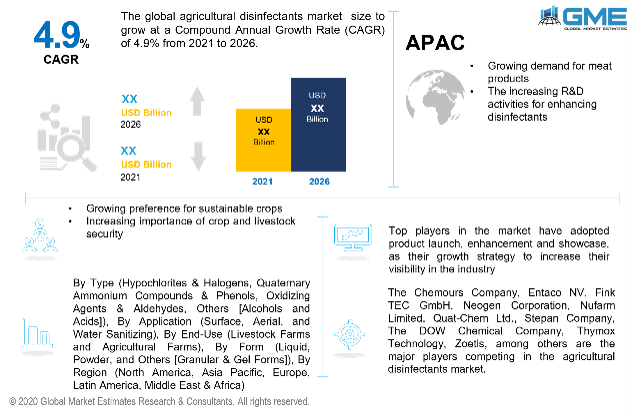

Global Agricultural Disinfectants Market Size, Trends & Analysis - Forecasts to 2026 By Type (Hypochlorites & Halogens, Quaternary Ammonium Compounds & Phenols, Oxidizing Agents & Aldehydes, Others [Alcohols and Acids]), By Application (Surface, Aerial, and Water Sanitizing), By End-Use (Livestock Farms and Agricultural Farms), By Form (Liquid, Powder, and Others [Granular & Gel Forms]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

An essential component used for livestock and crop protection is agricultural disinfectants. They are implemented to boost animal as well as plant health. The continuously rising population accelerates the need for high agricultural productivity, hence driving the agricultural disinfectants market’s growth globally. Furthermore, the deterioration of water quality, the incidence of water shortages, and environmental constraints further boost agricultural disinfectants' demand to increase farm productivity.

The demand for meat products is on the rise, thus surging the growth in the agricultural disinfectants' market due to the increasing pressure on livestock farmers for good animal health. Additionally, in animal feed, the ban on antibiotics is backing up the market’s growth. Appropriate disinfection is essential for the optimal protection of crops and livestock to sterilize undesirable and harmful microorganisms. They are used in drinking water, on surfaces, and in yards to prevent dangerous diseases. Thus, routine cleanliness and the frequent removal of manure result in the livestock population’s better health.

The emergence of new techniques for vegetable production in vertical farming & greenhouses and the prohibition on the use of antibiotics in animal feed stimulates the global agricultural disinfectants market. This has further led to a significant demand for disinfectants in crops to achieve efficient food yield and optimum production.

Furthermore, reducing operating expenditures, increasing stress on enhancing performance, and maintaining regulatory standards impact the global agricultural disinfectant market. However, companies and governments' rise in the number of initiatives to spread awareness among growers and farmers on the instructions for optimum agricultural disinfectants will give momentum to the market's overall growth. R&D laboratories offer tremendous growth potential for this market. The number of research projects on the use of environment-friendly agricultural disinfectants in developing countries has increased.

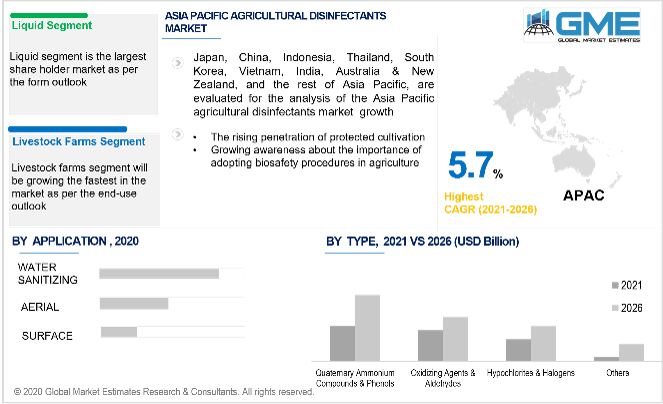

By type, the market is categorized into four segments: hypochlorites & halogens, quaternary ammonium compounds & phenols, oxidizing agents & aldehydes, and others like alcohols and acids. The quaternary ammonium compounds & phenols segment is foreseen to predominate. This is due to their properties of being non-toxic, effective, supports microbial detachment, and prevents regrowth, non-corrosive, non-irritating, flavorless, and odorless. Phenols have corrosive properties and have potential systemic toxicity. They are prevalently implemented because of their outstanding penetrating power into organic matter. Hence, they are primarily used to disinfect organic materials or equipment. Moreover, quaternary ammonium compounds and phenols are readily accessible and are inexpensive. These disinfectants' wide-ranging characteristics are the significant factors expected to enhance the market for quaternary ammonium compounds and phenols throughout the forecast period.

By application, the market is categorized into three segments: surface, aerial, and water sanitizing. The water sanitizing segment is foreseen to predominate. Various protected cultivation systems, like vertical farming, indoor farming, and hydroponics, lessen biotic stresses on crops, like attacks by pests and pathogens. These systems have led to yields that have a minute or no pesticide residues at all. The susceptibility of crops being attacked by pathogens is negligible in protected cultivation, but the maintenance of protected cultivation facilities to have 100% pathogen and pest control has become a necessity. Thus, disinfectants have an essential role in the sanitization process of equipment and the protected cultivation facilities in the pre-planting stage. The enlarged area under protected cultivation facilities will influence the market's growth for water sanitizing-based agricultural disinfectants positively. Hence, the water sanitizing segment is foreseen to dominate the market.

Depending on end-use, the market is classified into two segments: livestock farms and agricultural farms. The livestock farms segment is presumed to lead the market. Livestock production premises like pens for lambing, barns, weaning, calving, and holding animals at all times encounter problems associated with the hosting of suckling mothers, new-born, young, and pregnant animals. Newborn animals are especially vulnerable and susceptible to diseases because their immune systems are underdeveloped. Same with suckling mothers and pregnant animals, due to the growing fetus's needs or suckling baby. The deployment of farm biosecurity employing agricultural disinfectants will lead to propulsion in the livestock farms- based agricultural disinfectants market throughout the estimated period.

By form, the market is categorized into three segments: liquid, powder, and others like granular & gel forms. The liquid segment will dominate the market share. This can be ascribed to its primacy features, including it being inexpensive than the other forms. These disinfectants in liquid form are soluble, easily available, and extensively used in livestock to eradicate diseases and agricultural farms to enhance crop productivity. These factors will stimulate segment augmentation throughout the forecast period.

The agricultural disinfectants market by region can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Due to the extremely growing market for livestock and premium meat products in North America, agricultural disinfectants are projected to be in high demand. Furthermore, this area has a better market preference for agricultural disinfectants in livestock farms. Furthermore, the preference for sustainable crops and government regulations on antibiotics in animal feed is projected to fuel development in the region's core demographic. Notwithstanding, Europe holds the second-largest share of the overall agricultural disinfectants market, owing to its vast agricultural fields, and this area is likely to open up potential avenues in respect of demand. Germany is a competitive marketplace, but the increasing importance of crop and livestock security is expected to create enough prospects for emerging players in the immediate future.

Through the forecast period, the Asia Pacific market will exhibit the highest CAGR. Primarily, increasing R&D activities for enhancing disinfectants in countries like China & India will drive the market’s growth in the Asia-Pacific region. Steadily increasing livestock productivity and the expansion of livestock farms in the Asia-Pacific region, combined with enhanced penetration of guarded cultivation, are accelerating the demand for agricultural disinfectants. Through the forecast period, constraints such as a deficit of knowledge concerning scientific disinfection practices in agricultural retain and the overwhelming development of end-user sectors are foreseen to drive the demand in the region.

The Chemours Company, Entaco NV, Fink TEC GmbH, Neogen Corporation, Nufarm Limited, Quat-Chem Ltd., Stepan Company, The DOW Chemical Company, Thymox Technology, Zoetis, among others, are some of the identified market players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Agricultural Disinfectants Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-Use Overview

2.1.5 Form Overview

2.1.6 Regional Overview

Chapter 3 Global Agricultural Disinfectants Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Demand for Meat Products

3.3.1.2 Rising Organic Agricultural Disinfectants and Ban on Antibiotics in Animal Feed

3.3.2 Industry Challenges

3.3.2.1 Ill After Effects of Few Products

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-Use Growth Scenario

3.4.4 Form Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Agricultural Disinfectants Market, By Type

4.1 Type Outlook

4.2 Hypochlorites & Halogens

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Quaternary Ammonium Compounds & Phenols

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Oxidizing Agents & Aldehydes

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Agricultural Disinfectants Market, By Application

5.1 Application Outlook

5.2 Surface

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Aerial

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Water Sanitizing

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Agricultural Disinfectants Market, By End-Use

6.1 End-Use Outlook

6.2 Livestock Farms

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Agricultural Farms

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Agricultural Disinfectants Market, By Form

7.1 Form Outlook

7.2 Liquid

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Powder

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Others

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Global Agricultural Disinfectants Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2016-2026 (USD Million)

8.2.2 Market Size, By Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.2.5 Market Size, By Form, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.2.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2016-2026 (USD Million)

8.3.2 Market Size, By Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.5 Market Size, By Form, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Form, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Form, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2016-2026 (USD Million)

8.4.2 Market Size, By Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.5 Market Size, By Form, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Form, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market size, By End-Use, 2016-2026 (USD Million)

8.4.9.4 Market size, By Form, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Form, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2016-2026 (USD Million)

8.5.2 Market Size, By Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.5 Market Size, By Form, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Form, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2016-2026 (USD Million)

8.6.2 Market Size, By Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.5 Market Size, By Form, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Form, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Form, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Form, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 The Chemours Company

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Entaco NV

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Fink TEC GmbH

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Neogen Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Nufarm Limited

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Quat-Chem Ltd.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Stepan Company

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 The DOW Chemical Company

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Thymox Technology

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Zoetis

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

The Global Agricultural Disinfectants Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Agricultural Disinfectants Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS