Global Bioherbicides Market Size, Trends & Analysis - Forecasts to 2026 By Source (Microbial, Biochemical, Others), By Application (Agricultural Crop [Fruits & Vegetables, Cereals & Pulses, Oilseeds & Grains], Non- Agricultural Crop [Plantation Crops, Turf & Ornamentals]) By Formulation (Granule, Liquid, Others), By Mode of Application (Seed Treatment, Foliar, Soil Formulation, Post-Harvest), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

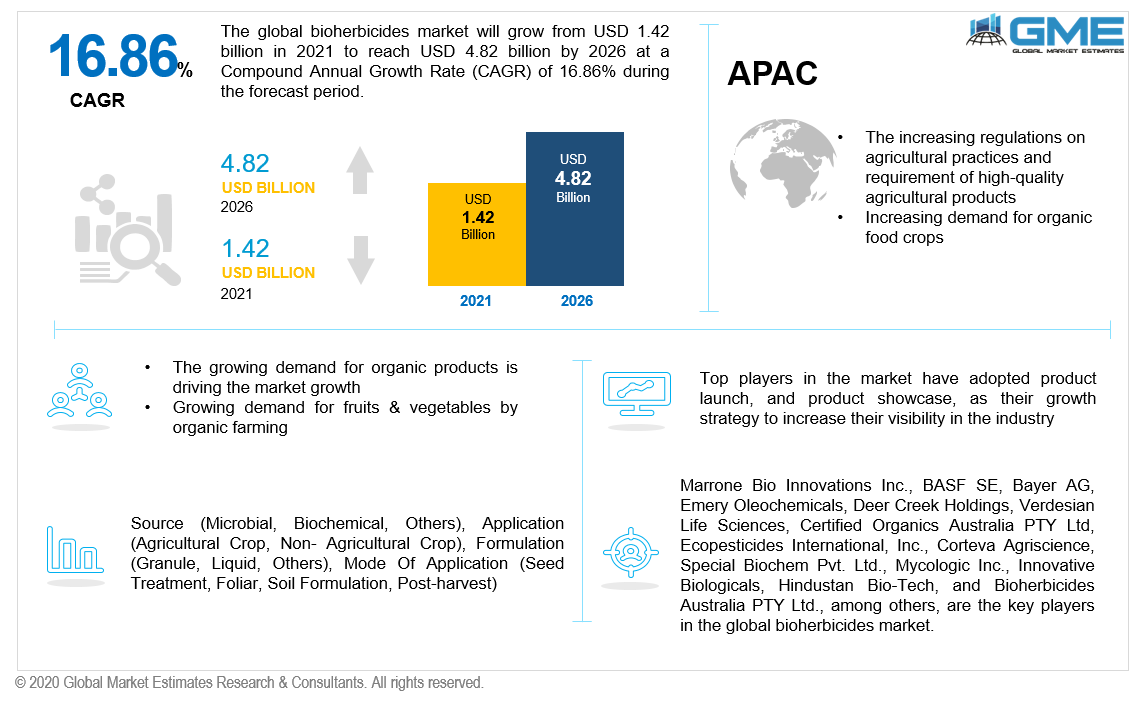

The global bioherbicides market is estimated to be valued at USD 1.42 billion in 2021 and is projected to reach USD 4.82 billion by 2026 at a CAGR of 16.86%.

The global bioherbicides market will grow rapidly owing to factors such as rising awareness of the benefits of bioherbicides in chemical-free farming, increasing demand for organic farming, and rising advancements to launch bioherbicides that are more effective against all types of weeds and unwanted plants.

Weeds in crop and vegetable fields reduce the soil’s physical properties, degrade the crop quality and ultimately increase the burden of labor costs too. Bioherbicides are organic herbicides/ biological agents that are used in agricultural practices to control the growth of weeds and unwanted plants. Hence, bioherbicides are a sustainable way to manage crop quality. As compared to synthetic herbicides, bioherbicides offer a high level of specificity against the targeted weed while causing no harm or damage to the healthy crop. Hence, the growing use of herbicides for organic farming is less toxic, less expensive, and less harmful to the environment than conventional fertilizers. These factors are supporting the growth of the market. The rising demand for bioherbicides from the organic horticulture industry for controlling weed coupled with the increasing government initiatives for promoting organic farming are accelerating the demand for bioherbicides in the market.

The increasing demand for organic vegetables, fruits, and crops, is mainly due to the rising consumption rate across developed and developing regions. However, fluctuations in raw material costs may act as a hindrance to the organic food market & bioherbicides market growth from 2021 to 2026.

The impact of COVID-19 was fairly positive owing to the rising demand for bioherbicides from the organic food industry, increasing awareness regarding chemical-free and nature-friendly farming, and rising health-consciousness amongst consumers across the globe.

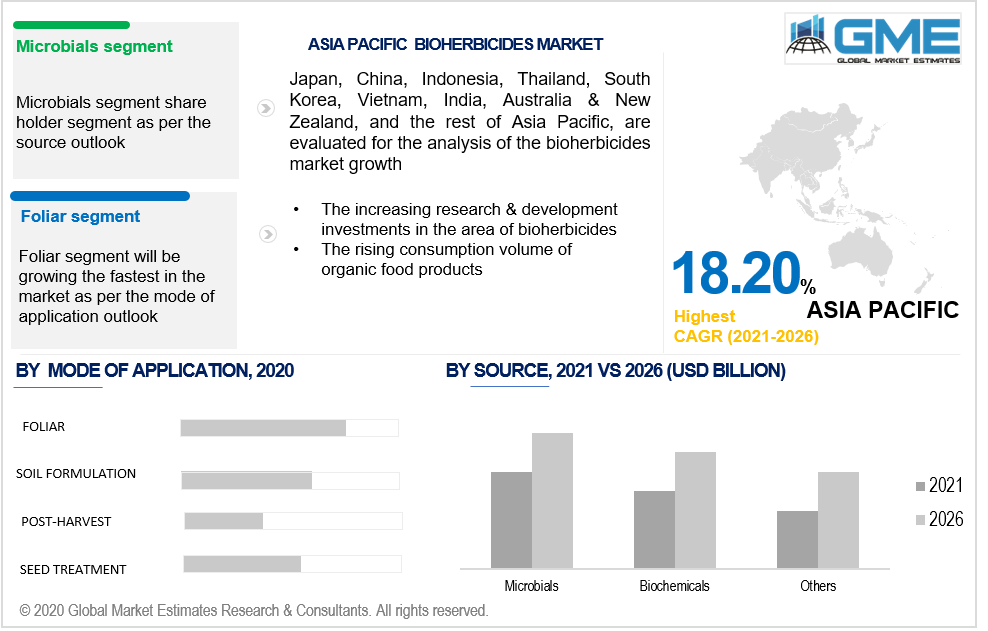

Depending on the source, the bioherbicides market is segmented into microbial, biochemical, and others. The microbial segment is expected to dominate the market during the forecast period [2021-2026]. This is mainly attributed to the increasing number of microbial herbicide product launch strategies by the top market players in developed and developing regions.

Weeds compete with crops for one or more plant growth factors such as mineral nutrients, water, solar energy, and space. However, microorganisms are the key active element in microbial bioherbicides, which inhibit weed development and protect crop quality. Microbial can control a wide range of weeds, but they can also be specific to a single weed.

The market bioherbicides and their applications include agricultural crops and non-agricultural crops. The non-agricultural crops is further sub-segmented into plantation crops, turfs & ornamentals, and agricultural crops is sub-segmented into fruits & vegetables, cereals & pulses, and oilseeds & grains.

The non-agricultural segment is expected to grow at a higher CAGR rate during the forecast period as compared to the latter one. Owing to stringent laws to abide by the Integrated Pest Management (IPM) Practices by both developed and developing region’s farmers, growing awareness about scientific maintenance of grasses, and rising market for organic farming, non-agricultural segment is expected to grow at a faster rate.

Moreover, bioherbicides are also used commercially to remove unnecessary weeds surrounding railway tracks, and hence this factor acts as a driving force for the market to grow in parallel industries too.

The agricultural crops segment is expected to hold the largest share of the market during the forecast period. Due to the widespread use of bioherbicides in the cultivation of fruits and vegetables, the segment is likely to withhold a strong position from 2021 to 2026. The rising demand for fruits and vegetables, combined with the growing popularity of organic herbicides for farming, is expected to drive segmental growth.

Depending on the mode of application, the market is categorized as a seed treatment, foliar, soil formulation, and post-harvest. The foliar application is anticipated to grow the fastest during the forecast period of 2021 to 2026. However, the seed treatment segment is expected to hold the largest share of the global bioherbicides market during the forecast period.

Due to increasing demand for better-quality agricultural products and increasing stringent agricultural practice norms to use bioherbicides by the governments of Asian countries, the Asia Pacific region is expected to grow at the highest CAGR rate during the forecast period.

Moreover, rising awareness about the environmental hazards of synthetic fertilizers along with the growing popularity of organically grown foods among consumers in developing countries such as India, China, Japan and Malaysia, etc. are some of the factors driving the bioherbicides market in this region.

North America is analyzed to be the second-largest bioherbicides market. Countries like United States and Canada led the market owing to the rising awareness of organic farming along with the implementation of stringent agriculture and environmental safety norms to use environment-friendly herbicides and pesticides. In addition, regional government initiatives intended to improve crop and seed safety are expected to play a significant role in propelling the North American bioherbicides market during the forecast period of 2021 to 2026.

Marrone Bio Innovations Inc., BASF SE, Bayer AG, Emery Oleochemicals, Deer Creek Holdings, Verdesian Life Sciences, Certified Organics Australia PTY Ltd, Ecopesticides International, Inc., Corteva Agriscience, Special Biochem Pvt. Ltd., Mycologic Inc., Innovative Biologicals, Hindustan Bio-Tech, and Bioherbicides Australia PTY Ltd., among others, are the key players in the global bioherbicides market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2019, American Vanguard Corporation entered into a collaboration with Corteva Agriscience for their herbicide brands. The products are tank-mix partners for a variety of common agricultural herbicides launched for the United States market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Bioherbicides Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Formulation Overview

2.1.4 Mode of Application Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Bioherbicides Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The growing demand for organic products

3.3.2 Industry Challenges

3.3.2.1 Lack of consumer awareness and adoption of bioherbicides

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Mode of Application Growth Scenario

3.4.4 Formulation Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Bioherbicides Market, By Source

4.1 Source Outlook

4.2 Microbials

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Biochemicals

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Others

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Bioherbicides Market, By Formulation

5.1 Formulation Outlook

5.2 Granule

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Liquids

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Others

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Bioherbicides Market, By Mode of Application

6.1 Mode of Application Outlook

6.2 Seed Treatment

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Foliar

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Soil Formulation

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Post-Harvest

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Bioherbicides Market, By Application

7.1 Application Outlook

7.2 Non -Agricultural Group

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2.1 Plantation Crops Market Size, By Region, 2020-2026 (USD Billion)

7.2.1 Turf & Ornamentals Market Size, By Region, 2020-2026 (USD Billion)

7.3 Agricultural Crop

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3.1.1 Fruits & Vegetables Market Size, By Region, 2020-2026 (USD Billion)

7.3.1.2 Cereals & Pulses Market Size, By Region, 2020-2026 (USD Billion)

7.3.1.3 Oilseeds & Grains Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Bioherbicides Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Source, 2020-2026 (USD Billion)

8.2.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.2.5 Market Size, By Formulation, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Source, 2020-2026 (USD Billion)

8.3.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.4 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.5 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Source, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Source, 2020-2026 (USD Billion)

8.4.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.4 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.4.5 Market Size, By Formulation, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Source, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Source, 2020-2026 (USD Billion)

8.5.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.4 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.5.5 Market Size, By Formulation, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Source, 2020-2026 (USD Billion)

8.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.4 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.6.5 Market Size, By Formulation, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Source, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Source, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Formulation, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Source, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Mode of Application, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Formulation, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 BASF SE

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Bayer AG

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Marrone Bio Innovations Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 Corteva Agriscience

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Verdesian Life Sciences

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Special Biochem Pvt. Ltd

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Mycologic Inc

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 Bioherbicides Australia PTY Ltd

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 Emery Oleochemicals

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Certified Organics Australia PTY Ltd

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Bioherbicides Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bioherbicides Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS