Global Automotive Seat Belts Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Retractor Pretensioner and Buckle Pretensioner), By End User (OEM and Aftermarket), By Vehicle Type (Passenger Cars and Commercial Vehicles), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

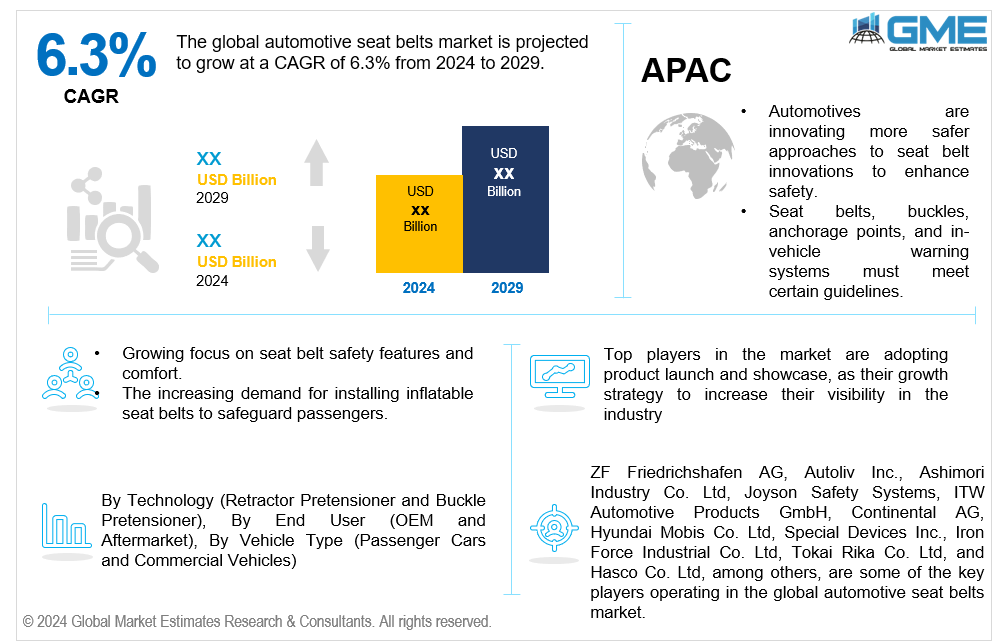

The global automotive seat belts market is projected to grow at a CAGR of 6.3% from 2024 to 2029.

The automobile seat belts are a critical component of the development of automotive safety systems, predominantly due to the increasing use of vehicles worldwide and the strict safety regulations required. Seat belts are critical safety devices that secure passengers during incidents, thereby decreasing the likelihood of injury. The market is experiencing a surge in advanced safety seat belt features and enhanced product offerings to satisfy diverse vehicle requirements and stringent safety regulations as seat belt manufacturers increase their focus on innovation and compliance. According to the National Safety Council (NSC), seat belt use in the United States increased from 91.6% in 2022 to 91.9% in 2023.

Key players in the car seat belts market focus on seat belt innovations to meet changing automotive safety belts standards worldwide. This involves utilizing various materials to improve robustness and convenience, ultimately enhancing safety. Government laws for the use of seat belts in motor vehicles, combined with public outreach initiatives, are raising knowledge about the importance of using a seat belt. The United States New Car Assessment Program (NCAP) serves to evaluate vehicle occupant protection, which includes ratings for child safety seats, seat belt testing standards, and testing passive safety systems.

The retractor pretensioner segment is expected to hold the largest share of the market during the forecast period. As a result of the growing demand for retractor seatbelt pretensioners, numerous manufacturers are forming partnerships with major industry companies to procure seat belt components for their forthcoming vehicle models. Automakers are proactively integrating seatbelt pretensioners as standard equipment into their vehicle models in order to satisfy consumer demand for safer vehicles. The three-point seat belts are among the most used retractor seatbelt system which is commonly used across the industry.

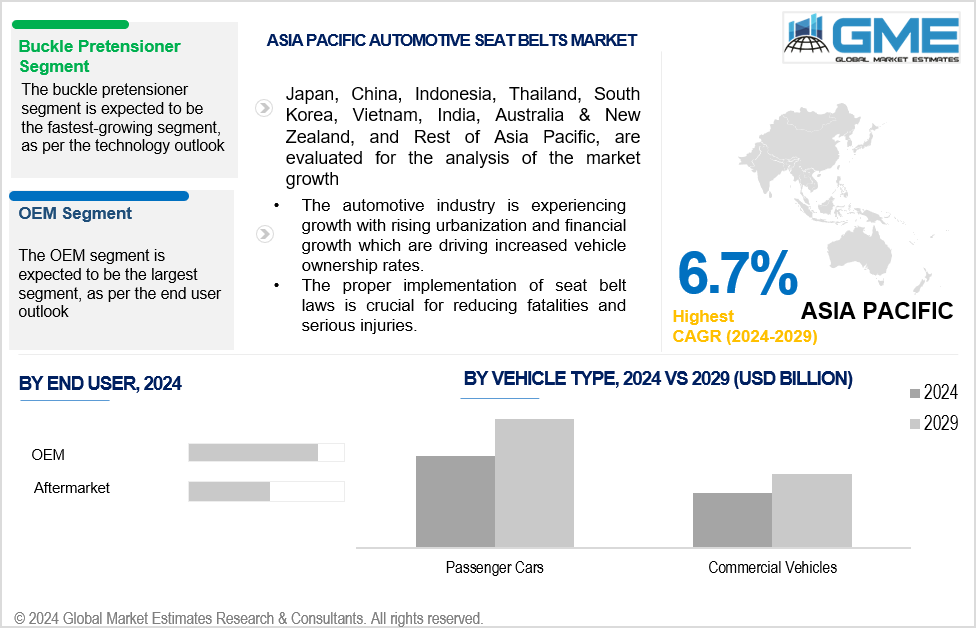

The buckle pretensioner segment is analyzed to be the fastest-growing segment in the market from 2024 to 2029. The industry is witnessing a rise in the use of buckle pretensioners, as they are capable of integrating seamlessly with other sophisticated safety systems, such as airbags, to offer comprehensive occupant protection. Additionally, Skoda has patented the world's first illuminated smart seat belt buckle, which incorporates a clear translucent button instead of the conventional red eject button.

The OEM segment is analyzed to hold the largest market share from 2024 to 2029. OEM safety belts, including seat belt retractors and seat belt webbing, are meticulously designed and produced to fit certain vehicle models such as SUVs, sedans, and hatchbacks. OEM seat belts have the added benefit of being insured by a manufacturer warranty, guaranteeing quality and durability. As vehicle production increases and safety regulations tighten, the demand for OEM seat belts is also growing, further driving market expansion.

The aftermarket segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. Designed as cost-effective alternatives to OEM products, aftermarket seat belts utilize a variety of seat belt components that may vary in quality and specifications. These seat belts cater to a wide range of vehicles, providing options for repairs or upgrades. These kinds of belts can be used in older and less common cars. Comparatively, aftermarket seat belts can be customized to meet consumer needs and are affordable.

The passenger cars segment is analyzed to hold the largest market share of the market from 2024 to 2029. The market for automotive safety belts will witness growth in tandem with the increase in passenger car sales. These vehicles typically use advanced seat belts technologies, such as pretensioners and load limiters, to improve occupant safety. Furthermore, innovations in seat belt buckle design ensure greater dependability and ease of use, contributing to total seat belt industry growth. Increased worldwide sales of environmentally friendly vehicles like electric vehicles is expected to drive passenger car category growth throughout the projection period.

The commercial vehicles segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. The commercial vehicle market for seat belts is rapidly growing due to urban development, expanding highways, and increasing automobile demand. Seat belt market trends indicate that as commercial vehicles prioritize driver safety and aim to reduce insurance costs, strong seat belt systems are essential for protecting employees and maintaining operational efficiency.

North America is expected to be the largest region in the global market. The region is used to the widespread adoption of seat belts due to stringent seat belt regulations and road safety. The user is required by law to wear a seat belt at all times or face harsher fines. Seat belt usage statistics by the National Highway Traffic Safety Administration (NHTSA) in the United States of America show an estimate of seat belt use by adult front-seat passengers in 2022 of 91.6%.

Asia Pacific is predicted to witness rapid growth during the forecast period. Increased vehicle production, road infrastructure upgrades, and stringent road safety standards are likely to drive the seat belt industry. Seat belt market segmentation is becoming more refined as automotive seat belt suppliers cater to specific vehicle types and safety standards. This involves providing sophisticated seat belt systems for passenger cars, trucks, and luxury vehicles. The emphasis on achieving various regulatory criteria and improving passenger safety is driving providers to develop and increase their product offerings, hence accelerating market growth.

ZF Friedrichshafen AG, Autoliv Inc., Ashimori Industry Co. Ltd, Joyson Safety Systems, ITW Automotive Products GmbH, Continental AG, Hyundai Mobis Co. Ltd, Special Devices Inc., Iron Force Industrial Co. Ltd, Tokai Rika Co. Ltd, and Hasco Co. Ltd, among others, are some of the key players operating in the global automotive seat belts market.

Please note: This is not an exhaustive list of companies profiled in the report.

On August 23, 2023, the United States proposed requiring passenger rear seat belt reminder systems. The National Highway Traffic Safety Administration (NHTSA) proposed a new warning system that would extend to both rear-seat and front-seat passengers and expand current warnings for the driver.

On September 22, 2023, Autoliv and Great Wall Motor collaborated on advanced automotive safety technologies. The collaboration includes an integrated safety system solution - the zero-gravity seat - for autonomous vehicles. The Autoliv zero-gravity seat features airbags and an integrated seatbelt for optimal safety.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AUTOMOTIVE SEAT BELTS MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Automotive Seat Belts Market : Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Retractor Pretensioner

4.4.1 Retractor Pretensioner Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Buckle Pretensioner

4.5.1 Buckle Pretensioner Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL AUTOMOTIVE SEAT BELTS MARKET, BY END USER

5.1 Introduction

5.2 Automotive Seat Belts Market : End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 OEM

5.4.1 OEM Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Aftermarket

5.5.1 Aftermarket Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL AUTOMOTIVE SEAT BELTS MARKET, BY VEHICLE TYPE

6.1 Introduction

6.2 Automotive Seat Belts Market : Vehicle Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Passenger Cars

6.4.1 Passenger Cars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Commercial Vehicles

6.5.1 Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL AUTOMOTIVE SEAT BELTS MARKET, BY REGION

7.1 Introduction

7.2 North America Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Technology

7.2.2 By End User

7.2.3 By Vehicle Type

7.2.4 By Country

7.2.4.1 U.S. Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Technology

7.2.4.1.2 By End User

7.2.4.1.3 By Vehicle Type

7.2.4.2 Canada Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Technology

7.2.4.2.2 By End User

7.2.4.2.3 By Vehicle Type

7.2.4.3 Mexico Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Technology

7.2.4.3.2 By End User

7.2.4.3.3 By Vehicle Type

7.3 Europe Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Technology

7.3.2 By End User

7.3.3 By Vehicle Type

7.3.4 By Country

7.3.4.1 Germany Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Technology

7.3.4.1.2 By End User

7.3.4.1.3 By Vehicle Type

7.3.4.2 U.K. Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Technology

7.3.4.2.2 By End User

7.3.4.2.3 By Vehicle Type

7.3.4.3 France Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Technology

7.3.4.3.2 By End User

7.3.4.3.3 By Vehicle Type

7.3.4.4 Italy Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Technology

7.3.4.4.2 By End User

7.2.4.4.3 By Vehicle Type

7.3.4.5 Spain Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Technology

7.3.4.5.2 By End User

7.2.4.5.3 By Vehicle Type

7.3.4.6 Netherlands Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Technology

7.3.4.6.2 By End User

7.2.4.6.3 By Vehicle Type

7.3.4.7 Rest of Europe Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Technology

7.3.4.7.2 By End User

7.2.4.7.3 By Vehicle Type

7.4 Asia Pacific Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Technology

7.4.2 By End User

7.4.3 By Vehicle Type

7.4.4 By Country

7.4.4.1 China Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Technology

7.4.4.1.2 By End User

7.4.4.1.3 By Vehicle Type

7.4.4.2 Japan Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Technology

7.4.4.2.2 By End User

7.4.4.2.3 By Vehicle Type

7.4.4.3 India Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Technology

7.4.4.3.2 By End User

7.4.4.3.3 By Vehicle Type

7.4.4.4 South Korea Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Technology

7.4.4.4.2 By End User

7.4.4.4.3 By Vehicle Type

7.4.4.5 Singapore Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Technology

7.4.4.5.2 By End User

7.4.4.5.3 By Vehicle Type

7.4.4.6 Malaysia Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Technology

7.4.4.6.2 By End User

7.4.4.6.3 By Vehicle Type

7.4.4.7 Thailand Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Technology

7.4.4.7.2 By End User

7.4.4.7.3 By Vehicle Type

7.4.4.8 Indonesia Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Technology

7.4.4.8.2 By End User

7.4.4.8.3 By Vehicle Type

7.4.4.9 Vietnam Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Technology

7.4.4.9.2 By End User

7.4.4.9.3 By Vehicle Type

7.4.4.10 Taiwan Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Technology

7.4.4.10.2 By End User

7.4.4.10.3 By Vehicle Type

7.4.4.11 Rest of Asia Pacific Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Technology

7.4.4.11.2 By End User

7.4.4.11.3 By Vehicle Type

7.5 Middle East and Africa Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Technology

7.5.2 By End User

7.5.3 By Vehicle Type

7.5.4 By Country

7.5.4.1 Saudi Arabia Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Technology

7.5.4.1.2 By End User

7.5.4.1.3 By Vehicle Type

7.5.4.2 U.A.E. Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Technology

7.5.4.2.2 By End User

7.5.4.2.3 By Vehicle Type

7.5.4.3 Israel Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Technology

7.5.4.3.2 By End User

7.5.4.3.3 By Vehicle Type

7.5.4.4 South Africa Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Technology

7.5.4.4.2 By End User

7.5.4.4.3 By Vehicle Type

7.5.4.5 Rest of Middle East and Africa Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Technology

7.5.4.5.2 By End User

7.5.4.5.2 By Vehicle Type

7.6 Central and South America Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Technology

7.6.2 By End User

7.6.3 By Vehicle Type

7.6.4 By Country

7.6.4.1 Brazil Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Technology

7.6.4.1.2 By End User

7.6.4.1.3 By Vehicle Type

7.6.4.2 Argentina Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Technology

7.6.4.2.2 By End User

7.6.4.2.3 By Vehicle Type

7.6.4.3 Chile Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Technology

7.6.4.3.2 By End User

7.6.4.3.3 By Vehicle Type

7.6.4.4 Rest of Central and South America Automotive Seat Belts Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Technology

7.6.4.4.2 By End User

7.6.4.4.3 By Vehicle Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 ZF Friedrichshafen AG

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Autoliv Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Ashimori Industry Co. Ltd

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Joyson Safety Systems

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 ITW Automotive Products GmbH

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Continental AG

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Hyundai Mobis Co. Ltd

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Special Devices Inc.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Iron Force Industrial Co. Ltd

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Tokai Rika Co. Ltd

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Hasco Co. Ltd

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

8.4.12 Other Companies

8.4.12.1 Business Description & Financial Analysis

8.4.12.2 SWOT Analysis

8.4.12.3 Products & Services Offered

8.4.12.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Automotive Seat Belts Market, By Technology, 2021-2029 (USD Mllion)

2 Retractor Pretensioner Market, By Region, 2021-2029 (USD Mllion)

3 Buckle Pretensioner Market, By Region, 2021-2029 (USD Mllion)

4 Global Automotive Seat Belts Market, By End User, 2021-2029 (USD Mllion)

5 OEM Market, By Region, 2021-2029 (USD Mllion)

6 Aftermarket Market, By Region, 2021-2029 (USD Mllion)

7 Global Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Mllion)

8 Passenger Cars Market, By Region, 2021-2029 (USD Mllion)

9 Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

12 North America Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

13 North America Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

14 North America Automotive Seat Belts Market, By Country, 2021-2029 (USD Million)

15 U.S. Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

16 U.S. Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

17 U.S. Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

18 Canada Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

19 Canada Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

20 Canada Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

21 Mexico Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

22 Mexico Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

23 Mexico Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

24 Europe Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

25 Europe Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

26 Europe Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

27 Europe Automotive Seat Belts Market, By COUNTRY, 2021-2029 (USD Million)

28 Germany Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

29 Germany Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

30 Germany Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

31 U.K. Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

32 U.K. Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

33 U.K. Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

34 France Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

35 France Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

36 France Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

37 Italy Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

38 Italy Automotive Seat Belts Market, By End Use , 2021-2029 (USD Million)

39 Italy Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

40 Spain Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

41 Spain Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

42 Spain Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

43 Rest Of Europe Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

44 Rest Of Europe Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

45 Rest of Europe Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

46 Asia Pacific Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

47 Asia Pacific Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

48 Asia Pacific Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

49 Asia Pacific Automotive Seat Belts Market, By Country, 2021-2029 (USD Million)

50 China Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

51 China Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

52 China Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

53 India Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

54 India Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

55 India Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

56 Japan Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

57 Japan Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

58 Japan Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

59 South Korea Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

60 South Korea Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

61 South Korea Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

62 Singapore Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

63 Singapore Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

64 Singapore Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

65 Malaysia Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

66 Malaysia Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

67 Malaysia Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

68 Thailand Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

69 Thailand Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

70 Thailand Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

71 Indonesia Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

72 Indonesia Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

73 Indonesia Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

74 Vietnam Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

75 Vietnam Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

76 Vietnam Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

77 Taiwan Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

78 Taiwan Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

79 Taiwan Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

80 Rest of Asia Pacific Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

81 Rest of Asia Pacific Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

82 Rest of Asia Pacific Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

83 Middle East and Africa Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

84 Middle East and Africa Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

85 Middle East and Africa Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

86 Middle East and Africa Automotive Seat Belts Market, By Country, 2021-2029 (USD Million)

87 Saudi Arabia Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

88 Saudi Arabia Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

89 Saudi Arabia Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

90 UAE Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

91 UAE Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

92 UAE Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

93 Israel Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

94 Israel Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

95 Israel Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

96 South Africa Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

97 South Africa Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

98 South Africa Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

99 Rest of Middle East and Africa Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

100 Rest of Middle East and Africa Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

101 Rest of Middle East and Africa Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

102 Central and South America Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

103 Central and South America Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

104 Central and South America Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

105 Central and South America Automotive Seat Belts Market, By Country, 2021-2029 (USD Million)

106 Brazil Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

107 Brazil Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

108 Brazil Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

109 Argentina Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

110 Argentina Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

111 Argentina Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

112 Chile Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

113 Chile Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

114 Chile Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

115 Rest of Central and South America Automotive Seat Belts Market, By Technology, 2021-2029 (USD Million)

116 Rest of Central and South America Automotive Seat Belts Market, By End User, 2021-2029 (USD Million)

117 Rest of Central and South America Automotive Seat Belts Market, By Vehicle Type, 2021-2029 (USD Million)

118 ZF Friedrichshafen AG: Products & Services Offering

119 Autoliv Inc.: Products & Services Offering

120 Ashimori Industry Co. Ltd: Products & Services Offering

121 Joyson Safety Systems: Products & Services Offering

122 ITW Automotive Products GmbH: Products & Services Offering

123 CONTINENTAL AG: Products & Services Offering

124 Hyundai Mobis Co. Ltd : Products & Services Offering

125 Special Devices Inc.: Products & Services Offering

126 Iron Force Industrial Co. Ltd, Inc: Products & Services Offering

127 Tokai Rika Co. Ltd: Products & Services Offering

128 Hasco Co. Ltd: Products & Services Offering

129 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Automotive Seat Belts Market Overview

2 Global Automotive Seat Belts Market Value From 2021-2029 (USD Mllion)

3 Global Automotive Seat Belts Market Share, By Technology (2023)

4 Global Automotive Seat Belts Market Share, By End User (2023)

5 Global Automotive Seat Belts Market Share, By Vehicle Type (2023)

6 Global Automotive Seat Belts Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Automotive Seat Belts Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Automotive Seat Belts Market

11 Impact Of Challenges On The Global Automotive Seat Belts Market

12 Porter’s Five Forces Analysis

13 Global Automotive Seat Belts Market: By Technology Scope Key Takeaways

14 Global Automotive Seat Belts Market, By Technology Segment: Revenue Growth Analysis

15 Retractor Pretensioner Market, By Region, 2021-2029 (USD Mllion)

16 Buckle Pretensioner Market, By Region, 2021-2029 (USD Mllion)

17 Global Automotive Seat Belts Market: By End User Scope Key Takeaways

18 Global Automotive Seat Belts Market, By End User Segment: Revenue Growth Analysis

19 OEM Market, By Region, 2021-2029 (USD Mllion)

20 Aftermarket Market, By Region, 2021-2029 (USD Mllion)

21 Global Automotive Seat Belts Market: By Vehicle Type Scope Key Takeaways

22 Global Automotive Seat Belts Market, By Vehicle Type Segment: Revenue Growth Analysis

23 Passenger Cars Market, By Region, 2021-2029 (USD Mllion)

24 Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global Automotive Seat Belts Market: Regional Analysis

27 North America Automotive Seat Belts Market Overview

28 North America Automotive Seat Belts Market, By Technology

29 North America Automotive Seat Belts Market, By End User

30 North America Automotive Seat Belts Market, By Vehicle Type

31 North America Automotive Seat Belts Market, By Country

32 U.S. Automotive Seat Belts Market, By Technology

33 U.S. Automotive Seat Belts Market, By End User

34 U.S. Automotive Seat Belts Market, By Vehicle Type

35 Canada Automotive Seat Belts Market, By Technology

36 Canada Automotive Seat Belts Market, By End User

37 Canada Automotive Seat Belts Market, By Vehicle Type

38 Mexico Automotive Seat Belts Market, By Technology

39 Mexico Automotive Seat Belts Market, By End User

40 Mexico Automotive Seat Belts Market, By Vehicle Type

41 Four Quadrant Positioning Matrix

42 Company Market Share Analysis

43 ZF Friedrichshafen AG: Company Snapshot

44 ZF Friedrichshafen AG: SWOT Analysis

45 ZF Friedrichshafen AG: Geographic Presence

46 Autoliv Inc.: Company Snapshot

47 Autoliv Inc.: SWOT Analysis

48 Autoliv Inc.: Geographic Presence

49 Ashimori Industry Co. Ltd: Company Snapshot

50 Ashimori Industry Co. Ltd: SWOT Analysis

51 Ashimori Industry Co. Ltd: Geographic Presence

52 Joyson Safety Systems: Company Snapshot

53 Joyson Safety Systems: Swot Analysis

54 Joyson Safety Systems: Geographic Presence

55 ITW Automotive Products GmbH: Company Snapshot

56 ITW Automotive Products GmbH: SWOT Analysis

57 ITW Automotive Products GmbH: Geographic Presence

58 Continental AG: Company Snapshot

59 Continental AG: SWOT Analysis

60 Continental AG: Geographic Presence

61 Hyundai Mobis Co. Ltd : Company Snapshot

62 Hyundai Mobis Co. Ltd : SWOT Analysis

63 Hyundai Mobis Co. Ltd : Geographic Presence

64 Special Devices Inc.: Company Snapshot

65 Special Devices Inc.: SWOT Analysis

66 Special Devices Inc.: Geographic Presence

67 Iron Force Industrial Co. Ltd, Inc.: Company Snapshot

68 Iron Force Industrial Co. Ltd, Inc.: SWOT Analysis

69 Iron Force Industrial Co. Ltd, Inc.: Geographic Presence

70 Tokai Rika Co. Ltd: Company Snapshot

71 Tokai Rika Co. Ltd: SWOT Analysis

72 Tokai Rika Co. Ltd: Geographic Presence

73 Hasco Co. Ltd: Company Snapshot

74 Hasco Co. Ltd: SWOT Analysis

75 Hasco Co. Ltd: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global Automotive Seat Belts Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Seat Belts Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS