Global Automotive Turbocharger Market Size, Trends & Analysis - Forecasts to 2026 By Fuel Type (Diesel, Gasoline, Alternate Fuel/CNG), By Vehicle Type (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicle), By Technology (Variable Geometry Turbocharger (VGT/VNT), Wastegate Turbocharger, Electric Turbocharger), By Sales Channel (Original Equipment Manufacturer, Aftermarket), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

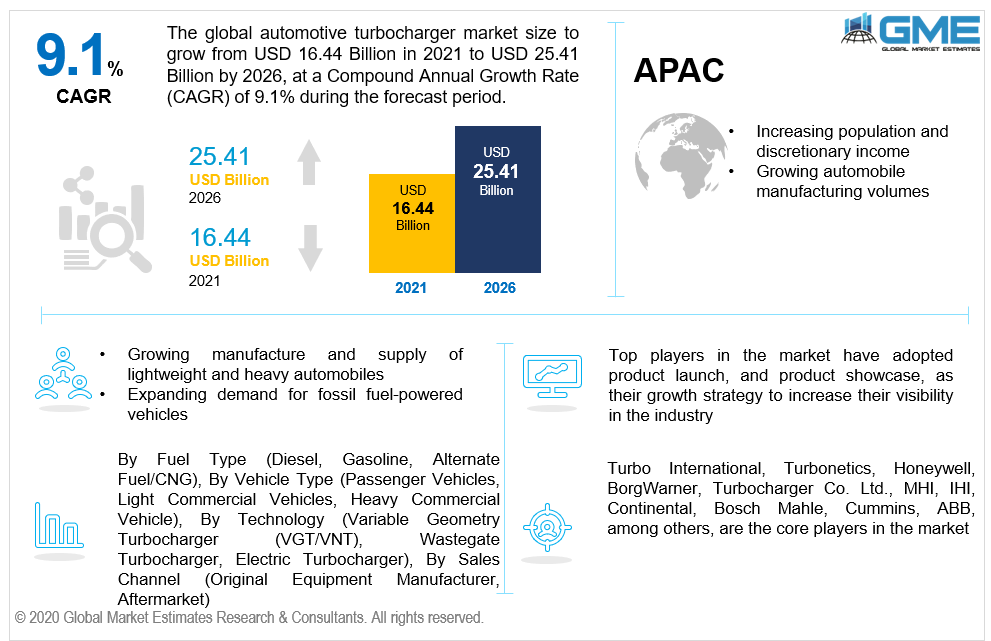

The global automotive turbocharger market is estimated to be valued at USD 16.44 billion in 2021 and is projected to reach USD 25.41 billion by 2026 at a CAGR of 9.1%. According to our automotive turbocharger market report, the transition towards direct gasoline engines is being driven by the rising movement of light-weighting engines in commercial vehicles, which is favorably stimulating the proliferation of automotive turbochargers.

Original equipment manufacturers (OEMs) are implementing engine-downsizing tactics to maximize vehicle fuel efficiency as a result of the increasing adoption of rigorous automobile emission standards around the world. This phenomenon is likely to increase the automotive turbocharger manufacturers market share, which serves an important function in reducing vehicle emissions and improving fuel economy. Additionally, the stable rise in demand for fossil fuel-powered vehicles in the global economy, due to determinants such as rising demographics and relatively high discretionary earnings, is foreseen to favorably impact the revenue rise in the national and international market.

Following its breakthrough in diesel engines, turbochargers were implemented in gasoline engines to improve the vehicle's fuel economy. The market for turbocharger-based engines for automobiles is continually expanding due to their tremendous performance in both types of fuel engines. Furthermore, as a result of government pollution management measures and an upsurge in the market for fuel-efficient vehicles, several countries around the world have taken significant steps to reduce emissions and their reliance on exhaustible resources. Turbochargers aid in the reduction of gasoline and diesel utilization by vehicles, as well as in the reduction of vehicular emissions. Perhaps it boosts fuel economy, and it is because of these considerations that the impetus for turbocharger technology application has grown stronger globally.

The global market is anticipated to be hampered by constraints, including a dearth of public understanding regarding car engines and the price point of turbochargers. In addition, despite tough rules, the constant rise in demand for zero-emission or electric vehicles, as well as the accelerated switch to hybrid vehicles, is likely to limit the expansion of the market.

Nonetheless, the major automotive manufacturers are investing extensively in research to discover and create improved technology in automobiles, so that they may provide their consumers with the most technically sophisticated models possible and sustain a strong market standing. Moreover, globally, the government is funding research to help the automotive sector grow, as well as launching numerous schemes and offering subsidies to encourage people to utilize automobiles.

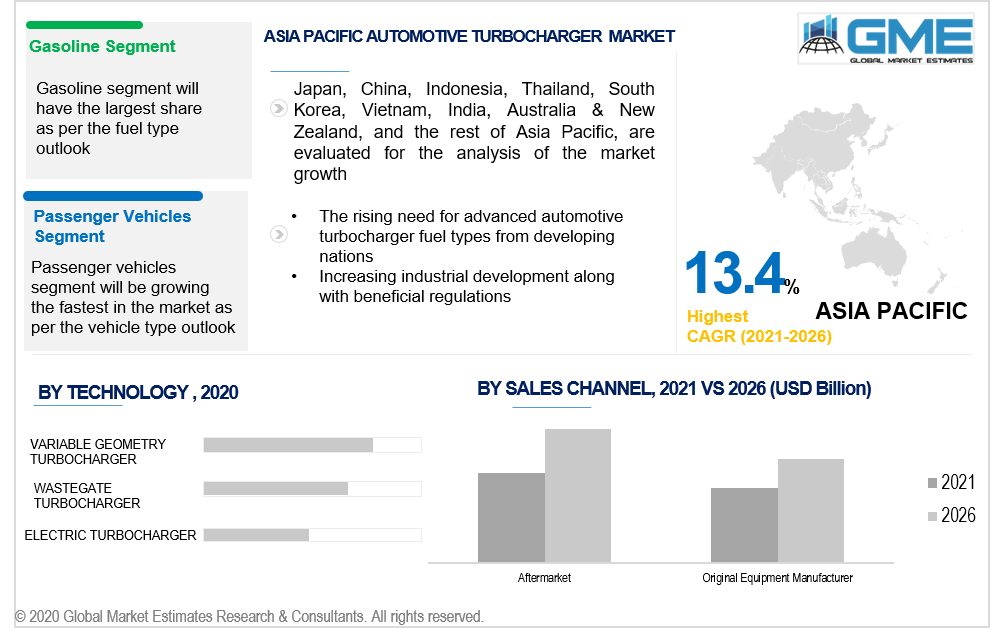

Depending on the fuel type, the market is categorized as diesel, gasoline, alternate fuel/CNG. Gasoline is foreseen to predominate. The market for such turbochargers will be driven by an improvement in the need for gasoline engines in light-duty automobiles. Although most commercial vehicles are diesel-powered and practically all of them have turbochargers, the diesel turbocharger field has evolved. However, the need for gasoline turbochargers is rapidly increasing because it complies with new automobile norms. The demand for gasoline turbochargers has grown as a result of the deployment of Turbocharged Gasoline Direct Injection Engines (TGDI) in gasoline automobiles, and stricter pollution standards will continue to push the market.

Depending on the vehicle type, the market is categorized as passenger vehicles, light commercial vehicles, and heavy commercial vehicles. The passenger car segment is presumed to report the largest market share due to consumers' growing preference for high-performance, and low-emission vehicles. Several major companies have produced fuel cell car turbochargers, which help to improve power production efficiency by delivering a healthy environment to fuel cell batteries. The emergence of fuel cell technology in the passenger vehicle market is likely to accelerate the aforesaid trend, propelling the turbocharger market forward. Furthermore, as discretionary income rises, so do the sales and manufacturing of passenger cars around the world. Consequently, the administration's strict emission laws and guidelines are likely to boost the market's growth even further.

Depending on the technology, the market is categorized as variable geometry turbocharger (VGT/VNT), wastegate turbocharger, electric turbocharger. Variable geometry turbocharger is foreseen to predominate. Owing to the advantages including no wastegate nozzle blocking, elevated air-fuel proportion & apex torque at low engine speeds, better operational accelerations without the necessity for turbines with rising pumping deficit at high engine speeds, a stronger capacity to protect a broader range of low BSFC in the engine speed–load realm, having the potential to give engine braking, ability to increase exhaust temperature for better engine management unit control, high level of emission compliance, and most importantly it is exclusively used in passenger vehicles.

Depending on the sales channel, the market is categorized as original equipment manufacturers (OEM) and aftermarket. Aftermarket is foreseen to predominate. The primary purpose of the aftermarket distribution channel in the market is to replace defective engine parts. The market need will be created by the rising requirement for engine parts in the vehicle sector as a result of recurrent engine part breakdowns Automotive component manufacturers are using e-commerce channels to sell aftermarket turbochargers to their buyers. Furthermore, system makers are emphasizing increasing their aftermarket share by providing consumers with long-term guarantees and solutions, which is propelling the market forward.

Europe is foreseen to hold the largest market share. The leading automobile corporations in the world are based in European nations, including Germany, France, Italy, and Spain. As a result, the area led the total market and is predicted to develop rapidly throughout the forecast period. Meanwhile, Europe, particularly nations like Italy and Spain, is one of the most hit areas by the COVID-19 epidemic. Furthermore, the combined influence of COVID-19 and Brexit is projected to slow growth in the United Kingdom. As a result, the possibility of a long rehabilitation phase from the epidemic's effects is likely to limit regional expansion.

Asia Pacific is expected to witness the highest CAGR over the forecast period, owing to growing automobile manufacturing volumes in economies including China, India, and the countries of Southeast Asia. Nonetheless, post-COVID19 epidemic uncertainty concerning automobile production patterns in the area is projected to have a detrimental influence on the entire market's development. Due to the nation's huge manufacturing volume of automobiles, China controls the total market for turbochargers in the area. Furthermore, China was one of the first nations to recuperate from COVID-19 and resume production. As a result, demand for turbochargers is likely to increase throughout the forecast period.

Turbo International, Turbonetics, Honeywell, BorgWarner, Turbocharger Co. Ltd., MHI, IHI, Continental, Bosch Mahle, Cummins, ABB, among others, are the core players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Automotive Turbocharger Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Fuel Type Overview

2.1.3 Vehicle Type Overview

2.1.4 Technology Overview

2.1.5 Sales Channel Overview

2.1.6 Regional Overview

Chapter 3 Global Automotive Turbocharger Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Stringent Vehicle Emission Regulations

3.3.1.2 Growing Demand for Fuel Efficient Vehicles.

3.3.2 Industry Challenges

3.3.2.1 Availability of Inexpensive Substitute Technology

3.4 Prospective Growth Scenario

3.4.1 Fuel Type Growth Scenario

3.4.2 Vehicle Type Growth Scenario

3.4.3 Technology Growth Scenario

3.4.4 Sales Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Automotive Turbocharger Market, By Fuel Type

4.1 Fuel Type Outlook

4.2 Diesel

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Gasoline

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Alternate Fuel/CNG

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Automotive Turbocharger Market, By Vehicle Type

5.1 Vehicle Type Outlook

5.2 Passenger Vehicles

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Light Commercial Vehicles

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Heavy Commercial Vehicle

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Automotive Turbocharger Market, By Technology

6.1 Technology Outlook

6.2 Variable Geometry Turbocharger (VGT/VNT)

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Wastegate Turbocharger

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Electric Turbocharger

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Automotive Turbocharger Market, By Sales Channel

7.1 Sales Channel Outlook

7.2 Original Equipment Manufacturer

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Aftermarket

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Automotive Turbocharger Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.2.3 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.2.4 Market Size, By Technology, 2019-2026 (USD Million)

8.2.5 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.6.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.3 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.5 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.4.3 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.4.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.5 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.4.9.2 Market size, By Vehicle Type, 2019-2026 (USD Million)

8.4.9.3 Market size, By Technology, 2019-2026 (USD Million)

8.4.9.4 Market size, By Sales Channel, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.5.3 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.5.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5.5 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.6.3 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6.5 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Fuel Type, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Vehicle Type, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Sales Channel, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Turbo International

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Turbonetics

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Honeywell

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 BorgWarner

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Turbocharger Co. Ltd.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Continental

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Bosch Mahle

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Cummins

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 ABB

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 MHI

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 IHI

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Other Companies

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

The Global Automotive Turbocharger Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Automotive Turbocharger Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS