1.22 billion promise to develop a new generation of all-electric vehicles in the UK. Moreover, Stellantis unveiled a strategy for EV batteries in July 2021 with a goal of over 260 GWh by 2030, backed by five "Gigafactories" across Europe and North America, and a plan of U.S.D 32.28 billion through 2025. This will be an addition to the existing two plants in Kaiserslautern and Douvrin, France. The location of the following Gigafactory may be in Italy. These initiatives are anticipated to drive the market at a significant rate.

In the current market scenario, Europe is estimated to be the largest market for gigafactories. The European Union accounts for the maximum investments in the battery plant sector. This European industrialization strategy for the battery industry has been in the works for some years. Northvolt started up its facility in northern Sweden, which is anticipated to have a capacity of 32 GWh per year, as the first European gigafactory to begin producing its own battery cell technology in Europe.

In addition, the business is entering into collaborations with significant OEMs in the automobile industry in order to create new initiatives, including the recently announced deal with Volvo (whereby they expect, from 2025, to have a new gigafactory in Gothenburg with the capacity to equip 500,000 electric cars per year).

Since the Inflation Reduction Act was implemented, the U.S.'s anticipated capacity for lithium-ion battery gigafactories has increased by a factor of two faster than that of Europe. European efforts to increase domestic lithium-ion battery manufacture were far further advanced than American ones. However, with high electricity costs in Europe and the implementation of the Inflation Reduction Act's (IRA) tax incentives for buying EV batteries made in the U.S., producing domestic battery modules and packs, and deploying independent battery energy storage systems have transformed the landscape.

Tesla Inc., LG Chem, Contemporary Amperex Technology Co. Limited (CATL), BYD Co Ltd, SAMSUNG SDI CO., LTD., BAK Power Battery, LG Chem, General Motors, Volkswagen, and Panasonic among others, are some key players in the gigafactory market.

Please note: This is not an exhaustive list of companies profiled in the report.

Numerous EV-focused projects have been expanded or expedited, while Turkish company Kontrolmatik has doubled the scale of its planned U.S. gigafactory, and Norwegian company FREYR is speeding up its ambitions. Both companies are energy-focused. Such initiatives by companies are accelerating the market growth.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.6.1 Model Details

1.6.1.1 Top-Down Approach

1.6.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1 Global Market Outlook

2.2 End-Use Outlook

2.3 Application Outlook

2.4 Regional Outlook

Chapter 3 Global Gigafactory Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Gigafactory Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Gigafactory Market: By Industry Trend Analysis

4.1 By Industry: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Automotive

4.2.1 Market Estimates & Forecast Analysis of Automotive Segment, By Region, 2019-2027 (USD Billion)

4.3 Others

4.3.1 Market Estimates & Forecast Analysis of Others Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Gigafactory Market: By Application Trend Analysis

5.1 By Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 EV Battery & Assembly

5.2.1 Market Estimates & Forecast Analysis of EV Battery & Assembly, By Region, 2019-2027 (USD Billion)

5.3 Others

5.3.1 Market Estimates & Forecast Analysis of Others Market Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Gigafactory Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.2.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.6 Mexico

6.2.6.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.7 Russia

6.3.7.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.8 Italy

6.3.8.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.9 Spain

6.3.9.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.10 Netherlands

6.3.10.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.11 Rest of Europe

6.3.11.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.3.11.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.7 South Korea

6.4.7.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.8 Thailand

6.4.8.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.9 Indonesia

6.4.9.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.9.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.10 Malaysia

6.4.10.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.10.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.11 Singapore

6.4.11.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.11.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.12 Vietnam

6.4.12.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.12.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.13 Rest of Asia Pacific

6.4.13.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.4.13.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.5.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.5 Argentina

6.5.5.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.6 Chile

6.5.6.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.5.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.7 Rest of Central & South America

6.5.7.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.5.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.6.3 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.6.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.5 United Arab Emirates

6.6.5.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.7 Israel

6.6.7.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.6.7.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.8 Rest of Middle East & Africa

6.5.8.1 Market Estimates & Forecast Analysis, By Industry, 2019-2027 (USD Billion)

6.5.8.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 End-User Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 Tesla Inc.

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Product Benchmarking

8.2 LG Chem

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Product Benchmarking

8.3 Contemporary Amperex Technology Co. Limited (CATL)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Product Benchmarking

8.4 BYD Co Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Product Benchmarking

8.5 SAMSUNG SDI CO., LTD.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Product Benchmarking

8.6 BAK Power Battery

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.7 LG Chem

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.8 General Motors

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Product Benchmarking

8.9 Volkswagen

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Product Benchmarking

8.10 Other Companies

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in the Gigafactory Market

2 Global Gigafactory Market: Key Market Drivers

3 Global Gigafactory Market: Key Market Challenges

4 Global Gigafactory Market: Key Market Opportunities

5 Global Gigafactory Market: Key Market Restraints

6 Global Gigafactory Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Gigafactory Market, By Industry, 2019-2027 (USD Billion)

8 Automotive: Global Gigafactory Market, By Region, 2019-2027 (USD Billion)

9 Others: Global Gigafactory Market, By Region, 2019-2027 (USD Billion)

10 Global Gigafactory Market, By Application, 2019-2027 (USD Billion)

11 EV Battery & Assembly: Global Gigafactory Market, By Region, 2019-2027 (USD Billion)

12 Respiratory Diseases: Global Gigafactory Market, By Region, 2019-2027 (USD Billion)

13 Others: Global Gigafactory Market, By Region, 2019-2027 (USD Billion)

14 Regional Analysis: Global Gigafactory Market, By Region, 2019-2027 (USD Billion)

15 North America: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

16 North America: Gigafactory Market, By Application, 2019-2027 (USD Billion)

17 North America: Gigafactory Market, By Country, 2019-2027 (USD Billion)

18 U.S: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

19 U.S: Gigafactory Market, By Application, 2019-2027 (USD Billion)

20 Canada: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

21 Canada: Gigafactory Market, By Application, 2019-2027 (USD Billion)

22 Mexico: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

23 Mexico: Gigafactory Market, By Application, 2019-2027 (USD Billion)

24 Europe: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

25 Europe: Gigafactory Market, By Application, 2019-2027 (USD Billion)

26 Europe: Gigafactory Market, By Country, 2019-2027 (USD Billion)

27 Germany: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

28 Germany: Gigafactory Market, By Application, 2019-2027 (USD Billion)

29 UK: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

30 UK: Gigafactory Market, By Application, 2019-2027 (USD Billion)

31 France: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

32 France: Gigafactory Market, By Application, 2019-2027 (USD Billion)

33 Italy: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

34 Italy: Gigafactory Market, By Application, 2019-2027 (USD Billion)

35 Spain: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

36 Spain: Gigafactory Market, By Application, 2019-2027 (USD Billion)

37 Netherlands: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

38 Netherlands: Gigafactory Market, By Application, 2019-2027 (USD Billion)

39 Rest Of Europe: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

40 Rest Of Europe: Gigafactory Market, By Application, 2019-2027 (USD Billion)

41 Asia Pacific: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

42 Asia Pacific: Gigafactory Market, By Application, 2019-2027 (USD Billion)

43 Asia Pacific: Gigafactory Market, By Country, 2019-2027 (USD Billion)

44 China: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

45 China: Gigafactory Market, By Application, 2019-2027 (USD Billion)

46 India: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

47 India: Gigafactory Market, By Application, 2019-2027 (USD Billion)

48 Japan: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

49 Japan: Gigafactory Market, By Application, 2019-2027 (USD Billion)

50 South Korea: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

51 South Korea: Gigafactory Market, By Application, 2019-2027 (USD Billion)

52 Thailand: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

53 Thailand: Gigafactory Market, By Application, 2019-2027 (USD Billion)

54 Indonesia: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

55 Indonesia: Gigafactory Market, By Application, 2019-2027 (USD Billion)

56 Malaysia: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

57 Malaysia: Gigafactory Market, By Application, 2019-2027 (USD Billion)

58 Singapore: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

59 Singapore: Gigafactory Market, By Application, 2019-2027 (USD Billion)

60 Vietnam: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

61 Vietnam: Gigafactory Market, By Application, 2019-2027 (USD Billion)

62 Middle East & Africa: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

63 Middle East & Africa: Gigafactory Market, By Application, 2019-2027 (USD Billion)

64 Middle East & Africa: Gigafactory Market, By Country, 2019-2027 (USD Billion)

65 Saudi Arabia: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

66 Saudi Arabia: Gigafactory Market, By Application, 2019-2027 (USD Billion)

67 UAE: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

68 UAE: Gigafactory Market, By Application, 2019-2027 (USD Billion)

69 Israel: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

70 Israel: Gigafactory Market, By Application, 2019-2027 (USD Billion)

71 South Africa: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

72 South Africa: Gigafactory Market, By Application, 2019-2027 (USD Billion)

73 Central & South America: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

74 Central & South America: Gigafactory Market, By Application, 2019-2027 (USD Billion)

75 Central & South America: Gigafactory Market, By Country, 2019-2027 (USD Billion)

76 Brazil: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

77 Brazil: Gigafactory Market, By Application, 2019-2027 (USD Billion)

78 Chile: Gigafactory Market, By Industry, 2019-2027 (USD Billion)

79 Chile: Gigafactory Market, By Application, 2019-2027 (USD Billion)

80 Tesla Inc.: Products Offered

81 LG Chem: Products Offered

82 Contemporary Amperex Technology Co. Limited (CATL): Products Offered

83 BYD Co Ltd: Products Offered

84 SAMSUNG SDI CO., LTD.: Products Offered

85 BAK Power Battery: Products Offered

86 Volkswagen: Products Offered

87 LG Chem: Products Offered

88 General Motors: Products Offered

89 Other Companies: Products Offered

List of Figures

1. Global Gigafactory Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Gigafactory Market: Penetration & Growth Prospect Mapping

7. Global Gigafactory Market: Value Chain Analysis

8. Global Gigafactory Market Drivers

9. Global Gigafactory Market Restraints

10. Global Gigafactory Market Opportunities

11. Global Gigafactory Market Challenges

12. Key Gigafactory Market Manufacturer Analysis

13. Global Gigafactory Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Tesla Inc.: Company Snapshot

16. Tesla Inc.: Swot Analysis

17. LG Chem: Company Snapshot

18. LG Chem: Swot Analysis

19. Contemporary Amperex Technology Co. Limited (CATL): Company Snapshot

20. Contemporary Amperex Technology Co. Limited (CATL): Swot Analysis

21. BYD Co Ltd: Company Snapshot

22. BYD Co Ltd: Swot Analysis

23. SAMSUNG SDI CO., LTD.: Company Snapshot

24. SAMSUNG SDI CO., LTD.: Swot Analysis

25. Volkswagen: Company Snapshot

26. Volkswagen: Swot Analysis

27. LG Chem: Company Snapshot

28. LG Chem: Swot Analysis

29. General Motors: Company Snapshot

30. General Motors: Swot Analysis

31. BAK Power Battery: Company Snapshot

32. BAK Power Battery: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Gigafactory Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Gigafactory Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS