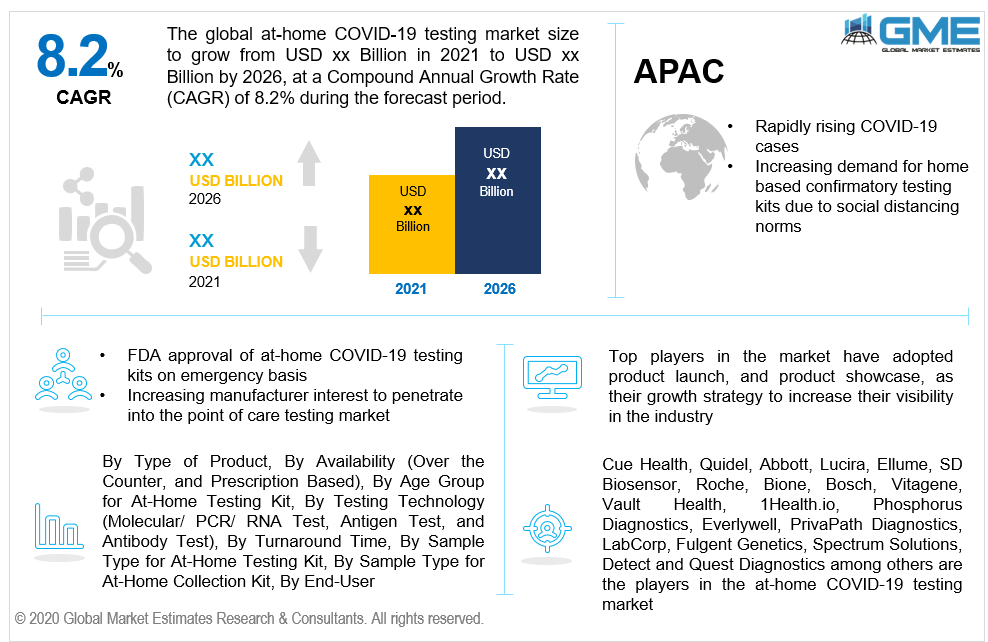

Global At-Home COVID-19 Testing Market Size, Trends & Analysis - Forecasts to 2026 By Type of Product (At-Home Testing Kit and At-Home Collection Kit), By Availability (Over the Counter, and Prescription Based), By Age Group for At-Home Testing Kit (Age 2 & Above, Age 8 & Above, and Age 14 & Above), By Testing Technology (Molecular/ PCR/ RNA Test, Antigen Test, and Antibody Test), By Turnaround Time (10 Minutes TAT, 15 Minutes TAT, and 30 Minutes TAT), By Sample Type for At-Home Testing Kit (Nasopharyngeal & Throat Swab, and Blood Test), By Sample Type for At-Home Collection Kit (Nasal or Cheek Swab Test, and Saliva Test) By End-User (Home Use, and Commercial Use), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

COVID-19 infection spread has affected many lives and is continuing to affect the major part of the population across both developed and developing regions. As per the latest data by WHO, as of 24th March 2021, there are around 393,531 COVID-19 active new cases and around 123,419,065 confirmed cases. The rising need for pre-infection diagnosis has surged many healthcare organizations to develop a rapid test since the augment of the pandemic.

Amid the COVID-19 pandemic, most of the point of care manufacturers were keen and engrossed in the research and development of offering rapid, highly portable, and compact home-based COVID-19 confirmatory tests. Some of which are Cue Health, Quidel, Abbott, Lucira, Ellume, SD Biosensor, Roche, Bione, and Bosch. Since March 2020, these top companies have been receiving emergency FDA approval for home care use to overcome the lack of testing facilities in the U.S. Hence, the FDA agency has authorized 5-7 kits/ devices for emergency use since the initial days of the pandemic. These kits are simple to use without any intervention of any healthcare worker, where the patient has to self-administer his COVID-19 test using a nasal swab or in some cases blood samples. With a feature of quick result delivery, this market is ought to be a boom for home-based testing of chronic diseases and infection. These kits provide results in less than 30 minutes and are fit for patients ranging from the age group of 2 and above. The result format of these kits shows a positive or negative test which is as accurate as the laboratory-based test. Hence, the rapidly rising COVID-19 cases, increasing pressure on social distancing at public places, increasing demand for the home-based minimally invasive confirmatory test, and rising need for cost curbing for the pre-infection diagnosis will help the market growth positively.

However, the market does have some form of restraint which can act as a hindrance for its adoption from 2021 to 2026. These tests have chances to show false negatives or false positives results if the tests are antigen technology-based. This has also been brought to the public notice by the FDA in the form of a warning. The FDA had stated that patients whose nasal swab test on the point of care kit comes out to be negative and still experience COVID-like symptoms are strictly told to follow-up with an authorized lab for a retest. Hence, such challenges may hamper the growth rate of the product in the market.

Based on the type of rapid test product available, the market is segmented into the at-home testing kit and at-home collection kit. The market for at-home testing kits will be growing faster than the collection kit owing to advantages such as low turnaround time for results, minimally invasive, and self-monitoring feature. The rising COVID-19 cases have left the common masses to opt for the screening test and not wait for the symptoms to augment. Hence, the pre-COVID-19 infection screening trend will help the at-home testing kit segment will gain more popularity than the collection kit from 2021 to 2026 in terms of growth rate.

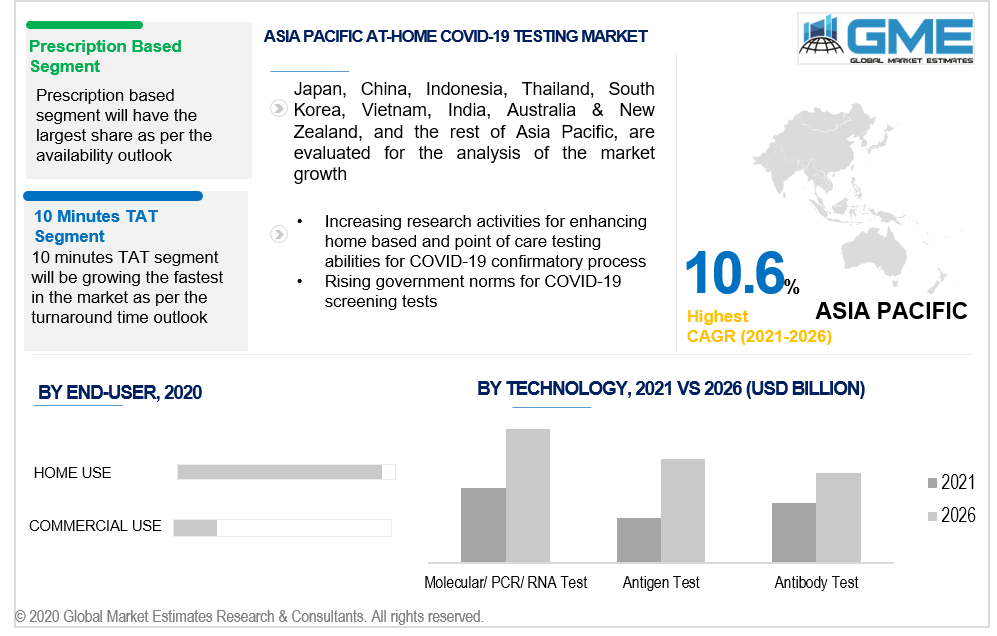

Based on the type of availability of these in-house testing kits, the market can be segregated into counter, and prescription-based. Most of the commercialized products available in the market are designed for prescription-based purchase. Hence, the market for this segment is ought to be the largest in terms of market value or revenue sales from 2021 to 2026.

Based on the type of patient's age group, the market for the at-home testing kit segment is divided into age 2 & above, age 8 & above, and age 14 & above. Most of the commercialized products available in the market are designed for age 2 & above patients. Hence, testing opportunities for a wide range of age groups will help the age 2 & above segment be the largest in terms of revenue sales from 2021 to 2026.

Based on the technology used for offering home-based rapid COVID-19 test are molecular/ PCR/ RNA test, antigen test, and antibody test. The high accuracy technology for detection confirmatory presence of COVID-19 infection is the molecular/ PCR/ RNA test which will gain more traction than other tests owing to issues related to false-positive or false-negative test results.

Based on the result generation time, the market is studied in three forms namely, 10 minutes TAT, 15 minutes TAT, and 30 minutes TAT. The 10 minutes TAT segment will grow the fastest owing to its low time consumption for offering test results. However, the market is dominant with the 15 minutes TAT segment as of 2021.

Based on the sample type collected for the in-house home testing kit, the market is segmented into nasopharyngeal & throat swabs, and blood tests. The confirmatory presence of COVID-19 infection is determined through the nasopharyngeal & throat swab sample, unlike the blood test which provides the presence of antibodies generated against the infection. Hence, this segment is ought to be the largest segment in the market.

Based on the sample type collected for the in-house home collecting kit, the market is segregated into nasal or cheek swab tests, and saliva tests. As the saliva test is a non-invasive way to give a sample and also as it has a high rating for giving accurate results, the market for saliva test will be the largest for at-home sample collection kits.

Based on potential users of these portable, compact, and point of care rapid testing kits, the market is segmented into home use and commercial use. The home-use segment is definitely on the rise for achieving the top market position in terms of end-users.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). FDA approval for the home-based testing kits is as of now limited to only developed nations such as Australia, the US, Europe, and others. Hence, the market for home-based COVID-19 testing kits will be the largest for North America. Owing to the rapid and uncontrollable rise in COVID-19 cases in Asian countries, the market for APAC will be growing the fastest from 2021 to 2026.

Cue Health, Quidel, Abbott, Lucira, Ellume, SD Biosensor, Roche, Bione, Bosch, Vitagene, Vault Health, 1Health.io, Phosphorus Diagnostics, Everlywell, PrivaPath Diagnostics, LabCorp, Fulgent Genetics, Spectrum Solutions, Detect, and Quest Diagnostics among others are the players in the at-home COVID-19 testing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2020, FDA authorized Lucira’s at-home COVID-19 testing kit for home-based use on an emergency ground.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global At-Home COVID-19 Testing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the At-Home COVID-19 Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS