Global Axle Dampers Market Size, Trends & Analysis - Forecasts to 2029 By Type (Double-tube Shaft Damper and Single-tube Shaft Damper), By Application (Commercial Vehicles and Passenger Vehicles), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

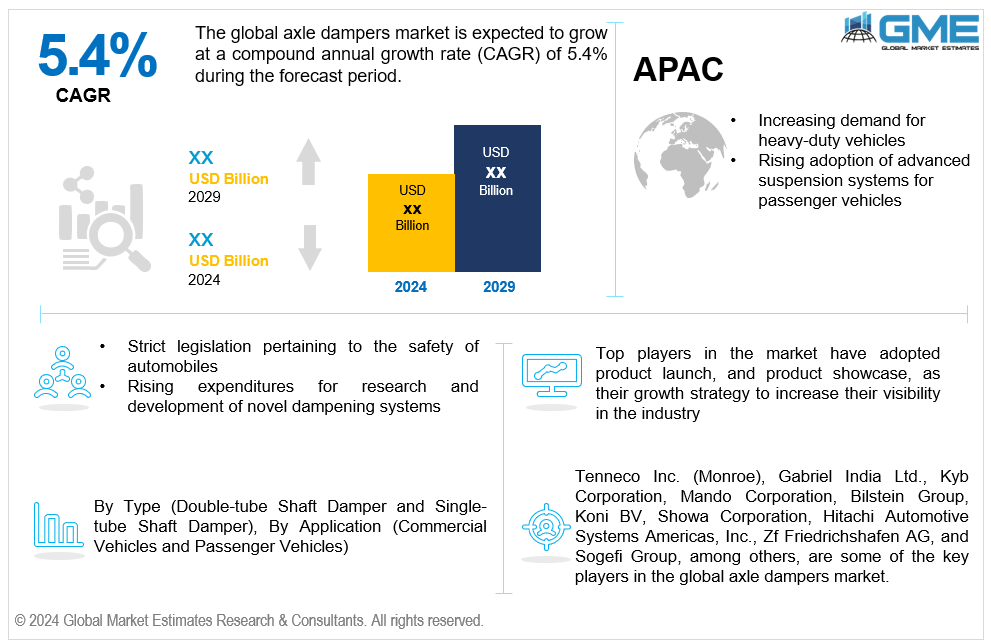

The global axle dampers market is estimated to exhibit a CAGR of 5.4% from 2024 to 2029.

The primary factors propelling the market growth are the increasing demand for heavy-duty vehicles and the rising adoption of advanced suspension systems for passenger vehicles. Axle vibration dampers, a crucial component of suspension damping systems, play a pivotal role in enhancing vehicle ride comfort and overall performance. As heavy-duty vehicles traverse diverse terrains and endure varying loads, the need for robust suspension system components becomes paramount. Manufacturers are continually innovating in vehicle damping technology to meet stringent performance and durability standards, thereby expanding the shock absorber market. Automotive suspension solutions are evolving to address specific challenges, such as axle vibrations, which affect vehicle stability and passenger comfort. This trend is affecting the way the automobile industry as a whole approaches improving ride comfort and operating economy in heavy-duty applications, in addition to promoting developments in axle dampers. For instance, the National Automobile Dealers Association reports that sales of commercial trucks exceeded 476,000 units worldwide in 2022.

Stringent legislation pertaining to the safety of automobiles and rising expenditures for research and development of novel dampening systems are anticipated to bolster market growth. Improvements in automotive ride quality are required by vehicle safety laws, guaranteeing a more comfortable and secure driving experience. Enhanced suspension dampening mechanisms are crucial for meeting these safety standards, as they directly impact the dampening coefficient of the vehicle's suspension system. By optimizing automotive vibration control, manufacturers are able to reduce the impact of road irregularities, thus improving passenger comfort and vehicle longevity. The development and integration of advanced axle suspension dampers play a pivotal role in vehicle stability enhancement, which is crucial for both safety and performance. Additionally, stringent regulations push for better suspension tuning technologies, which refine the balance between comfort and control, ensuring vehicles are both safe and pleasant to drive.

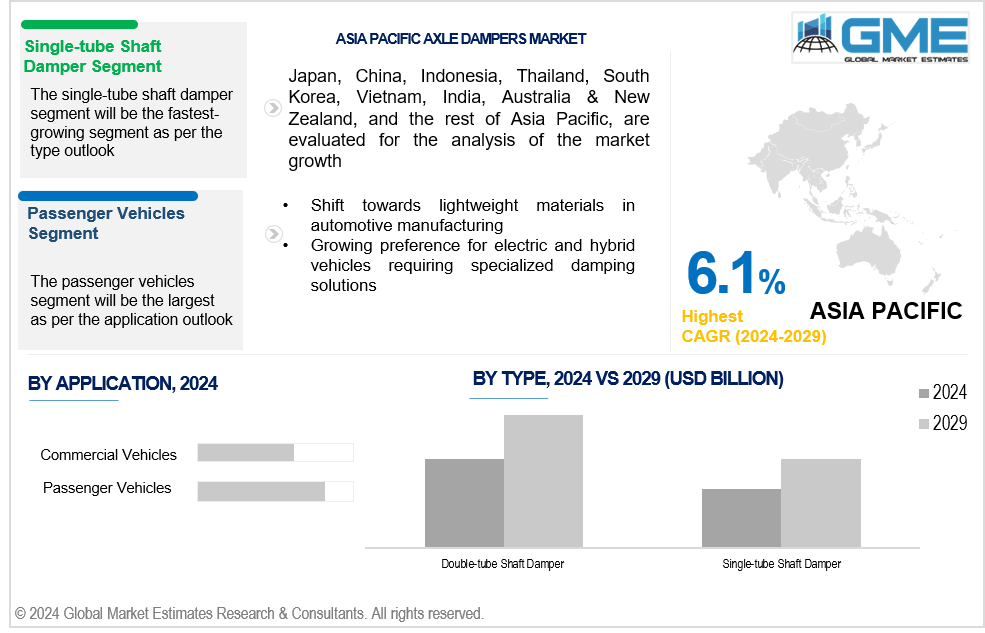

Shift towards lightweight materials in automotive manufacturing, coupled with the growing preference for electric and hybrid vehicles requiring specialized damping solutions, propel market growth. By incorporating lightweight materials in automotive chassis components, manufacturers can enhance fuel efficiency and reduce overall vehicle weight. This shift necessitates advanced damper strut assemblies that can effectively complement the lighter structures without compromising performance. As vehicles become lighter, the demand for efficient axle shock absorbers increases to maintain optimal vehicle handling dynamics and ensure stable driving conditions. Improved road shock absorption is essential to mitigate the effects of lighter chassis, leading to a heightened focus on vehicle suspension performance. The integration of advanced materials in these components helps achieve the delicate balance between durability and performance, driving innovation in the market.

Developments in materials science, such as the creation of strong, lightweight composite materials, present axle damper producers with opportunities to create more effective, long-lasting, and ecologically responsible products. Additionally, manufacturers have an opportunity to create smart dampers that integrate with advanced driver assistance systems (ADAS) to offer real-time adjustments and enhanced vehicle dynamics.

However, the high expense of developing cutting-edge dampening procedures and price fluctuations of raw materials limit market growth.

The double-tube shaft damper segment is expected to hold the largest share of the market over the forecast period. Double-tube dampers are frequently used in mass-market automobiles such as sedans, hatchbacks, and small SUVs. Due to the large production volume in these vehicle categories, there is a significant demand for them.

The single-tube shaft damper segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Single-tube dampers contribute to constant damping performance under high-stress circumstances as they dissipate heat more effectively than double-tube dampers. Due to this, they are excellent choices for a variety of vehicle applications, including performance and passenger automobiles.

The passenger vehicles segment is expected to hold the largest share of the market over the forecast period. In terms of production and sales, passenger cars make up the majority of the automotive market. The sheer number of passenger cars produced each year creates a large need for axle dampers.

The commercial vehicles segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. E-commerce is growing at an exponential rate, which has raised the need for effective logistics and transportation systems. Axle dampers that are both long-lasting and highly effective are becoming increasingly important as a result of the increase in the manufacturing and sales of commercial vehicles like delivery vans and trucks.

North America is expected to be the largest region in the global market. The growing adoption of electric and hybrid vehicles in North America necessitates specialized axle dampers designed to handle these vehicles' unique characteristics, which is driving the market growth in the region.

Asia Pacific is anticipated to witness rapid growth during the forecast period. With major contributions from nations like China, Japan, South Korea, and India, the region is one of the world's major centers for automobile production. The number of vehicles produced fuels the need for axle dampers, which are crucial parts of suspension systems.

Tenneco Inc. (Monroe), Gabriel India Ltd., Kyb Corporation, Mando Corporation, Bilstein Group, Koni BV, Showa Corporation, Hitachi Automotive Systems Americas, Inc., Zf Friedrichshafen AG, and Sogefi Group, among others, are some of the key players in the global axle dampers market.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL AXLE DAMPERS MARKET, BY Type

4.1 Introduction

4.2 Axle Dampers Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Double-tube Shaft Damper

4.4.1 Double-tube Shaft Damper Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Single-tube Shaft Damper

4.5.1 Single-tube Shaft Damper Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL AXLE DAMPERS MARKET, BY APPLICATION

5.1 Introduction

5.2 Axle Dampers Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Commercial Vehicles

5.4.1 Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Passenger Vehicles

5.5.1 Passenger Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL AXLE DAMPERS MARKET, BY REGION

6.1 Introduction

6.2 North America Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central and South America Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Axle Dampers Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Tenneco Inc. (Monroe)

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Gabriel India Ltd.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Kyb Corporation

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Mando Corporation

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Bilstein Group

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 KONI BV

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Showa Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Hitachi Automotive Systems Americas

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Zf Friedrichshafen AG

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Sogefi Group

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

2 Double-tube Shaft Damper Market, By Region, 2021-2029 (USD Mllion)

3 Single-tube Shaft Damper Market, By Region, 2021-2029 (USD Mllion)

4 Global Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

5 Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

6 Passenger Vehicles Market, By Region, 2021-2029 (USD Mllion)

7 Regional Analysis, 2021-2029 (USD Mllion)

8 North America Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

9 North America Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

10 North America Axle Dampers Market, By COUNTRY, 2021-2029 (USD Mllion)

11 U.S. Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

12 U.S. Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

13 Canada Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

14 Canada Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

15 Mexico Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

16 Mexico Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

17 Europe Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

18 Europe Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

19 EUROPE Axle Dampers Market, By COUNTRY, 2021-2029 (USD Mllion)

20 Germany Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

21 Germany Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

22 U.K. Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

23 U.K. Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

24 France Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

25 France Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

26 Italy Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

27 Italy Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

28 Spain Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

29 Spain Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

30 Netherlands Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

31 Netherlands Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

32 Rest Of Europe Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

33 Rest Of Europe Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

34 Asia Pacific Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

35 Asia Pacific Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

36 ASIA PACIFIC Axle Dampers Market, By COUNTRY, 2021-2029 (USD Mllion)

37 China Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

38 China Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

39 Japan Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

40 Japan Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

41 India Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

42 India Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

43 South Korea Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

44 South Korea Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

45 Singapore Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

46 Singapore Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

47 Thailand Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

48 Thailand Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

49 Malaysia Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

50 Malaysia Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

51 Indonesia Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

52 Indonesia Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

53 Vietnam Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

54 Vietnam Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

55 Taiwan Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

56 Taiwan Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

57 Rest of APAC Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

58 Rest of APAC Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

59 Middle East and Africa Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

60 Middle East and Africa Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

61 MIDDLE EAST & AFRICA Axle Dampers Market, By COUNTRY, 2021-2029 (USD Mllion)

62 Saudi Arabia Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

63 Saudi Arabia Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

64 UAE Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

65 UAE Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

66 Israel Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

67 Israel Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

68 South Africa Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

69 South Africa Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

70 Rest Of Middle East and Africa Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

71 Rest Of Middle East and Africa Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

72 Central and South America Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

73 Central and South America Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

74 CENTRAL AND SOUTH AMERICA Axle Dampers Market, By COUNTRY, 2021-2029 (USD Mllion)

75 Brazil Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

76 Brazil Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

77 Chile Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

78 Chile Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

79 Argentina Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

80 Argentina Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

81 Rest Of Central and South America Axle Dampers Market, By Type, 2021-2029 (USD Mllion)

82 Rest Of Central and South America Axle Dampers Market, By Application, 2021-2029 (USD Mllion)

83 Tenneco Inc. (monroe): Products & Services Offering

84 Gabriel India Ltd.: Products & Services Offering

85 Kyb Corporation: Products & Services Offering

86 Mando Corporation: Products & Services Offering

87 Bilstein Group: Products & Services Offering

88 KONI BV: Products & Services Offering

89 Showa Corporation: Products & Services Offering

90 Hitachi Automotive Systems Americas: Products & Services Offering

91 Zf Friedrichshafen AG, Inc: Products & Services Offering

92 Sogefi Group: Products & Services Offering

93 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Axle Dampers Market Overview

2 Global Axle Dampers Market Value From 2021-2029 (USD Mllion)

3 Global Axle Dampers Market Share, By Type (2023)

4 Global Axle Dampers Market Share, By Application (2023)

5 Global Axle Dampers Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Axle Dampers Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Axle Dampers Market

10 Impact Of Challenges On The Global Axle Dampers Market

11 Porter’s Five Forces Analysis

12 Global Axle Dampers Market: By Type Scope Key Takeaways

13 Global Axle Dampers Market, By Type Segment: Revenue Growth Analysis

14 Double-tube Shaft Damper Market, By Region, 2021-2029 (USD Mllion)

15 Single-tube Shaft Damper Market, By Region, 2021-2029 (USD Mllion)

16 Global Axle Dampers Market: By Application Scope Key Takeaways

17 Global Axle Dampers Market, By Application Segment: Revenue Growth Analysis

18 Commercial Vehicles Market, By Region, 2021-2029 (USD Mllion)

19 Passenger Vehicles Market, By Region, 2021-2029 (USD Mllion)

20 Regional Segment: Revenue Growth Analysis

21 Global Axle Dampers Market: Regional Analysis

22 North America Axle Dampers Market Overview

23 North America Axle Dampers Market, By Type

24 North America Axle Dampers Market, By Application

25 North America Axle Dampers Market, By Country

26 U.S. Axle Dampers Market, By Type

27 U.S. Axle Dampers Market, By Application

28 Canada Axle Dampers Market, By Type

29 Canada Axle Dampers Market, By Application

30 Mexico Axle Dampers Market, By Type

31 Mexico Axle Dampers Market, By Application

32 Four Quadrant Positioning Matrix

33 Company Market Share Analysis

34 Tenneco Inc. (monroe): Company Snapshot

35 Tenneco Inc. (monroe): SWOT Analysis

36 Tenneco Inc. (monroe): Geographic Presence

37 Gabriel India Ltd.: Company Snapshot

38 Gabriel India Ltd.: SWOT Analysis

39 Gabriel India Ltd.: Geographic Presence

40 Kyb Corporation: Company Snapshot

41 Kyb Corporation: SWOT Analysis

42 Kyb Corporation: Geographic Presence

43 Mando Corporation: Company Snapshot

44 Mando Corporation: Swot Analysis

45 Mando Corporation: Geographic Presence

46 Bilstein Group: Company Snapshot

47 Bilstein Group: SWOT Analysis

48 Bilstein Group: Geographic Presence

49 KONI BV: Company Snapshot

50 KONI BV: SWOT Analysis

51 KONI BV: Geographic Presence

52 Showa Corporation : Company Snapshot

53 Showa Corporation : SWOT Analysis

54 Showa Corporation : Geographic Presence

55 Hitachi Automotive Systems Americas: Company Snapshot

56 Hitachi Automotive Systems Americas: SWOT Analysis

57 Hitachi Automotive Systems Americas: Geographic Presence

58 Zf Friedrichshafen AG, Inc.: Company Snapshot

59 Zf Friedrichshafen AG, Inc.: SWOT Analysis

60 Zf Friedrichshafen AG, Inc.: Geographic Presence

61 Sogefi Group: Company Snapshot

62 Sogefi Group: SWOT Analysis

63 Sogefi Group: Geographic Presence

64 Other Companies: Company Snapshot

65 Other Companies: SWOT Analysis

66 Other Companies: Geographic Presence

The Global Axle Dampers Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Axle Dampers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS