Global Bioinformatics in IVD Testing Market Size, Trends & Analysis - Forecasts to 2026 By Type (Hardware, Software), By Application (Cardiovascular Diseases, Chronic Diseases, Diabetes, Cancer, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

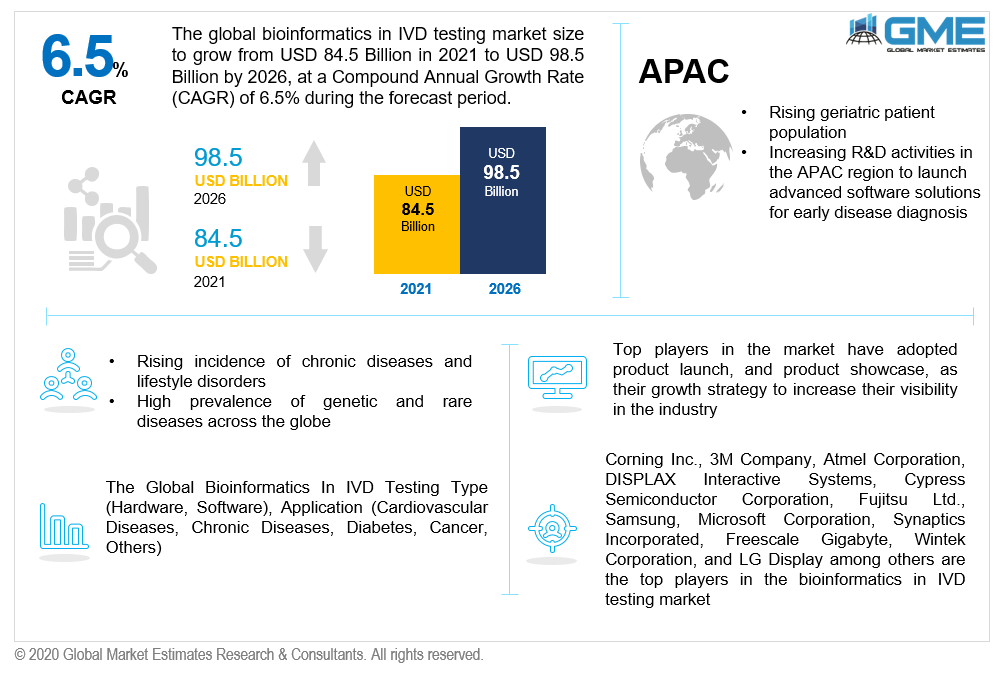

The global bioinformatics in IVD testing market size will grow from USD 84.5 Billion in 2021 to USD 98.5 Billion by 2026, with a CAGR value of 6.5%. The Bioinformatics in the IVD Testing market will witness substantial growth mainly due to factors such as increasing prevalence of chronic diseases, genetic disorders, rising geriatric population, growing awareness related to early disease diagnosis, government initiatives for funding research activities, and increasing product launch strategies in the industry. With the increasing prevalence of diseases such as cancer and HIV, the global bioinformatics in the IVD testing market is growing rapidly. There has been a significant increase in demand for proteomics, mass spectroscopy, DNA sequencing, and genomic-based instruments and technologies which will support the market growth.

Bioinformatics is a multidisciplinary research area that combines biology, computer science, mathematics, and statistics to manage the ever-increasing amount of biological data. Bioinformatics-based testing has greatly aided cancer detection and treatment planning. Its use in infectious disease diagnostics allows for identifying difficult-to-culture pathogenic bacteria or viruses, as well as the investigation of infection epidemiology.

Bioinformatics use in identifying and analyzing human gene mutations is a breakthrough to diagnose common illnesses, inherited diseases, and various forms of cancer, also to forecast the prognosis of malignant diseases.

Increased demand for nucleic acid and protein sequencing, increased initiatives from private and government agencies, increased proteomics and genomics research, and increased molecular biology and drug discovery research are the other factors that enhance the market. Low-cost genome sequencing has caused a proliferation of genetic knowledge on diseases and health, which is another factor driving the bioinformatics market in IVD research. Another important reason for this market to grow is the rising partnership strategies between bioinformatics IVD companies with IT companies to develop specialized devices and solutions for the diagnosis of hereditary or incurable diseases. Cancer detection and therapy management have benefited greatly from the bioinformatics-based analysis. It also enables the detection of difficult culture pathogens (viruses or bacteria) to gain a better understanding of infection epidemiology. In the IVD research industry, bioinformatics diagnoses hereditary diseases, common illnesses, and also predicts the onset of cancer.

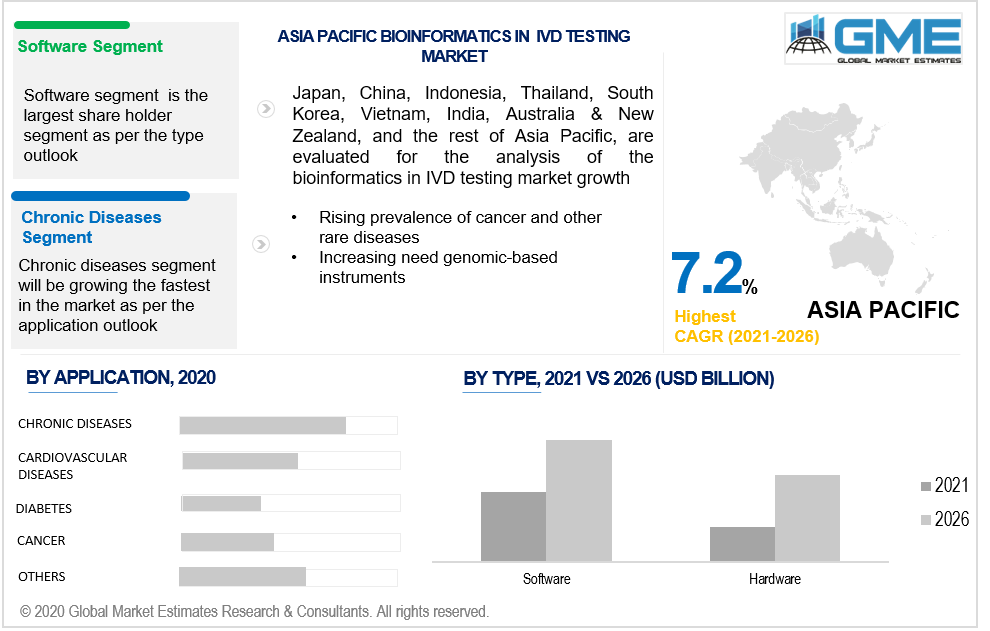

Based on type, the market is segmented into hardware and software. During the forecast period, the market for Software type is estimated to grow at the highest CAGR value from 2021 to 2026. Bioinformatics software and applications are used to collect, evaluate, store, and integrate biological and genetic data. These can be used to develop gene-based drugs in the future. Pathologists, healthcare workers, doctors, and physicians can now cultivate viruses and harmful bacteria using computer diagnostics.

Based on application, the market is segmented into cardiovascular diseases, chronic diseases, diabetes, and cancer, among others. During the forecast period of 2021 to 2026, the market for chronic diseases is estimated to grow at the highest compound annual growth rate. In terms of volume, the heart disease group holds the largest market share. This is due to the high prevalence of cardiovascular and rare heart disease in developing countries and improvements in lifestyle leading to other chronic disease spurs. Moreover, the high obesity rate driving up the number of diabetic patients and ultimately leading the segment to grow rapidly. The rising prevalence of chronic diseases (cancer, cardiovascular disease, and neurological disease) and high awareness and understanding of the effects of life-threatening diseases are driving demand for solutions that can provide resources to improve patient health at a reasonable cost. These drivers largely contribute to the growth of the market from 2021 to 2026.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Due to rising health consciousness, increasing patient spending capabilities, rising early disease diagnosis awareness, North America currently holds the largest market share in this market. The bioinformatics in the IVD testing market is expected to be driven by a large number of healthcare investments in the European region too. Furthermore, the high adoption of IoT technologies in this industry is expected to have a positive effect on regional market development. Furthermore, the bioinformatics market in this area is expected to be primarily driven by key countries such as the United Kingdom, France, and Italy. It is discovered that North America and Europe are the most mature markets, owing to the region's state-of-the-art healthcare infrastructure and early adoption of cutting-edge technologies. For the same reasons, the European economy has taken a dominant role Meanwhile, bioinformatics in IVD testing markets in the Asia Pacific and Latin America are fast expanding because of the region's strengthening healthcare infrastructure.

As a result of the rising incidence of cancer and other uncommon diseases, in Asia-Pacific, the region is expected to dominate the market during the forecast period. The market for technologically advanced medicines rises in tandem with the world's population. Cancer is common in developing countries and cities that promote business development, such as Japan, Hong Kong, and India.

ABB Group, Siemens, Weg, Parker Hannifin Corp., Nidec Motor Corporation, ASTRO Motorengesellschaft mbH & Co.KG, Illumina, Allied Motion Technologies Inc., Maxon motor AG, Buhler Motor GmbH, Kollmorgen Corp are the top players in bioinformatics in IVD testing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2021, Illumina launched pan-cancer IVD Test, a cloud-based bioinformatics platform, and increased its market visibility.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Bioinformatics In IVD Testing Industry Overview, 2020-2026

2.1.1 Type Overview

2.1.2 Application Overview

Chapter 3 Global Bioinformatics In IVD Testing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing awareness related to the use of biobanks

3.3.1.2 Growing prevalence of cancer and other rare life-threatening disorders

3.3.2 Industry Challenges

3.3.2.1 High capital investment

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Bioinformatics In IVD Testing Market, By Type

4.1 Type Outlook

4.2 Hardware

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Software

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Bioinformatics In IVD Testing Market, By Application

5.1 Application Outlook

5.2 Chronic Diseases

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Cardiovascular Diseases

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Diabetes

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Cancer

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Bioinformatics In IVD Testing Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Aperio Technologies, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Medtronic Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Chronix Biomedical Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Everist Genomics, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 IBM Corporation

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Signal Genetics

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Biodiscovery, Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 Silicon Valley Biosystems

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Affymetrix

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Datech Oncology

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Bioinformatics in IVD Testing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Bioinformatics in IVD Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS