Global Automotive Films Market Size, Trends & Analysis - Forecasts to 2029 By Type (Automotive Window Films, Automotive Wrap Films, and Paint Protection Films), By Application (Interior and Exterior), By Vehicle Type (Passenger Vehicles and Commercial Vehicles), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

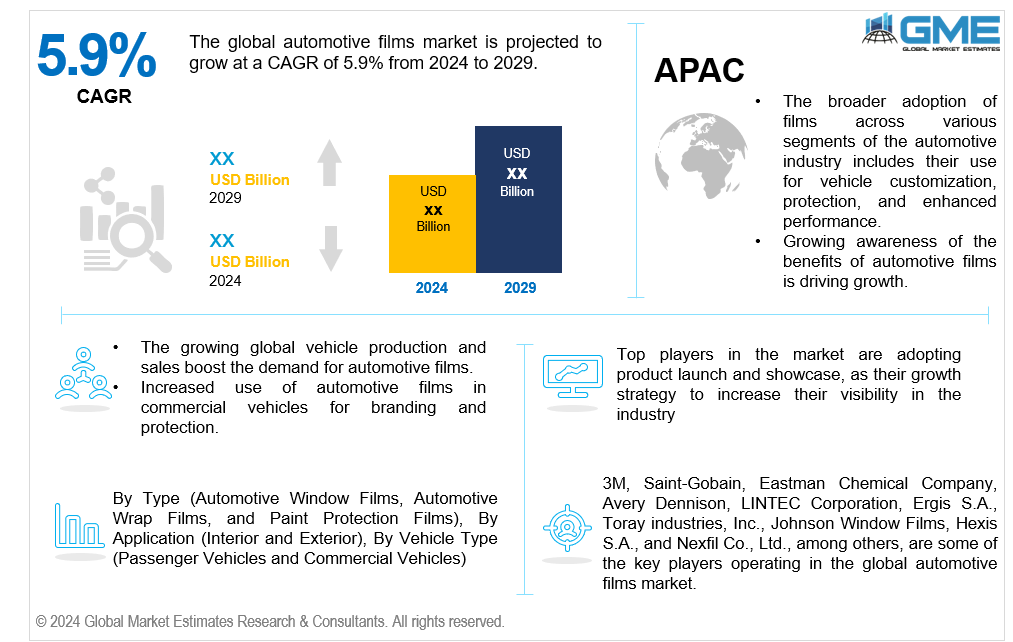

The global automotive films market is projected to grow at a CAGR of 5.9% from 2024 to 2029.

The automotive film industry is expanding rapidly, driven by a variety of applications that enhance vehicle visual appeal, protection, and comfort. Car window tinting films are in high demand due to their ability to minimize heat, glare, and UV radiation, which improves driving comfort and protects the interior. Automotive window films are also popular for privacy, with privacy car window films providing an extra level of security. Furthermore, the trend of car personalization has driven up demand for vehicle wrap films, allowing owners to change the color or style of their vehicles without requiring a permanent paint job.

Technological advancements in the sector have resulted in the production of longer-lasting and more reliable films. Anti-glare automobile films, for example, increase visibility and reduce eye strain for drivers, thereby improving overall safety. Car body wraps are now available in a variety of finishes and textures to meet the diverse needs of customers seeking unique and personalized car appearances. The increase in car production, particularly in emerging economies, has also contributed to the growing popularity of these films.

Despite the market's growth, several restraints could potentially hinder its expansion. The high cost of advanced films and professional installation services may deter some consumers. Additionally, regulatory restrictions in certain regions regarding the permissible levels of tinting on windows could impact the adoption of car window tinting films. However, the market continues to grow as consumer awareness of the benefits of automotive films increases. Innovations and cost reductions are making these products more accessible, ensuring sustained demand across various segments of the automotive industry.

The automotive window films segment is expected to hold the largest share of the market during the forecast period. The market for automobile window films is rapidly expanding as consumers become more aware of the benefits of UV protection car films, which reduce harmful UV radiation while enhancing vehicle comfort. Furthermore, the growing demand for increased privacy and aesthetic customization in automobiles is propelling the use of these films across multiple countries.

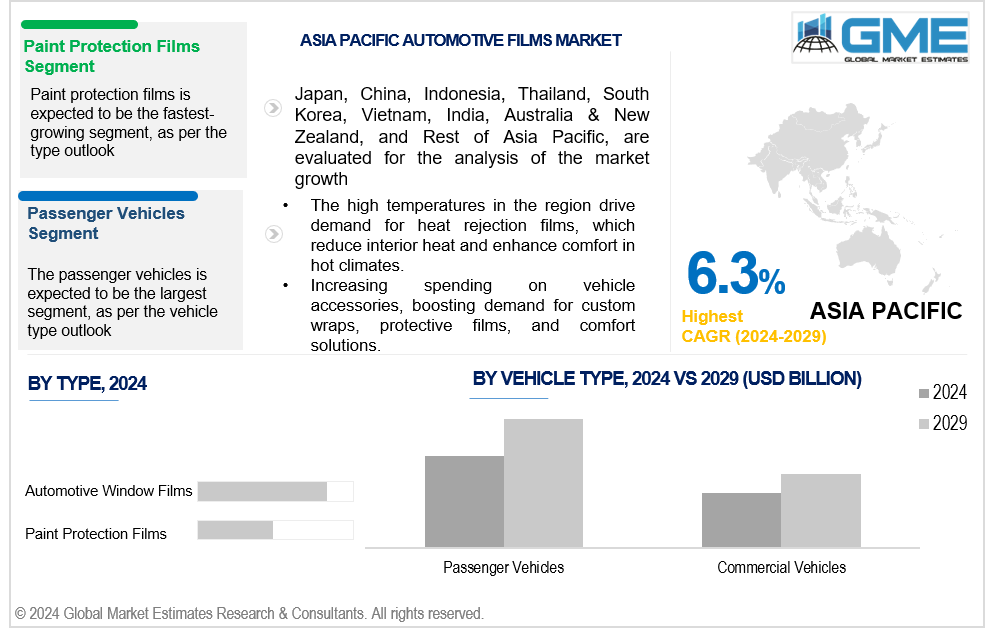

The paint protection films segment is projected to be the fastest-growing segment in the market from 2024 to 2029. Automotive paint protection films (PPF) are driving market expansion by offering an effective barrier against bumps, chipping, and other types of damage, thereby protecting the vehicle's appearance and value. The rising demand for scratch-resistant automobile films reflects consumers' desire for durable vehicle exteriors and lower maintenance expenses. Furthermore, advances in film technology have made these products more durable and easier to install, increasing their popularity among automotive owners.

The exterior segment is expected to hold the largest market share from 2024 to 2029. Vehicle wrap films and automobile body wraps are becoming increasingly popular as they provide a cost-effective and individualized vehicle appearance while also protecting the exterior of the vehicle. These films allow for color changes, branding, and unique designs without permanently affecting the vehicle's paint. This trend is driven by buyers' growing desire to maintain the beauty and value of their vehicles over time.

The interior segment is projected to be the fastest-growing segment in the market from 2024 to 2029. Automotive films are becoming increasingly popular for vehicle interiors, as car safety films strengthen glass against breakage and potential collisions, providing protection. Furthermore, heat rejection automotive films improve passenger comfort by minimizing the amount of heat that enters the car, making the interior climate more pleasant and energy-efficient, further boosting growth in the market.

The passenger vehicles segment is expected to hold the largest market share from 2024 to 2029. Passenger vehicles are largely driving demand for automotive films, as owners strive to enhance the aesthetics, comfort, and protection of their vehicles. The growing trend of vehicle personalization, including color changes and distinctive designs through automotive film installation, reflects a significant consumer desire for customized and visually appealing vehicles.

The commercial vehicles segment is projected to be the fastest-growing segment in the market from 2024 to 2029. Commercial vehicles are contributing to the growth of the automotive film market by using films for both functional and branding purposes. Fleet operators are increasingly using vehicle graphic films for advertising and branding, enabling cost-effective and high-impact marketing methods. The rising application of automotive films across diverse commercial industries highlights their growing significance in enhancing vehicle performance and boosting brand visibility.

North America is expected to be the largest region in the global market. North America dominates the automotive film industry due to the high demand for automobile vinyl wraps and the large number of vehicles in the region. Both businesses and consumers utilize these wraps for branding and customization, while automobile window and paint protection films are popular for increased comfort and safety.

Asia Pacific is predicted to witness rapid growth during the forecast period. The region's strong economic growth and rising vehicle ownership are driving the popularity of automotive films. Automotive film market trends show a growing interest in high-performance films and customization options in the region. This trend is supported by the expanding auto industry and increased awareness of the benefits of advanced technologies, such as self-healing car films.

3M, Saint-Gobain, Eastman Chemical Company, Avery Dennison, LINTEC Corporation, Ergis S.A., Toray Industries, Inc., Johnson Window Films, Hexis S.A., and Nexfil Co., Ltd., among others, are some of the key players operating in the global automotive films market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2023, Toray Industries, Inc. introduced PICASUS, a high heat-insulating solar control film designed for advanced mobility applications. This film, developed using the company’s innovative nano-multilayer technology, provides glass-like transparency while offering excellent thermal insulation from the sun’s infrared rays.

In February 2023, Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a company that manufactures paint protection and window films for the auto and architectural markets in the Asia-Pacific region. This acquisition allowed Eastman to strengthen its presence in China and boost its financial performance.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AUTOMOTIVE FILMS MARKET, BY TYPE

4.1 Introduction

4.2 Automotive Films Market : Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Automotive Window Films

4.4.1 Automotive Window Films Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Automotive Wrap Films

4.5.1 Automotive Wrap Films Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Paint Protection Films

4.6.1 Paint Protection Films Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE

5.1 Introduction

5.2 Automotive Films Market : Vehicle Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Passenger Vehicles

5.4.1 Passenger Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Commercial Vehicles

5.5.1 Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL AUTOMOTIVE FILMS MARKET, BY APPLICATION

6.1 Introduction

6.2 Automotive Films Market : Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Interior

6.4.1 Interior Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Exterior

6.5.1 Exterior Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL AUTOMOTIVE FILMS MARKET, BY REGION

7.1 Introduction

7.2 North America Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type

7.2.2 By Vehicle Type

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By Vehicle Type

7.2.4.1.3 By Application

7.2.4.2 Canada Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By Vehicle Type

7.2.4.2.3 By Application

7.2.4.3 Mexico Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By Vehicle Type

7.2.4.3.3 By Application

7.3 Europe Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type

7.3.2 By Vehicle Type

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By Vehicle Type

7.3.4.1.3 By Application

7.3.4.2 U.K. Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By Vehicle Type

7.3.4.2.3 By Application

7.3.4.3 France Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By Vehicle Type

7.3.4.3.3 By Application

7.3.4.4 Italy Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By Vehicle Type

7.2.4.4.3 By Application

7.3.4.5 Spain Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type

7.3.4.5.2 By Vehicle Type

7.2.4.5.3 By Application

7.3.4.6 Netherlands Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type

7.3.4.6.2 By Vehicle Type

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type

7.3.4.7.2 By Vehicle Type

7.2.4.7.3 By Application

7.4 Asia Pacific Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type

7.4.2 By Vehicle Type

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type

7.4.4.1.2 By Vehicle Type

7.4.4.1.3 By Application

7.4.4.2 Japan Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type

7.4.4.2.2 By Vehicle Type

7.4.4.2.3 By Application

7.4.4.3 India Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type

7.4.4.3.2 By Vehicle Type

7.4.4.3.3 By Application

7.4.4.4 South Korea Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type

7.4.4.4.2 By Vehicle Type

7.4.4.4.3 By Application

7.4.4.5 Singapore Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type

7.4.4.5.2 By Vehicle Type

7.4.4.5.3 By Application

7.4.4.6 Malaysia Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type

7.4.4.6.2 By Vehicle Type

7.4.4.6.3 By Application

7.4.4.7 Thailand Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type

7.4.4.7.2 By Vehicle Type

7.4.4.7.3 By Application

7.4.4.8 Indonesia Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type

7.4.4.8.2 By Vehicle Type

7.4.4.8.3 By Application

7.4.4.9 Vietnam Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type

7.4.4.9.2 By Vehicle Type

7.4.4.9.3 By Application

7.4.4.10 Taiwan Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type

7.4.4.10.2 By Vehicle Type

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type

7.4.4.11.2 By Vehicle Type

7.4.4.11.3 By Application

7.5 Middle East and Africa Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type

7.5.2 By Vehicle Type

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type

7.5.4.1.2 By Vehicle Type

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type

7.5.4.2.2 By Vehicle Type

7.5.4.2.3 By Application

7.5.4.3 Israel Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type

7.5.4.3.2 By Vehicle Type

7.5.4.3.3 By Application

7.5.4.4 South Africa Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type

7.5.4.4.2 By Vehicle Type

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type

7.5.4.5.2 By Vehicle Type

7.5.4.5.2 By Application

7.6 Central and South America Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type

7.6.2 By Vehicle Type

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type

7.6.4.1.2 By Vehicle Type

7.6.4.1.3 By Application

7.6.4.2 Argentina Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type

7.6.4.2.2 By Vehicle Type

7.6.4.2.3 By Application

7.6.4.3 Chile Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type

7.6.4.3.2 By Vehicle Type

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Automotive Films Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type

7.6.4.4.2 By Vehicle Type

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 3M

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Saint-Gobain

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Eastman Chemical Company

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Avery Dennison

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 LINTEC Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Ergis S.A.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Toray industries, Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Johnson Window Films

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Hexis S.A.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Nexfil Co., Ltd.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Automotive Films Market, By Type, 2021-2029 (USD MILLION)

2 Automotive Window Films Market, By Region, 2021-2029 (USD MILLION)

3 Automotive Wrap Films Market, By Region, 2021-2029 (USD MILLION)

4 Paint Protection Films Market, By Region, 2021-2029 (USD MILLION)

5 Global Automotive Films Market, By Vehicle Type, 2021-2029 (USD MILLION)

6 Passenger Vehicles Market, By Region, 2021-2029 (USD MILLION)

7 Commercial Vehicles Market, By Region, 2021-2029 (USD MILLION)

8 Global Automotive Films Market, By Application, 2021-2029 (USD MILLION)

9 Interior Market, By Region, 2021-2029 (USD MILLION)

10 Exterior Market, By Region, 2021-2029 (USD MILLION)

11 Regional Analysis, 2021-2029 (USD MILLION)

12 North America Automotive Films Market, By Type, 2021-2029 (USD Million)

13 North America Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

14 North America Automotive Films Market, By Application, 2021-2029 (USD Million)

15 North America Automotive Films Market, By Country, 2021-2029 (USD Million)

16 U.S. Automotive Films Market, By Type, 2021-2029 (USD Million)

17 U.S. Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

18 U.S. Automotive Films Market, By Application, 2021-2029 (USD Million)

19 Canada Automotive Films Market, By Type, 2021-2029 (USD Million)

20 Canada Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

21 Canada Automotive Films Market, By Application, 2021-2029 (USD Million)

22 Mexico Automotive Films Market, By Type, 2021-2029 (USD Million)

23 Mexico Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

24 Mexico Automotive Films Market, By Application, 2021-2029 (USD Million)

25 Europe Automotive Films Market, By Type, 2021-2029 (USD Million)

26 Europe Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

27 Europe Automotive Films Market, By Application, 2021-2029 (USD Million)

28 Europe Automotive Films Market, By COUNTRY, 2021-2029 (USD Million)

29 Germany Automotive Films Market, By Type, 2021-2029 (USD Million)

30 Germany Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

31 Germany Automotive Films Market, By Application, 2021-2029 (USD Million)

32 U.K. Automotive Films Market, By Type, 2021-2029 (USD Million)

33 U.K. Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

34 U.K. Automotive Films Market, By Application, 2021-2029 (USD Million)

35 France Automotive Films Market, By Type, 2021-2029 (USD Million)

36 France Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

37 France Automotive Films Market, By Application, 2021-2029 (USD Million)

38 Italy Automotive Films Market, By Type, 2021-2029 (USD Million)

39 Italy Automotive Films Market, By End Use , 2021-2029 (USD Million)

40 Italy Automotive Films Market, By Application, 2021-2029 (USD Million)

41 Spain Automotive Films Market, By Type, 2021-2029 (USD Million)

42 Spain Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

43 Spain Automotive Films Market, By Application, 2021-2029 (USD Million)

44 Rest Of Europe Automotive Films Market, By Type, 2021-2029 (USD Million)

45 Rest Of Europe Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

46 Rest of Europe Automotive Films Market, By Application, 2021-2029 (USD Million)

47 Asia Pacific Automotive Films Market, By Type, 2021-2029 (USD Million)

48 Asia Pacific Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

49 Asia Pacific Automotive Films Market, By Application, 2021-2029 (USD Million)

50 Asia Pacific Automotive Films Market, By Country, 2021-2029 (USD Million)

51 China Automotive Films Market, By Type, 2021-2029 (USD Million)

52 China Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

53 China Automotive Films Market, By Application, 2021-2029 (USD Million)

54 India Automotive Films Market, By Type, 2021-2029 (USD Million)

55 India Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

56 India Automotive Films Market, By Application, 2021-2029 (USD Million)

57 Japan Automotive Films Market, By Type, 2021-2029 (USD Million)

58 Japan Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

59 Japan Automotive Films Market, By Application, 2021-2029 (USD Million)

60 South Korea Automotive Films Market, By Type, 2021-2029 (USD Million)

61 South Korea Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

62 South Korea Automotive Films Market, By Application, 2021-2029 (USD Million)

63 Singapore Automotive Films Market, By Type, 2021-2029 (USD Million)

64 Singapore Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

65 Singapore Automotive Films Market, By Application, 2021-2029 (USD Million)

66 Malaysia Automotive Films Market, By Type, 2021-2029 (USD Million)

67 Malaysia Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

68 Malaysia Automotive Films Market, By Application, 2021-2029 (USD Million)

69 Thailand Automotive Films Market, By Type, 2021-2029 (USD Million)

70 Thailand Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

71 Thailand Automotive Films Market, By Application, 2021-2029 (USD Million)

72 Indonesia Automotive Films Market, By Type, 2021-2029 (USD Million)

73 Indonesia Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

74 Indonesia Automotive Films Market, By Application, 2021-2029 (USD Million)

75 Vietnam Automotive Films Market, By Type, 2021-2029 (USD Million)

76 Vietnam Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

77 Vietnam Automotive Films Market, By Application, 2021-2029 (USD Million)

78 Taiwan Automotive Films Market, By Type, 2021-2029 (USD Million)

79 Taiwan Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

80 Taiwan Automotive Films Market, By Application, 2021-2029 (USD Million)

81 Rest of Asia Pacific Automotive Films Market, By Type, 2021-2029 (USD Million)

82 Rest of Asia Pacific Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

83 Rest of Asia Pacific Automotive Films Market, By Application, 2021-2029 (USD Million)

84 Middle East and Africa Automotive Films Market, By Type, 2021-2029 (USD Million)

85 Middle East and Africa Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

86 Middle East and Africa Automotive Films Market, By Application, 2021-2029 (USD Million)

87 Middle East and Africa Automotive Films Market, By Country, 2021-2029 (USD Million)

88 Saudi Arabia Automotive Films Market, By Type, 2021-2029 (USD Million)

89 Saudi Arabia Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

90 Saudi Arabia Automotive Films Market, By Application, 2021-2029 (USD Million)

91 UAE Automotive Films Market, By Type, 2021-2029 (USD Million)

92 UAE Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

93 UAE Automotive Films Market, By Application, 2021-2029 (USD Million)

94 Israel Automotive Films Market, By Type, 2021-2029 (USD Million)

95 Israel Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

96 Israel Automotive Films Market, By Application, 2021-2029 (USD Million)

97 South Africa Automotive Films Market, By Type, 2021-2029 (USD Million)

98 South Africa Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

99 South Africa Automotive Films Market, By Application, 2021-2029 (USD Million)

100 Rest of Middle East and Africa Automotive Films Market, By Type, 2021-2029 (USD Million)

101 Rest of Middle East and Africa Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Automotive Films Market, By Application, 2021-2029 (USD Million)

103 Central and South America Automotive Films Market, By Type, 2021-2029 (USD Million)

104 Central and South America Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

105 Central and South America Automotive Films Market, By Application, 2021-2029 (USD Million)

106 Central and South America Automotive Films Market, By Country, 2021-2029 (USD Million)

107 Brazil Automotive Films Market, By Type, 2021-2029 (USD Million)

108 Brazil Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

109 Brazil Automotive Films Market, By Application, 2021-2029 (USD Million)

110 Argentina Automotive Films Market, By Type, 2021-2029 (USD Million)

111 Argentina Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

112 Argentina Automotive Films Market, By Application, 2021-2029 (USD Million)

113 Chile Automotive Films Market, By Type, 2021-2029 (USD Million)

114 Chile Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

115 Chile Automotive Films Market, By Application, 2021-2029 (USD Million)

116 Rest of Central and South America Automotive Films Market, By Type, 2021-2029 (USD Million)

117 Rest of Central and South America Automotive Films Market, By Vehicle Type, 2021-2029 (USD Million)

118 Rest of Central and South America Automotive Films Market, By Application, 2021-2029 (USD Million)

119 3M: Products & Services Offering

120 Saint-Gobain: Products & Services Offering

121 Eastman Chemical Company: Products & Services Offering

122 Avery Dennison: Products & Services Offering

123 LINTEC Corporation: Products & Services Offering

124 ERGIS S.A.: Products & Services Offering

125 Toray industries, Inc.: Products & Services Offering

126 Johnson Window Films: Products & Services Offering

127 Hexis S.A.: Products & Services Offering

128 Nexfil Co., Ltd.: Products & Services Offering

129 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Automotive Films Market Overview

2 Global Automotive Films Market Value From 2021-2029 (USD Million)

3 Global Automotive Films Market Share, By Type (2023)

4 Global Automotive Films Market Share, By Vehicle Type (2023)

5 Global Automotive Films Market Share, By Application (2023)

6 Global Automotive Films Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Automotive Films Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Automotive Films Market

11 Impact Of Challenges On The Global Automotive Films Market

12 Porter’s Five Forces Analysis

13 Global Automotive Films Market: By Type Scope Key Takeaways

14 Global Automotive Films Market, By Type Segment: Revenue Growth Analysis

15 Automotive Window Films Market, By Region, 2021-2029 (USD Million)

16 Automotive Wrap Films Market, By Region, 2021-2029 (USD Million)

17 Paint Protection Films Market, By Region, 2021-2029 (USD Million)

18 Global Automotive Films Market: By Vehicle Type Scope Key Takeaways

19 Global Automotive Films Market, By Vehicle Type Segment: Revenue Growth Analysis

20 Passenger Vehicles Market, By Region, 2021-2029 (USD Million)

21 Commercial Vehicles Market, By Region, 2021-2029 (USD Million)

22 Global Automotive Films Market: By Application Scope Key Takeaways

23 Global Automotive Films Market, By Application Segment: Revenue Growth Analysis

24 Interior Market, By Region, 2021-2029 (USD Million)

25 Exterior Market, By Region, 2021-2029 (USD Million)

26 Regional Segment: Revenue Growth Analysis

27 Global Automotive Films Market: Regional Analysis

28 North America Automotive Films Market Overview

29 North America Automotive Films Market, By Type

30 North America Automotive Films Market, By Vehicle Type

31 North America Automotive Films Market, By Application

32 North America Automotive Films Market, By Country

33 U.S. Automotive Films Market, By Type

34 U.S. Automotive Films Market, By Vehicle Type

35 U.S. Automotive Films Market, By Application

36 Canada Automotive Films Market, By Type

37 Canada Automotive Films Market, By Vehicle Type

38 Canada Automotive Films Market, By Application

39 Mexico Automotive Films Market, By Type

40 Mexico Automotive Films Market, By Vehicle Type

41 Mexico Automotive Films Market, By Application

42 Four Quadrant Positioning Matrix

43 Company Market Share Analysis

44 3M: Company Snapshot

45 3M: SWOT Analysis

46 3M: Geographic Presence

47 Saint-Gobain: Company Snapshot

48 Saint-Gobain: SWOT Analysis

49 Saint-Gobain: Geographic Presence

50 Eastman Chemical Company: Company Snapshot

51 Eastman Chemical Company: SWOT Analysis

52 Eastman Chemical Company: Geographic Presence

53 Avery Dennison: Company Snapshot

54 Avery Dennison: Swot Analysis

55 Avery Dennison: Geographic Presence

56 LINTEC Corporation: Company Snapshot

57 LINTEC Corporation: SWOT Analysis

58 LINTEC Corporation: Geographic Presence

59 Ergis S.A.: Company Snapshot

60 Ergis S.A.: SWOT Analysis

61 Ergis S.A.: Geographic Presence

62 Toray industries, Inc.: Company Snapshot

63 Toray industries, Inc.: SWOT Analysis

64 Toray industries, Inc.: Geographic Presence

65 Johnson Window Films: Company Snapshot

66 Johnson Window Films: SWOT Analysis

67 Johnson Window Films: Geographic Presence

68 Hexis S.A.: Company Snapshot

69 Hexis S.A.: SWOT Analysis

70 Hexis S.A.: Geographic Presence

71 Nexfil Co., Ltd.: Company Snapshot

72 Nexfil Co., Ltd.: SWOT Analysis

73 Nexfil Co., Ltd.: Geographic Presence

74 Other Companies: Company Snapshot

75 Other Companies: SWOT Analysis

76 Other Companies: Geographic Presence

The Global Automotive Films Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Films Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS