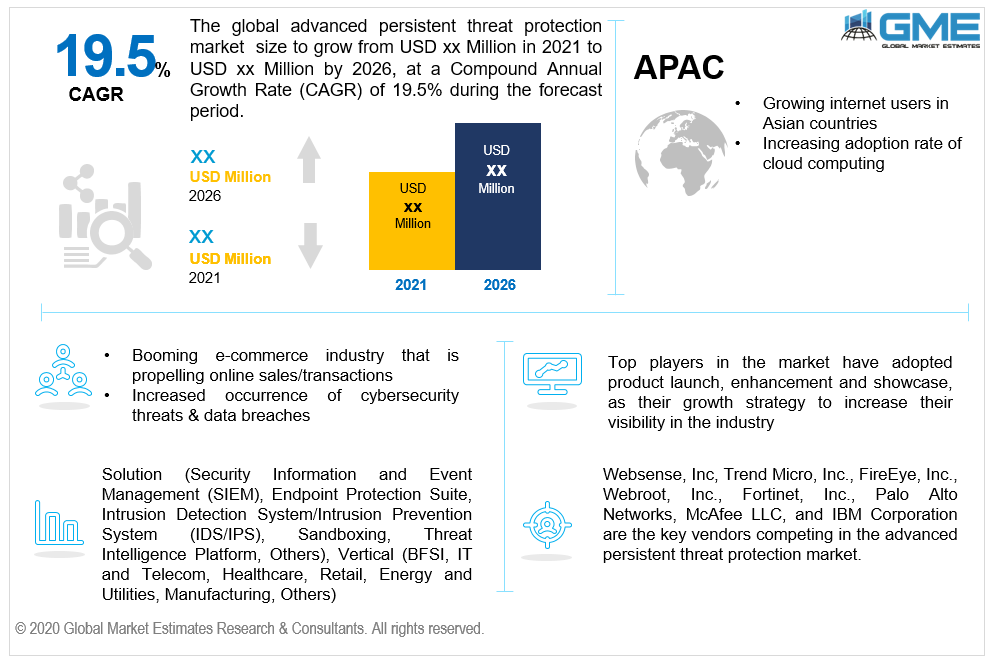

Global Advanced Persistent Threat Protection Market Size, Trends, and Analysis- Forecasts To 2026 By Solution (Security Information and Event Management (SIEM), Endpoint Protection Suite, Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Sandboxing, Threat Intelligence Platform, Others), By Vertical (BFSI, IT and Telecom, Healthcare, Retail, Energy and Utilities, Manufacturing, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

An advance persistent threat is one in which an unauthorized individual gets the access to extremely sensitive or confidential information. Organizations have multiple forms of extremely sensitive records, and data loss is often a concern. As a result, advanced persistent threat protection platform and solution is used all across the globe in order to secure confidential and sensitive data. This advanced persistent threat protection platform is useful for increasing network security and protecting records from unauthorised entry. Data storage needs, have increased as a result of increased merger of digitization and cloud migration with various industrial verticals. The advanced persistent threat protection market will be growing rapidly mainly due to increasing launch of emerging and advanced managed security services and platforms. Moreover the market is projected to be fuelled by rising demand for SIEM solution, which assist in the deployment of next-generation security technologies with frequent updates.

External threats are constantly on the lookout for opportunities to hack security networks and obtain access to sensitive data. As vast data collections are stored inside the cloud networks from multiple sources, cloud adoption is boosting the APT security market. APT is used to carry out targeted attacks in order to achieve a good security breach. The key aims of these attacks are to interrupt business and make political statements. Such attacks are typically long-term in nature and are often enhanced and tailored to the target environment and market. Targeted attacks take control of an entity's sensitive command and control communications, enabling them to monitor all devices linked to the command and control communication center.

APT protection technologies are now becoming more common as a result of stringent government rules regulating cybersecurity and data protection. All companies must conform to industry-specific security requirements and have the technology in place to introduce advanced security technologies like APT protection. Due to increased awareness of data security, security laws are likely to become stricter in the coming years. However, the varied nature of security threats and a shortage of subject matter professionals in the field of advanced persistent threat protection could restrict the overall market development.

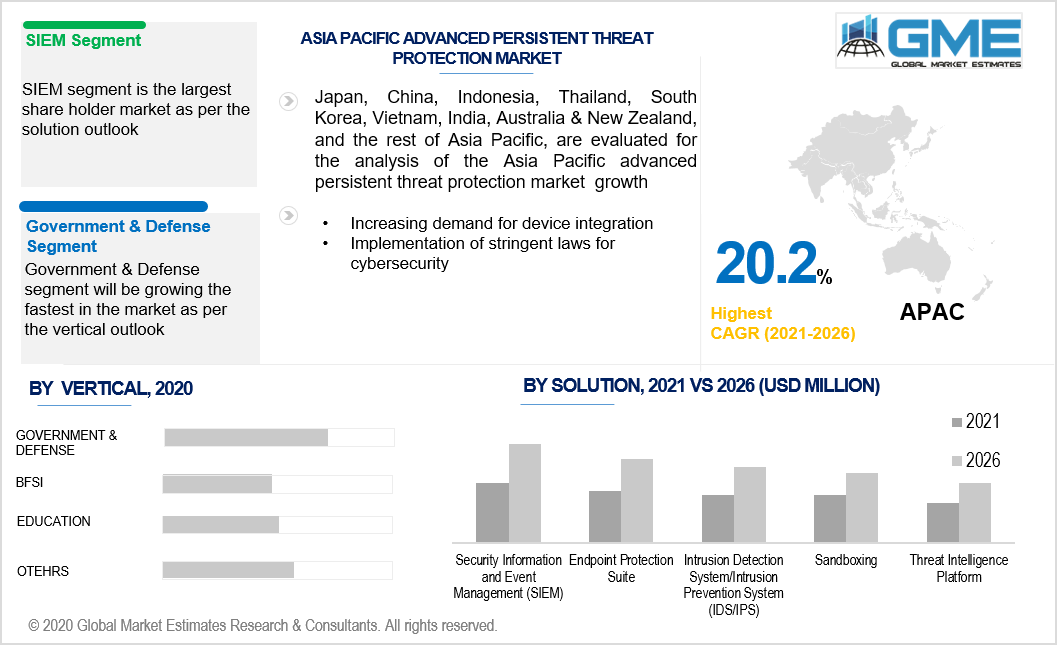

Based on the solutions the market has been segregated into Sandboxing, Intrusion Detection System/Intrusion Prevention System (IDS/IPS), Security Information and Event Management (SIEM), Threat Intelligence Platform, Endpoint Protection Suite, and Others. The SIEM segment is projected to have the highest market share. SIEM receives security data from network devices, servers, and domain controllers, analyses the data for patterns, identify risks, and helps administrators to investigate any alarms. This solution holds more importance and priority in the market. Also the major reason for it being the top shareholder in the market is the increasing demand for SIEM in government agencies and top financial firms.

The market has been categorized by vertical into retail, BFSI, energy and utilities, IT and telecom, manufacturing, healthcare, and others. Various vertical lines, such as BFSI, education, government and defense, and others, are rapidly adopting advanced persistent market threat security approaches that have led to consumer development globally. In the global advanced persistent threat protection industry, the government division is estimated to have the largest sales share. This is attributed to a growth in the need to protect confidential data in these industries. The advanced persistent threat protection market is gaining momentum in the digital world as the threat environment changes quickly. Advanced persistent threat data protection solutions are made up of three modules that work together to prevent, identify, and minimize possible persistent threats. IDS/IPS, endpoint protection, forensic analysis, next-generation firewalls, SIEM, sandboxing, and other advanced persistent threat technologies are among them.

Geographically, the global APT Security market is dominated by North America. This is mainly due to factors such as growing data protection issues around organizations, ever-increasing cyber-attacks, and strict cybersecurity standards and regulations. The number of advanced and targeted cybersecurity incidents is on the rise in the country, resulting in the widespread adoption of APT protection solutions. Another primary driving force in the North American economy is the expansion of online business purchases. Cybercrime is rising at an exponential rate, according to the governments of the Canada and United States. These countries' governments are spending extensively on cybersecurity and improving compliance requirements for proactively avoiding APTs. In the United States, the new compliance standard mandates that companies should have IT security solutions that include security information and event management (SIEM).

During the forecast period, the Asia Pacific advanced persistent threat protection market is also anticipated to grow at the fastest rate. The top market players in the Asia Pacific region have announced to spend heavily on big data analytics research projects and tap the opportunistic areas. This is expected to greatly raise consumer demand. China holds a large share of the market. Growing internet users' number and penetration rates, cloud computing's high adoption rate, and increased demand for device integration are all projected to be core drivers of the APT industry in China over the forecast period of 2021 to 2026. IaaS and SaaS have been the priority of cloud computing in China. However, as cloud computing and the internet of things become more broadly accepted, the threat of cyber-attacks has risen dramatically, posing a challenge to the global APT market. Cyber-attacks have been increasingly common in recent years.

Trend Micro, Inc., Websense, Inc, FireEye, Inc., Fortinet, Inc., McAfee LLC, Webroot, Inc., Palo Alto Networks, and IBM Corporation are the key vendors competing in the advanced persistent threat protection market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December of 2020, Fortinet announced a partnership with Amazon Web Services (AWS) in order to deliver advanced security to customers through AWS’s cloud services, applications, and network.

In April 2020 McAfee and Zyxel, a pioneer in providing secure, AI- and cloud-powered home and business solutions, announced their strategic collaboration. Following the collaboration, the firms announced the plan to provide small and medium-sized enterprises (SMEs) with an integrated one-box security solution.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Advanced Persistent Threat Protection Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Solution Overview

2.1.3 Vertical Overview

2.1.4 Regional Overview

Chapter 3 Advanced Persistent Threat Protection Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Advanced Persistent Threat Protection Tools

3.3.1.2 The Rising Cases of Cyber Threats and Crime

3.3.2 Industry Challenges

3.3.2.1 High Cost Associated With Threat Protection Platform and Solutions in Developing Countries

3.4 Prospective Growth Scenario

3.4.1 Solution Growth Scenario

3.4.2 Vertical Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Advanced Persistent Threat Protection Market, By Solution

4.1 Solution Outlook

4.2 Security Information and Event Management (SIEM)

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Endpoint Protection Suite

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Sandboxing

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Threat Intelligence Platform

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Advanced Persistent Threat Protection Market, By Vertical

5.1 Vertical Outlook

5.2 BFSI

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 IT and Telecom

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Healthcare

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Retail

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Manufacturing

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Energy and Utilities

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Advanced Persistent Threat Protection Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Solution, 2016-2026 (USD Million)

6.2.3 Market Size, By Vertical, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Solution, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Solution, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Solution, 2016-2026 (USD Million)

6.3.3 Market Size, By Vertical, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Solution, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Solution, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Solution, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Solution, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Solution, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Solution, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Solution, 2016-2026 (USD Million)

6.4.3 Market Size, By Vertical, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Solution, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Solution, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Solution, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Solution, 2016-2026 (USD Million)

6.4.7.2 Market size, By Vertical, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Solution, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Solution, 2016-2026 (USD Million)

6.5.3 Market Size, By Vertical, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Solution, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Solution, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Solution, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Solution, 2016-2026 (USD Million)

6.6.3 Market Size, By Vertical, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Solution, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Solution, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Vertical, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Solution, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Vertical, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Websense, Inc

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Trend Micro, Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 FireEye, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Webroot, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Fortinet, Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Palo Alto Networks

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 McAfee LLC

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 IBM Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Advanced Persistent Threat Protection Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Advanced Persistent Threat Protection Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS