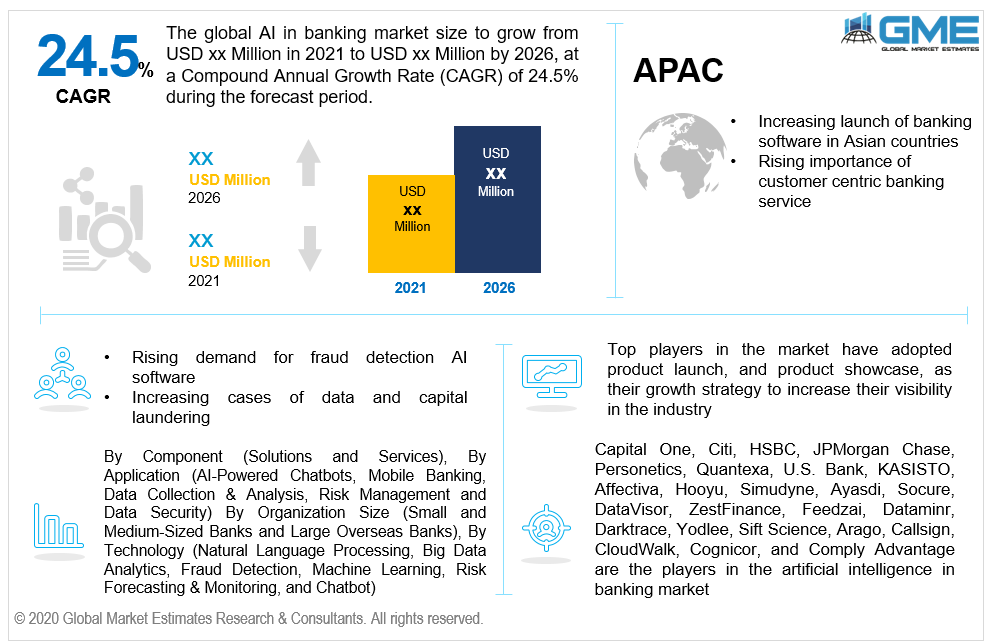

Global Artificial Intelligence in Banking Market Size, Trends & Analysis - Forecasts to 2026 By Component (Solutions and Services), By Application (AI-Powered Chatbots, Mobile Banking, Data Collection & Analysis, Risk Management and Data Security) By Organization Size (Small and Medium-Sized Banks and Large Overseas Banks), By Technology (Natural Language Processing, Big Data Analytics, Fraud Detection, Machine Learning, Risk Forecasting & Monitoring, and Chatbot), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global artificial intelligence in banking market is projected to grow at a CAGR value of 24.5% during the forecast period of 2021 to 2026. Artificial intelligence has successfully marked its importance in all the verticals and has also helped enhance the banking industry. Customer-centric banking service is the key goal of all the banks across the globe and the augment of artificial intelligence will help to accelerate the aim and help the sector grow rapidly. As per the reports of OpenText Survey, around 80% of the banks across the globe are well versed with the potential advantages offered by AI, and how it can help accelerate customer-banking experience and revenue growth. Considering these opportunities, various banks across developed and developing regions have taken initiatives to deploy AI in their core banking services. Services such as AI in the front office (conversational banking and chatbot), back-office (credit underwriting), and middle office refers to anti-fraud assessment and analysis. Out of these applications, the use of AI in chatbots and anti-fraud assessment has gained popularity since the integration of the two industries. With the help of AI in banking, the customers and the bank owners both can enjoy cost-saving opportunities.

Hence with the launch of advanced technologies such as AI-based core banking software for retail and commercial banks, also with increasing demand for hassle-free online and mobile banking services, and the increasing trend of offering customer-centric services will drive the market from 2021 to 2026. Moreover, rising online fraud cases, increasing data theft in the banking industry, and the rising need for data security are helping the market gain popularity.

Based on the component, the market is segmented into solutions and services. The services segment will be the fastest growing segment owing to an increasing number of software installations across large-sized and small and mid-sized banks, and increasing demand for AI-based services in developing countries. Another major reason for this segment to grow rapidly is the increasing launch of Fintech start-up firms with competitive services offerings in the field of banking and finance.

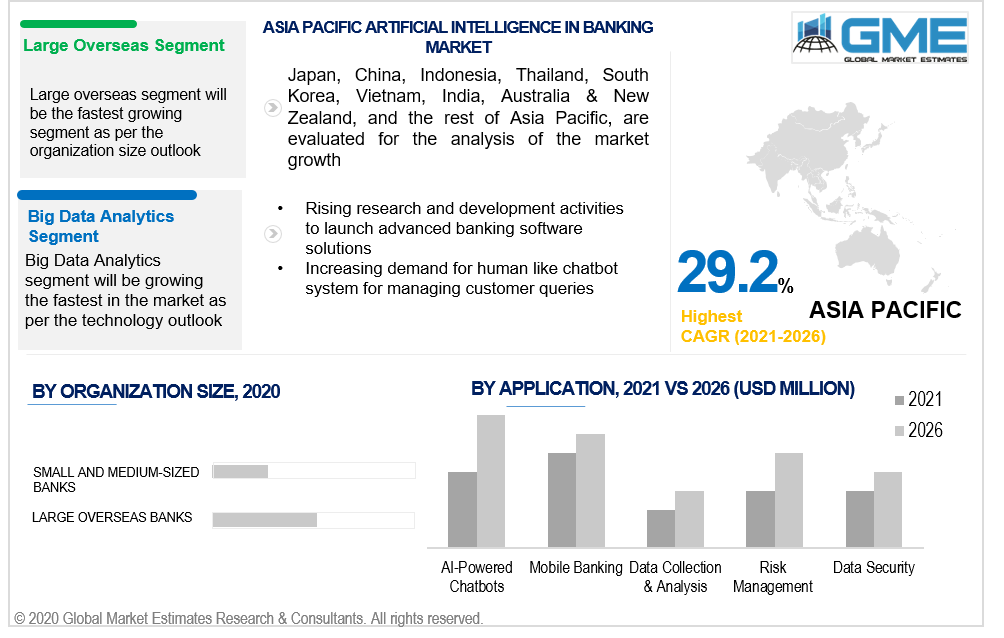

Small and medium-sized banks and large overseas banks are the segmentation based on the size of the organization in the artificial intelligence in banking market. The large overseas banks' segment will be the largest one in terms of revenue sales and market share. This is mainly attributed to increasing awareness regarding the benefits and advantages of artificial intelligence in banking services, rising threats to data and capital security, increasing online fraud cases, and rising demand for big data analytics. Also, with an increasing number of saving and current accounts, overseas banks have deployed artificial intelligence for managing mobile banking, credit card tracking, payment management, complaint track management, chatbot service, and loan operation management.

Based on the applications of AI in the banking sector, the market can be split into AI-powered chatbots, mobile banking, data collection & analysis, risk management, and data security. The chatbot application segment is analyzed to be growing the fastest from 2021 to 2026. Global banks are enjoying the advantages of AI on the front end to enhance customer identification and authentication, mimic live real human-like employees through chatbots and voice assistants. Certain AI use cases have already gained prominence across banks' operations, with chatbots in the front office and anti-payments fraud in the middle office.

The top AI technologies used in the banking sector are natural language processing, big data analytics, fraud detection, machine learning, risk forecasting & monitoring, and chatbot. The fraud detection segment will be the fastest growing segment in the market from 2021 to 2026. Major Banks across the globe have implemented AI within their middle-office operations to prevent data theft and online payment fraud. AI is also used to improve processes for anti-money laundering (AML) and know-your-customer (KYC) regulatory checks and hence holds a significant position in the market.

As per the geographical analysis, the artificial intelligence in the banking market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). North America (the United States, Canada, and Mexico) will be the market segment with a lion’s share. The dominant position is attributed to the rising adoption of AI in Fintech solutions for banks and other financial sectors, strong economic growth, high spending power in solutions and services to render customer-friendly service, strong presence of top AI-based companies, and rising investment and support by government entities for the development of AI in the banking sector. However, the Asia Pacific segment will be the fastest growing segment in the market from 2021 to 2026. This is mainly due to increasing awareness about Fintech solutions for back-office operations, front office management, and middle office assessment. Also with the increasing number of banks and overseas branches, and the rising number of saving account holders in developing regions, the market for APAC is ought to be growing rapidly.

Capital One, Citi, HSBC, JPMorgan Chase, Personetics, Quantexa, U.S. Bank, KASISTO, Affectiva, Hooyu, Simudyne, Ayasdi, Socure, DataVisor, ZestFinance, Feedzai, Dataminr, Darktrace, Yodlee, Sift Science, Arago, Callsign, CloudWalk, Cognicor, and Comply Advantage among others are the key players in the artificial intelligence in the banking market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Artificial Intelligence in Banking Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Organization Size Overview

2.1.3 Component Overview

2.1.4 Application Overview

2.1.5 Technology Overview

2.1.6 Regional Overview

Chapter 3 Artificial Intelligence in Banking Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the Fintech Software Products for Banking Sector

3.3.1.2 Rising Cases of Online Money Laundering and Data Theft

3.3.2 Industry Challenges

3.3.2.1 Lack of Awareness Regarding Application of AI in Front Office, Middle Office and Back Office Operations

3.4 Prospective Growth Scenario

3.4.1 Organization Size Growth Scenario

3.4.2 Component Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Artificial Intelligence in Banking Market, By Organization Size

4.1 Organization Size Outlook

4.2 Small and Medium-Sized Banks

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Large Overseas Banks

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Artificial Intelligence in Banking Market, By Application

5.1 Application Outlook

5.2 AI-Powered Chatbots

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Mobile Banking

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Data Collection & Analysis

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Risk Management

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Data Security

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Artificial Intelligence in Banking Market, By Component

6.1 Solutions

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Services

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Artificial Intelligence in Banking Market, By Technology

7.1 Natural Language Processing

7.1.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Big Data Analytics

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Fraud Detection

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Machine Learning

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

7.5 Risk Forecasting & Monitoring

7.5.1 Market Size, By Region, 2019-2026 (USD Million)

7.6 Chatbot

7.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Artificial Intelligence in Banking Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Organization Size, 2019-2026 (USD Million)

8.2.3 Market Size, By Component, 2019-2026 (USD Million)

8.2.4 Market Size, By Application, 2019-2026 (USD Million)

8.2.5 Market Size, By Technology, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.2.4.2 Market Size, By Component, 2019-2026 (USD Million)

8.2.4.3 Market Size, By Application, 2019-2026 (USD Million)

Market Size, By Technology, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Component, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.3 Market Size, By Component, 2019-2026 (USD Million)

8.3.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.5 Market Size, By Technology, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Component, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Component, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Component, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Component, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Component, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Component, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.3 Market Size, By Component, 2019-2026 (USD Million)

8.4.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.5 Market Size, By Technology, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Component, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Component, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Component, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.9.2 Market size, By Component, 2019-2026 (USD Million)

8.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.9.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Component, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.3 Market Size, By Component, 2019-2026 (USD Million)

8.5.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.5 Market Size, By Technology, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Component, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Component, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Component, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.3 Market Size, By Component, 2019-2026 (USD Million)

8.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.5 Market Size, By Technology, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Component, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Component, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Component, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Technology, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Capital One

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Citi

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 HSBC

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 JPMorgan Chase

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Personetics

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Quantexa

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 U.S. Bank

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 KASISTO

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Affectiva

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Artificial Intelligence in Banking Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Artificial Intelligence in Banking Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS