Global Airport People Mover Market Size, Trends & Analysis - Forecasts to 2026 By Concourse Type (Airside, Landside), By Mover Type (Monorail, Duorail, Automated Guide-Way Transit or Maglev), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

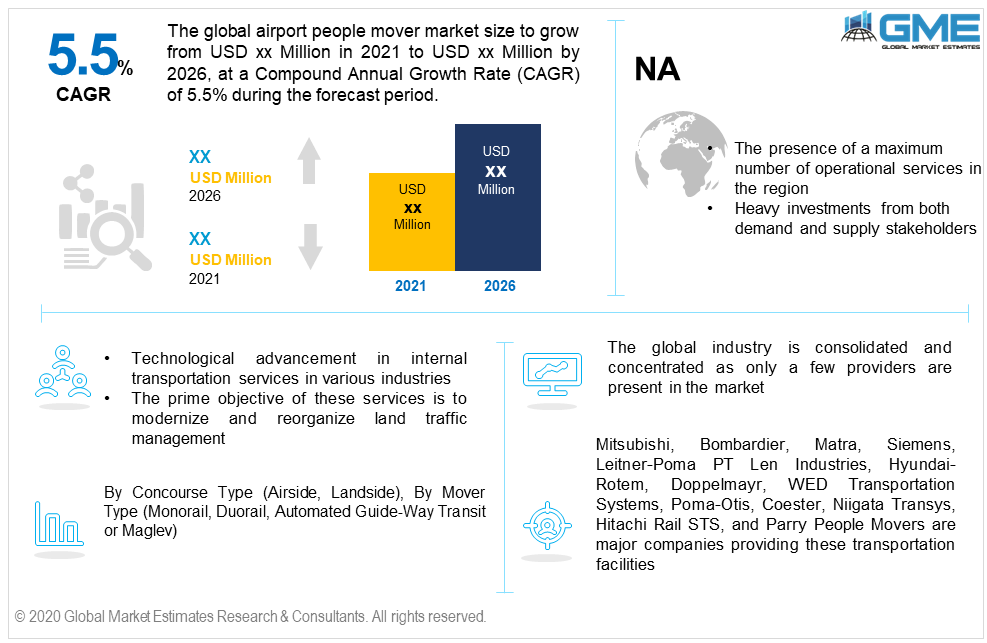

Technological advancement in internal transportation services in various industries has promoted new developments in the industry. Global Airport People Mover Market will witness over 5.5% CAGR up to 2026, with North America holding the largest share. Providing facilities such as automated transit on the airside and landside to improve time and traffic management are the major reasons to drive the demand. The industry provides various improvements in the respective applications related to transportation, traffic management, and safety. These services not only uplift the premises' procedures but also offers a streamlined transit system.

The key purpose of these amenities is to modernize and reorganize land traffic management. These transportation services help the premises in identifying the cause and effect of delays and mismanagement. Long-term efficiency and improving airside & landside area are the major factors to implement and deploy the monorail, Duorail, or automated transit.

Expansion in the aviation industry along with the necessity to manage and smoothen the overall operation in the airports will proliferate the market penetration. Currently, there are around 58 automated transit functioning in the airport globally. The industry is concentrated and competitive due to a limited number of providers. The U.S., UK, Germany, Japan, and China are early adopters and have the highest number of transits that are currently operational.

Changing industry scenarios and the construction of new airports will result in high deployment in developing countries. Government intervention to upgrade the internal transportation services along with the necessity to upkeep with the technical advancement in the smart cities will result in high penetration during the forecast period.

Faster acceleration, time management, and the ability to allocate more than 200 people at a time are prime technicalities to invest in these transit systems. However, high initial investment along with partnering with the service provider to build infrastructure is a long-term procedure that may result in a stagnant adoption rate in underdeveloped countries.

The concourse type segment is segregated into Landside and Airside. The airside concourse dominated the overall demand and accounted for more than 50% of the concourse type share in 2019. A high rate of deployment along with increasing demand for automated transportation on the airside will result in high demand in the coming years. The landside concourse will witness high growth up to 2026. High safety norms and premise confidentiality are major reasons for limited deployment in the landside concourse. However, the segment will witness an increased demand in the coming years.

Duorail, Monorail, and Automated Guide-way Transit are three major types identified in the industry. Monorail led the mover type segment and accounted for over 30% of the share. Early adoption and easy running procedure are the prime factors to drive expansion in this segment. The Automated Guide-way Transit or Maglev holds the highest potential in the coming years and is expected to witness the highest CAGR of around 6.5% during the forecast period. Energy efficiency & conservation, improved connectivity, technological advancement, and fast services are the major reasons to induce growth in this segment. Maglev transits are a futuristic approach and hold a promising future for the upcoming automated transportation services.

North America, led by the U.S. Airport People Mover Market will dominate the industry and is expected to hold over 40% of the revenue share by 2026. The presence of a maximum number of operational services in the region along with the early adoption of a technologically advanced transportation system will contribute to the regional industry growth. Heavy investments from both demand and supply stakeholders along with infrastructure capacity to support and run advanced systems is another reason to fuel market growth.

The Asia Pacific region is projected to witness over 6% CAGR up to 2026. Automated transportation industry advancement along with technological up-gradation to enhance the transportation services on airside and landside will promote the industry expansion. China, Japan, South Korea, and Indonesia are the key adopting countries.

The European market is expected to hold over 22% of the share by 2026. The respective growth is positively influenced by the increasing investment in the aerospace and transportation industry. The aviation services providers are becoming more responsive and working towards premises development. Also, inclination towards sustainable transportation practice is another cause to implement these technologies.

Mitsubishi, Bombardier, Matra, Siemens, Leitner-Poma PT Len Industries, Hyundai-Rotem, Doppelmayr, WED Transportation Systems, Poma-Otis, Coester, Niigata Transys, Hitachi Rail STS, and Parry People Movers are major companies providing these transportation facilities.

Please note: This is not an exhaustive list of companies profiled in the report.

The global industry is consolidated and concentrated as only a few providers are present in the market. Technological advancement and better services in terms of safety, quickness, and travel experience may result in new product developments.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Airport people mover industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Concourse type overview

2.1.3 Mover type overview

2.1.4 Regional overview

Chapter 3 Airport People Mover Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Airport People Mover Market, By Concourse Type

4.1 Concourse Type Outlook

4.2 Airside

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Landside

4.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Airport People Mover Market, By Mover Type

5.1 Mover Type Outlook

5.2 Monorail

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Duorail

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Automated Guide-way Transit or Maglev

5.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Airport People Mover Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by concourse type, 2019-2026 (USD Million)

6.2.3 Market size, by mover type, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by concourse type, 2019-2026 (USD Million)

6.2.4.2 Market size, by mover type, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by concourse type, 2019-2026 (USD Million)

6.2.5.2 Market size, by mover type, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by concourse type, 2019-2026 (USD Million)

6.3.3 Market size, by mover type, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by concourse type, 2019-2026 (USD Million)

6.2.4.2 Market size, by mover type, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by concourse type, 2019-2026 (USD Million)

6.3.5.2 Market size, by mover type, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by concourse type, 2019-2026 (USD Million)

6.3.6.2 Market size, by mover type, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by concourse type, 2019-2026 (USD Million)

6.3.7.2 Market size, by mover type, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by concourse type, 2019-2026 (USD Million)

6.3.8.2 Market size, by mover type, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by concourse type, 2019-2026 (USD Million)

6.3.9.2 Market size, by mover type, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by concourse type, 2019-2026 (USD Million)

6.4.3 Market size, by mover type, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by concourse type, 2019-2026 (USD Million)

6.4.4.2 Market size, by mover type, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by concourse type, 2019-2026 (USD Million)

6.4.5.2 Market size, by mover type, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by concourse type, 2019-2026 (USD Million)

6.4.6.2 Market size, by mover type, 2019-2026 (USD Million)

6.4.7 Singapore

6.4.7.1 Market size, by concourse type, 2019-2026 (USD Million)

6.4.7.2 Market size, by mover type, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by concourse type, 2019-2026 (USD Million)

6.4.8.2 Market size, by mover type, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by concourse type, 2019-2026 (USD Million)

6.5.3 Market size, by mover type, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by concourse type, 2019-2026 (USD Million)

6.5.4.2 Market size, by mover type, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by concourse type, 2019-2026 (USD Million)

6.5.5.2 Market size, by mover type, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by concourse type, 2019-2026 (USD Million)

6.6.3 Market size, by mover type, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by concourse type, 2019-2026 (USD Million)

6.6.4.2 Market size, by mover type, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by concourse type, 2019-2026 (USD Million)

6.6.5.2 Market size, by mover type, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 Mitsubishi

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Bombardier

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Matra

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Siemens

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Leitner-Poma

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 PT Len Industri

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Hyundai-Rotem

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Doppelmayr

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 WED Transportation Systems

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Poma-Otis

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Coester

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Niigata Transys

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Hitachi Rail STS

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Parry People Movers

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

The Global Airport People Mover Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Airport People Mover Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS