Global Anthocyanin Market Size, Trends, and Analysis - Forecasts To 2026 By Source (Fruits, Vegetables, Flowers, Legumes & Cereal), By End-Use (Food & Beverage Industry, Nutraceutical Industry, Pharmaceutical Industry, Personal Care and Cosmetic Industry, Animal Feed), By Application (Viscosity Modifier, Natural Colorants, Anti-oxidants), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

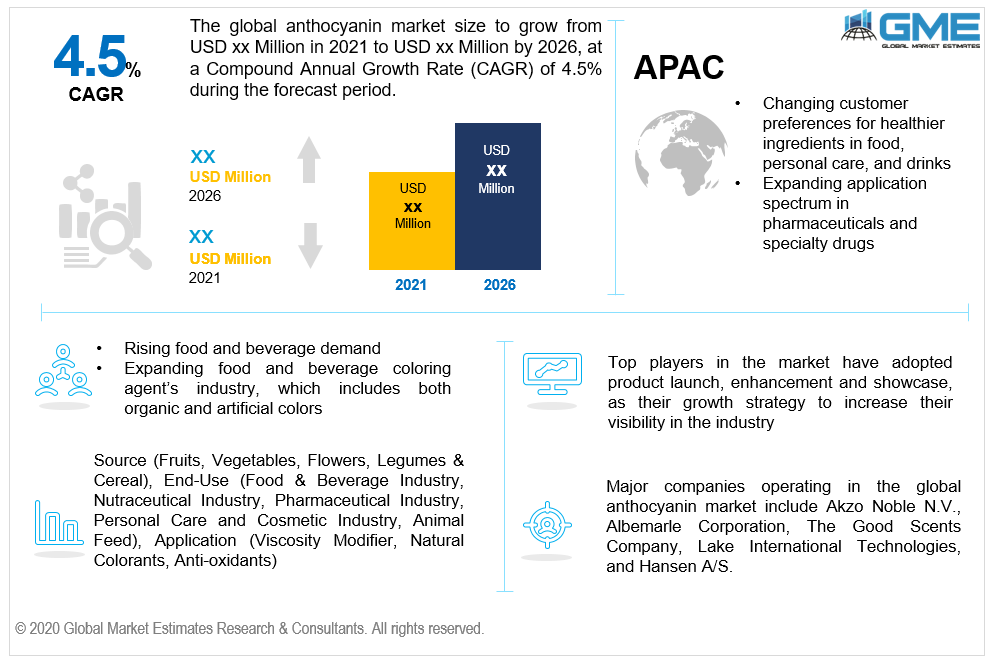

Anthocyanin is a type of flavonoid. It's a broad category of plant-based pigments that are used as a natural coloring agent in a variety of applications. There is no smell or taste to it. It comes in a variety of colors, ranging from purple to red to blue. Anthocyanin is a water-soluble dye that is commonly used as a natural colorant in the food and beverage sector. Anthocyanin has several health benefits; it functions as an antioxidant. Anthocyanin is derived from purple, red, or blue-colored vegetables and fruits. Oranges, red cabbage, eggplant, black rice, plums, mangos, blueberries, black beans, raspberries, black currant, berries, figs, beets, red-fleshed peaches, cherries, pomegranates, asparagus, kidney beans, and radishes are some of the sources which contain anthocyanin. The global anthocyanin industry is anticipated to rise significantly over the forecast period, attributable to rising food and beverage demand, particularly in the BRICS and South Asian developing countries. Over the projected timeframe, the expanding food and beverage coloring agent’s industry, which includes both organic and artificial colors, is estimated to bolster anthocyanin demand. Over the projected timeline, the industry is expected to develop due to expanding application spectrum in pharmaceuticals and specialty drugs. Anti-microbial, anti-allergic, anti-inflammatory, and microcirculation enhancement properties, as well as other health benefits, are expected to drive market development in this category over the forthcoming years.

Cancer, diabetes, cognitive impairment, and in a variety of cardiovascular disorders anthocyanin has been efficacious. Other factors anticipated to drive market development over the projected timeline include rapid urban growth and rising customer spending power, especially in developing nations like Brazil, India, and China. Another factor predicted to boost the anthocyanin market within the next five years is evolving food consumption habits combined with a rise in nutritious food demand. Fruit concentrates are expected to rise due to a shift in customer tastes for nutritious and appealing packaged food and beverage items. Several regulatory restrictions concerning the use of anthocyanins are expected to have a detrimental impact on market development in the coming years.

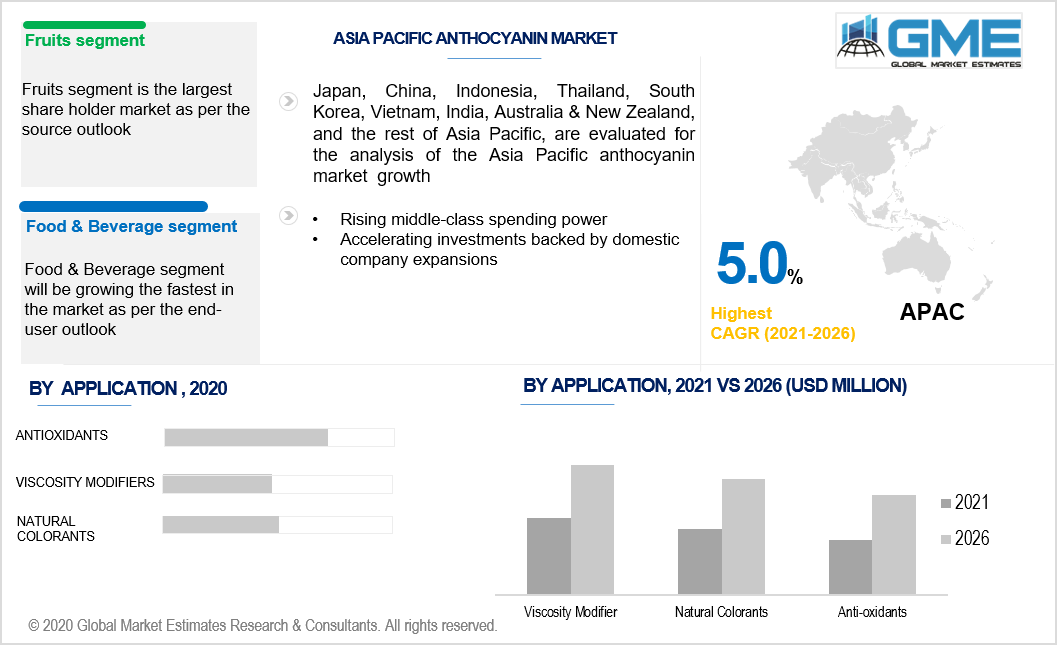

Because of the rising intake of fruits by health-freak individuals, the fruit segment is expected to dominate the source segment over the estimated timeline. Antioxidants are abundant in anthocyanin-based vegetables and fruits, which aid in the battle against free radicals. It also aids in the prevention of inflammation, viruses, and cancer. It's used to combat a variety of health issues including the common cold, high blood pressure, and urinary tract infections.

The food and beverage market will dominate the end-use industry over the projected timeframe, owing to the growing number of anthocyanin applications in a range of food and beverage items, as opposed to applications in other end-use sectors. As the demand for organic additives and colorants over artificial variants continues to accelerate, following international regulatory authorities' recognition as an efficacious and healthy ingredient, anthocyanin has achieved broad adoption in the global food and beverage sector. Because of their greater level of antioxidant activity and a broad variety of medical benefits, such as mitigating chronic disease and enhancing the look of skin, the market for anthocyanins in personal care items such as body lotion, face cream, and lipstick has increased dramatically. To keep up with the trend, several major brands are incorporating anthocyanin as the main ingredient in their body care and skincare items. Tatcha LLC, for example, sells a skincare product called "The Dewy Skin Cream" that is high in anthocyanin.

The global anthocyanin industry has been divided into viscosity modifiers, anti-oxidants, and natural colorants based on application. Antioxidants are projected to be the most popular application category over the projected timeframe, attributed to the growing popularity of consuming healthier food and beverage applications. Anthocyanin is becoming more widely used as a vital antioxidant in a variety of health and energy drinks, which is expected to drive demand growth in the near future. Natural colorants are expected to see significant market development, particularly in consumer-sensitive areas like Europe and North America. Natural colorants are used in personal health care items, as well as food and beverage blending. Because of their capacity to sustain sufficient viscosity in the food and beverages industry, viscosity modifiers are predicted to experience an above-average consumer demand within the next five years, fueling industry development.

Because of the increasing preference for naturally produced antioxidants in the area, Europe is anticipated to hold a substantial regional anthocyanin industry, and it is projected to expand significantly over the estimated timeline. Due to rising food and beverage demand in these countries, the United Kingdom and Ireland are expected to lead the European industry. Europe is closely followed by North America, which is expected to rise significantly due to the rising demand for viscosity modifiers and natural colorants. Due to rising anthocyanin demand in food applications, the United States is expected to be the region's leader. Due to changing customer preferences for healthier ingredients in food, personal care, and drinks goods, rising middle-class spending power, and accelerating investments backed by domestic company expansions, Asia Pacific is expected to expand significantly. Due to the rising food and beverage demand, India and China are expected to be the region's top contenders. Also, social media channels are projected to be widely used to expand consumer base and profit margins by raising awareness about anthocyanin's advantages and increasing demand in all industries. Due to the rising demand for healthier products in the form of capsules and drinks, South America is expected to experience significant market development. Developing markets such as Mexico, China, Brazil, and India are projected to drive future demand.

Major companies operating in the global anthocyanin market include Albemarle Corporation, Lake International Technologies, Akzo Noble N.V., The Good Scents Company, and Hansen A/S among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Anthocyanin Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Anthocyanin Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Food and Beverage Demand, Particularly in the BRICS and South Asian Developing Countries

3.3.2 Industry Challenges

3.3.2.1 Lack of Consistency in Regulations Pertaining to the use of Anthocyanin

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Anthocyanin Market, By Source

4.1 Source Outlook

4.2 Fruits

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Vegetables

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Flowers

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Legumes & Cereal

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Anthocyanin Market, By Application

5.1 Application Outlook

5.2 Viscosity Modifier

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Natural Colorants

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Anti-Oxidants

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Anthocyanin Market, By End-User

6.1 Food & Beverage Industry

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Nutraceutical Industry

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Pharmaceutical Industry

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Personal Care and Cosmetic Industry

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Animal Feed

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Anthocyanin Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Source, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By End-User, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Source, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.4.3 Market Size, By End-User, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Source, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Source, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Source, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Source, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Source, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Source, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Source, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Source, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Source, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Source, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Source, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Source, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Source, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Source, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Source, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Source, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Source, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Source, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Source, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Source, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Source, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Source, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Albemarle Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Lake International Technologies

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Akzo Noble N.V.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 The Good Scents Company

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Hansen A/S

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Other Companies

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

The Global Anthocyanin Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Anthocyanin Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS