Global AR & VR in Surgery Market Size, Trends & Analysis - Forecasts to 2026 By Component (Hardware, Software, Service), By Technology (Augmented Reality [Surgery, Training & Simulation], Virtual Reality [Surgery, Training & Simulation]), By Product (Robotic, Wearable Devices, Non-Wearable Devices), By Surgery Type (Ophthalmology, Neurosurgery, Microsurgeries, Orthopedic), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

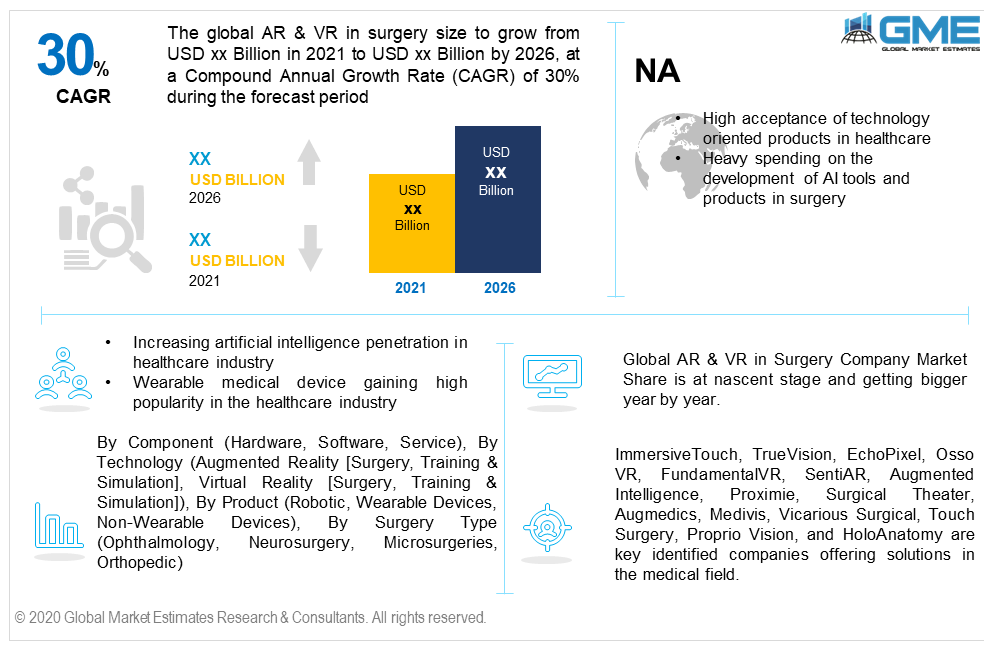

Global AR & VR in Surgery market will witness over 30% CAGR from 2021 to 2026. Increasing technological tools and product adoption in the healthcare industry for pre and during operation are key factors to fuel the market growth. Improved operation experience with better results is a major reason for the healthcare industry to adopt this technology. Ophthalmology, neurosurgery, microsurgeries, and orthopedic are major medical fields where the technology is adopted at a higher rate. Different modes are being used to implement these technologies in the form of wearable devices, non-wearable devices, and robotics. However, the limited availability of skilled practitioners and their suitability with the usage of AI tools may limit the industry scope in some countries.

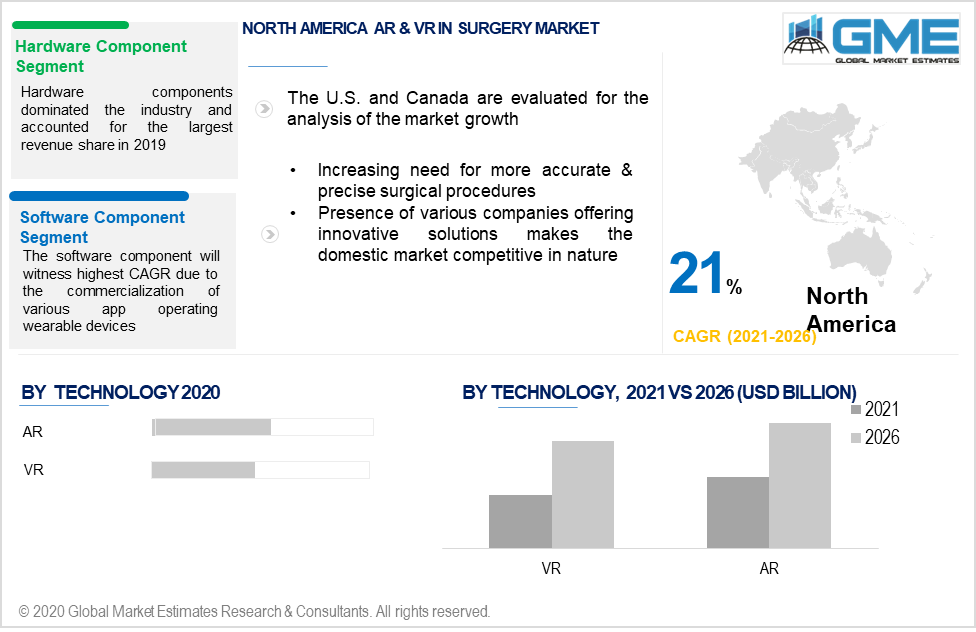

By component, the market is segmented into hardware, software, and service. Hardware components dominated the industry and accounted for the largest revenue share in 2019. Numerous solution offerings with the latest tools & technology are major contributing factors to support the adoption. The software component will witness the highest CAGR due to the commercialization of various app operating wearable devices specially made for surgical application.

The technology segment is divided into Augmented Reality and Virtual Reality. Later both the segments are sub segmented into the surgery and training & simulation. Each technology holds numerous possibilities and potential to improvise the overall surgical and training experience. The industry is gaining high attention from institutes and centres for training and simulation purposes. Through this process, the students and trainees get hands-on experience. The training & simulation segment is projected to witness over 25% of the growth up to 2026.

The products are categorized into robotic, wearable devices, and non-wearable devices. Robotic operations with the help of virtual reality tools are witnessing high adoption in recent years. Increasing healthcare practitioners' confidence in the artificial intelligence tools along with regular upgradation to improve the operation outcome are key influencing factors to drive demand.

Wearable devices usually include helmets and glasses. The segment is expected to dominate the product segment in the coming years. The increasing availability of diversified wearable devices specifically designed for surgical applications along with rising doctor's confidence over the usage of these devices will proliferate the demand in this segment.

Ophthalmology, Neurosurgery, Microsurgery, and Orthopedic are the major medical fields where there is high adoption of augmented reality & virtual reality during or before the operation. High precision rate along with more accurate operations are the major causes to implement these technological tools in the operation.

Ophthalmology is among the major fields to adopt this technology and is expected to witness over 21% of the growth rate up to 2026. Ease in processing, lesser risk, and effective results are key advantages offered by the industry in ophthalmology operations. The other lucrative medical field is orthopedics. The segment is gaining high popularity in recent years and is expected to account for more than 25% of the share by 2026.

North America AR & VR in Surgery Market dominated the regional share and held for over 35% of the market share in 2019. The high adoption rate of technology oriented surgeries along with the presence of numerous augmented reality & virtual reality platforms for simulation and training are key success factors to drive regional growth. Support from the FDA to commercialize the usage of AI products in the surgical process will support the future development of the market.

Asia Pacific AR & VR in Surgery Market will witness over 25% CAGR during the forecast period. Increasing technological advancement in the healthcare industry along with heavy investment by medical science to adopt the latest tools during surgery will induce regional industry growth. China, India, South Korea, Japan, and Singapore will be the key contributing countries in the region. The APAC healthcare industry is high technology focused and rigorously works on new platforms. However, a lack of standardization and support to get international approval and certifications limits the industry scope in the international market.

European market is encouraged by the technology development and innovation to upgrade surgical experience. Precise operation and monitoring along with better training and simulation to the doctors, nurses, and medical students are key reasons to stimulate regional demand.

Global Company Market Share is at nascent stage and getting bigger year by year. Availability of very few authorized and certified products and technologies in the medical field makes the industry more concentrated in nature. However, there is a high scope of new market entrants with advanced technological solutions in the near future. Strategic partnerships along with collaboration with healthcare providers and medical institutes are among the key strategies witnessed in the industry.

ImmersiveTouch, TrueVision, EchoPixel, Osso VR, FundamentalVR, SentiAR, Augmented Intelligence, Proximie, Surgical Theater, Augmedics, Medivis, Vicarious Surgical, Touch Surgery, Proprio Vision, and HoloAnatomy are key identified companies offering solutions in the medical field.

Please note: This is not an exhaustive list of companies profiled in the report.

The global industry holds a promising future for the existing as well as new market entrants due to digitalization in the healthcare industry along with the increasing trust of patients and doctors in artificial intelligence and its tools.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 AR & VR in surgery industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Component overview

2.1.3 Technology overview

2.1.4 Product overview

2.1.5 Surgery type overview

2.1.6 Regional overview

Chapter 3 AR & VR in Surgery Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Production overview

3.10.1 Formulation

3.10.2 End-Use

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 AR & VR in Surgery Market, By Component

4.1 Component Outlook

4.2 Hardware

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Software

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Surgery

4.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 AR & VR in Surgery Market, By Technology

5.1 Technology Outlook

5.2 Augmented Reality

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.2 Surgery

5.2.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.3 Training & Simulation

5.2.3.1 Market size, by region, 2019-2026 (USD Million)

5.5 Virtual Reality

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.5.2 Surgery

5.5.2.1 Market size, by region, 2019-2026 (USD Million)

5.5.3 Training & Simulation

5.5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 AR & VR in Surgery Market, By Product

6.1 Product Outlook

6.2 Robotic

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Wearable devices

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Non-wearable devices

6.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 AR & VR in Surgery Market, By Surgery Type

7.1 Surgery Type Outlook

7.2 Ophthalmology

7.2.1 Market size, by region, 2019-2026 (USD Million)

7.3 Neurosurgery

7.3.1 Market size, by region, 2019-2026 (USD Million)

7.4 Microsurgery

7.4.1 Market size, by region, 2019-2026 (USD Million)

7.5 Orthopedic

7.5.1 Market size, by region, 2019-2026 (USD Million)

7.6 Others

7.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 8 AR in Construction Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market size, by country 2019-2026 (USD Million)

8.2.2 Market size, by component, 2019-2026 (USD Million)

8.2.3 Market size, by technology, 2019-2026 (USD Million)

8.2.4 Market size, by product, 2019-2026 (USD Million)

8.2.5 Market size, by surgery type, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market size, by component, 2019-2026 (USD Million)

8.2.6.2 Market size, by technology, 2019-2026 (USD Million)

8.2.6.3 Market size, by product, 2019-2026 (USD Million)

8.2.6.4 Market size, by surgery type, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market size, by component, 2019-2026 (USD Million)

8.2.7.2 Market size, by technology, 2019-2026 (USD Million)

8.2.7.3 Market size, by product, 2019-2026 (USD Million)

8.2.7.4 Market size, by surgery type, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market size, by country 2019-2026 (USD Million)

8.3.2 Market size, by component, 2019-2026 (USD Million)

8.3.3 Market size, by technology, 2019-2026 (USD Million)

8.3.4 Market size, by product, 2019-2026 (USD Million)

8.3.5 Market size, by surgery type, 2019-2026 (USD Million)

8.3.6 Germany

8.2.6.1 Market size, by component, 2019-2026 (USD Million)

8.2.6.2 Market size, by technology, 2019-2026 (USD Million)

8.2.6.3 Market size, by product, 2019-2026 (USD Million)

8.2.6.4 Market size, by surgery type, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market size, by component, 2019-2026 (USD Million)

8.3.7.2 Market size, by technology, 2019-2026 (USD Million)

8.3.7.3 Market size, by product, 2019-2026 (USD Million)

8.3.7.4 Market size, by surgery type, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market size, by component, 2019-2026 (USD Million)

8.3.8.2 Market size, by technology, 2019-2026 (USD Million)

8.3.8.3 Market size, by product, 2019-2026 (USD Million)

8.3.8.4 Market size, by surgery type, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market size, by component, 2019-2026 (USD Million)

8.3.9.2 Market size, by technology, 2019-2026 (USD Million)

8.3.9.3 Market size, by product, 2019-2026 (USD Million)

8.3.9.4 Market size, by surgery type, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market size, by component, 2019-2026 (USD Million)

8.3.10.2 Market size, by technology, 2019-2026 (USD Million)

8.3.10.3 Market size, by product, 2019-2026 (USD Million)

8.3.10.4 Market size, by surgery type, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market size, by country 2019-2026 (USD Million)

8.4.2 Market size, by component, 2019-2026 (USD Million)

8.4.3 Market size, by technology, 2019-2026 (USD Million)

8.4.4 Market size, by product, 2019-2026 (USD Million)

8.4.5 Market size, by surgery type, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market size, by component, 2019-2026 (USD Million)

8.4.6.2 Market size, by technology, 2019-2026 (USD Million)

8.4.6.3 Market size, by product, 2019-2026 (USD Million)

8.4.6.4 Market size, by surgery type, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market size, by component, 2019-2026 (USD Million)

8.4.7.2 Market size, by technology, 2019-2026 (USD Million)

8.4.7.3 Market size, by product, 2019-2026 (USD Million)

8.4.7.4 Market size, by surgery type, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market size, by component, 2019-2026 (USD Million)

8.4.8.2 Market size, by technology, 2019-2026 (USD Million)

8.4.8.3 Market size, by product, 2019-2026 (USD Million)

8.4.8.4 Market size, by surgery type, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market size, by component, 2019-2026 (USD Million)

8.4.9.2 Market size, by technology, 2019-2026 (USD Million)

8.4.9.3 Market size, by product, 2019-2026 (USD Million)

8.4.9.4 Market size, by surgery type, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market size, by component, 2019-2026 (USD Million)

8.4.10.2 Market size, by technology, 2019-2026 (USD Million)

8.4.10.3 Market size, by product, 2019-2026 (USD Million)

8.4.10.4 Market size, by surgery type, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market size, by country 2019-2026 (USD Million)

8.5.2 Market size, by component, 2019-2026 (USD Million)

8.5.3 Market size, by technology, 2019-2026 (USD Million)

8.5.4 Market size, by product, 2019-2026 (USD Million)

8.5.5 Market size, by surgery type, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market size, by component, 2019-2026 (USD Million)

8.5.6.2 Market size, by technology, 2019-2026 (USD Million)

8.5.6.3 Market size, by product, 2019-2026 (USD Million)

8.5.6.4 Market size, by surgery type, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market size, by component, 2019-2026 (USD Million)

8.5.7.2 Market size, by technology, 2019-2026 (USD Million)

8.5.7.3 Market size, by product, 2019-2026 (USD Million)

8.5.7.4 Market size, by surgery type, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market size, by country 2019-2026 (USD Million)

8.6.2 Market size, by component, 2019-2026 (USD Million)

8.6.3 Market size, by technology, 2019-2026 (USD Million)

8.6.4 Market size, by product, 2019-2026 (USD Million)

8.6.5 Market size, by surgery type, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market size, by component, 2019-2026 (USD Million)

8.6.6.2 Market size, by technology, 2019-2026 (USD Million)

8.6.6.3 Market size, by product, 2019-2026 (USD Million)

8.6.6.4 Market size, by surgery type, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market size, by component, 2019-2026 (USD Million)

8.6.7.2 Market size, by technology, 2019-2026 (USD Million)

8.6.7.3 Market size, by product, 2019-2026 (USD Million)

8.6.7.4 Market size, by surgery type, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive analysis, 2020

9.2 ImmersiveTouch

9.2.1 Company overview

9.2.2 Financial analysis

9.2.3 Strategic positioning

9.2.4 Info graphic analysis

9.3 TrueVision

9.3.1 Company overview

9.3.2 Financial analysis

9.3.3 Strategic positioning

9.3.4 Info graphic analysis

9.4 EchoPixel

9.4.1 Company overview

9.4.2 Financial analysis

9.4.3 Strategic positioning

9.4.4 Info graphic analysis

9.5 Osso VR

9.5.1 Company overview

9.5.2 Financial analysis

9.5.3 Strategic positioning

9.5.4 Info graphic analysis

9.6 FundamentalVR

9.6.1 Company overview

9.6.2 Financial analysis

9.6.3 Strategic positioning

9.6.4 Info graphic analysis

9.7 SentiAR

9.7.1 Company overview

9.7.2 Financial analysis

9.7.3 Strategic positioning

9.7.4 Info graphic analysis

9.8 Augmented Intelligence

9.8.1 Company overview

9.8.2 Financial analysis

9.8.3 Strategic positioning

9.8.4 Info graphic analysis

9.9 Proximie

9.9.1 Company overview

9.9.2 Financial analysis

9.9.3 Strategic positioning

9.9.4 Info graphic analysis

9.10 Surgical Theater

9.10.1 Company overview

9.10.2 Financial analysis

9.10.3 Strategic positioning

9.10.4 Info graphic analysis

9.11 Augmedics

9.11.1 Company overview

9.11.2 Financial analysis

9.11.3 Strategic positioning

9.11.4 Info graphic analysis

9.12 Medivis

9.12.1 Company overview

9.12.2 Financial analysis

9.12.3 Strategic positioning

9.12.4 Info graphic analysis

9.13 Vicarious Surgical

9.13.1 Company overview

9.13.2 Financial analysis

9.13.3 Strategic positioning

9.13.4 Info graphic analysis

9.14 Touch Surgery

9.14.1 Company overview

9.14.2 Financial analysis

9.14.3 Strategic positioning

9.14.4 Info graphic analysis

9.15 Proprio Vision

9.15.1 Company overview

9.15.2 Financial analysis

9.15.3 Strategic positioning

9.15.4 Info graphic analysis

9.16 HoloAnatomy

9.16.1 Company overview

9.16.2 Financial analysis

9.16.3 Strategic positioning

9.16.4 Info graphic analysis

9.17 Orca Health

9.17.1 Company overview

9.17.2 Financial analysis

9.17.3 Strategic positioning

9.17.4 Info graphic analysis

The Global AR & VR in Surgery Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the AR & VR in Surgery Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS