Global Blood Preparation Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Whole Blood (Red Cells, Granulocytes, Plasma, Platelets), Blood Components (Whole Blood Components, Packed Red Cells, Leukocyte Reduced Red Blood Cells, Frozen Plasma, Platelet Concentrate, Cryoprecipitate), Blood Derivatives), By Antithrombotic and Anticoagulants Type (Platelet Aggregation Inhibitors (Glycoprotein Inhibitors, COX Inhibitors, ADP Antagonists, Others), Fibrinolytics (Tissue Plasminogen Activator (tPA), Streptokinase, Urokinase), Anticoagulants (Heparins (Unfractionated Heparin, Low Molecular Weight Heparin (LMWH), Ultra-low Molecular Weight Heparin), Vitamin K Antagonists, Direct Thrombin Inhibitors, Direct Factor Xa Inhibitors)), By Antithrombotic and Anticoagulants Application (Thrombocytosis, Pulmonary Embolism, Renal Impairment, Angina Blood Vessel Complications, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

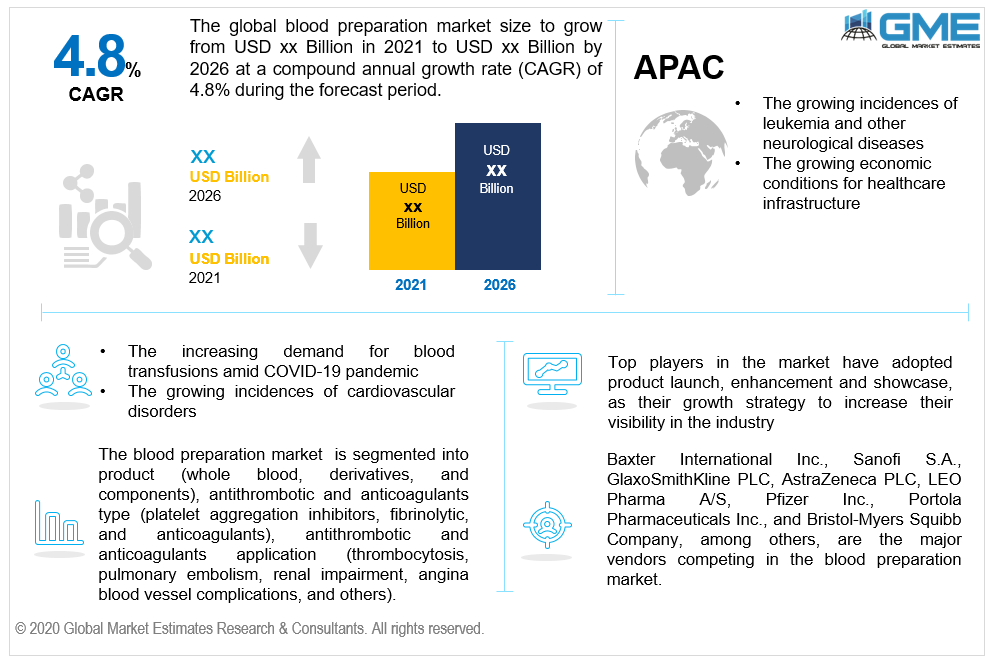

Blood preparation is vital in many treatment procedures especially for life-threatening disorders that require the need to screen patients for major surgeries and procedures. The growing demand for blood transfusions and blood components during and after surgeries are expected to be the major drivers of the blood preparation market. The most common and initial procedures before surgeries are blood transfusion and blood screening analysis in hospitals. The growing geriatric population and the growing expenditure on healthcare are expected to further increase the blood preparation market. The development of new technologies especially those related to separating blood components is also contributing to the growth of the blood preparation market. Government initiatives to improve blood collection through donor incentivization and reimbursement policies are also expected to positively impact the growth of the blood preparation market. Government and private institutes are releasing many awareness programs aimed at raising awareness for early detection and prevention of thrombosis. Anticoagulants for alleviating cardiac problems arising from blood clots and antithrombotic products to treat thrombocytosis are growing in demand. Secondary thrombocytosis is becoming more common due to the rising prevalence of other conditions like rheumatoid arthritis, asplenia, hemorrhages, and other conditions. Angina pectoris is another cardiovascular disorder that is treated through the use of anticoagulants. Nitroglycerine is the more commonly used but the disadvantages of using it are expected to result in the increased use of anticoagulants.

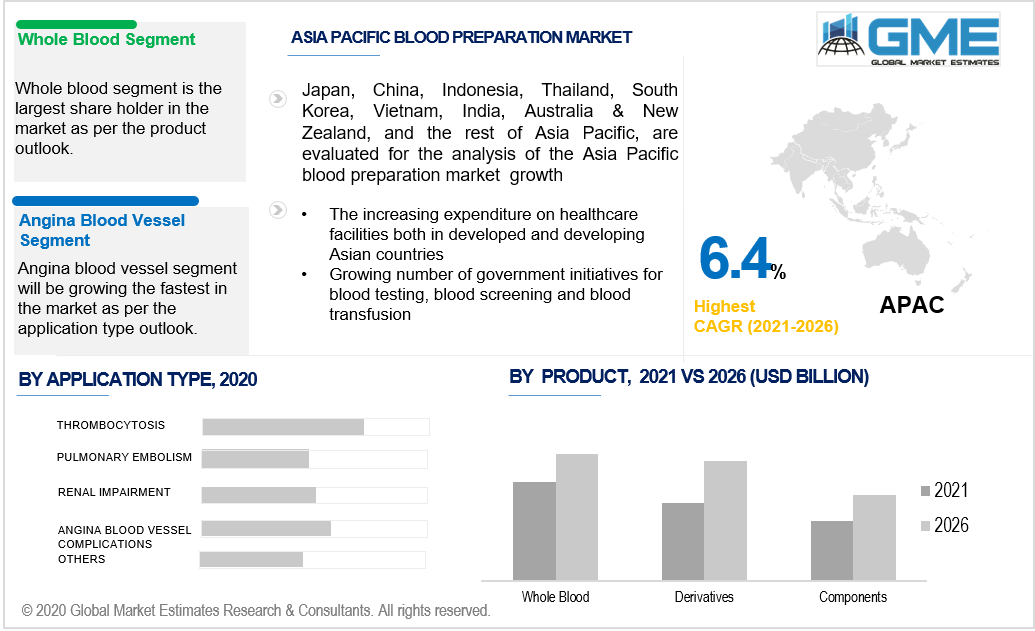

Based on the various blood preparation products, the blood preparation market can be segmented into whole blood, derivatives, and components. The whole blood segment is expected to hold the largest share of the market as per revenue during the forecast period. Whole blood is mainly required for blood transfusions in the event of excess blood loss. With the increase in the number of surgeries across the globe, the market is also witnessing the rise in demand for whole blood samples. Patients after most major surgeries require blood transfusions to make up for lost blood which has led to the dominance of the whole blood segment. Whole blood is easily available, inexpensive, and has lower maintenance costs which have been the major drivers of the blood preparation market. The blood derivatives segment is expected to register the fastest growth rate during the forecast period. The development of various plasma-derived proteins like immunoglobulins, human fibrin foam, human thrombin, and coagulation factor products are expected to be major drivers of the blood preparation market. Blood derivates like hyperimmune and immunoglobulin are used as immunity boosters for patients suffering from life-threatening diseases like Ebola. Growing instances of such diseases and technological advancements are expected to increase the demand for blood derivates and result increase in the growth rate of the blood derivatives segment.

Based on the various types of antithrombotic and anticoagulants available, the blood preparation market can be segmented into platelet aggregation inhibitors, fibrinolytic, and anticoagulants. The anticoagulants segment is expected to hold the lion’s share of the revenue during the forecast period. They are also used to treat thromboembolic diseases. The anticoagulants market is also expected to be the fastest-growing segment during the forecast period. The increasing number of novel anticoagulants being developed by pharmaceutical firms and the expected release of already developed products are expected to result in the growth of the anticoagulants segment.

Based on the applications of antithrombotic and anticoagulants, the blood preparation market can be segmented into thrombocytosis, pulmonary embolism, renal impairment, angina blood vessel complications, and others. The thrombocytosis segment is expected to hold the dominant share of the market during the forecast period. Thrombocytosis leads to the coagulation of blood within the body’s circulatory system which can cause heart conditions that can cause serious harm and even death. The high rate of such thrombocytosis conditions in the population in recent years has resulted in the dominance of the thrombocytosis segment. The angina blood vessels segment is expected to grow at the fastest rate during the forecast period. The rising number of cardiovascular problems in the population combined with the growing number of novel medications available are expected to be the major drivers of the growth of the angina blood vessels segment during the forecast period.

The North American region is expected to be the dominant region during the forecast period. The large incidences of cardiovascular disorders in the population in this region and the large geriatric population in the region combined with high expenditures on healthcare have been the major drivers of the blood preparation market in the North American region. The APAC region is expected to be the fastest-growing region during the forecast period. Increasing expenditure on healthcare infrastructure by governments is expected to result in the growth of the blood preparation market in the region. The region is also witnessing an increasing number of cardiovascular disorders, leukaemia, and other neurological disorders within the population. Growing economic conditions and better healthcare initiatives by both government and private entities are expected to drive the growth in the blood preparation market in the APAC region.

Sanofi S.A., Baxter International Inc., GlaxoSmithKline PLC, LEO Pharma A/S, AstraZeneca PLC, Pfizer Inc., Bristol-Myers Squibb Company, and Portola Pharmaceuticals Inc., among others, are the major vendors competing in the blood preparation market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Blood Preparation Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Antithrombotic and Anticoagulants Type Overview

2.1.4 Antithrombotic and Anticoagulants Application Overview

2.1.5 Regional Overview

Chapter 3 Blood Preparation Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Blood Preparation Tools

3.3.1.2 The Growing Demand for Blood Transfusions & Blood Components During & After Surgeries

3.3.2 Industry Challenges

3.3.2.1 High Cost Associated With Automated Systems

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Antithrombotic and Anticoagulants Type Growth Scenario

3.4.3 Antithrombotic and Anticoagulants Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Blood Preparation Market, By Product Type

4.1 Product Type Outlook

4.2 Whole Blood

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Blood Component

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Blood Derivatives

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Blood Preparation Market, By Antithrombotic and Anticoagulants Type

5.1 Antithrombotic and Anticoagulants Type Outlook

5.2 Platelet Aggregation Inhibitors

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Fibrinolytics

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Anticoagulants

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Blood Preparation Market, By Antithrombotic and Anticoagulants Application

6.1 Thrombocytosis

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Pulmonary Embolism

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Renal Impairment

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Angina Blood Vessel Complications

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Blood Preparation Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.2.4 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.2.4.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.2.5.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.4 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.4.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.5.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.6.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.7.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.8.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.3.9.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.4.4 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.4.4.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.4.5.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.4.6.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.4.7.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.4.8.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.5.4 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.5.4.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.5.5.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.5.6.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.6.4 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.6.4.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.6.5.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Antithrombotic and Anticoagulants Type, 2019-2026 (USD Million)

6.6.6.3 Market Size, By Antithrombotic and Anticoagulants Application, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Sanofi S.A.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Baxter International

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 GlaxoSmithKline PLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 LEO Pharma A/S

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 AstraZeneca PLC

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Pfizer Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Bristol-Myers Squibb Company

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Portola Pharmaceuticals Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Others

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Blood Preparation Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Blood Preparation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS