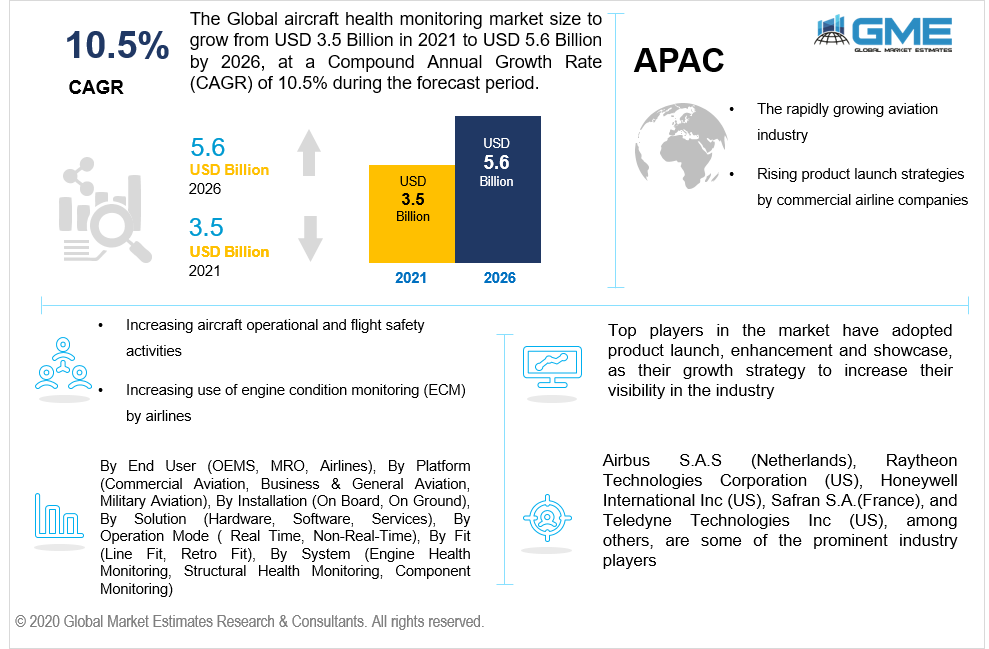

Global Aircraft Health Monitoring Market Size, Trends, and Analysis - Forecasts to 2026 By End User (OEMS, MRO, Airlines), By Platform (Commercial Aviation, Business & General Aviation, Military Aviation), By Installation (On Board, On Ground), By Solution (Hardware, Software, Services), By Operation Mode ( Real Time, Non-Real-Time), By Fit (Line Fit, Retro Fit), By System (Engine Health Monitoring, Structural Health Monitoring, Component Monitoring), Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global aircraft health monitoring market will grow from USD 3.5 billion in 2021 to USD 5.6 billion by 2026 at a CAGR value of 10.5% from 2021 to 2026.

An aircraft health monitoring system monitors the health of various aircraft systems by collecting data from components such as engines, structures, and avionics. This data is analyzed to diagnose and predict the probable failure of components, which helps reduce maintenance cost.

The growth of the aircraft health monitoring market is majorly attributed to the increasing aircraft operational and flight safety activities, increasing use of engine condition monitoring (ECM) by airlines and rising launch of innovative cloud-based IT solutions for storage of health monitoring data.

The airline industry is expected to grow rapidly especially due to ease on lockdown norms across the globe. Various aircraft companies are providing a wide range of services to their global customer base. However, with increasing progress in aircraft technology and customer base, the market is ought to be growing positively. The requirement of aircraft health monitoring systems (AHMS) is a must in order to maintain good condition of aircraft systems. AHMS incorporates various features of practice, solutions, and tools that help monitor the airplane's working and serviceability and analyze the necessary requirements that need to be made. Implementing the AHMS in aircraft management enables the operators to check or monitor the aircraft's working conditions and alert them if servicing or upgrading is required.

Nowadays, large-scale aircraft companies enter into a contract type partnership with the industry players of the AHMS market to ensure safety and guarantee of the airplane's serviceability. Having AHMS in the airplane's system also reduces maintenance costs and the need for servicing by the airline operating companies, thus ensuring the passengers' safety. As of 2017, 63% of the airliners worldwide have adopted AHM Systems into their operations and reported experiencing increased reliability and safety in their aircraft since the installation and this percentage is expected to rise rapidly.

With emerging innovations, the AHMS has also enhanced its deliverables. These systems have also incorporated robotic management and Unmanned Ariel Vehicles (UAV), which enable time efficiency in the maintenance process. The incorporation of technology and 4D graphics has helped the AHMS operators build models and photographs for more complex aircraft analysis. Hence, with technical advancements the demand for AHMS is expected to rise rapidly during the forecast period.

The COVID-19 has taken a colossal toll on the global economic activity with individuals, organizations, governments, and businesses having to adapt to the challenges of the crisis. Air travel restrictions across various regions for both domestic and international flights have led to inactive fleets across the globe and caused harm to the AHMS market too. Various stakeholders such as component providers, system manufacturers, government agencies, suppliers, distributors, aircraft & engine manufacturers, and MRO companies are impacted significantly due to the slowdown of transportation, border closures, and increase in the number of inactive fleets.

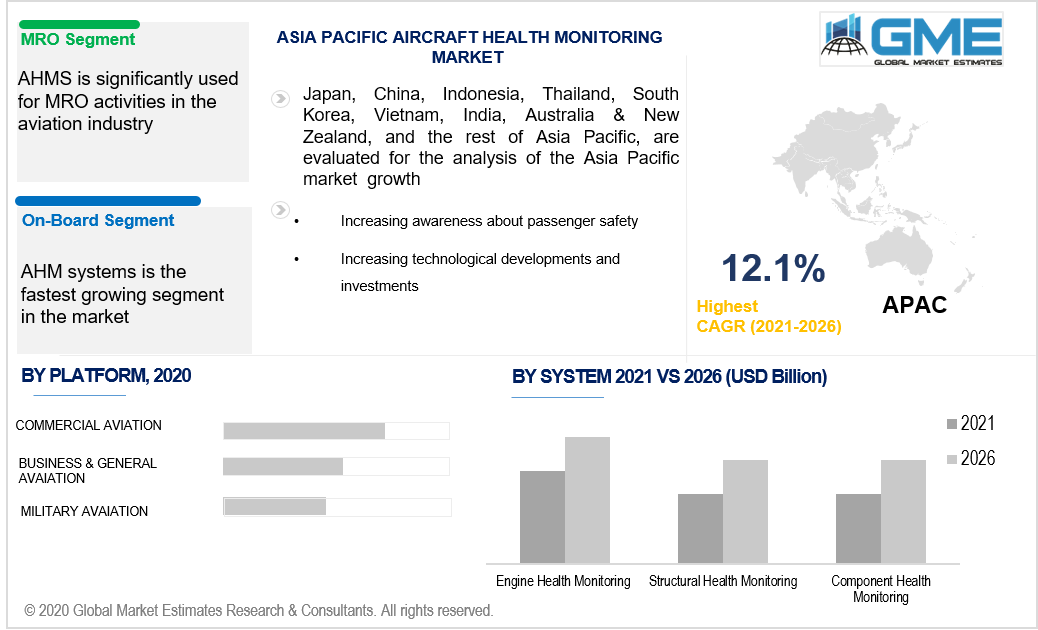

Based on the end user, the market is segmented into OEMS, MRO, and airlines. AHMS is significantly used for MRO activities in the aviation industry and hence this segment is expected to grow the fastest. Maintenance, Repair, and Overhaul are requisites of ensuring the safety of the aircraft and its service. The increasing value of the aviation industry has correspondingly increased the demand and value of MRO in the market.

Based on the platform, the market is segmented into commercial aviation, business & general aviation, military aviation. Commercial aviation has seen a surge in demand and is also analyzed to be the largest segment of the market.

The increasing passenger base has also encouraged new commercial airline companies to emerge into the aviation business. Passenger and cargo transport demands the extensive use of AHM systems that ensure passengers' safety during the air journey and the pilot's safety. The constant operations and increasing number of fleets, demand high maintenance systems which are cost-efficient and facilitate efficiency.

Based on the installation type, the market is segmented into on board, and on ground. AHM systems most commonly have on board installations and hence this segment is expected to grow the fastest.

Monitoring the onboard systems and controlling the panel status and equipment becomes very necessary to ensure the safety of the passengers. AHM systems also generate onboard data, which improves the service deliverance of the aircraft companies.

Based on the solution type, the market is segmented into hardware, software, and services. The operating companies prefer AHM with highly hardware based systems and hence this segment is the fastest growing one in the market.

The hardware mechanism enables in-depth monitoring of the equipment and machines, ensuring their creditability in operating. The AHM system communicates with the hardware systems present in the aircraft to regulate and generate security checks in them. Specialized sensors in the AHM systems associate with the working of the hardware equipment in the aircraft's operating systems and monitor its properties.

Based on the operation mode, the market is segmented into real time, and non-real-time. The operating aircraft companies mostly prefer Real-time operating systems within the AHM system and hence this segment is the largest shareholder of the market. Real-time operations enable accessing and processing real-time generated big data, without lags or delays, to ensure constant monitoring and accountability of the aircraft's system.

Based on fit type, the market is segmented into line fit, and retro fit. In order to increase their fleet deliveries, aircraft manufacturers and airline companies are adopting line-fit options into their AHM and manufacturing stages. Line fit option facilitates the manufacturers and operators to understand their end-users and the requirements of good operation in the aircraft.

Based on the system type, the market is segmented into engine health monitoring, structural health monitoring, and component monitoring. Aircraft operators significantly adopt engine health monitoring systems as they are the crucial aspects of ensuring the passengers' safety and aircraft's serviceability. It enables the engine to self-monitor itself and record all the errors and failures in its operations. These properties in engine health monitoring systems reduce the maintenance and operational cost for the system managers. The advancing technology in engine health monitoring systems increases the reliability and maturity of the aircraft. The sensor technology helps capture pictures to understand the operating conditions of the aircraft engines.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and Africa, and Asia Pacific regions. North American region dominated the AHM system market. The growing aviation industry is naturally boosting the demand for AHM systems in the U.S. Increasing awareness about safety and concerns regarding the same has increased the necessity of installing AHM systems by all the aircraft operators.

APAC will be the fastest growing segment in the market. The countries like China, Japan and India are some of the largest AHM system adopters due to their increasing demand for aircraft models. Increasing technological developments and investments in the aviation industry to ensure security and safety are the driving factors for the increasing growth in the APAC region's AHM market.

Airbus S.A.S (Netherlands), Raytheon Technologies Corporation (US), Honeywell International Inc (US), Safran S.A.(France), and Teledyne Technologies Inc (US), among others, are some of the ley players.

In January 2020, Safran S.A. launched a service that assisted the customers in monitoring and checking the aircraft engine's health indicator.

In December 2020, Intelsat took over Gogo Commercial Aviation, to improve its product portfolio in aircraft health monitoring.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aircraft Health Monitoring Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Platform Overview

2.1.3 Installation Overview

2.1.4 End-User Overview

2.1.5 Solution Overview

2.1.6 Operation Mode Overview

2.1.7 Fit Phase Overview

2.1.8 System Overview

2.1.9 Regional Overview

Chapter 3 Aircraft Health Monitoring Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing aircraft operational and flight safety activities

3.3.2 Industry Challenges

3.3.2.1 Disruption in raw material supply and manufacturing units due to COVID-19 pandemic

3.4 Prospective Growth Scenario

3.4.1 Platform Growth Scenario

3.4.2 Installation Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Solution Growth Scenario

3.4.5 Operation Mode Scenario

3.4.6 Fit Phase Scenario

3.4.7 System Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Solution Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Aircraft Health Monitoring Market, By Platform

4.1 Platform Outlook

4.2 Commercial Aviation

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 Business & General Aviation

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

4.4 Military Aviation

4.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Aircraft Health Monitoring Market, By Installation

5.1 Installation Outlook

5.2 On Board

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 On Ground

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Aircraft Health Monitoring Market, By End-User

6.1 OEMs

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 MRO

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 Airlines

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Aircraft Health Monitoring Market, By Solution

7.1 Hardware

7.1.1 Market Size, By Region, 2021-2026 (USD Billion)

7.2 Software

7.2.1 Market Size, By Region, 2021-2026 (USD Billion)

7.3 Services

7.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 8 Aircraft Health Monitoring Market, By Fit Phase

8.1 Line Fit

8.1.1 Market Size, By Region, 2021-2026 (USD Billion)

8.2 Retro Fit

8.2.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 9 Aircraft Health Monitoring Market, By Operation Mode

9.1 Real Time

9.1.1 Market Size, By Region, 2021-2026 (USD Billion)

9.2 Non-Real-Time

9.2.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 10 Aircraft Health Monitoring Market, By System

10.1 Engine Health Monitoring

10.1.1 Market Size, By Region, 2021-2026 (USD Billion)

10.2 Structural Health Monitoring

10.2.1 Market Size, By Region, 2021-2026 (USD Billion)

10.3 Component Monitoring

10.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 11 Aircraft Health Monitoring Market, By Region

11.1 Regional outlook

11.2 North America

11.2.1 Market Size, By Country 2021-2026 (USD Billion)

11.2.2 Market Size, By Platform, 2021-2026 (USD Billion)

11.2.3 Market Size, By Installation, 2021-2026 (USD Billion)

11.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

11.2.5 Market Size, By Solution, 2021-2026 (USD Billion)

11.2.6 Market Size, By Fit, 2021-2026 (USD Billion)

11.2.7 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.2.8 Market Size, By System, 2021-2026 (USD Billion)

11.2.9 U.S.

11.2.9.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.2.9.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.2.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.2.9.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.2.9.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.2.9.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.2.9.7 Market Size, By System, 2021-2026 (USD Billion)

11.2.10 Canada

11.2.10.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.2.10.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.2.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.2.10.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.2.10.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.2.10.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.2.10.7 Market Size, By System, 2021-2026 (USD Billion)

11.2.10 Mexico

11.2.11.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.2.11.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.2.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.2.11.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.2.11.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.2.11.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.2.10.7 Market Size, By System, 2021-2026 (USD Billion)

11.3 Europe

11.3.1 Market Size, By Country 2021-2026 (USD Billion)

11.3.2 Market Size, By Platform, 2021-2026 (USD Billion)

11.3.3 Market Size, By Installation, 2021-2026 (USD Billion)

11.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

11.3.5 Market Size, By Solution, 2021-2026 (USD Billion)

11.3.6 Market Size, By Fit, 2021-2026 (USD Billion)

11.3.7 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.3.8 Market Size, By System, 2021-2026 (USD Billion)

11.3.9 Germany

11.3.9.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.3.9.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.3.9.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.3.9.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.3.9.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.3.9.7 Market Size, By System, 2021-2026 (USD Billion)

11.3.10 UK

11.3.10.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.3.10.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.3.10.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.3.10.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.3.10.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.3.10.7 Market Size, By System, 2021-2026 (USD Billion)

11.3.11 France

11.3.11.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.3.11.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.3.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.3.11.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.3.11.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.3.11.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.3.11.7 Market Size, By System, 2021-2026 (USD Billion)

11.4 Asia Pacific

11.4.1 Market Size, By Country 2021-2026 (USD Billion)

11.4.2 Market Size, By Platform, 2021-2026 (USD Billion)

11.4.3 Market Size, By Installation, 2021-2026 (USD Billion)

11.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

11.4.5 Market Size, By Solution, 2021-2026 (USD Billion)

11.4.6 Market Size, By Fit, 2021-2026 (USD Billion)

11.4.7 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.4.8 Market Size, By System, 2021-2026 (USD Billion)

11.4.9 China

11.4.9.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.4.9.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.4.9.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.4.9.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.4.9.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.4.9.7 Market Size, By System, 2021-2026 (USD Billion)

11.4.10 India

11.4.10.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.4.10.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.4.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.4.10.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.4.10.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.4.10.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.4.10.7 Market Size, By System, 2021-2026 (USD Billion)

11.4.11 Japan

11.4.11.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.4.11.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.4.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.4.11.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.4.11.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.4.11.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.4.11.7 Market Size, By System, 2021-2026 (USD Billion)

11.5 MEA

11.5.1 Market Size, By Country 2021-2026 (USD Billion)

11.5.2 Market Size, By Platform, 2021-2026 (USD Billion)

11.5.3 Market Size, By Installation, 2021-2026 (USD Billion)

11.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

11.5.5 Market Size, By Solution, 2021-2026 (USD Billion)

11.5.6 Market Size, By Fit, 2021-2026 (USD Billion)

11.5.7 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.5.8 Market Size, By System, 2021-2026 (USD Billion)

11.5.9 Saudi Arabia

11.5.9.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.5.9.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.5.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.5.9.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.5.9.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.5.9.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.5.9.7 Market Size, By System, 2021-2026 (USD Billion)

11.5.10 UAE

11.5.10.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.5.10.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.5.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.5.10.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.5.10.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.5.10.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.5.10.7 Market Size, By System, 2021-2026 (USD Billion)

11.6 CSA

11.6.1 Market Size, By Country 2021-2026 (USD Billion)

11.6.2 Market Size, By Platform, 2021-2026 (USD Billion)

11.6.3 Market Size, By Installation, 2021-2026 (USD Billion)

11.6.4 Market Size, By End-User, 2021-2026 (USD Billion)

11.6.5 Market Size, By Solution, 2021-2026 (USD Billion)

11.6.6 Market Size, By Fit, 2021-2026 (USD Billion)

11.6.7 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.6.8 Market Size, By System, 2021-2026 (USD Billion)

11.6.9 Brazil

11.6.9.1 Market Size, By Platform, 2021-2026 (USD Billion)

11.6.9.2 Market Size, By Installation, 2021-2026 (USD Billion)

11.6.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

11.6.9.4 Market Size, By Solution, 2021-2026 (USD Billion)

11.6.9.5 Market Size, By Fit, 2021-2026 (USD Billion)

11.6.9.6 Market Size, By Operation Mode, 2021-2026 (USD Billion)

11.6.9.7 Market Size, By System, 2021-2026 (USD Billion)

Chapter 12 Company Landscape

12.1 Competitive Analysis, 2020

12.2 Airbus S.A.S

12.2.1 Company Overview

12.2.2 Financial Analysis

12.2.3 Strategic Positioning

12.2.4 Info Graphic Analysis

12.3 Raytheon Technologies Corporation

12.3.1 Company Overview

12.3.2 Financial Analysis

12.3.3 Strategic Positioning

12.3.4 Info Graphic Analysis

12.4 Honeywell International Inc

12.4.1 Company Overview

12.4.2 Financial Analysis

12.4.3 Strategic Positioning

12.4.4 Info Graphic Analysis

12.5 Safran S.A.

12.5.1 Company Overview

12.5.2 Financial Analysis

12.5.3 Strategic Positioning

12.5.4 Info Graphic Analysis

12.6 Teledyne Technologies Inc

12.6.1 Company Overview

12.6.2 Financial Analysis

12.6.3 Strategic Positioning

12.6.4 Info Graphic Analysis

12.7 Ultra

12.7.1 Company Overview

12.7.2 Financial Analysis

12.7.3 Strategic Positioning

12.7.4 Info Graphic Analysis

12.8 GE

12.10.1 Company Overview

12.10.2 Financial Analysis

12.10.3 Strategic Positioning

12.10.4 Info Graphic Analysis

12.11 Ventura Aerospace, Inc

12.12.1 Company Overview

12.12.2 Financial Analysis

12.12.3 Strategic Positioning

12.12.4 Info Graphic Analysis

12.10 Others

12.10.1 Company Overview

12.10.2 Financial Analysis

12.10.3 Strategic Positioning

12.10.4 Info Graphic Analysis

The Global Aircraft Health Monitoring Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aircraft Health Monitoring Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS