Global Biosensors Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Thermal, Electrochemical, Piezoelectric, and Optical), By Application (Medical, Food Toxicity, Bioreactor, Agriculture, Environment, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

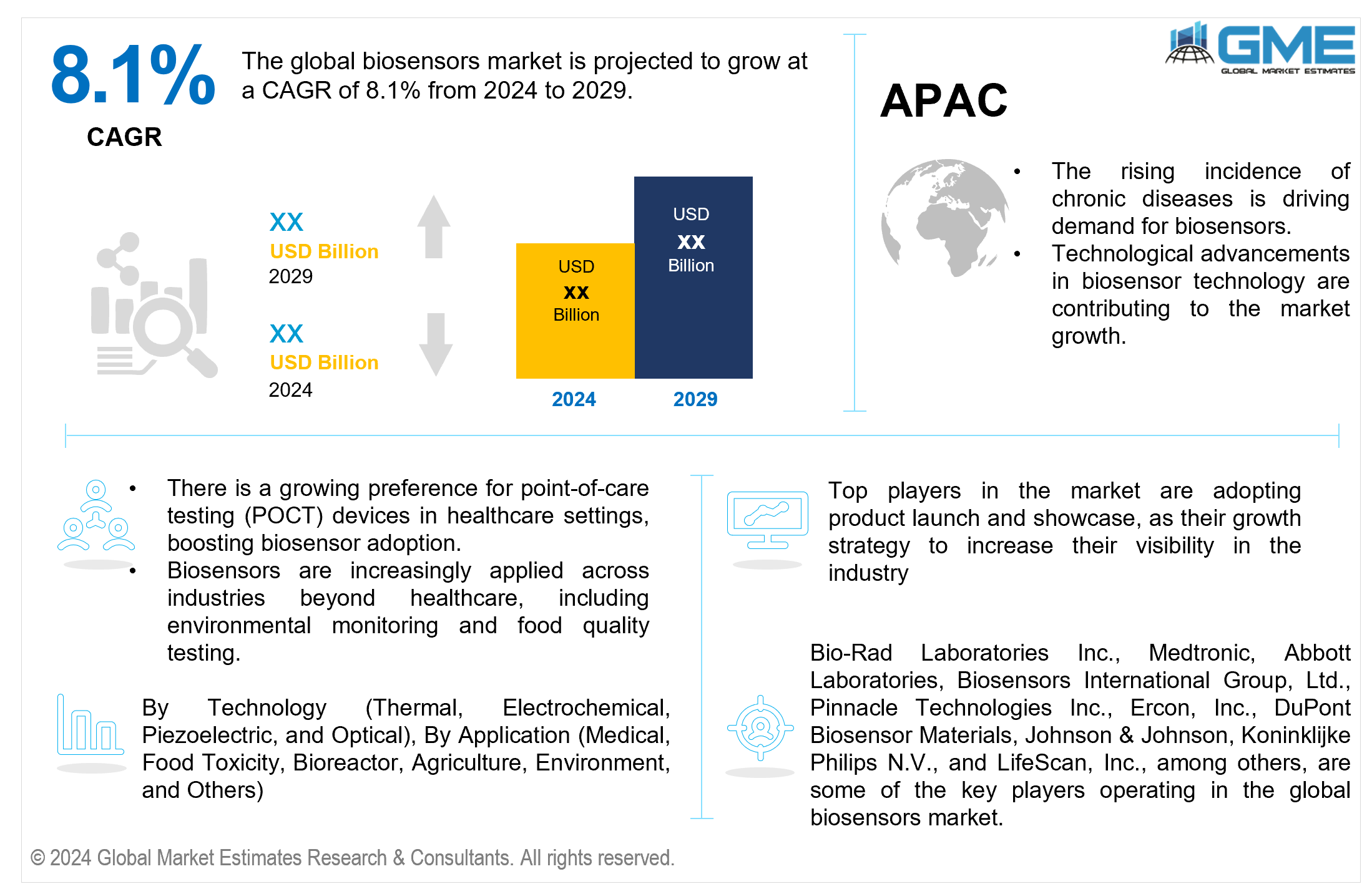

The global biosensors market is projected to grow at a CAGR of 8.1% from 2024 to 2029.

The development of biosensor technology and the broad use of biosensors across industries are two major drivers of the global biosensor market growth. The rising popularity of medical biosensors can be attributed to their crucial role in healthcare diagnostics and patient monitoring. With the ability to offer patients and healthcare professionals continuous, real-time data, wearable biosensors—like glucose monitoring biosensors—are revolutionizing the management of chronic diseases. The market is growing because these devices improve clinical results and increase patient compliance.

Environmental biosensors represent a significant application that propels the market. Due to growing environmental concerns and legal requirements, these devices are essential for monitoring pollutants and guaranteeing environmental safety. New developments in point-of-care biosensors, which offer quick, on-site diagnostic results, are the consequence of integrating biosensors in healthcare. This ability improves the accessibility and effectiveness of medical diagnostics, and it is especially useful in distant and resource-constrained environments.

Technological improvements in optical biosensors and electrochemical biosensors have greatly enhanced biosensor sensitivity, specificity, and reliability. The advancements in biosensor applications, including biosensors in biotechnology and diagnostic biosensors, where accurate detection and measurement are required, further contribute to the market growth. Furthermore, the introduction of wireless biosensors has enabled remote monitoring and telemedicine, broadening the market's reach. The performance and affordability of these devices are constantly being improved through research and biosensor development in manufacture and invention.

Comprehensive biosensor market analysis supports market growth by highlighting the growing need for and potential for biosensors across sectors. The biosensor manufacturing and development of biosensor devices is getting more advanced, emphasizing downsizing and integration with digital technology. This progress propels the biosensor market, transforming biosensor research into a fast-evolving sector. Overall, the global biosensors market is expected to grow significantly due to its diverse applications and biosensor innovation in biosensor technology.

The biosensors market is constrained by high research costs, technological obstacles in reaching high sensitivity and specificity, regulatory barriers, and low end-user awareness. These constraints may limit market penetration and widespread use of biosensor technology in a variety of applications.

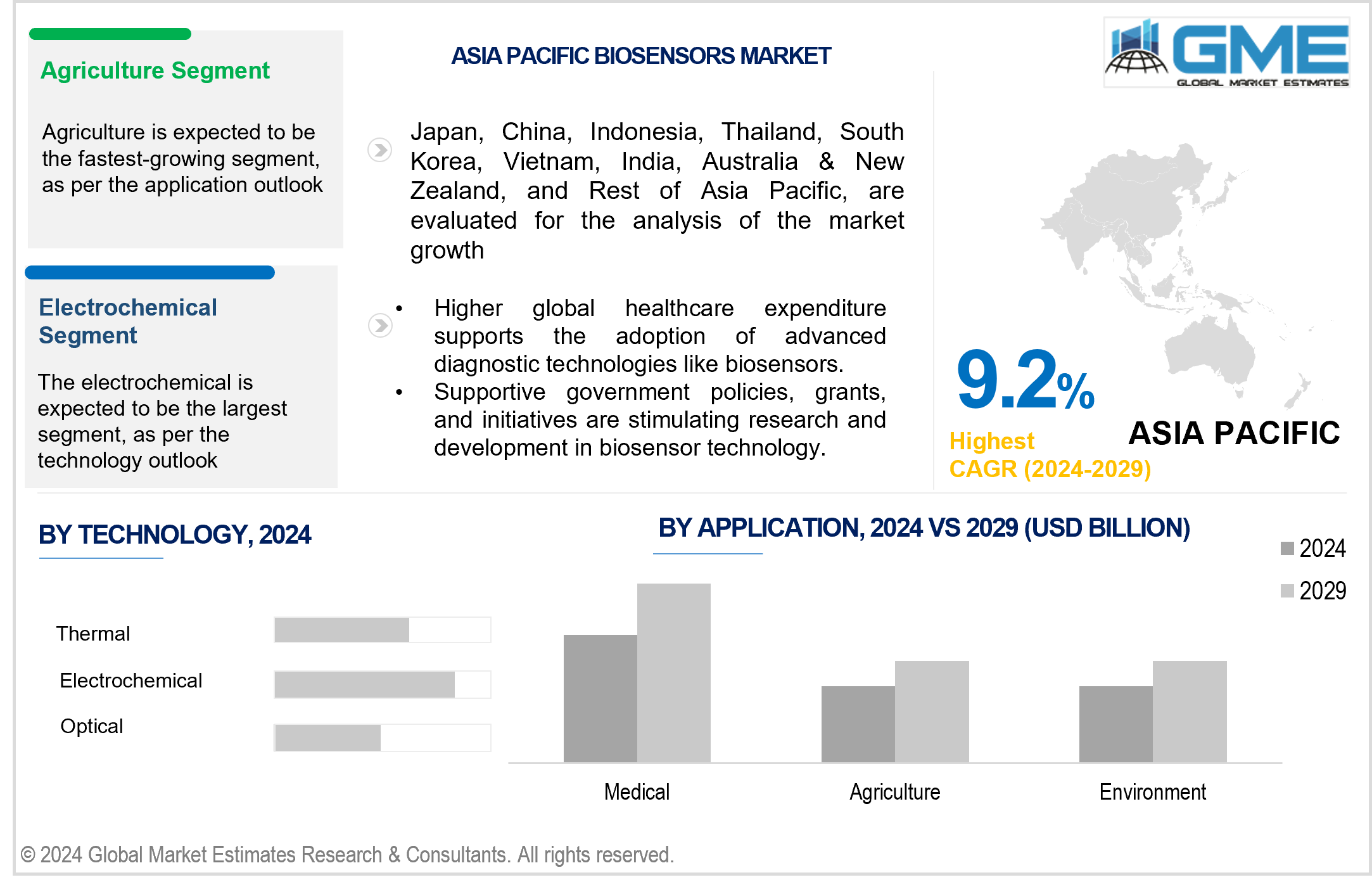

The electrochemical segment is expected to hold the largest share of the market. This growth is due to its high sensitivity, selectivity, and cost-effectiveness. Electrochemical biosensors are commonly utilized in medical diagnosis, environmental monitoring, and food safety. Furthermore, advances in nanotechnology have improved the performance and compactness of electrochemical biosensors, making them more appealing for various applications and fueling their market dominance.

The optical segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is due to its high specificity, real-time detection capabilities, and non-invasive nature. Photonic technology advancements and microfluidic integration have increased sensitivity and mobility. Increased applications in medical diagnostics, environmental monitoring, biotechnology research, and developments in wearable and point-of-care devices drive demand for optical biosensors..

The agriculture segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029 due to the increasing demand for precision farming, soil health monitoring, and pest management. Biosensors provide real-time, precise data for improving agricultural yields and decreasing pesticide use. Technological developments and increased adoption of sustainable farming practices increase demand, contributing to the segment's market growth.

The medical segment is expected to hold the largest share of the market. This is due to the rising need for diagnostic and monitoring devices. Biosensors are essential for blood glucose monitoring, disease diagnosis, and patient care. Technological developments, the rising prevalence of chronic diseases, and the increased demand for point-of-care testing all contribute to their widespread acceptance.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include improved healthcare infrastructure, significant R&D spending, and widespread acceptance of breakthrough technologies. The presence of major market participants and collaboration among the market players. For instance, in November 2023, DuPont Liveo Healthcare Solutions partnered with STMicroelectronics to develop a new smart wearable device for remote biosignal monitoring, known as the DuPont Liveo Smart Biosensing Patch. Additionally, the rising prevalence of chronic diseases and the expanding demand for point-of-care diagnostics contribute to the market growth.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the due to rising healthcare costs, the prevalence of chronic diseases, advances in biotechnology, and supportive government efforts. Furthermore, increased awareness of personalized medicine, an aging population, and technological advancements in biosensor devices all contribute to the market's growth. Major investments in R&D, as well as the existence of significant market participants, all contribute to this expansion.

Bio-Rad Laboratories Inc., Medtronic, Abbott Laboratories, Biosensors International Group, Ltd., Pinnacle Technologies Inc., Ercon, Inc., DuPont Biosensor Materials, Johnson & Johnson, Koninklijke Philips N.V., and LifeScan, Inc., among others, are some of the key players operating in the global biosensors market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, Medtronic announced the CE Mark approval of its MiniMed 780G system with the Simplera Sync sensor, a ground-breaking development in diabetes management. The Simple Sync sensor is a disposable, all-in-one continuous glucose monitor (CGM) that requires no fingersticks or overtape, significantly enhancing user convenience with a quick, less-than-10-second insertion process.

In January 2024, Abbott Laboratories received the U.S. FDA clearance for two new continuous glucose monitoring systems available over the counter without a prescription. These systems, Libre Rio and Lingo, cater to different user groups. Libre Rio is designed for Type 2 diabetes patients who do not use insulin, offering them real-time glucose monitoring capabilities.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL BIOSENSORS MARKET, BY APPLICATION

4.1 Introduction

4.2 Biosensors Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Medical

4.4.1 Medical Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Food Toxicity

4.5.1 Food Toxicity Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Bioreactor

4.6.1 Bioreactor Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Agriculture

4.7.1 Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Environment

4.8.1 Environment Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL BIOSENSORS MARKET, BY TECHNOLOGY

5.1 Introduction

5.2 Biosensors Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Thermal

5.4.1 Thermal Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Electrochemical

5.5.1 Electrochemical Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Piezoelectric

5.6.1 Piezoelectric Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Optical

5.7.1 Optical Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL BIOSENSORS MARKET, BY REGION

6.1 Introduction

6.2 North America Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By Technology

6.2.3 By Country

6.2.3.1 U.S. Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Application

6.2.3.1.2 By Technology

6.2.3.2 Canada Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Application

6.2.3.2.2 By Technology

6.2.3.3 Mexico Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Application

6.2.3.3.2 By Technology

6.3 Europe Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Application

6.3.2 By Technology

6.3.3 By Country

6.3.3.1 Germany Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Application

6.3.3.1.2 By Technology

6.3.3.2 U.K. Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Application

6.3.3.2.2 By Technology

6.3.3.3 France Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Application

6.3.3.3.2 By Technology

6.3.3.4 Italy Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Application

6.3.3.4.2 By Technology

6.3.3.5 Spain Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Application

6.3.3.5.2 By Technology

6.3.3.6 Netherlands Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Technology

6.3.3.7 Rest of Europe Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Technology

6.4 Asia Pacific Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Application

6.4.2 By Technology

6.4.3 By Country

6.4.3.1 China Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Application

6.4.3.1.2 By Technology

6.4.3.2 Japan Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Application

6.4.3.2.2 By Technology

6.4.3.3 India Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Application

6.4.3.3.2 By Technology

6.4.3.4 South Korea Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Application

6.4.3.4.2 By Technology

6.4.3.5 Singapore Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Application

6.4.3.5.2 By Technology

6.4.3.6 Malaysia Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Technology

6.4.3.7 Thailand Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Technology

6.4.3.8 Indonesia Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Application

6.4.3.7.2 By Technology

6.4.3.9 Vietnam Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Application

6.4.3.8.2 By Technology

6.4.3.10 Taiwan Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Application

6.4.3.10.2 By Technology

6.4.3.11 Rest of Asia Pacific Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Application

6.4.3.11.2 By Technology

6.5 Middle East and Africa Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Application

6.5.2 By Technology

6.5.3 By Country

6.5.3.1 Saudi Arabia Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Application

6.5.3.1.2 By Technology

6.5.3.2 U.A.E. Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Application

6.5.3.2.2 By Technology

6.5.3.3 Israel Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Application

6.5.3.3.2 By Technology

6.5.3.4 South Africa Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Application

6.5.3.4.2 By Technology

6.5.3.5 Rest of Middle East and Africa Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Application

6.5.3.5.2 By Technology

6.6 Central and South America Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Application

6.6.2 By Technology

6.6.3 By Country

6.6.3.1 Brazil Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Application

6.6.3.1.2 By Technology

6.6.3.2 Argentina Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Application

6.6.3.2.2 By Technology

6.6.3.3 Chile Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Technology

6.6.3.3 Rest of Central and South America Biosensors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Technology

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Bio-Rad Laboratories Inc.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Medtronic

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Abbott Laboratories

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Biosensors International Group, Ltd.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Pinnacle Technologies Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Ercon, Inc.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 DuPont Biosensor Materials

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Johnson & Johnson

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Koninklijke Philips N.V.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 LifeScan, Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Biosensors Market, By Application, 2021-2029 (USD Mllion)

2 Medical Market, By Region, 2021-2029 (USD Mllion)

3 Bioreactor Market, By Region, 2021-2029 (USD Mllion)

4 Food Toxicity Market, By Region, 2021-2029 (USD Mllion)

5 Agriculture Market, By Region, 2021-2029 (USD Mllion)

6 Environment Market, By Region, 2021-2029 (USD Mllion)

7 OtHERS Market, By Region, 2021-2029 (USD Mllion)

8 Global Biosensors Market, By Technology, 2021-2029 (USD Mllion)

9 Thermal Market, By Region, 2021-2029 (USD Mllion)

10 Electrochemical Market, By Region, 2021-2029 (USD Mllion)

11 Piezoelectric Market, By Region, 2021-2029 (USD Mllion)

12 Optical Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Biosensors Market, By Application, 2021-2029 (USD Mllion)

15 North America Biosensors Market, By Technology, 2021-2029 (USD Mllion)

16 North America Biosensors Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Biosensors Market, By Application, 2021-2029 (USD Mllion)

18 U.S. Biosensors Market, By Technology, 2021-2029 (USD Mllion)

19 Canada Biosensors Market, By Application, 2021-2029 (USD Mllion)

20 Canada Biosensors Market, By Technology, 2021-2029 (USD Mllion)

21 Mexico Biosensors Market, By Application, 2021-2029 (USD Mllion)

22 Mexico Biosensors Market, By Technology, 2021-2029 (USD Mllion)

23 Europe Biosensors Market, By Application, 2021-2029 (USD Mllion)

24 Europe Biosensors Market, By Technology, 2021-2029 (USD Mllion)

25 Europe Biosensors Market, By Country, 2021-2029 (USD Mllion)

26 Germany Biosensors Market, By Application, 2021-2029 (USD Mllion)

27 Germany Biosensors Market, By Technology, 2021-2029 (USD Mllion)

28 U.K. Biosensors Market, By Application, 2021-2029 (USD Mllion)

29 U.K. Biosensors Market, By Technology, 2021-2029 (USD Mllion)

30 France Biosensors Market, By Application, 2021-2029 (USD Mllion)

31 France Biosensors Market, By Technology, 2021-2029 (USD Mllion)

32 Italy Biosensors Market, By Application, 2021-2029 (USD Mllion)

33 Italy Biosensors Market, By Technology, 2021-2029 (USD Mllion)

34 Spain Biosensors Market, By Application, 2021-2029 (USD Mllion)

35 Spain Biosensors Market, By Technology, 2021-2029 (USD Mllion)

36 Netherlands Biosensors Market, By Application, 2021-2029 (USD Mllion)

37 Netherlands Biosensors Market, By Technology, 2021-2029 (USD Mllion)

38 Rest Of Europe Biosensors Market, By Application, 2021-2029 (USD Mllion)

39 Rest Of Europe Biosensors Market, By Technology, 2021-2029 (USD Mllion)

40 Asia Pacific Biosensors Market, By Application, 2021-2029 (USD Mllion)

41 Asia Pacific Biosensors Market, By Technology, 2021-2029 (USD Mllion)

42 Asia Pacific Biosensors Market, By Country, 2021-2029 (USD Mllion)

43 China Biosensors Market, By Application, 2021-2029 (USD Mllion)

44 China Biosensors Market, By Technology, 2021-2029 (USD Mllion)

45 Japan Biosensors Market, By Application, 2021-2029 (USD Mllion)

46 Japan Biosensors Market, By Technology, 2021-2029 (USD Mllion)

47 India Biosensors Market, By Application, 2021-2029 (USD Mllion)

48 India Biosensors Market, By Technology, 2021-2029 (USD Mllion)

49 South Korea Biosensors Market, By Application, 2021-2029 (USD Mllion)

50 South Korea Biosensors Market, By Technology, 2021-2029 (USD Mllion)

51 Singapore Biosensors Market, By Application, 2021-2029 (USD Mllion)

52 Singapore Biosensors Market, By Technology, 2021-2029 (USD Mllion)

53 Thailand Biosensors Market, By Application, 2021-2029 (USD Mllion)

54 Thailand Biosensors Market, By Technology, 2021-2029 (USD Mllion)

55 Malaysia Biosensors Market, By Application, 2021-2029 (USD Mllion)

56 Malaysia Biosensors Market, By Technology, 2021-2029 (USD Mllion)

57 Indonesia Biosensors Market, By Application, 2021-2029 (USD Mllion)

58 Indonesia Biosensors Market, By Technology, 2021-2029 (USD Mllion)

59 Vietnam Biosensors Market, By Application, 2021-2029 (USD Mllion)

60 Vietnam Biosensors Market, By Technology, 2021-2029 (USD Mllion)

61 Taiwan Biosensors Market, By Application, 2021-2029 (USD Mllion)

62 Taiwan Biosensors Market, By Technology, 2021-2029 (USD Mllion)

63 Rest of APAC Biosensors Market, By Application, 2021-2029 (USD Mllion)

64 Rest of APAC Biosensors Market, By Technology, 2021-2029 (USD Mllion)

65 Middle East and Africa Biosensors Market, By Application, 2021-2029 (USD Mllion)

66 Middle East and Africa Biosensors Market, By Technology, 2021-2029 (USD Mllion)

67 Middle East and Africa Biosensors Market, By Country, 2021-2029 (USD Mllion)

68 Saudi Arabia Biosensors Market, By Application, 2021-2029 (USD Mllion)

69 Saudi Arabia Biosensors Market, By Technology, 2021-2029 (USD Mllion)

70 UAE Biosensors Market, By Application, 2021-2029 (USD Mllion)

71 UAE Biosensors Market, By Technology, 2021-2029 (USD Mllion)

72 Israel Biosensors Market, By Application, 2021-2029 (USD Mllion)

73 Israel Biosensors Market, By Technology, 2021-2029 (USD Mllion)

74 South Africa Biosensors Market, By Application, 2021-2029 (USD Mllion)

75 South Africa Biosensors Market, By Technology, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Biosensors Market, By Application, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Biosensors Market, By Technology, 2021-2029 (USD Mllion)

78 Central and South America Biosensors Market, By Application, 2021-2029 (USD Mllion)

79 Central and South America Biosensors Market, By Technology, 2021-2029 (USD Mllion)

80 Central and South America Biosensors Market, By Country, 2021-2029 (USD Mllion)

81 Brazil Biosensors Market, By Application, 2021-2029 (USD Mllion)

82 Brazil Biosensors Market, By Technology, 2021-2029 (USD Mllion)

83 Chile Biosensors Market, By Application, 2021-2029 (USD Mllion)

84 Chile Biosensors Market, By Technology, 2021-2029 (USD Mllion)

85 Argentina Biosensors Market, By Application, 2021-2029 (USD Mllion)

86 Argentina Biosensors Market, By Technology, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Biosensors Market, By Application, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Biosensors Market, By Technology, 2021-2029 (USD Mllion)

89 Bio-Rad Laboratories Inc.: Products & Services Offering

90 Medtronic: Products & Services Offering

91 Abbott Laboratories: Products & Services Offering

92 Biosensors International Group, Ltd.: Products & Services Offering

93 Pinnacle Technologies Inc.: Products & Services Offering

94 ERCON, INC.: Products & Services Offering

95 DuPont Biosensor Materials : Products & Services Offering

96 Johnson & Johnson: Products & Services Offering

97 Koninklijke Philips N.V., Inc: Products & Services Offering

98 LifeScan, Inc.: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Biosensors Market Overview

2 Global Biosensors Market Value From 2021-2029 (USD Mllion)

3 Global Biosensors Market Share, By Application (2023)

4 Global Biosensors Market Share, By Technology (2023)

5 Global Biosensors Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Biosensors Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Biosensors Market

10 Impact Of Challenges On The Global Biosensors Market

11 Porter’s Five Forces Analysis

12 Global Biosensors Market: By Application Scope Key Takeaways

13 Global Biosensors Market, By Application Segment: Revenue Growth Analysis

14 Medical Market, By Region, 2021-2029 (USD Mllion)

15 Food Toxicity Market, By Region, 2021-2029 (USD Mllion)

16 AgricultureMarket, By Region, 2021-2029 (USD Mllion)

17 Environment Market, By Region, 2021-2029 (USD Mllion)

18 Bioreactor Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global Biosensors Market: By Technology Scope Key Takeaways

21 Global Biosensors Market, By Technology Segment: Revenue Growth Analysis

22 Thermal Market, By Region, 2021-2029 (USD Mllion)

23 Electrochemical Market, By Region, 2021-2029 (USD Mllion)

24 Piezoelectric Market, By Region, 2021-2029 (USD Mllion)

25 Optical Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Biosensors Market: Regional Analysis

28 North America Biosensors Market Overview

29 North America Biosensors Market, By Application

30 North America Biosensors Market, By Technology

31 North America Biosensors Market, By Country

32 U.S. Biosensors Market, By Application

33 U.S. Biosensors Market, By Technology

34 Canada Biosensors Market, By Application

35 Canada Biosensors Market, By Technology

36 Mexico Biosensors Market, By Application

37 Mexico Biosensors Market, By Technology

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Bio-Rad Laboratories Inc.: Company Snapshot

41 Bio-Rad Laboratories Inc.: SWOT Analysis

42 Bio-Rad Laboratories Inc.: Geographic Presence

43 Medtronic: Company Snapshot

44 Medtronic: SWOT Analysis

45 Medtronic: Geographic Presence

46 Abbott Laboratories: Company Snapshot

47 Abbott Laboratories: SWOT Analysis

48 Abbott Laboratories: Geographic Presence

49 Biosensors International Group, Ltd.: Company Snapshot

50 Biosensors International Group, Ltd.: Swot Analysis

51 Biosensors International Group, Ltd.: Geographic Presence

52 Pinnacle Technologies Inc.: Company Snapshot

53 Pinnacle Technologies Inc.: SWOT Analysis

54 Pinnacle Technologies Inc.: Geographic Presence

55 Ercon, Inc.: Company Snapshot

56 Ercon, Inc.: SWOT Analysis

57 Ercon, Inc.: Geographic Presence

58 DuPont Biosensor Materials : Company Snapshot

59 DuPont Biosensor Materials : SWOT Analysis

60 DuPont Biosensor Materials : Geographic Presence

61 Johnson & Johnson: Company Snapshot

62 Johnson & Johnson: SWOT Analysis

63 Johnson & Johnson: Geographic Presence

64 Koninklijke Philips N.V., Inc.: Company Snapshot

65 Koninklijke Philips N.V., Inc.: SWOT Analysis

66 Koninklijke Philips N.V., Inc.: Geographic Presence

67 LifeScan, Inc.: Company Snapshot

68 LifeScan, Inc.: SWOT Analysis

69 LifeScan, Inc.: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Biosensors Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Biosensors Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS