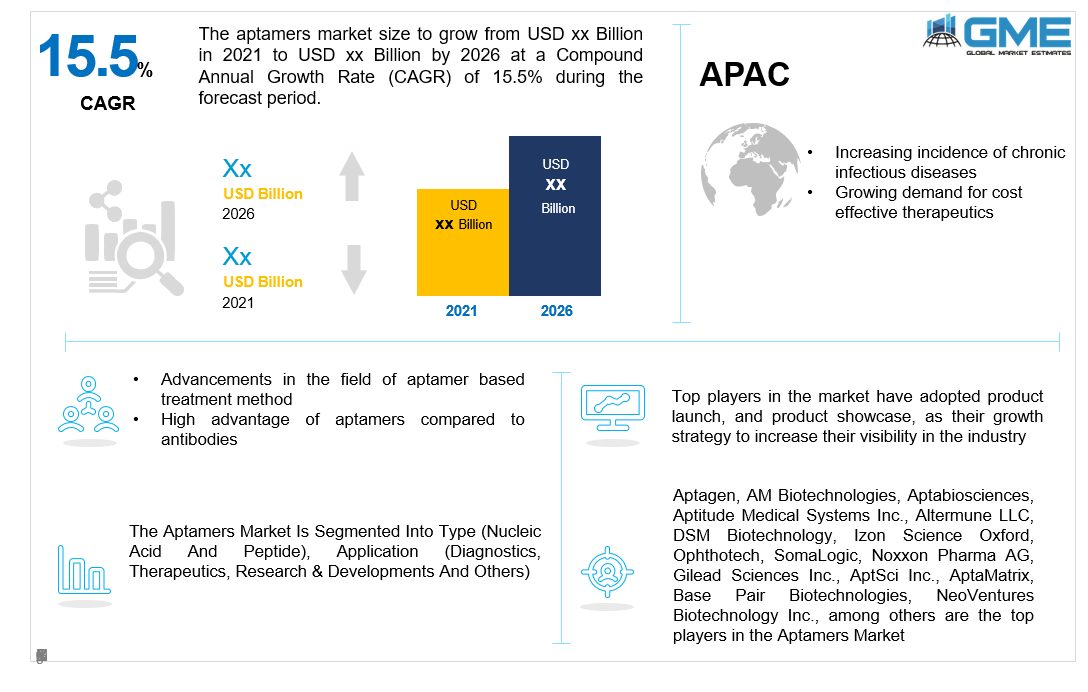

Global Aptamers Market Size, Trends & Analysis - Forecasts to 2026 By Type (Nucleic Acid and Peptide), By Application (Diagnostics, Therapeutics, Research & Developments, and Others), By Region (North America, Asia Pacific, CSA, Europe, and The Middle East and Africa); End-User, Landscape, Company Market Share Analysis, and Competitor Analysis

Aptamers are single-stranded short DNA or RNA molecules that can selectively bind to specific targets such as peptides, proteins, small molecules, carbohydrates, live cells and toxins. Due to their tendency to form helices and single-stranded loops, Aptamers can form a variety of shapes. They are flexible and block areas with high selectivity. Their binding is characterized by tertiary structure and not primary design. They are used for research and clinical purposes related to macromolecular drugs. Aptamers also have industrial and clinical applications. Aptamers have many advantages that antibodies and other substitutes due to which their market will be growing rapidly. Advantages contributing to the growth are because Aptamers offer better thermal stability, shorter production time, cost effective synthesis procedure, and ability to target a wider spectrum of molecules.

The first aptamer that was approved for medical usage in 2004 by the US Food and Drug Administration was pegaptanib sodium for macular degeneration.

Aptamers are single-stranded nucleotide that are artificially incorporated by an in vitro procedure known as the Systematic Evolution of Ligands by Exponential Enrichment (SELEX). Subsequently, aptamers are promising for identifying bacterial, and viral infections and treating these diseases. As the industrial application is concerned, aptamers are used in the food industry for quality check of the food items.

As the application of aptamers is quite common in all fields and is also used and produced by many competitors, the cost of aptamers is quite low to sustain the competition. For instance, the cost of 1mg of antibody which costs upto USD 1000 and the cost of 1 mg of biotinylated aptamer costs as low as USD 100 (depending upon the sequence), the differentiating ratio will be 1:10.

The factors driving the growth of this market are the increasing usage of aptamers in fields such as research, diagnostics, industrial, and medicine. Cost effectiveness too plays a major role in supporting the market demand for Aptamers. Increasing research activities in the pharmacy and biotechnology industries and rising government expenditure to support the research activities will support the market grow from 2021 to 2026. Furthermore, rapid rise in the infection related cases across the globe along with increasing geriatric patient population, the market will grow exponentially.

North America holds the largest share in the market owing to increasing number of research trials and activities related to Aptamers in the US, followed by the Asia Pacific region which will be growing the fastest in the market from 2021-2026. Although aptamers have proven to be highly effective yet they are still in the nascent research stage of acceptance across all the fields. Hence, this factor will hamper the growth of the market during the forecast period.

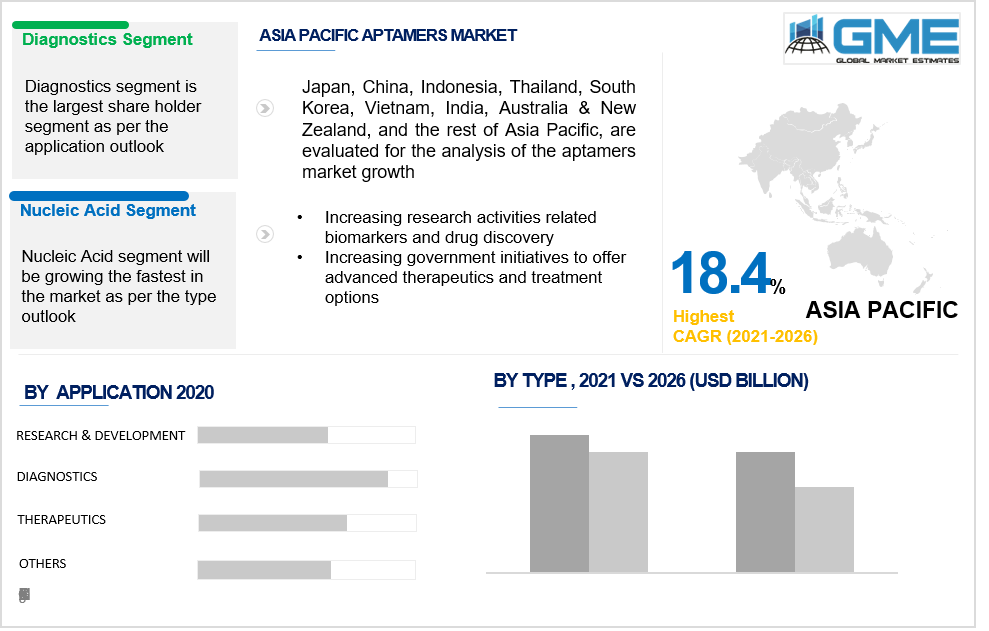

Based on type, the aptamers can be segregated into nucleic acid and peptide. The nucleic acid segment is the leading segment as it has a widespread use in applications such as cancer diagnostics, disease diagnosis, drug delivery research, and non-immunogenic research. They are used as therapeutic treatment option for cancer patients who are going through post-chemotherapy recovery stage in order to reduce the effect of the radiation on healthy cells. Nucleic acid aptamers have a higher thermodynamic and chemical stability than peptide therapies, which has enabled them to grab a considerable revenue share in the market.

Based on the application, the aptamers market can be segregated into diagnostics, therapeutics, research & developments, and others. The diagnostics segment has been analyzed to be dominant segment owing to its wide usage in the field of infectious and non-infectious disease detection. Aptamers are in high demand for molecular imaging, biomarker discovery, and other diagnostic applications, which has fuelled the growth of the segment. Furthermore, numerous research investigations have highlighted this molecule's potential for the identification of a variety of chronic disorders which are helping the market grow rapidly.

Therapeutic applications are expected to grow rapidly during the forecast period. When compared to antibody medicines, Aptamers have significant advantages over antibodies, because unlike antibody medicines, this chemically produced molecule attaches to target proteins 1,000 times stronger and with greater stability.

North America is dominating this market owing to the advanced made in the disease diagnosis field. This region has been at the forefront in conducting research and development programs in cancer research too. Also, the region has been heavily investing in the pharmaceutical, diagnostics, and clinical industries due to the increasing number of chronic diseases in the region. The Asia Pacific is the fastest-growing market owing to the rapid development in the infrastructural capability of research programs, medical institutions, hospitals, and diagnostic laboratories. Also, Asia Pacific is one of the most promising markets for aptamers as it is the manufacturing hub for the pharmaceutical and biotechnological industry. An increasing number of life-threatening infectious diseases in the region has been acting as a favorable driver to the market in the Asia Pacific region.

Aptagen, AM Biotechnologies, Aptabiosciences, Aptitude Medical Systems Inc., Altermune LLC, DSM Biotechnology, Izon Science Oxford, Ophthotech, SomaLogic, Noxxon Pharma AG, Gilead Sciences Inc., AptSci Inc., AptaMatrix, Base Pair Biotechnologies, NeoVentures Biotechnology Inc., among others are the top players in the Aptamers Market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2021, Aptamer Group the developer of Optimer reagents announced its merger with Mologic, which is a manufacturer of lateral flow and rapid diagnostic test kits. The merger was executed with an aim to manufacture testing kits for Novel Coronavirus i.e. SARS-CoV-2.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Aptamers Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Aptamers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing usage of aptamers in fields of

research, medicine, industrial and clinical diagnostics

3.3.1.2 Rising prevalence of infectious diseases

3.3.2 Industry Challenges

3.3.2.1 High-cost treatment associated with the use of Aptamers in the developing regions

3.4 Prospective Growth Scenario

3.4.1 Type

3.4.2 Application

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Aptamers Market, By Type

4.1 Type Outlook

4.2 Nucleic Acid

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Peptide

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Aptamers Market, By Application

5.1 Application Outlook

5.2 Diagnostics

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Therapeutics

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Research & Developments

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Aptamers Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Application, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Application, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Application, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Application, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Application, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Application, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Aptagen

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 AM Biotechnologies

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Aptabiosciences

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Aptitude Medical Systems Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Altermune LLC

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 DSM Biotechnology

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Izon Science Oxford

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 Ophthotech

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 SomaLogic

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Noxxon Pharma AG

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Gilead Sciences Inc.

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

7.13 AptSci Inc.

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info-Graphic Analysis

7.14 AptaMatrix

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info-Graphic Analysis

7.15 Base Pair Biotechnologies

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info-Graphic Analysis

7.16 NeoVentures Biotechnology Inc

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info-Graphic Analysis

7.17 Other Companies

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info-Graphic Analysis

The Global Aptamers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Aptamers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS