Global Beta-Glucan Market Size, Trends, and Analysis - Forecasts to 2026 By Source (Cereal, Mushroom, Yeasts, Seaweed), By Type (Soluble, Insoluble), By Application (Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Animal Feed, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

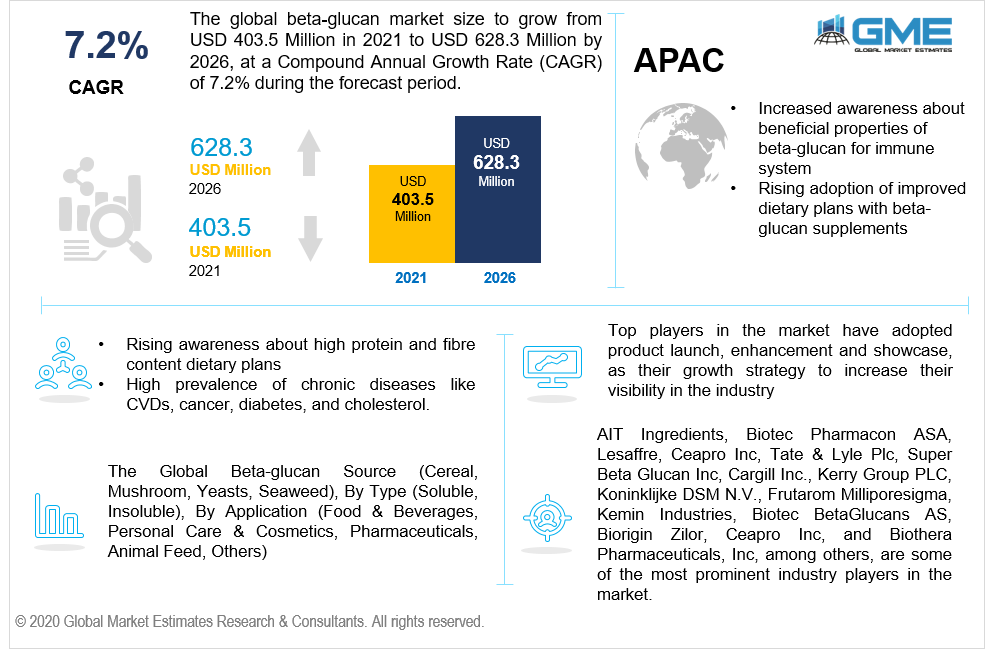

The global beta-glucan market is estimated to be valued at USD 403.5 million in 2021 and is projected to reach USD 628.3 million by 2026, at a CAGR of 7.2%. The demand for beta-glucan has increased drastically owing to rising awareness amongst users related to healthy dietary supplements across the globe. Beta-glucan is one of the most efficient sources to control the increasing cholesterol in the body. Studies have shown that approximately 93 million adults over 20 years and above age have reported higher cholesterol rates of 200 mg/dl in the United States. Heart diseases are highly prevalent in populations aging above 50-70 years; however, today, individuals being reported with heart diseases are considerable of a very young age mainly due to their highly unstable and unbalanced health and immune systems. The World Health Organization reports show that 17.9 million individuals are affected by severe heart diseases, and 4 out of the five individuals affected by these heart diseases are below the age of 70 years. The high prevalence of heart diseases and high cholesterol issues have accelerated the usage of these beta-glucan across the globe.

Beta-glucan are the type of sugar compounds or fibers that are majorly found on the cell walls of microorganisms like bacteria, algae, fungi, yeast, or plants. These fibers hold a significant role in the medical industry. Consumers around the world are becoming extremely health-conscious, and have high awareness about maintaining a good immune system. Hence because of these factors, the market for glucan will be rising rapidly from 2021-2026.

The U.S Food and Drug Administration (FDA) has recently published a study on the usefulness of beta-glucan to maintain a healthy heart. Their studies have also proved the fact that consuming beta-glucan in various forms reduces cholesterol rates by approximately 5 % to 7 % in an individual’s body. The growing number of diabetes patients around the world are also suggested to incorporate food containing beta-glucan components in it, as these fibers assist in reducing the risk of type 2 diabetes and also help control the blood sugar of those who already have diabetes. Also, the increasing rate of patients, especially women with cervical cancer, is growing across the globe. Beta-glucan is typically a common and standardly used treatment to cure cervical cancer. Hence, because of these factors the market for glucan will be exponentially increasing during the forecast period.

Besides the market being highly driven by the demand for beta-glucan to treat various diseases, the manufacturers and prominent industry players are bringing in a variety of products that have incorporated beta-glucan as a healthy option for the consumers.

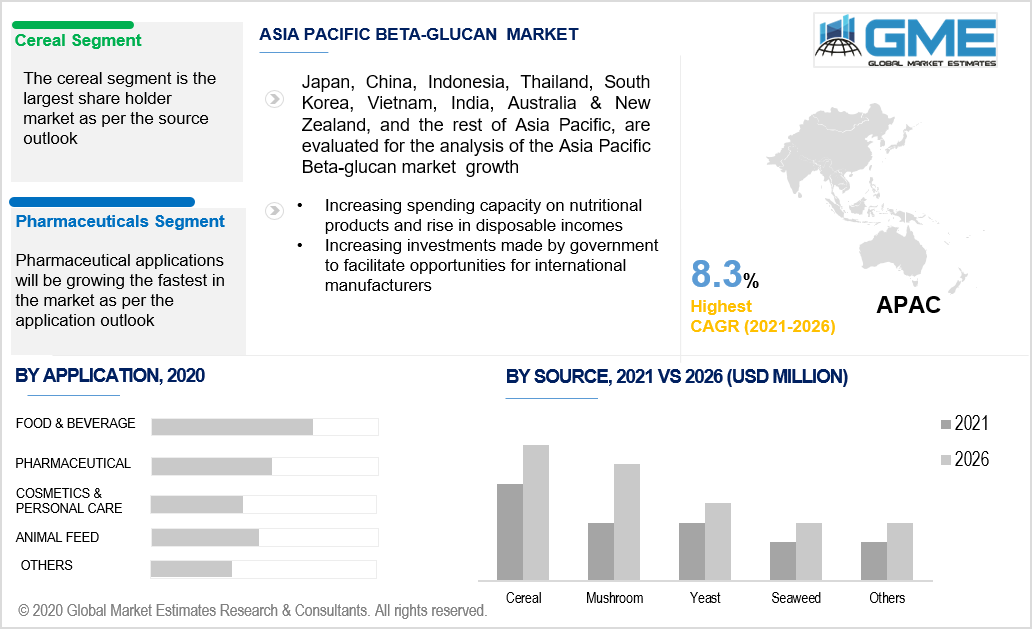

Based on the source, the beta-glucan market is segmented into cereal, mushroom, yeast, and seaweed. Amongst these, cereal is the majorly demanded source to incorporate beta-glucan into the dietary plans and hence will be the largest shareholder in the market. Cereals like oats and barley have a high concentration of beta-glucan, which is extremely helpful in controlling cholesterol and diabetes levels. These cereals like oat and barley are considered an option that promotes ease in cooking and saves time.

Mushrooms are expected to witness fast growth within the market during the forecast period. The beta-glucan content present in the mushroom makes it a highly demanded source for immune modulation and has anti-tumor properties.

Based on the type of beta-glucan, the market is segmented into soluble and insoluble types. The soluble type of beta-glucan holds a dominant position in the market as compared to the insoluble beta-glucan. Soluble type of beta-glucan efficiently dissolves in the water. Various food types consumed by individuals consist of varying ratios of soluble and insoluble beta-glucan. However, beta-glucan present in the sources like cereals and its supplementary forms like oats, barley, pulses, or other grains, are majorly soluble. These are highly demanded due to their soluble nature that makes digestive processes easy and assists the intestinal part to absorb all the required and essential fibers of beta-glucan from it.

Based on the application, the beta-glucan market can be segmented into food and beverages, pharmaceuticals, cosmetics & personal care, animal feed, and others. The food and beverage industry is the biggest user of beta-glucan for its various application purposes and hence holds a dominating position in the market. Sources of beta-glucan are cereals like oats, barley, pulses, grains, or plants like mushrooms and seaweed which are incorporated in various forms in an individual's diet. The increasing demand for these accelerates the growth of the food and beverage industry in the beta-glucan market compared to the rest of the applications.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

As per the geographic scope, the Asia-Pacific region has a dominant position in the market. The countries in the Asia Pacific region are experiencing an increase in their per capita income and are witnessing an increasing awareness regarding special food ingredients and supplements. Countries in the APAC region like India, Thailand, Bangladesh, and other countries are experiencing a constant increase in chronic diseases like heart issues, diabetes, and cholesterol issues amongst both geriatric and young individuals. On the other hand, North America will be the 2nd largest regional segment in the market.

AIT Ingredients, Biotec Pharmacon ASA, Lesaffre, Ceapro Inc, Tate & Lyle Plc, Super Beta Glucan Inc, Cargill Inc., Kerry Group PLC, Koninklijke DSM N.V., Frutarom Milliporesigma, Kemin Industries, Biotec BetaGlucans AS, Biorigin Zilor, Ceapro Inc, and Biothera Pharmaceuticals, Inc, among others, are some of the most prominent industry players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2020, Lesaffre acquired the majority of shares in Biohymn Biotechnology based in China. The company is specialized in the manufacturing of yeast extracts and yeast.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Beta-Glucan Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Type Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Beta-Glucan Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing application of beta-glucan in different industries

3.3.1.2 Increasing health consciousness among consumers

3.3.2 Industry Challenges

3.3.2.1 High cost of beta-glucan extraction

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Beta-Glucan Market, By Source

4.1 Source Outlook

4.2 Cereal

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Mushroom

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Yeasts

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Seaweed

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Global Beta-Glucan Market, By Type

5.1 Type Outlook

5.2 Insoluble

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Soluble

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Beta-Glucan Market, By Application

6.1 Application Outlook

6.2 Pharmaceuticals

6.2.1 Market size, By Region, 2020-2026 (USD Million)

6.3 Food & Beverages

6.3.1 Market size, By Region, 2020-2026 (USD Million)

6.4 Personal Care & Cosmetics

6.4.1 Market size, By Region, 2020-2026 (USD Million)

6.5.1 Market size, By Region, 2020-2026 (USD Million)

6.6 Others

6.5.1 Market size, By Region, 2020-2026 (USD Million)

Chapter 7 Global Beta-Glucan Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Source, 2020-2026 (USD Million)

7.2.3 Market Size, By Type, 2020-2026 (USD Million)

7.2.4 Market Size, By Application, 2020-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Source, 2020-2026 (USD Million)

7.2.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Source, 2020-2026 (USD Million)

7.2.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.2.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Source, 2020-2026 (USD Million)

7.3.3 Market Size, By Type, 2020-2026 (USD Million)

7.3.4 Market Size, By Application, 2020-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market Size, By Source, 2020-2026 (USD Million)

7.2.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Source, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Source, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Source, 2020-2026 (USD Million)

7.3.8.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Source, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Source, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Type, 2020-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Source, 2020-2026 (USD Million)

7.4.3 Market Size, By Type, 2020-2026 (USD Million)

7.4.4 Market Size, By Application, 2020-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Source, 2020-2026 (USD Million)

7.4.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.4.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Source, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Source, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Type, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Source, 2020-2026 (USD Million)

7.4.8.2 Market size, By Type, 2020-2026 (USD Million)

7.4.8.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Source, 2020-2026 (USD Million)

7.4.9.2 Market Size, By Type, 2020-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Source, 2020-2026 (USD Million)

7.5.3 Market Size, By Type, 2020-2026 (USD Million)

7.5.4 Market Size, By Application, 2020-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Source, 2020-2026 (USD Million)

7.5.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.5.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Source, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Source, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Type, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Source, 2020-2026 (USD Million)

7.6.3 Market Size, By Type, 2020-2026 (USD Million)

7.6.4 Market Size, By Application, 2020-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Source, 2020-2026 (USD Million)

7.6.5.2 Market Size, By Type, 2020-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Source, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Type, 2020-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Source, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Type, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Biotec Pharmacon ASA

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info-Graphic Analysis

8.3 Biothera Pharmaceticals

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Ceapro Inc

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Immunomedic AS

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Super Beta Glucan Inc

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 DSM NV

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Tate & Lyle plc (Tate & Lyle Oat Ingredients)

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Groupe Soufflet SA (AIT Ingredients)

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Zilor Inc (Biorigin)

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.11 Cargill Incorporated

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Beta-Glucan Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Beta-Glucan Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS