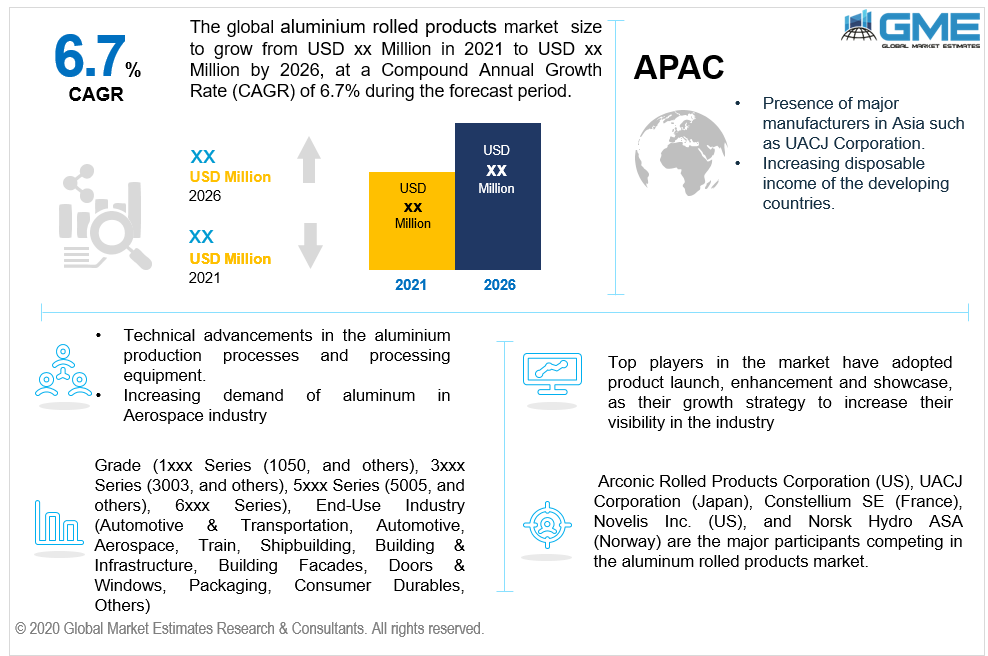

Global Aluminium Rolled Products Market Size, Trends, and Analysis- Forecasts To 2026 By Grade (1xxx Series (1050, & Others), 3xxx Series (3003, & Others), 5xxx Series (5005, & Others), 6xxx Series), By End-Use Industry (Automotive & Transportation, Aerospace, Railway, Shipbuilding, Building & Infrastructure, Building Facades, Doors & Windows, Packaging, Consumer Durables, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

Aluminium is the 6th most ductile and 2nd most malleable metal existing on the earth. With a density of 2.7g/cm, it is relatively light and is impervious to particles. When alloyed, it has a greater degree of conductivity and shows considerable strength. The products that are flat-rolled using hot rolling and cold rolling procedures, including coils, plates, and sheets, are considered to be aluminium rolled products. In the manufacturing, automobile, transportation, and construction industries, these goods are commonly used while in the automobile and transport category, the 6xxx grade is the most widely used. Technical advancements in aluminium manufacturing processes and processing equipment, developments and improvements in the automotive industry, and high aluminium use in various sectors such as packaging and foil and building and construction are main factors driving demand for aluminium rolled goods. The growing demand for these items in the automotive sectors, the use of flat-rolled aluminium products in the packaging industry, increasing use of flexible foil-based packaging in the food and beverage business, and the use of aluminium foils in medical packaging are stimulating the growth of the aluminium rolled products market. Usage of flat-rolled aluminium products in the automobile sector to produce and use lightweight fuel-efficient vehicles has increased solely because they have the potential to create complicated shapes on long continuous pieces and could be utilized for various construction materials that affect the demand for aluminium rolled products. In addition, the growth of the manufacturing and construction industry, R&D activities for new and affordable aluminium goods, rapid urbanization, and the increase in country’s disposable income have a positive impact on the demand for aluminium rolled goods. Besides, the growing demand for value-added and recycled aluminium products and the need for aluminium in developing markets are broadening lucrative prospects for market participants in aluminium rolled products in the forecast period.

On the other hand, the factors anticipated to hinder the growth of the market for aluminium rolled products are high capital investments and the impact of COVID-19 on end-use sectors. The growth in greenhouse gas emissions is expected to threaten the demand for Aluminium-rolled goods in the forecast period.

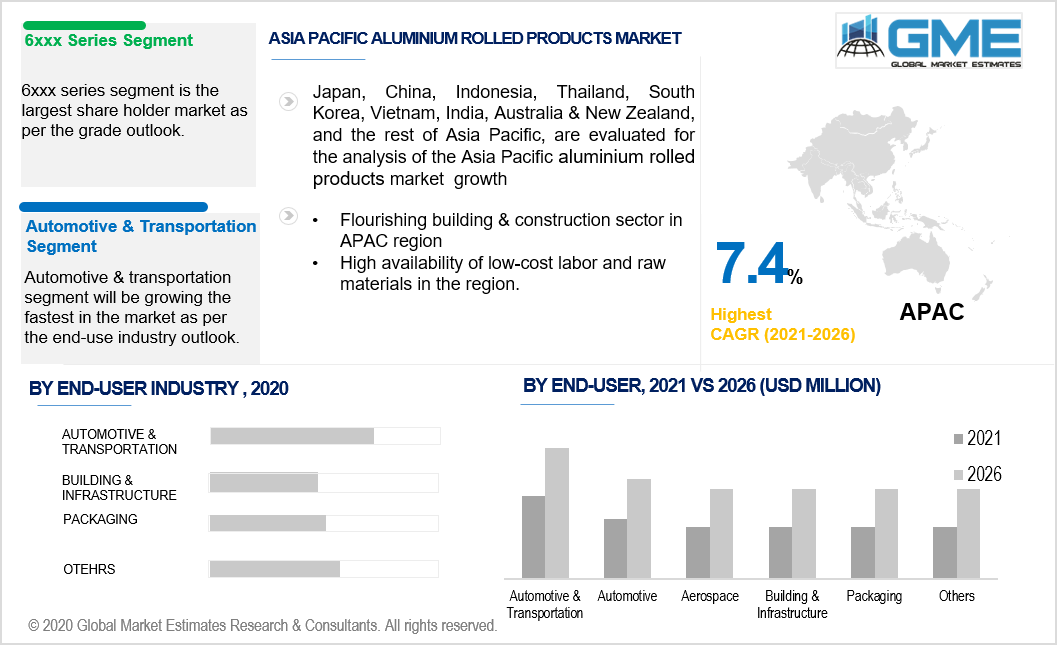

Based on grade, the Aluminium rolled products market has been categorized into 1xxx series (1050 and others), 3xxx series (3003 and others), 5xxx series (5005 and others), and 6xxx series. The largest share of this market is held by the 6xxx Series and is also projected to grow the fastest during the forecast period. During the forecast period, the 1xxx Series (1050, others) is predicted to be the second fastest growing segment. This grade of product has the greatest resistance to corrosion and shows outstanding properties for brazing, welding, and forming. An alloy of 1060 provides food container and chemical and food handling equipment applications. Their diverse applications and properties drive the demand and growth of the market.

Based on the end-use industry, the global aluminium rolled products market has been categorized into railway, automotive, doors & windows, aerospace, shipbuilding, building facades, automotive & transportation, packaging, building & infrastructure, consumer durables, and others. The automotive & transportation sector is estimated to account for the largest market share during the forecast period. Aluminium used in the automobile industry adds advantages to fuel efficiency, reduces the vehicle's weight, and decreases the emission of CO2. Most of the elements of the vehicle are made up of Aluminium-engine radiators, wheels and bumpers, and the frame as well. Besides, during the estimated period, the building and infrastructure segment is analyzed to grow the fastest. Due to its high corrosion resistance and lightness characteristics, it is used in the building and infrastructure industry in external facades, roofs and walls, windows, and doors. It is environment friendly, has low maintenance costs, is durable, and offers product and building finishes. In addition, during the forecast period, the packaging segment is estimated to be the second fastest growing segment.

The Asia Pacific is analyzed to be the fastest growing regional segment of the market in 2020. It is anticipated that the presence of major manufacturers, combined with increasing disposable income of the countries, changing lifestyle, and growth in the building & construction sector, would drive the growth of the Asia Pacific market for aluminium rolled products. The availability of low-cost labour and raw materials in the Asia Pacific region are some of the other drivers of the market. Other factors anticipated propelling the growth of the industry are the increasingly growing population and urbanization. Due to the growing need for aluminium in the automotive sector, the enforcement of strict environmental legislation related to carbon emissions from vehicles, and the need for lightweight materials in the automotive industry, North America is perceived to be the largest market. The Middle East and Africa are predicted to have a significant share in the market because of the rising construction industry in the region.

UACJ Corporation, Arconic Rolled Products Corporation, Novelis Inc., Constellium SE, Norsk, Aleris, Hindalco, Gulf Aluminium Rolling Mill, Chinalco Group, AMAG Rolling, JW Aluminium, Yieh Group, Mingtai Aluminium, RUSAL, Nanshan Aluminium, Xiashun Holdings, SNTO, KOBELCO, and Lotte are the major participants competing in the aluminium rolled products market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2020, Novelis Inc., announced the acquisition of Aleris Corporation in order to enhance its product portfolio, top build a professional and diverse workforce, and strengthen the company’s commitment to safety, efficiency, consistency, and collaboration.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aluminium Rolled Products Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Grade Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Aluminium Rolled Products Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology advancement in aluminium rolled products

3.3.1.2 Flourishing food & beverage and packaging industry in APAC region

3.3.2 Industry Challenges

3.3.2.1 Negative impact of COVID-19 on automobile industry and its manufacturing process

3.4 Prospective Growth Scenario

3.4.1 Grade Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Aluminium Rolled Products Market, By Grade

4.1 Grade Outlook

4.2 1xxx Series (1050, & Others)

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 3xxx Series (3003, & Others)

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 5xxx Series (5005, & Others)

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 6xxx Series

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Aluminium Rolled Products Market, By End-User

5.1 End-User Outlook

5.2 Automotive & Transportation

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Aerospace

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Railway

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Shipbuilding

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Building & Infrastructure

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.8 Building Facades

5.8.1 Market Size, By Region, 2016-2026 (USD Million)

5.9 Doors & Windows

5.9.1 Market Size, By Region, 2016-2026 (USD Million)

5.10 Packaging

5.10.1 Market Size, By Region, 2016-2026 (USD Million)

5.11 Consumer Durables

5.11.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Aluminium Rolled Products Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Grade, 2016-2026 (USD Million)

6.2.3 Market Size, By End-User, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Grade, 2016-2026 (USD Million)

6.3.3 Market Size, By End-User, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Grade, 2016-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Grade, 2016-2026 (USD Million)

6.4.3 Market Size, By End-User, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Grade, 2016-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Grade, 2016-2026 (USD Million)

6.5.3 Market Size, By End-User, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Grade, 2016-2026 (USD Million)

6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Grade, 2016-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Grade, 2016-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Grade, 2016-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 UACJ Corporation

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Arconic Rolled Products Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Novelis Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Constellium SE

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Norsk

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Aleris

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Hindalco

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Gulf Aluminium Rolling Mill

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Chinalco Group

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Aluminium Rolled Products Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aluminium Rolled Products Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS