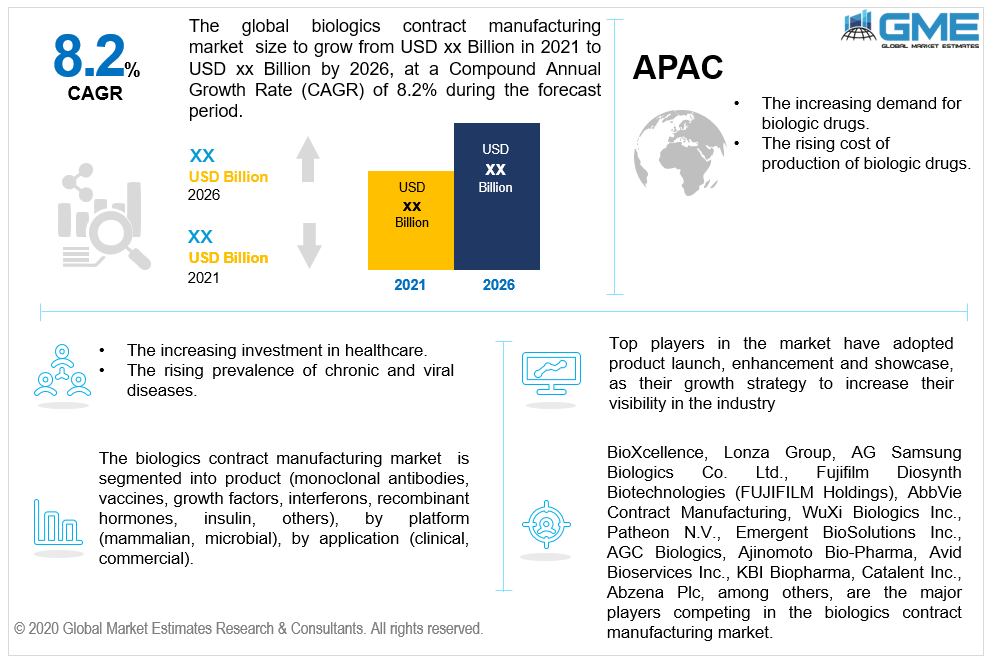

Global Biologics Contract Manufacturing Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Monoclonal Antibodies, Vaccines, Growth Factors, Interferons, Recombinant Hormones, Insulin, Others), By Platform (Mammalian, Microbial), By Application (Clinical, Commercial), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Biologics are bioengineered protein-based drugs that target specific areas of the immune system. Biologic drugs are different from chemically synthesized drugs as biologics are manufactured from organic sources. Growing instances of chronic diseases and viral outbreaks of H1N1, COVID, among others have increased the need for biological drugs in the market. Companies have to meet the growing demand and are slowly beginning to outsource various stages of pharmaceutical manufacturing from development and innovation to contract to manufacture. Governments are also incentivizing the development of pharmaceutical drug manufacturing facilities. For instance, the Singaporean government attracted biologic contract manufacturing investment of around USD 1 billion. Small and medium-sized companies are often unable to bear the costs of having an in-house manufacturing facility with state-of-the-art equipment. Companies have to conduct clinical trials, manufacture the drugs and then distribute them, if a product fails in the market the cost incurred will be high. Biological contract manufacturers conduct clinical trials for the company, manufacture, and package the product for their client company. The increasing regulations and increased clinical trials required before a drug can be released have also increased the demand for contract manufacturing. The biologic contract manufacturing market is driven by the increasing number of small and medium pharmaceutical manufacturing companies, strict regulations by governments, increased incidences of chronic diseases and viral outbreaks, increasing drug production cost, and the growing demand for pharmaceutical drugs. Biologic contract manufacturing companies offer companies their dedicated equipment which can be utilized by the client at their convenience, this gives the clients access to state-of-the-art equipment without the overhead costs of having an in-house manufacturing facility. Biologic contract manufacturing allows pharmaceutical companies to sell their products at reduced prices which can increase the demand for their drug in the market and improve their market share. The risingstringent government norms and regulations for drug approval, intellectual property rights, availability of skilled labor force are major restraints to the growth of the biologics contract manufacturing market.

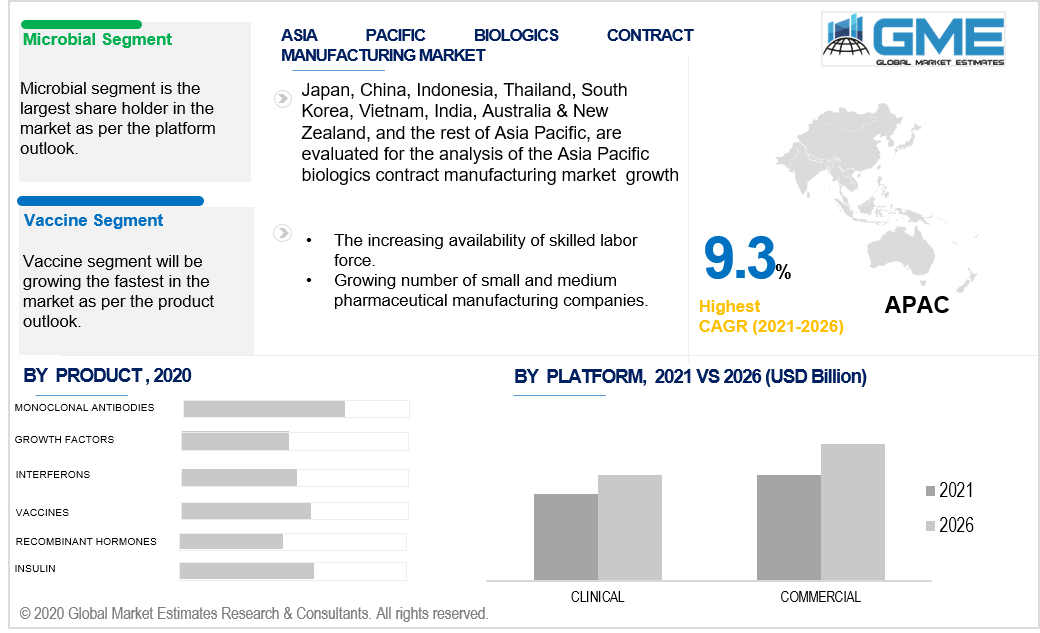

Based on the product, the market can be segmented as monoclonal antibodies, vaccines, growth factors, interferons, recombinant hormones, insulin, and others. The monoclonal antibodies are the dominant segment in the market while the vaccines segment is the fastest-growing segment in the biological contract manufacturing market. Monoclonal antibodies are widely used due to their ability to attack unhealthy cells while leaving healthy cells alone. This has seen them being widely used in cancer treatment, autoimmune disease treatment, etc. Vaccines are the fastest-growing segment due to the rising number of viral outbreaks in recent years. The growing population has increased the demand for vaccines in the market. The cheaper the manufacturing cost for producing vaccines, the greater will be their profit margins. Biologic contract manufacturing vendors help pharmaceutical companies to reduce the manufacturing cost of vaccines and allow them to sell them at a lower market price. Also, pharmaceutical companies have to keep up production with the increase in demand for vaccines. The current COVID situation has increased the demand for biologic contract manufacturers as there is a high demand for COVID vaccines and pharmaceutical companies have to rely on biologic contract manufacturing vendors to meet the market demand.

According to the application analysis, the segments are mammalian and microbial. The microbial segment held the largest share of the biological contract manufacturing market as the number of drugs that are synthesized from microbial sources like yeast and E.Coli are significantly higher than mammalian sources. The increasing demand for gene therapy has seen people move back to using microbial-based drugs rather than mammalian. Recombinant proteins were being generally produced from mammalian sources but recently pharmaceutical companies are switching back to microbial-based sources for producing recombinant drugs. The mammalian-based drug segment is still expected to grow at the fastest rate during the forecast period.

Based on the end application of biological drugs, the market can be segmented into clinical and commercial segments. The commercial segments held the largest market share in the biological contract manufacturing market. Commercial drugs are in high demand and are one of the driving factors for the increased demand for biologic contract manufacturing. Clinical drugs are those manufactured during the testing phase before they can be sent into the market. Pharmaceutical companies usually conduct their clinical trials and only contract out the manufacturing of drugs or at best drugs that are at phase III of clinical trials to biologic contract manufacturing vendors.

North American held the largest share of the biological contract manufacturing marketdue to the increasing demand for pharmaceutical drugs due to a large number of aged populations and heavy investments in the healthcare sector. The increased regulations placed on pharmaceutical companies by the FDA have driven the market in this region. The increasing number of incidences of chronic diseases is another major driver in this region. The APAC region showed the fastest growth among all regions. The APAC region’s growth is driven by the increasing number of small and medium pharmaceutical companies to whom larger pharmaceutical companies are outsourcing their drug manufacturing. The growing number of skilled labor in the region along with the growing government investment in healthcare are also major drivers in the region.

Lonza Group, BioXcellence, AG Samsung Biologics Co. Ltd., AbbVie Contract Manufacturing, Fujifilm Diosynth Biotechnologies (FUJIFILM Holdings), WuXi BiologicsInc., AGC Biologics, Ajinomoto Bio-Pharma, Patheon N.V., Emergent BioSolutions Inc., Avid Bioservices Inc., Catalent Inc., KBI Biopharma, and Abzena Plc, among others, are the major vendors competing in the biologics contract manufacturing market.

Please note: This is not an exhaustive list of companies profiled in the report.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Biologics Contract Manufacturing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biologics Contract Manufacturing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS