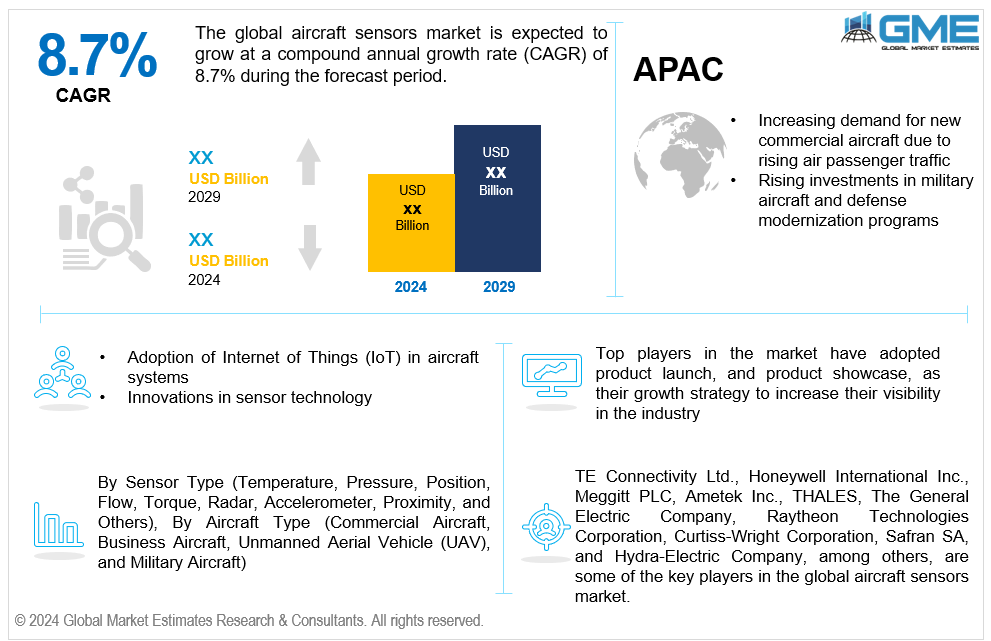

Global Aircraft Sensors Market Size, Trends & Analysis - Forecasts to 2029 By Sensor Type (Temperature, Pressure, Position, Flow, Torque, Radar, Accelerometer, Proximity, and Others), By Aircraft Type (Commercial Aircraft, Business Aircraft, Unmanned Aerial Vehicle (UAV), and Military Aircraft), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global aircraft sensors market is estimated to exhibit a CAGR of 8.7% from 2024 to 2029.

The primary factors propelling the market growth are the increasing demand for new commercial aircraft due to rising air passenger traffic and the rising investments in military aircraft and defense modernization programs. The need for advanced aerospace sensors grows as airlines expand their fleets to accommodate the passenger surge. Modern aircraft are equipped with sophisticated aircraft sensor technology, including flight sensors and avionics sensors, to enhance performance, safety, and efficiency. By using aircraft health monitoring systems, downtime and operating expenses are reduced, and real-time diagnosis and predictive maintenance are ensured. Additionally, the demand for precise aircraft navigation sensors and aircraft position sensors has escalated, ensuring accurate navigation and positioning. The aviation industry depends on these technical developments in sensor integration to maintain high levels of safety and dependability, which is driving market growth. For instance, according to the Bureau of Transportation Statistics (BTS), U.S. airlines transported 77.5 million system-wide (domestic and international) scheduled service passengers in April 2023, up 7.8% from the same month the previous year.

The increasing Internet of Things (IoT) adoption in aircraft systems and sensor technology innovations is expected to support market growth. Advances in aircraft temperature sensors and aircraft pressure sensors enable precise monitoring of critical engine and environmental conditions, ensuring optimal performance. The development of sophisticated aircraft speed sensors and aircraft vibration sensors contributes to smoother and safer flight operations by providing real-time data on aircraft dynamics. Moreover, the integration of aircraft proximity sensors and aircraft altitude sensors enhances navigation and collision avoidance systems, crucial for both commercial and military applications. Aircraft fuel sensors play a pivotal role in efficient fuel management, aiding in reducing operational costs and environmental impact. Additionally, the advancement of aircraft oxygen sensors improves life support systems, ensuring passenger and crew safety. By addressing the increased need for improved performance, safety, and efficiency in the aerospace sector, these innovations together propel the market growth.

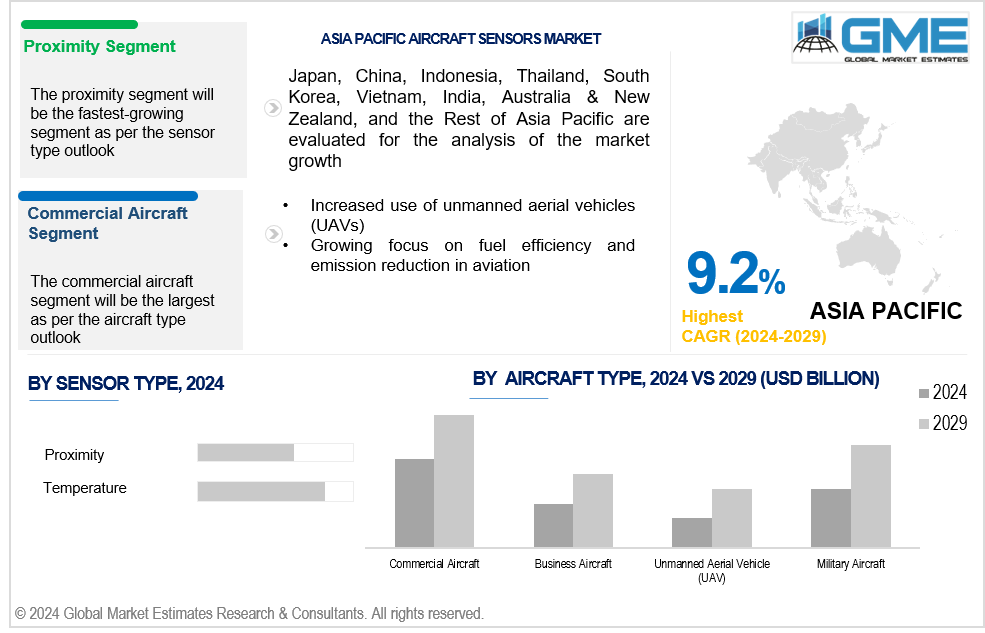

Increased use of unmanned aerial vehicles (UAVs) coupled with the growing focus on fuel efficiency and emission reduction in aviation propel market growth. UAVs rely heavily on aircraft sensor fusion and aircraft sensor integration to process data from multiple sources, ensuring accurate and reliable performance in complex environments. The demand for robust aircraft sensor reliability is paramount, given the critical nature of UAV missions in sectors such as surveillance, agriculture, and logistics. This surge in UAV deployment has led to noticeable aircraft sensor market trends, with a growing emphasis on miniaturization and enhanced functionality of sensors. The expanding applications of UAVs are highlighting the increasing need for specialized sensors, such as those for navigation, communication, and environmental monitoring.

The trend toward smart and connected aircraft presents sensor manufacturers with an opportunity to create cutting-edge solutions that facilitate real-time data monitoring and predictive maintenance. Additionally, a greater emphasis on flight safety systems creates opportunities for sophisticated sensors that can detect problems, offer early warnings, and enhance overall safety procedures.

However, stringent regulatory standards and certification processes for aircraft sensors and concerns about cybersecurity threats and data privacy may impede market growth over the forecast period.

The temperature segment is expected to hold the largest share of the market over the forecast period. Temperature sensors are essential for monitoring and preserving aircraft performance and safety. They take temperature readings in the engine, fuel system, and cabin conditions, among other areas of the aircraft. Accurate temperature monitoring helps prevent faults or breakdowns by ensuring that the aircraft works within acceptable temperature ranges.

The proximity segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The ability of proximity sensors to identify the location and presence of things without making physical touch is essential for improving both safety and operational effectiveness. They are employed in several aircraft functions, including cargo door operation, landing gear position sensing, and obstacle detection. Their capacity to offer immediate feedback contributes to increased safety by averting mishaps.

The commercial aircraft segment is expected to hold the largest share of the market over the forecast period. The majority of the world's fleet is commercial aircraft. Since thousands of commercial airplanes are in operation globally, there is a significant need for sensors to guarantee performance, efficiency, and safety.

The unmanned aerial vehicle (UAV) segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. With advancements in sensors, flight control systems, and data processing capabilities, UAV technology is developing quickly. The demand for advanced sensors is rising as a result of these improvements, which are increasing the adoption of UAVs across a variety of sectors, including agriculture and military.

North America is expected to be the largest region in the global market. The major aerospace producers and service providers, including Boeing, Lockheed Martin, and Northrop Grumman, are based in North America, which is propelling the market's growth in the region.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The need for aircraft sensors is rising as the Asia Pacific aviation sector focuses more on safety and regulatory compliance. Regional regulatory agencies are putting standards into place that call for sophisticated sensors to be used for reporting and monitoring.

TE Connectivity Ltd., Honeywell International Inc., Meggitt PLC, Ametek Inc., THALES, The General Electric Company, Raytheon Technologies Corporation, Curtiss-Wright Corporation, Safran SA, and Hydra-Electric Company, among others, are some of the key players in the global aircraft sensors market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, Raytheon reported that another successful live-fire event demonstrated how far along its Lower Tier Air and Missile Defense Sensor, or LTAMDS, is in its U.S. Army test program.

In February 2023, to help military units make decisions more quickly and act as a unit, Northrop Grumman Corporation started integrating and testing the new ultra-wideband Electronically-Scanned Multifunction Reconfigurable Integrated Sensor (EMRIS).

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AIRCRAFT SENSORS MARKET, BY Sensor Type

4.1 Introduction

4.2 Aircraft Sensors Market: Sensor Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Temperature

4.4.1 Temperature Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Pressure

4.5.1 Pressure Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Position

4.6.1 Position Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Flow

4.7.1 Flow Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Torque

4.8.1 Torque Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Radar

4.9.1 Radar Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Accelerometer

4.10.1 Accelerometer Market Estimates and Forecast, 2021-2029 (USD Million)

6.11 Proximity

6.11.1 Proximity Market Estimates and Forecast, 2021-2029 (USD Million)

6.12 Others

6.12.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL AIRCRAFT SENSORS MARKET, BY AIRCRAFT TYPE

5.1 Introduction

5.2 Aircraft Sensors Market: Aircraft Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Commercial Aircraft

5.4.1 Commercial Aircraft Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Business Aircraft

5.5.1 Business Aircraft Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Unmanned Aerial Vehicle (UAV)

5.6.1 Unmanned Aerial Vehicle (UAV) Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Military Aircraft

5.7.1 Military Aircraft Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL AIRCRAFT SENSORS MARKET, BY REGION

6.1 Introduction

6.2 North America Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Sensor Type

6.2.2 By Aircraft Type

6.2.3 By Country

6.2.3.1 U.S. Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Sensor Type

6.2.3.1.2 By Aircraft Type

6.2.3.2 Canada Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Sensor Type

6.2.3.2.2 By Aircraft Type

6.2.3.3 Mexico Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Sensor Type

6.2.3.3.2 By Aircraft Type

6.3 Europe Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Sensor Type

6.3.2 By Aircraft Type

6.3.3 By Country

6.3.3.1 Germany Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Sensor Type

6.3.3.1.2 By Aircraft Type

6.3.3.2 U.K. Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Sensor Type

6.3.3.2.2 By Aircraft Type

6.3.3.3 France Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Sensor Type

6.3.3.3.2 By Aircraft Type

6.3.3.4 Italy Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Sensor Type

6.3.3.4.2 By Aircraft Type

6.3.3.5 Spain Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Sensor Type

6.3.3.5.2 By Aircraft Type

6.3.3.6 Netherlands Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Sensor Type

6.3.3.6.2 By Aircraft Type

6.3.3.7 Rest of Europe Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Sensor Type

6.3.3.6.2 By Aircraft Type

6.4 Asia Pacific Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Sensor Type

6.4.2 By Aircraft Type

6.4.3 By Country

6.4.3.1 China Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Sensor Type

6.4.3.1.2 By Aircraft Type

6.4.3.2 Japan Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Sensor Type

6.4.3.2.2 By Aircraft Type

6.4.3.3 India Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Sensor Type

6.4.3.3.2 By Aircraft Type

6.4.3.4 South Korea Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Sensor Type

6.4.3.4.2 By Aircraft Type

6.4.3.5 Singapore Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Sensor Type

6.4.3.5.2 By Aircraft Type

6.4.3.6 Malaysia Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Sensor Type

6.4.3.6.2 By Aircraft Type

6.4.3.7 Thailand Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Sensor Type

6.4.3.6.2 By Aircraft Type

6.4.3.8 Indonesia Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Sensor Type

6.4.3.7.2 By Aircraft Type

6.4.3.9 Vietnam Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Sensor Type

6.4.3.8.2 By Aircraft Type

6.4.3.10 Taiwan Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Sensor Type

6.4.3.10.2 By Aircraft Type

6.4.3.11 Rest of Asia Pacific Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Sensor Type

6.4.3.11.2 By Aircraft Type

6.5 Middle East and Africa Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Sensor Type

6.5.2 By Aircraft Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Sensor Type

6.5.3.1.2 By Aircraft Type

6.5.3.2 U.A.E. Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Sensor Type

6.5.3.2.2 By Aircraft Type

6.5.3.3 Israel Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Sensor Type

6.5.3.3.2 By Aircraft Type

6.5.3.4 South Africa Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Sensor Type

6.5.3.4.2 By Aircraft Type

6.5.3.5 Rest of Middle East and Africa Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Sensor Type

6.5.3.5.2 By Aircraft Type

6.6 Central and South America Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Sensor Type

6.6.2 By Aircraft Type

6.6.3 By Country

6.6.3.1 Brazil Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Sensor Type

6.6.3.1.2 By Aircraft Type

6.6.3.2 Argentina Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Sensor Type

6.6.3.2.2 By Aircraft Type

6.6.3.3 Chile Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Sensor Type

6.6.3.3.2 By Aircraft Type

6.6.3.3 Rest of Central and South America Aircraft Sensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Sensor Type

6.6.3.3.2 By Aircraft Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 TE Connectivity Ltd.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Honeywell International Inc.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Meggitt PLC

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Ametek Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 THALES

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 THE GENERAL ELECTRIC COMPANY

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Raytheon Technologies Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Curtiss-Wright Corporation

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Safran SA

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Hydra-Electric Company

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

2 Temperature Market, By Region, 2021-2029 (USD Mllion)

3 Pressure Market, By Region, 2021-2029 (USD Mllion)

4 Position Market, By Region, 2021-2029 (USD Mllion)

5 Flow Market, By Region, 2021-2029 (USD Mllion)

6 Torque Market, By Region, 2021-2029 (USD Mllion)

7 Radar Market, By Region, 2021-2029 (USD Mllion)

8 Accelerometer Market, By Region, 2021-2029 (USD Mllion)

9 Proximity Market, By Region, 2021-2029 (USD Mllion)

10 Others Market, By Region, 2021-2029 (USD Mllion)

11 Global Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

12 Commercial Aircraft Market, By Region, 2021-2029 (USD Mllion)

13 Business Aircraft Market, By Region, 2021-2029 (USD Mllion)

14 Unmanned Aerial Vehicle (UAV) Market, By Region, 2021-2029 (USD Mllion)

15 Military Aircraft Market, By Region, 2021-2029 (USD Mllion)

16 Regional Analysis, 2021-2029 (USD Mllion)

17 North America Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

18 North America Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

19 North America Aircraft Sensors Market, By COUNTRY, 2021-2029 (USD Mllion)

20 U.S. Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

21 U.S. Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

22 Canada Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

23 Canada Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

24 Mexico Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

25 Mexico Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

26 Europe Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

27 Europe Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

28 EUROPE Aircraft Sensors Market, By COUNTRY, 2021-2029 (USD Mllion)

29 Germany Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

30 Germany Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

31 U.K. Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

32 U.K. Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

33 France Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

34 France Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

35 Italy Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

36 Italy Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

37 Spain Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

38 Spain Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

39 Netherlands Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

40 Netherlands Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

41 Rest Of Europe Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

42 Rest Of Europe Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

43 Asia Pacific Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

44 Asia Pacific Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

45 ASIA PACIFIC Aircraft Sensors Market, By COUNTRY, 2021-2029 (USD Mllion)

46 China Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

47 China Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

48 Japan Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

49 Japan Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

50 India Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

51 India Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

52 South Korea Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

53 South Korea Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

54 Singapore Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

55 Singapore Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

56 Thailand Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

57 Thailand Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

58 Malaysia Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

59 Malaysia Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

60 Indonesia Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

61 Indonesia Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

62 Vietnam Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

63 Vietnam Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

64 Taiwan Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

65 Taiwan Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

66 Rest of APAC Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

67 Rest of APAC Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

68 Middle East and Africa Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

69 Middle East and Africa Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

70 MIDDLE EAST & AFRICA Aircraft Sensors Market, By COUNTRY, 2021-2029 (USD Mllion)

71 Saudi Arabia Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

72 Saudi Arabia Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

73 UAE Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

74 UAE Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

75 Israel Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

76 Israel Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

77 South Africa Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

78 South Africa Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

79 Rest Of Middle East and Africa Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

80 Rest Of Middle East and Africa Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

81 Central and South America Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

82 Central and South America Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

83 CENTRAL AND SOUTH AMERICA Aircraft Sensors Market, By COUNTRY, 2021-2029 (USD Mllion)

84 Brazil Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

85 Brazil Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

86 Chile Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

87 Chile Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

88 Argentina Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

89 Argentina Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

90 Rest Of Central and South America Aircraft Sensors Market, By Sensor Type, 2021-2029 (USD Mllion)

91 Rest Of Central and South America Aircraft Sensors Market, By Aircraft Type, 2021-2029 (USD Mllion)

92 TE Connectivity Ltd.: Products & Services Offering

93 Honeywell International Inc.: Products & Services Offering

94 Meggitt PLC: Products & Services Offering

95 Ametek Inc.: Products & Services Offering

96 THALES: Products & Services Offering

97 THE GENERAL ELECTRIC COMPANY: Products & Services Offering

98 Raytheon Technologies Corporation: Products & Services Offering

99 Curtiss-Wright Corporation: Products & Services Offering

100 Safran SA, Inc: Products & Services Offering

101 Hydra-Electric Company: Products & Services Offering

102 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Aircraft Sensors Market Overview

2 Global Aircraft Sensors Market Value From 2021-2029 (USD Mllion)

3 Global Aircraft Sensors Market Share, By Sensor Type (2023)

4 Global Aircraft Sensors Market Share, By Aircraft Type (2023)

5 Global Aircraft Sensors Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Aircraft Sensors Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Aircraft Sensors Market

10 Impact Of Challenges On The Global Aircraft Sensors Market

11 Porter’s Five Forces Analysis

12 Global Aircraft Sensors Market: By Sensor Type Scope Key Takeaways

13 Global Aircraft Sensors Market, By Sensor Type Segment: Revenue Growth Analysis

14 Temperature Market, By Region, 2021-2029 (USD Mllion)

15 Pressure Market, By Region, 2021-2029 (USD Mllion)

16 Position Market, By Region, 2021-2029 (USD Mllion)

17 Flow Market, By Region, 2021-2029 (USD Mllion)

18 Torque Market, By Region, 2021-2029 (USD Mllion)

19 Radar Market, By Region, 2021-2029 (USD Mllion)

20 Accelerometer Market, By Region, 2021-2029 (USD Mllion)

21 Proximity Market, By Region, 2021-2029 (USD Mllion)

22 Others Market, By Region, 2021-2029 (USD Mllion)

23 Global Aircraft Sensors Market: By Aircraft Type Scope Key Takeaways

24 Global Aircraft Sensors Market, By Aircraft Type Segment: Revenue Growth Analysis

25 Commercial Aircraft Market, By Region, 2021-2029 (USD Mllion)

26 Business Aircraft Market, By Region, 2021-2029 (USD Mllion)

27 Unmanned Aerial Vehicle (UAV) Market, By Region, 2021-2029 (USD Mllion)

28 Military Aircraft Market, By Region, 2021-2029 (USD Mllion)

29 Regional Segment: Revenue Growth Analysis

30 Global Aircraft Sensors Market: Regional Analysis

31 North America Aircraft Sensors Market Overview

32 North America Aircraft Sensors Market, By Sensor Type

33 North America Aircraft Sensors Market, By Aircraft Type

34 North America Aircraft Sensors Market, By Country

35 U.S. Aircraft Sensors Market, By Sensor Type

36 U.S. Aircraft Sensors Market, By Aircraft Type

37 Canada Aircraft Sensors Market, By Sensor Type

38 Canada Aircraft Sensors Market, By Aircraft Type

39 Mexico Aircraft Sensors Market, By Sensor Type

40 Mexico Aircraft Sensors Market, By Aircraft Type

41 Four Quadrant Positioning Matrix

42 Company Market Share Analysis

43 TE Connectivity Ltd.: Company Snapshot

44 TE Connectivity Ltd.: SWOT Analysis

45 TE Connectivity Ltd.: Geographic Presence

46 Honeywell International Inc.: Company Snapshot

47 Honeywell International Inc.: SWOT Analysis

48 Honeywell International Inc.: Geographic Presence

49 Meggitt PLC: Company Snapshot

50 Meggitt PLC: SWOT Analysis

51 Meggitt PLC: Geographic Presence

52 Ametek Inc.: Company Snapshot

53 Ametek Inc.: Swot Analysis

54 Ametek Inc.: Geographic Presence

55 THALES: Company Snapshot

56 THALES: SWOT Analysis

57 THALES: Geographic Presence

58 THE GENERAL ELECTRIC COMPANY: Company Snapshot

59 THE GENERAL ELECTRIC COMPANY: SWOT Analysis

60 THE GENERAL ELECTRIC COMPANY: Geographic Presence

61 Raytheon Technologies Corporation : Company Snapshot

62 Raytheon Technologies Corporation : SWOT Analysis

63 Raytheon Technologies Corporation : Geographic Presence

64 Curtiss-Wright Corporation: Company Snapshot

65 Curtiss-Wright Corporation: SWOT Analysis

66 Curtiss-Wright Corporation: Geographic Presence

67 Safran SA, Inc.: Company Snapshot

68 Safran SA, Inc.: SWOT Analysis

69 Safran SA, Inc.: Geographic Presence

70 Hydra-Electric Company: Company Snapshot

71 Hydra-Electric Company: SWOT Analysis

72 Hydra-Electric Company: Geographic Presence

73 Other Companies: Company Snapshot

74 Other Companies: SWOT Analysis

75 Other Companies: Geographic Presence

The Global Aircraft Sensors Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aircraft Sensors Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS