Global Barrier Films Flexible Electronics Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Flexible Electronics, Photovoltaic, Others), By Application (Consumer Electronics, Automotive, Defense & Aerospace, Medical and Healthcare, Energy, Power & Utility, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Barrier films are flexible barrier coating used to protect electronic displays and components from water, oxygen, and other environmental factors. Some photovoltaic-based electrical equipment or components can react with moisture or oxygen, causing the system to malfunction. These films have a wide range of applications and help to extend the life of devices while being durable and lightweight. These often do not impair the device's functionality and provide benefits over conventional types of safety such as glass, which is rigid and brittle. To increase market share, businesses in the market use acquisitions and mergers, as well as innovation and lower production costs.

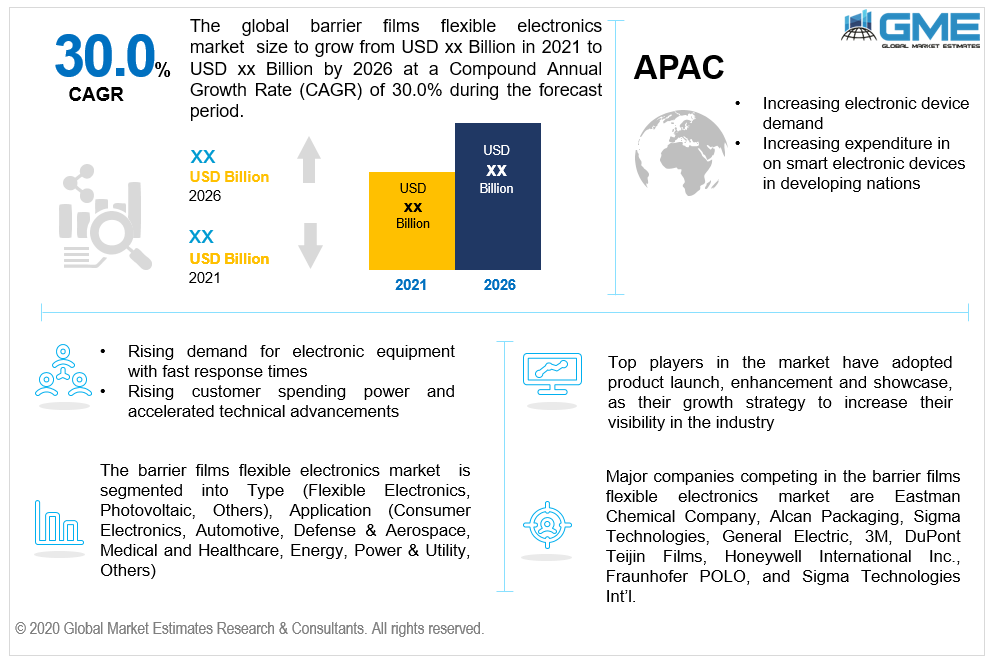

The market is anticipated to grow at a rapid pace in the near future. Flexible, organic, and printed electronics are encapsulated using flexible barrier films that maintain their functionality, flexibility, efficiency, and printability. Flexible barrier films are used in a variety of industries, including defense, healthcare, automobile, and electronic products. In comparison to glass, metal, and plastic substrates, flexible barrier films offer a higher degree of moisture and oxygen safety to electronic components. As a consequence, the resulting value loss is minimized. Flexible barrier films, on the other hand, still demand advances in substrate technology and material in order to balance encapsulation flexibility with electronic equipment. Over the forthcoming years, rising demand for electronic equipment with fast response times is anticipated to drive market development. Over the next few years, increasing demand for printed and organic electronic products is expected to be the primary driver of business expansion. Furthermore, rising customer spending power and accelerated technical advancements in electronic equipment are projected to boost demand growth for barrier films flexible electronics over the forecast period.

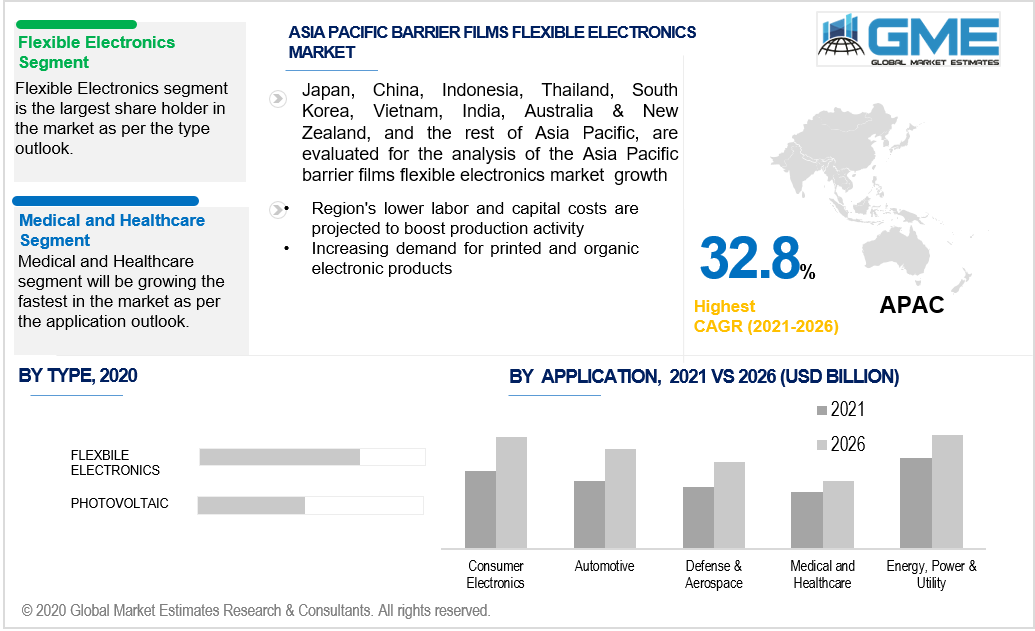

Global flexible barrier films for the electronics market are divided into two categories based on product type: photovoltaics, flexible electronics, and others. Flexible memory and flexible displays are two subcategories of the flexible electronics product type group. During the forecast period, flexible electronics is expected to dominate the market. Over the forecast period, the rising demand for flexible electronic displays for mobile phones is expected to drive the market's adoption of the device. Besides that, the market is anticipated to expand as demand for portable and smart devices rises. Furthermore, the market's growth is accelerated by the growth of printed electronics.

Based on application, the market has been categorized into automotive, power & utility, medical and healthcare, defense & aerospace, energy, consumer electronics, and others. Because of their numerous uses in the market, the medical and healthcare sub-segment is projected to have a significant share. The category is expected to expand due to the increased use of x-ray detectors, light therapies, lab-on-chip systems, smart plastics, healthcare photonics, and health monitoring devices. Flexible electronics' greatest benefit is its capability to blend onto a multitude of complex surfaces, like human skin, making wearable and biosensors devices production for human healthcare feasible. Wearable electronics with sensing capabilities are gaining traction as a propitious application for flexible / printed electronics. These instruments, which can be placed as a skin patch or inserted in an e-textile, allow for real-time recording and wireless transmission of parameters including temperature and heart rate.

Smartphones, televisions, and wearable devices are all forms of consumer electronics. This category also had the largest revenue, a pattern that is expected to increase from 2021-2026. It is mostly attributed to the extensive use of this technology in e-books, e-papers, tablets, and smartwatches, among other devices.

In 2020, North America was the most profitable region in the world. Various research universities dot the landscape, many of which are engaged in technology-related ventures. Furthermore, the emergence of a few main participants with barrier films flexible electronics-related competencies, equipment, process technology, and intellectual property is expected to accelerate regional development over the projected timeline. Because of exponentially increasing electronic device demand and increasing expenditure in the field, Asia Pacific is one of the product's most important markets. Besides, within the next five years, the region's lower labor and capital costs are projected to boost production activity. The barrier films flexible electronics market in the Asia Pacific is expected to rise at the highest rate across the globe. Moreover, after the APAC region, the European region will be growing the fastest in the market. Efforts to improve this technology, as shown by an incredibly diverse variety of EU-funded research programs, bolstered by robust regional and national efforts in nations such as the United Kingdom, Belgium, Finland, the Netherlands, and Germany, are projected to play a prominent part in boosting demand.

Major companies competing in the barrier films flexible electronics market are Eastman Chemical Company, Alcan Packaging, Sigma Technologies, General Electric, 3M, DuPont Teijin Films, Honeywell International Inc., Fraunhofer POLO, and Sigma Technologies.

Please note: This is not an exhaustive list of companies profiled in the report.

Fraunhofer Polymer Surfaces Alliance developed a method for altering films using a layering technique that is impervious to water vapor and oxygen while maintaining the film's flexibility and optical clarity. The technology is based on reactive sputtering-deposited oxide layers segregated by an intermediate polymer layer.

DuPont Teijin Films won the best technical development award for its me lines material, a polyester film that offers a clean on-demand surface to be used as a substrate in barrier film deposition operations. Since its inception, DuPont has served the growing flexible electronics market by designing flexible polymeric substrates that meet the needs of the electronics sector.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Barrier Films Flexible Electronics Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Barrier Films Flexible Electronics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Barrier Films Flexible Electronics

3.3.2 Industry Challenges

3.3.2.1 High Cost Associated With Smart and Latest Electronics for Developing Nations

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Barrier Films Flexible Electronics Market, By Type

4.1 Type Outlook

4.2 Flexible Electronics

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Photovoltaic

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Others

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Barrier Films Flexible Electronics Market, By Application

5.1 Application Outlook

5.2 Consumer Electronics

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Automotive

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Defense & Aerospace

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Medical and Healthcare

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Energy, Power & Utility

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Others

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Barrier Films Flexible Electronics Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Type, 2016-2026 (USD Million)

6.2.3 Market Size, By Application, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Type, 2016-2026 (USD Million)

6.3.3 Market Size, By Application, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Type, 2016-2026 (USD Million)

6.4.3 Market Size, By Application, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.7.2 Market size, By Application, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Type, 2016-2026 (USD Million)

6.5.3 Market Size, By Application, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Type, 2016-2026 (USD Million)

6.6.3 Market Size, By Application, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Eastman Chemical Company

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Alcan Packaging

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Sigma Technologies

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 General Electric

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 3M

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 DuPont

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Honeywell International Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Teijin Films

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Sigma Technologies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Barrier Films Flexible Electronics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Barrier Films Flexible Electronics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS