Global Anti-Aging Products Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Skin Care and Hair Care), By Distribution Channel (Supermarkets & Hypermarkets, and Online), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Both males and females' increasing desire for multi-functional cosmetics goods such as anti-wrinkle lotions is driving the market. In addition, increased consumer purchasing power on personal grooming goods and evolving lifestyles are boosting demand for the anti-aging products market. Moreover, technical advancements in the beauty business, together with freshly developed products with various formulations and essences, have resulted in regular product releases by top businesses, fueling worldwide anti-aging market expansion even further.

The increasing consciousness of physical image among both old and young customers has fueled the market for anti-aging products and technologies. The world's population is aging, and almost every nation in the world is witnessing an increase in the number and percentage of elderly people. As a result, population aging is set to become one of the most dramatic social changes of the twenty-first century, with consequences for almost all aspects of society and, as a result, there is a need for anti-aging products. Furthermore, the high buying power of consumers from both advanced and emerging nations contributes to the market's rapid expansion. However, because of the risks associated with these treatments, customers are willing to opt for a more convenient and natural solution. As a result, the market delivers a diverse range of anti-aging goods to satisfy a variety of customer desires, with anti-wrinkle products leading the market and accounting for the bulk of the overall share.

Furthermore, skin aging triggers several skin disorders, including increased exposure to skin infections, collagen loss, increased radiation sensitivity, and a reduction in subcutaneous fat problems as compared to younger skin. Such factors necessitate the use of anti-aging cosmetics in the elderly. The growing number of seminars, events, and promotions focused on beauty and personal care products and their advantages would also help with the acceptance of anti-aging cosmetics. Furthermore, rising awareness of grooming habits and hygiene among the middle-aged and geriatric community has led to an increase in the use of anti-aging cosmetics. Customer desire for natural and organic skincare products is expected to erode the dominance of chemical-based anti-aging products. High doses of chemical content in cosmetic skincare products can greatly increase the risk of skin allergies, reducing growth opportunities for the participants in the anti-aging products market.

Increased technology advances and R&D spending on anti-aging products are continuing to move the market forward. For example, cutting-edge technologies such as the transdermal absorption system aid in enhancing dispersion and soluble efficiency, as well as the cosmetic's overall efficacy. To meet the growing need for technologically advanced cosmetics by customers, companies in the field are increasingly developing innovative anti-aging cosmetic products. Aside from that, anti-aging beauty products are commonly used by spas and skincare clinics to provide customers with an effective skincare remedy. As a result, the rise of the spa, as well as the medical tourism sector, there is a boost in the demand for numerous innovative anti-aging cosmetics.

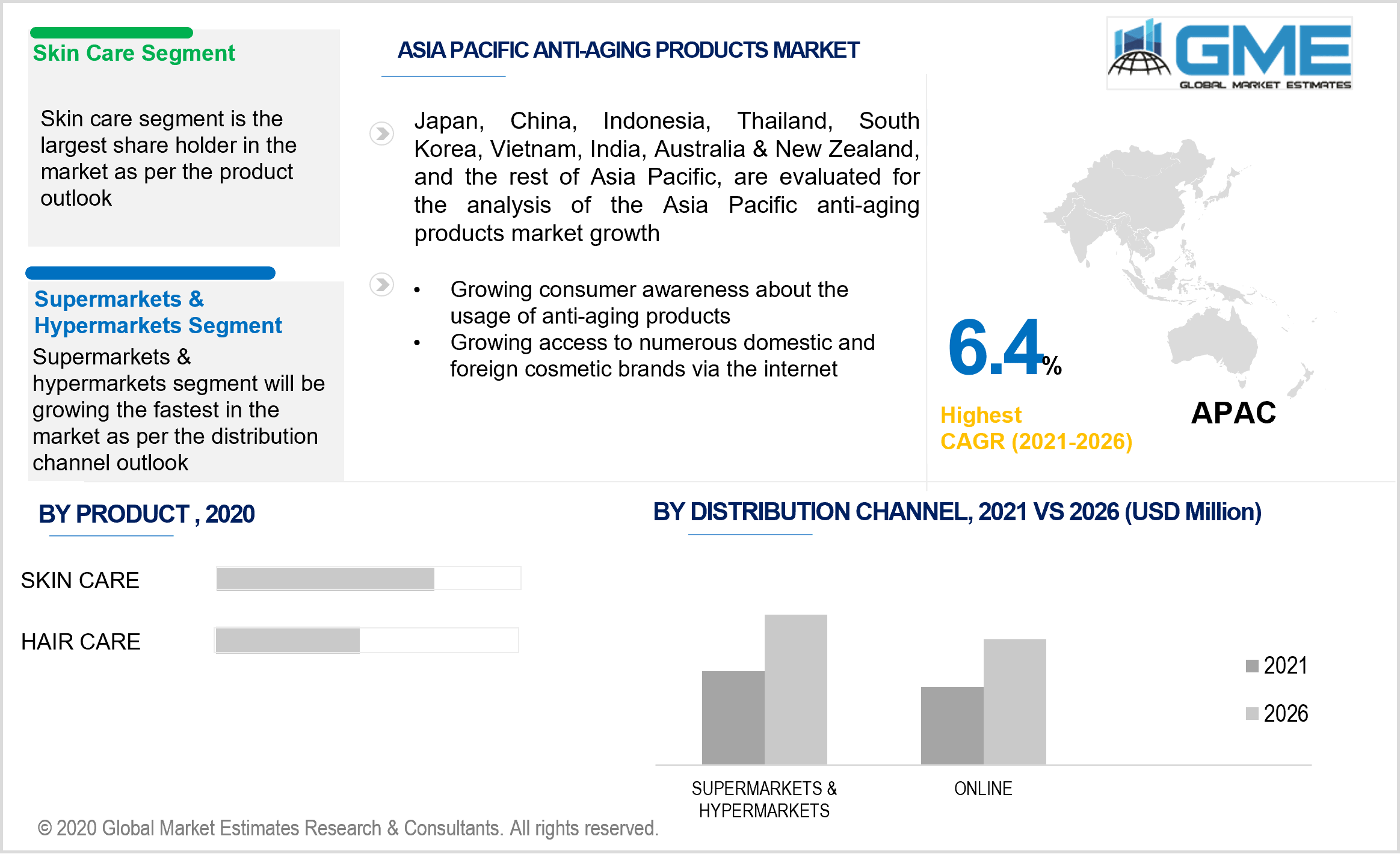

Depending on the product, the market is categorized as skin care and hair care. Skincare is foreseen to be leading in this market. Globally, companies are spending heavily on R&D to introduce innovative skin formulations. Furthermore, the rising incidence of skin conditions such as fine lines, wrinkles, and dark circles will stimulate the use of anti-aging skincare products. Since they penetrate the skin more quickly, serums and oils are becoming more popular as substitutes for creams and lotions. Another attribute that attracts consumers to this product is its non-greasy, light texture, which helps it to penetrate the skin easily. Furthermore, as customers grow more conscious of the use of chemicals in anti-aging formulations, they are opting for natural skincare formulations.

Depending on the distribution channel, the market is categorized as supermarkets & hypermarkets, and online. Supermarkets and hypermarkets accounted for the majority of global sales. Consumers tend to buy goods from supermarkets since they have a larger variety of choices and the ability to physically test the products before making an order. Additionally, these stores offer bulk buying discounts and deals, as well as the provision of annual membership, which is driving segment expansion. The value of robust advertising campaigns by leading brands and the renovated layout of hypermarkets in encouraging overall sales from these stores cannot be overstated. The organized retail sector's growth has fueled the cosmetic product demand from these channels. Moreover, enhanced exposure for established and local brands to sell their products is leading to this segment’s supremacy.

Due to the high visibility of aging signs and rising obesity in the country, North America is presumed to lead in the anti-aging product market. The market is rising as more people become conscious of aging factors and lifestyle changes. In countries like the United States and Canada, factors such as the government's rebate programs and rising disposable income are accelerating the market's growth pace. The growing demand for both men's and women's grooming products, as well as increased awareness about appearances and a quest for attractiveness, will move the market forward.

Due to the prevalence of a larger number of elderly people in the region, Asia Pacific is projected to lead in terms of CAGR. Furthermore, in countries such as Japan, China, and South Korea, the younger and middle-aged generations are gradually using cosmetics that can delay and remove symptoms of early aging, such as hair greying and the appearance of wrinkles and fine lines. As a consequence of these factors, skin and hair wellness product demand is rising. Furthermore, the rising availability of advanced cosmetics products, as well as augmented access to numerous domestic and foreign cosmetic brands via the internet, has aided in gaining more market share in the Asia Pacific region.

Estée Lauder Inc., L’Oréal, Bioderma, Procter & Gamble, Revlon, Unilever, PhotoMedex, Inc., Beiersdorf Limited, Lumenis, Clarin’s, Kiehls’s, Cellex-C International Inc., and The Boots Company PLC, among others are the leading anti-aging product manufacturers.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Anti-Aging Products Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Global Anti-Aging Products Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Geriatric Population

3.3.1.2 Rising Beauty Awareness

3.3.2 Industry Challenges

3.3.2.1 Side Effects of Chemical-Based Products

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Anti-Aging Products Market, By Product

4.1 Product Outlook

4.2 Skin Care

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Hair Care

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Anti-Aging Products Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Supermarkets & Hypermarkets

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Online

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Anti-Aging Products Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Estée Lauder Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 L’Oréal

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Bioderma

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Procter & Gamble

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Revlon

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Unilever

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 PhotoMedex, Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Beiersdorf Limited

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Lumenis

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Clarin’s

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Kiehls’s

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Cellex-C International Inc.

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 The Boots Company PLC

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Other Companies

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Anti-Aging Products Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Anti-Aging Products Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS