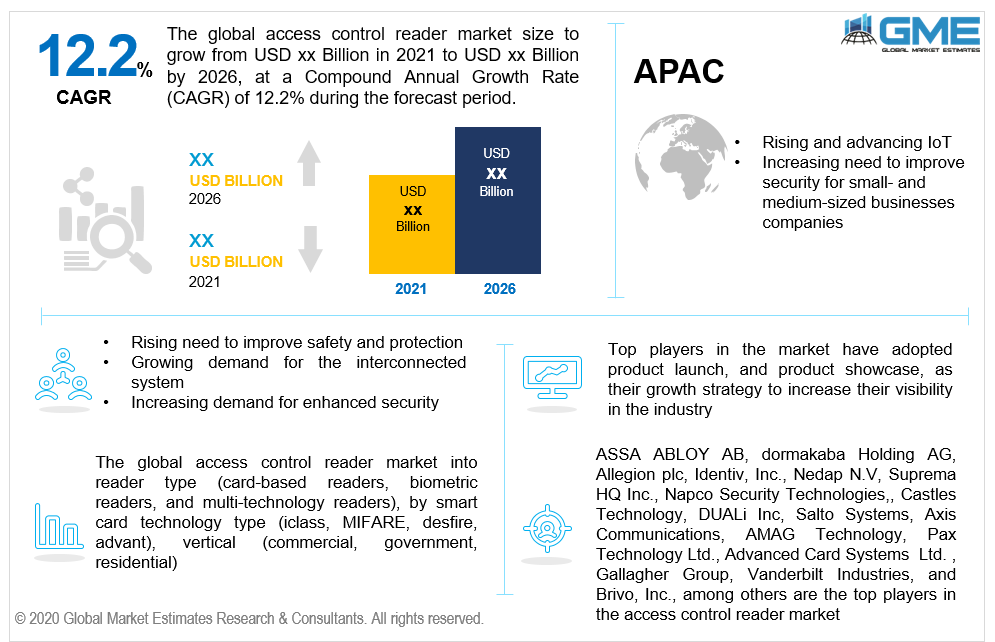

Global Access Control Reader Market Size, Trends & Analysis - Forecasts to 2026 By Reader Type (Card-based Readers {Magnetic Stripe Readers, Proximity Card Readers (125 kHz), Smart Card Readers (13.6 MHz)}, Biometric Readers {Fingerprint Recognition, Palm Recognition, Iris Recognition, Face Recognition, Vein Recognition, Voice Recognition}, and Multi-technology Readers), By Smart Card Technology Type (iCLASS, MIFARE, DESFire, LEGIC Advant, Others), By Vertical (Commercial, Government, Residential), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

In the fields of physical protection and data security, access control (AC) is a limited limitation on access to a location or other services. Consumption, entry, or usage are all examples of access. Two analog access control mechanisms are login credentials and locks. The practice of restricting licensed individuals' access to a property, a building, or space is referred to as "access control." Physical access may be controlled by a person (guard, bouncer, or receptionist), mechanical (locks and keys), or technical (access control devices, such as a mantra). In such settings, physical key control may also be used to handle and track mechanical access to or access certain small assets. The need to improve safety and protection across a variety of residential and commercial segments is fueling global market development. In contrast to the previous decade, the security and controls industry has changed due to rapid advances in cloud storage and access control.

The commercial sector is the largest user of access control readers. Access control systems are in high demand because they significantly reduce the need for manned defense, lowering security costs. These factors enable exchange and service organizations to use access control readers to protect individuals and properties.

The market drivers which contribute to the access control reader market include the growing need for security, advancing IoT, growing demand for the interconnected system, increasing demand for enhanced authentication along with contactless interfaces, rising fraud and theft, government initiatives, and increasing research and developments activities in the market. The access control reader market is expected to expand at a faster pace due to the rising demand for interconnected systems and user security concerns. Improved protected identity management, high demand for enhanced authentication, and contactless interfaces to accelerate smart card adoption are expected to be major growth drivers for the access control reader industry. As smart home technologies are becoming more widely accepted, the demand for wired access control systems for homes that can be accessed remotely is increasing. With the increasing adoption of IoT, consumers' willingness to implement solutions that make access control more convenient is expected to rise. As the complexity and sophistication of frauds, cyber-attacks, and government authentication requirements grow, the need to improve protection while lowering costs is becoming increasingly important across various industry verticals.

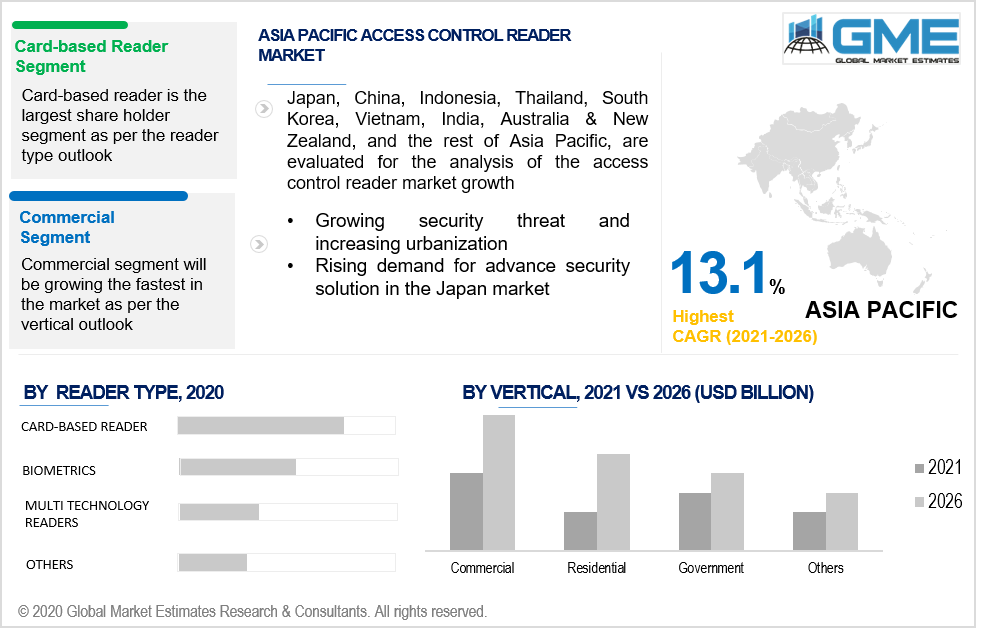

Based on the reader type, the market is segmented into card-based readers, biometric readers, and multi-technology readers. Card-based users have proven to be more dependable than biometric and electronic locks. One of the main factors driving the growth of card-based viewers is the increasing demand for intelligent and nearby devices to manage and monitor staff operations. Magnetic strips and chips are less reliable than intelligent chips. The rising demand for intelligent and proximity cards to control and track staff operations is one of the factors driving the creation of smart card readers. The growing penetration of card-based reader technology-equipped time and attendance, as well as access control solutions in various companies around the world, is among the forces influencing growth for card-based readers.

Based on the smart card technology type, the market is segmented into iclass, mifare, desfire, legic advant. During the forecast period, the market for DESFire is estimated to grow because of its stability along with all the technology available with good encryption.

Based on vertical, the market is segmented into commercial, government, residential. Access control readers are most commonly used in the commercial sector. Commercial properties such as businesses and data centers, BFSI, hotels, retail stores and malls, and entertainment venues have all been considered in this vertical. Access control readers are needed in these locations to protect people and properties by restricting access. Access control systems are in high demand because they reduce the need for manned security and, as a result, lower safety costs. These factors allow businesses and organizations to support access control publishers to protect individuals and properties.

Access control readers are used in smart homes to improve protection. The market is growing due to an increase in crime rates, ongoing technical advancements, and strong demand for detecting hazards such as fire and gas leakage, as well as ensuring the safety of children at home. The growing trend of smart homes is likely to expand the demand for access control readers in the residential market.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America.

Many governments and security agencies are compelled to use RFID and biometric technology to improve security features in their transactions as a result of a rise in cyber and malware attacks in the region. As a result, the access control industry's overall growth is aided.

Since the users who are mostly targeted in the United States are workers with administrative access to organizational protocols, hackers have full access to the networks, the United States accounts for a large portion of the global market for access control systems. This problem can be solved by implementing strategic IAM (Identity Access Management) techniques, such as switching from passwords to biometrics. Cloud-based IAM deployment models provide economies of scale, lower costs, the elimination of hardware deployment, and easier management. In contrast to legacy on-premise deployment models, their adoption is rapidly increasing.

Over the projected era, the Asia-Pacific region is expected to have the largest market share. As developing economies strive to upgrade their infrastructure, the demand for access control readers is expected to expand. Small and mid-sized enterprises, airports, hospitality businesses, ATMs, residential buildings, banks, and religious sites are expected to drive the access control reader market in Asian countries. Market growth is fueled by a significant population, significant investments in digitalization, rapid urbanization, and strong demand for security systems. Furthermore, emerging economies are improving their infrastructure, which is expected to increase the demand for access control readers.

ASSA ABLOY AB, Allegion PLC, IDEMIA, Suprema Hq Inc., NAPCO Security Technologies, Inc., Paxton Access Ltd., DUALi Inc., AXIS Communications AB, Advanced Card Systems Limited, Brivo, Inc., Dormakaba Holding AGIdentiv, Inc., Nedap N.V., Gemalto N.V. (Thales Group), Avigilon Corporation (MotoRoLA Solutions, Inc.), Peter Hengstler GmbH+Co. (PHG), Castles Technology, AMAG Technology, Inc., PAX Technology Limited, and Gallagher Group Limited, among others, are the top players in the global access control reader market.

In Aug 2019, to encourage contactless IDs in Apple wallet, Allegion launched Schlage commercial electronic locks, enabling children to easily open doors.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Access Control Reader Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Reader Type Overview

2.1.3 Smart Technology Type Overview

2.1.4 Vertical Overview

2.1.5 Regional Overview

Chapter 3 Global Access Control Reader Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for enhanced security

3.3.1.2 Contactless Interfaces to Boost Adoption of Smart Cards

3.3.1.3 Increased convenience, enhanced secure identity management, and improved human resource management

3.3.2 Industry Challenges

3.3.2.1 Security concerns related to unauthorized access and data breach

3.3.3 Restraints

3.3.3.1 Limited awareness about advanced security solutions

3.3.4 Opportunities

3.3.4.1 Increasing urbanization in emerging economies

3.4 Prospective Growth Scenario

3.4.1 Reader Type Growth Scenario

3.4.2 Smart Technology Type Growth Scenario

3.4.3 Vertical Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Access Control Reader Market, By Reader Type

4.1 Reader Type Outlook

4.2 Card-based Readers

4.2.1 Magnetic Stripe Readers

4.2.2 Proximity Card Readers (125 kHz)

4.2.3 Smart Card Readers (13.6 MHz)

4.2.4 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Biometrics

4.3.1 Fingerprint Recognition

4.3.2 Palm Recognition

4.3.3 Iris Recognition

4.3.4 Face Recognition

4.3.5 Vein Recognition

4.3.6 Voice Recognition

4.3.7 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Multi-Technology Readers

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Access Control Reader Market, By Smart Technology Type

5.1 Smart Technology Type Outlook

5.2 iCLASS

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 MIFARE

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 DESFire

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Advant

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Access Control Reader Market, By Vertical

6.1 Vertical Outlook

6.2 Commercial

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Residential

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Government

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Access Control Reader Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.2.3 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.2.4 Market Size, By Vertical, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.3 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.3.4 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Smart Technology Type, 2019-2026(USD Billion)

7.3.10.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.4.3 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.4.4 Market Size, By Vertical, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.4.8.2 Market size, By Smart Technology Type, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.5.3 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.5.4 Market Size, By Vertical, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Billion)

7.7.2 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.7.3 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.7.4 Market Size, By Vertical, 2019-2026 (USD Billion)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.7.5.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.7.5.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.7.6 UAE

7.7.6.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.7.6.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.7.6.3 Market Size, By Vertical, 2019-2026 (USD Billion)

7.7.7 South Africa

7.7.7.1 Market Size, By Reader Type, 2019-2026 (USD Billion)

7.7.7.2 Market Size, By Smart Technology Type, 2019-2026 (USD Billion)

7.7.7.3 Market Size, By Vertical, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 ASSA ABLOY AB

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 dormakaba Holding AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Allegion plc

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Identiv, Inc.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.8 Nedap N.V.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.8 Suprema HQ Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.8 Napco Security Technologies

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Gemalto N.V.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Avigilon Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 IDEMIA

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Peter Hengstler Gmbh+Co.

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Paxtron Access Ltd.

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Castles Technology

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 DUALi Inc.

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 Salto Systems

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

8.17 Axis Communications

8.17.1 Company Overview

8.17.2 Financial Analysis

8.17.3 Strategic Positioning

8.17.4 Info Graphic Analysis

8.18 AMAG Technology

8.18.1 Company Overview

8.18.2 Financial Analysis

8.18.3 Strategic Positioning

8.18.4 Info Graphic Analysis

8.19 Pax Technology Ltd.

8.19.1 Company Overview

8.19.2 Financial Analysis

8.19.3 Strategic Positioning

8.19.4 Info Graphic Analysis

8.20 Advanced Card Systems Ltd.

8.20.1 Company Overview

8.20.2 Financial Analysis

8.20.3 Strategic Positioning

8.20.4 Info Graphic Analysis

8.21 Gallagher Group

8.21.1 Company Overview

8.21.2 Financial Analysis

8.21.3 Strategic Positioning

8.21.4 Info Graphic Analysis

8.22 Vanderbilt Industries

8.22.1 Company Overview

8.22.2 Financial Analysis

8.22.3 Strategic Positioning

8.22.4 Info Graphic Analysis

8.23 Brivo, Inc.

8.23.1 Company Overview

8.23.2 Financial Analysis

8.23.3 Strategic Positioning

8.23.4 Info Graphic Analysis

8.24 Other Companies.

8.24.1 Company Overview

8.24.2 Financial Analysis

8.24.3 Strategic Positioning

8.24.4 Info Graphic Analysis

The Global Access Control Reader Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Access Control Reader Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS