Global Baggage Scanners Market Size, Trends & Analysis - Forecasts to 2026 By Product Size (Backpack X-Ray Scanner, Mail X-Ray Scanner, Small Size Baggage Scanner, Medium Size, Baggage Scanner, and Large Size Baggage Scanner) By End-Users (Aviation, Border Checkpoints, Ports, Critical Infrastructure); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

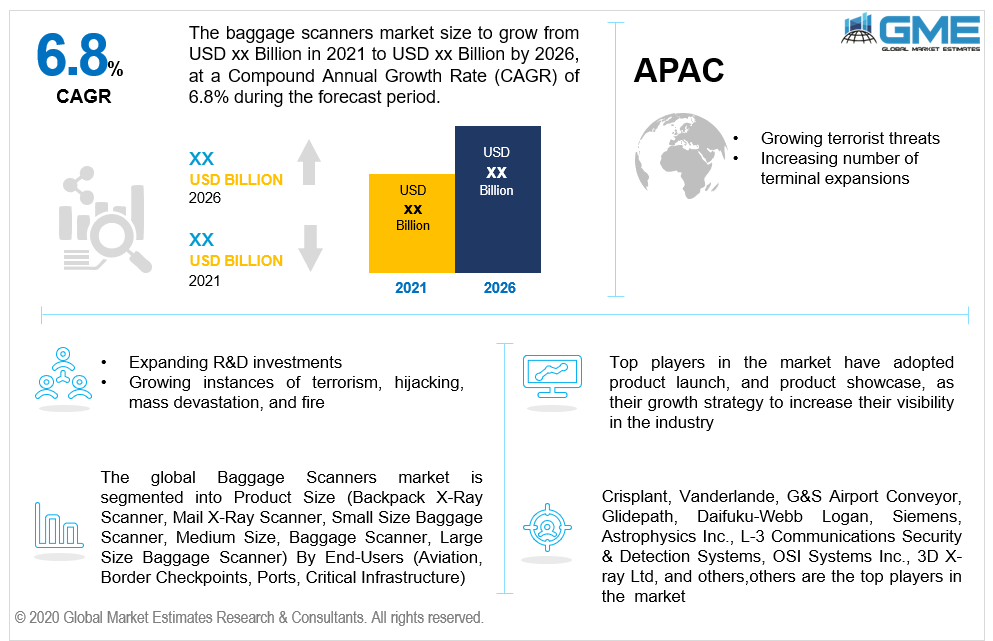

Increased usage of baggage scanners is estimated to fuel global market growth throughout the forecast period, attributable to considerations including growing terrorist activities all through the world, and also the construction and modernization of airports and railway stations. Furthermore, expanding government rules and regulations pertaining to public protection at airports and railway stations, as well as increased consciousness of security in public areas, are projected to drive expansion in the target market in the near future. Airport upgrades, a rising number of terminal expansions, and increased air passenger traffic are all reasons driving the use of baggage scanners. Increased terrorist threats, rising piracy, cross-border conflict, and an increase in cybercrime are among the main factors projected to boost market development. Baggage scanner technological advancements have greatly boosted industry expansion. A high pace of investment, along with a low rate of passenger growth, is projected to be a factor impeding the market growth.

Baggage scanners are advancing technologically as a result of increased security expenditures and manufacturer investments, establishing a trend in favor of the global baggage scanner market. During scanning, fluids, electrical devices, and gel items have to be separated from the baggage, but the equipment used in hospitals is currently being modified for baggage scanning purposes, providing a thorough image of the luggage and even finding a needle in a haystack. The increasing number of passengers increased R&D investments, and the threat of incidents like terrorism, hijacking, mass devastation, and fire are driving the growth of the global baggage scanner market. Countries with a high number of commuters, such as the United States, China, France, and Spain, are influencing the supply of luggage scanners to offer people security and calm. Airports in the United States screen about 2 million travelers every day, necessitating the use of quick and precise scanners.

Baggage scanners are used to guarantee national security at airports, railway stations, shipping ports, border posts, public events, and industrial buildings. Along with the increasing danger of extremism, an increase in drug smuggling, unlawful arms shipments, and cross-border migration via various forms of transportation are boosting the demand for baggage scanners at these facilities. With multiple aviation developments planned in the future years, airports are set to see an increase in the implementation of modern security equipment. Furthermore, the requirement for aviation authorities to modernize their current security equipment in order to comply with domestic and international aviation law will drive market demand.

Terrorist attacks are becoming more common throughout the world, which has alarmed the intelligence community. As a result of increased terrorist activity and resulting safety concerns, the requirement for security technologies like baggage scanners has skyrocketed in recent years. Recurrent terrorist threats, along with government support for the development of comprehensive surveillance architecture, portend well for industry growth. According to The Institute for Economics and Peace's most recent analysis, published in 2019, the yearly total of terror incidents nearly quadrupled between 2015 and 2018. With opponents' strength increasing at an unprecedented rate, such incidents will only become more common in future years. As a result, law enforcement and administration organizations throughout the world are sprucing up their security measures.

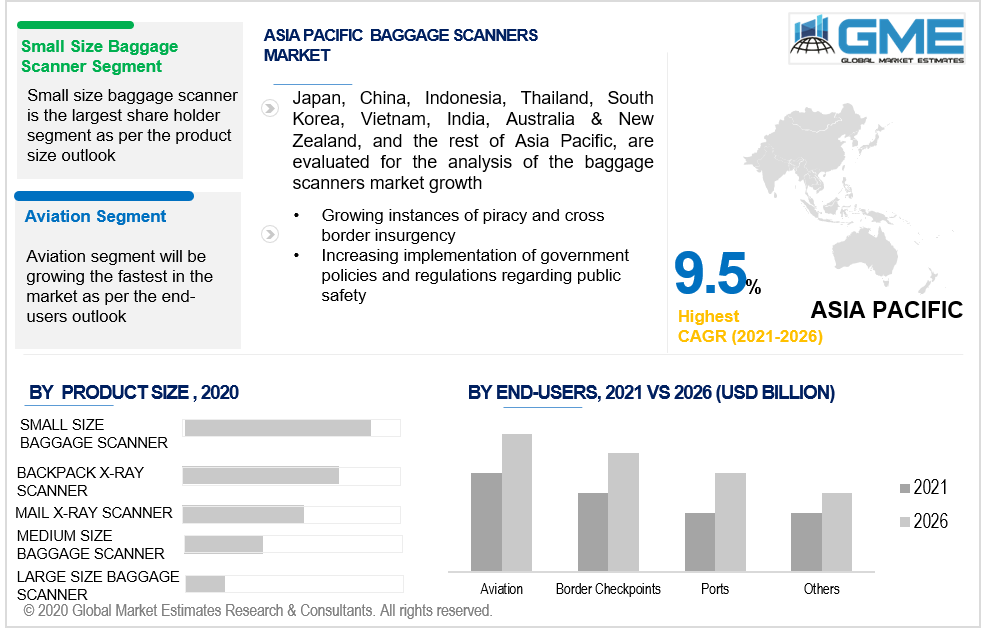

Based on the product size in the market, baggage scanners are divided into backpack x-ray scanners, mail x-ray scanners, a small size baggage scanner, a medium size, baggage scanner, and a large size baggage scanner. In terms of product size, small-size luggage scanners are foreseen to hold the largest market share. There is an unusually large number of tiny-sized baggage scanners, which are mostly utilized in locations where commuters carry on-the-go baggage, such as airports, train stations, retail malls, government offices, community centers, and sports clubs, among others. The value of baggage scanner shipping is the largest at airports, which use practically all types of baggage scanners. Hence, airports contribute to the growth of the global baggage scanner market.

Based on the type of end-user in the market, baggage scanners are divided into aviation, border checkpoints, ports, and critical infrastructure. Aviation is predicted to hold the largest market share. Manufacturers have been concentrating on the development of new goods for various applications due to fluctuating demand dependent on use. Increased terminal expansions, airport upgrades, and increased air passenger traffic are some of the causes driving the usage of baggage scanners at airports. Furthermore, the demand for greater security has risen as a result of heightened terror threats and cross-border insurgencies. As a result, the aforementioned factors propel market expansion.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Due to severe government rules and policies for community security at airports, railway stations, as well as other public areas in several nations in this area, the market in North America is likely to dominate the target market throughout the forecast period. Furthermore, the market in Europe is likely to expand at the second-fastest rate in regards to revenue over the forecast period, attributable to an increase in the number of travelers at railway stations and airports across the region. Moreover, the Asia Pacific market is predicted to grow significantly throughout the forecast period, on account of increasing tourism, exporting, and importing operations in multiple countries in this area.

Crisplant, Vanderlande, G&S Airport Conveyor, Glidepath, Daifuku-Webb Logan, Siemens, Astrophysics Inc., L-3 Communications Security & Detection Systems, OSI Systems Inc., 3D X-ray Ltd, and others, are the major players in the Baggage Scanners market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Baggage Scanners Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Size Overview

2.1.3 End-Users Overview

2.1.4 Regional Overview

Chapter 3 Global Baggage Scanners Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Implementation of Government Policies and Regulations Regarding Public Safety

3.3.1.2 Increasing Illegal and Terrorist Activities

3.3.2 Industry Challenges

3.3.2.1 Higher Installation Cost

3.4 Prospective Growth Scenario

3.4.1 Product Size Growth Scenario

3.4.2 End-Users Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Baggage Scanners Market, By Product Size

4.1 Product Size Outlook

4.2 Backpack X-Ray Scanner

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Mail X-Ray Scanner

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Small Size Baggage Scanner

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Medium Size Baggage Scanner

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Large Size Baggage Scanner

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Baggage Scanners Market, By End-Users

5.1 End-Users Outlook

5.2 Aviation

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Border Checkpoints

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Ports

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Critical Infrastructure

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Baggage Scanners Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Product Size, 2016-2026 (USD Million)

6.2.3 Market Size, By End-Users, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.2.4.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.2.5.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Product Size, 2016-2026 (USD Million)

6.3.3 Market Size, By End-Users, 2016-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.2.4.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.3.5.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.3.6.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.3.7.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.3.8.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.3.9.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Product Size, 2016-2026 (USD Million)

6.4.3 Market Size, By End-Users, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.4.4.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.4.5.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.4.6.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.4.7.2 Market size, By End-Users, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.4.8.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Product Size, 2016-2026 (USD Million)

6.5.3 Market Size, By End-Users, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.5.4.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.5.5.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.5.6.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Product Size, 2016-2026 (USD Million)

6.6.3 Market Size, By End-Users, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.6.4.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.6.5.2 Market Size, By End-Users, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Size, 2016-2026 (USD Million)

6.6.6.2 Market Size, By End-Users, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Crisplant

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Vanderlande

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 G&S Airport Conveyor

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Glidepath

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Daifuku-Webb Logan

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Siemens

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Astrophysics Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 L-3 Communications Security & Detection Systems

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 OSI Systems Inc.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 3D X-ray Ltd.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

The Global Baggage Scanners Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Baggage Scanners Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS