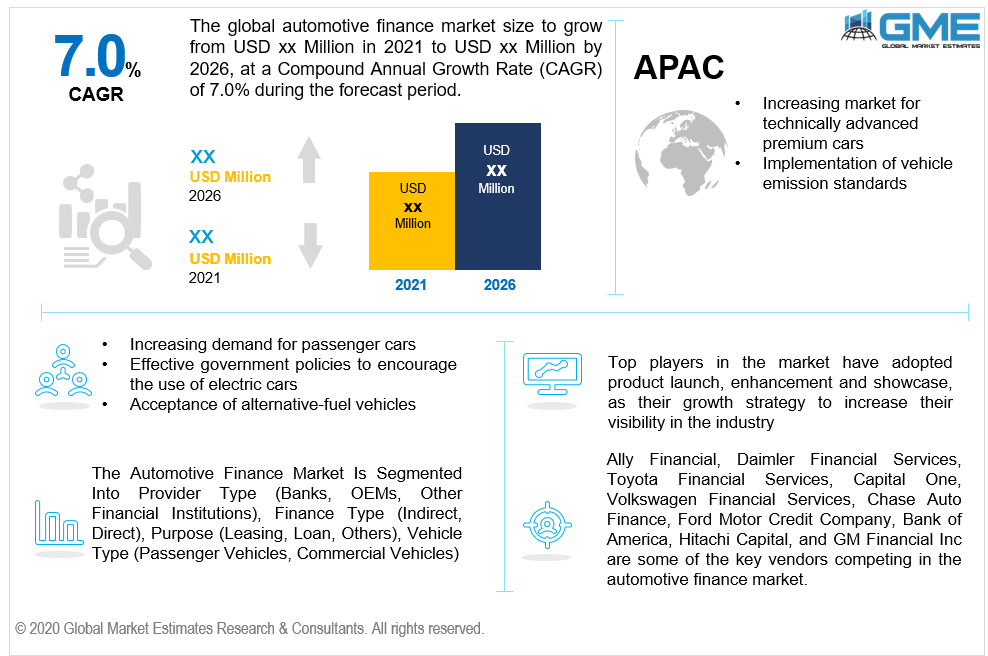

Global Automotive Finance Market Size, Trends, and Analysis- Forecasts To 2026 By Provider Type (Banks, OEMs, Other Financial Institutions), By Finance Type (Indirect, Direct), By Purpose (Leasing, Loan, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Automotive finance, also known as auto financing, is a type of scheme that provides financial goods and services to help customers buy cars without needing to pay in full upfront. Borrowing money from financial institutions like banks, credit unions, brokers, and other informal money lenders is one example of such a scheme.

The automotive finance industry is projected to rise in response to increasing demand for passenger cars, the acceptance of alternative-fuel vehicles, and effective government policies to encourage the use of electric cars. Electric cars minimize traffic jams and pollution while boosting productivity in the commercial world. The growing need to lower the costs of commercial goods transportation is driving the development of this industry. Lenders are using digital tools to improve consumer loyalty, business expansion, and organizational capability. There has been an increase in the number of pure digital automotive lenders, which has increased industry competition.

The rise of digitalization in the automobile industry has prompted lenders to incorporate digital technology into their business models in order to generate more sales. To deliver prompt services and increase customer loyalty, online services such as contracting, vehicle search and selection, pricing, credit approval, and communicating directly with lenders are available.

By integrating the lending and car-buying processes, financers are aiming to have a streamlined experience. Clients have greater flexibility with digital services, which provide search tools for individual recurring payments, pre-approval online, and automated contracting.

As technology advances and customer preferences change, market leaders are altering their business strategies. Increasing automobile modernization, vehicle connectivity convergence, autonomous vehicle production, the implementation of strict vehicular regulations, and the growing penetration of premium vehicles are among the factors affecting the automotive finance sector. For the development of their industrial activity, automobile financing companies are partnering with automotive OEMs, vehicle rental firms, and fleet operators.

The COVID-19 outbreak will have a negative effect on the industry. The instability in the economy has caused car buyers to put off purchasing new vehicles.

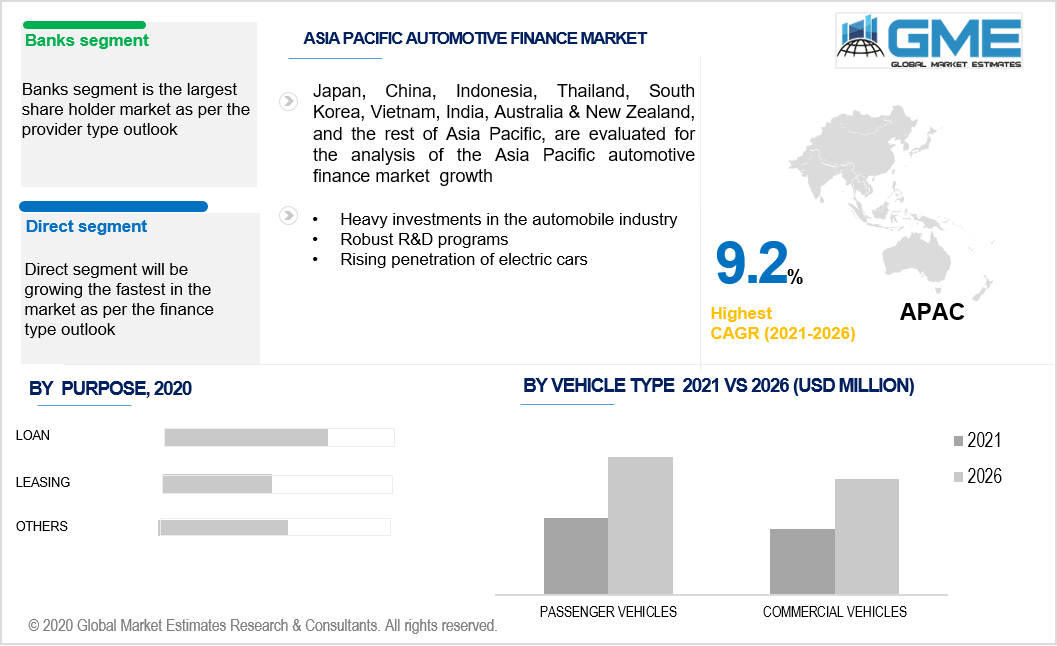

In 2020, the banks' division dominated the industry and contributed to the majority of global sales. The fast-processing capabilities combined with the need for minimal documentation, as well as the high-reliability features, have contributed to the banks' sector expansion. Previously, banks would only fund 70 percent to 80 percent of the overall vehicle cost. However, nowadays these banks are providing 100% financing on vehicles, and hence consumers are expressing a greater interest in buying a new car rather than a used car. Banks provide benefits such as low EMIs, reduced paperwork, low interest rates, and fast disbursement.

Over the estimated timeframe, the OEMs segment is expected to rise at the fastest pace. Since identical car components, such as those used in the vehicle financed, are available for maintenance or replacement, automotive OEMs have stronger after-sales services. OEMs are often regarded as mobility's future, due to their optimistic effect on emerging business strategies. Moreover, OEMs are working on widening their offers to include vehicle insurance.

The direct automotive financing segment had the largest market share in 2020. Direct automotive finance is in high demand since it allows customers to make lending demands straight to a lender or bank. The borrower can negotiate the terms of the loan with the auto finance provider directly. Consumers may use this lending option to get pre-approved for a car loan.

Over the forthcoming years, the indirect segment is expected to rise at the fastest pace. The main advantage of this form of indirect financing is that it encourages clients to get specialized advice from independent finance experts on-site. These experts also make sure that their customers figure out the right way to fund a vehicle when needed.

In 2020, the loan sector dominated the industry, accounting for the majority of global sales. For the majority of the world's population, taking out a loan to buy a vehicle has become a practice. Leasing and lending firms had more financing sources to make available to customers as the credit situation improved. Furthermore, low-interest loans are being offered by banks and credit unions to borrowers.

Over the projected era, the leasing segment is expected to rise at the fastest pace. The growing number of leasing companies in developing nations like Japan, China, and India can be attributed to the sector's development. In the automotive leasing sector, the rising pattern of digitalization is having a significant effect. Furthermore, automotive leasing firms are aggressively invested in digital technology like blockchain to improve the customer experience and increase revenue.

In 2020, the passenger vehicle category dominated the industry, accounting for the majority of global sales. Microcars, vans, SUVs, hatchbacks, MUVs, and sedans are a few examples of passenger vehicles. The market for automotive financing for passenger cars is projected to rise as spending power rises, the number of female drivers increases, customers' lifestyles change, the level of automotive manufacturing grows, and the market for fuel-efficient vehicles increases.

During the projected timeline, the commercial vehicle segment is expected to expand significantly. Since commercial vehicles are more costly than other types of vehicles, many banks and financial institutions have devised cost-effective lending programs with straightforward terms and conditions. Furthermore, as opposed to passenger vehicles, commercial vehicle loans have a faster approval period. Over the forthcoming years, the above factors are anticipated to boost the segment's development.

In 2020, Europe led the automotive financing industry, accounting for the majority share of global sales. The involvement of a significant number of automotive financing service firms in the area is responsible for the region's business expansion. Many market players offer their services through an online domain. This effort gives these participants a leg up on the competition.

Over the projected timeframe, Asia Pacific is predicted to be the fastest-growing regional segment. The increasing number of supportive government policies in nations like India, Japan, and China to encourage automobile sector development and sustain customer demand is anticipated to generate growth potential for the regional market. The region's market is also growing due to an increase in the number of vehicles, an increasing market for technically advanced premium cars, and the implementation of vehicle emission standards. Heavy investments in the automobile industry, robust R&D programs, rising penetration of electric cars, and the implementation of autonomous vehicles are just a few of the factors driving the industry forward.

Ally Financial, Daimler Financial Services, Toyota Financial Services, Capital One, Volkswagen Financial Services, Chase Auto Finance, Ford Motor Credit Company, Bank of America, Hitachi Capital, and GM Financial Inc are some of the key vendors competing in the automotive finance market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Automotive Finance Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Provider Type Overview

2.1.3 Finance Type Overview

2.1.4 Purpose Overview

2.1.5 Vehicle Type Overview

2.1.6 Regional Overview

Chapter 3 Automotive Finance Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing market for technically advanced premium cars

3.3.2 Industry Challenges

3.3.2.1 COVID-19 pandemic effect on the purchase of the cars

3.4 Prospective Growth Scenario

3.4.1 Provider Type Growth Scenario

3.4.2 Finance Type Growth Scenario

3.4.3 Purpose Growth Scenario

3.4.4 Vehicle Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Vehicle Type Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Automotive Finance Market, By Provider Type

4.1 Provider Type Outlook

4.2 Banks

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 OEMs

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Automotive Finance Market, By Finance Type

5.1 Finance Type Outlook

5.2 Indirect

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Direct

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Automotive Finance Market, By Purpose

6.1 Leasing

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Loans

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Others

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Automotive Finance Market, By Vehicle Type

7.1 Passenger Vehicles

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Commercial Vehicles

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Automotive Finance Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Provider Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Finance Type, 2016-2026 (USD Million)

8.2.4 Market Size, By Purpose, 2016-2026 (USD Million)

8.2.5 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.2.4.3 Market Size, By Purpose, 2016-2026 (USD Million)

Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.4 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.5 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.10.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.3.11.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Provider Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Finance Type, 2016-2026 (USD Million)

8.4.4 Market Size, By Purpose, 2016-2026 (USD Million)

8.4.5 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Finance Type, 2016-2026 (USD Million)

8.4.9.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Provider Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Finance Type, 2016-2026 (USD Million)

8.5.4 Market Size, By Purpose, 2016-2026 (USD Million)

8.5.5 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Provider Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Finance Type, 2016-2026 (USD Million)

8.6.4 Market Size, By Purpose, 2016-2026 (USD Million)

8.6.5 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Provider Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Finance Type, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Purpose, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Vehicle Type, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Ally Financial

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Daimler Financial Services

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Toyota Financial Services

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Capital One

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Volkswagen Financial Services

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Chase Auto Finance

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Ford Motor Credit Company

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Bank of America

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Hitachi Capital

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Hitachi Capital

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Automotive Finance Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Finance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS