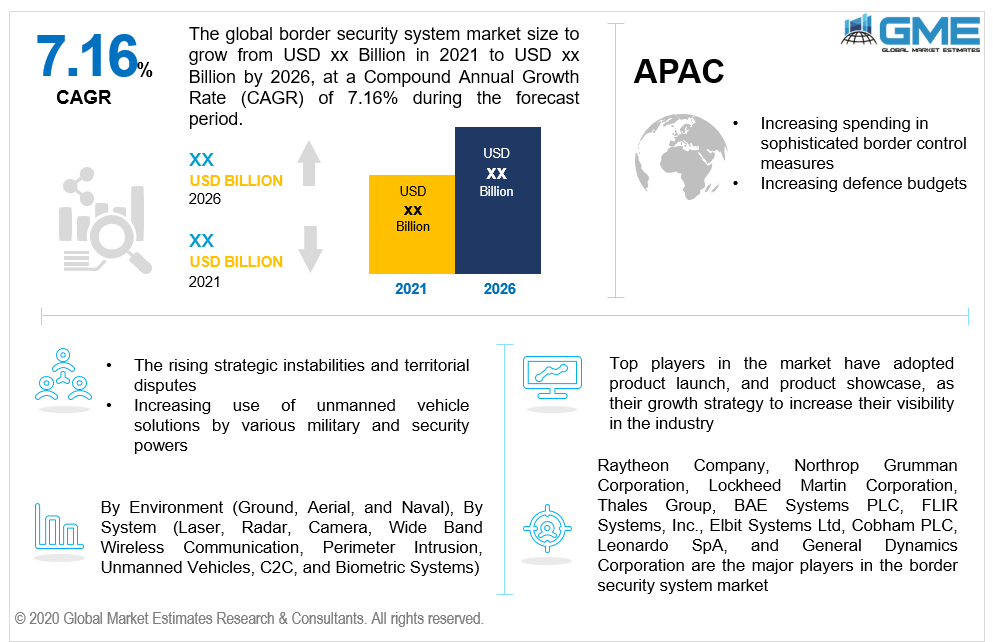

Global Border Security System Market Size, Trends & Analysis - Forecasts to 2026 By Environment (Ground, Aerial, and Naval), By System (Laser, Radar, Camera, Wide Band Wireless Communication, Perimeter Intrusion, Unmanned Vehicles, C2C, and Biometric Systems), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The border security system is an intelligent automatic surveillance system with a long-range operation and reliable performance. The border security infrastructure is commonly used to secure the country's borders from the illicit migration of firearms, narcotics, contraband, and people; thus, it is critical for homeland security, economic stability, and national sovereignty. A result of this system's ability to detect any unauthorised activities as well as report all such events occurring in the vicinity at the earliest will lead to the skyrocketing demand for border security system globally.

Furthermore, the global demand is rising significantly since the policymakers are increasing their budgets to combat infiltration, militant threats, illicit activity, and illegal immigration. The border security system is concerned with protecting the countries and international borders against human smuggling and terrorism activity. Moreover, it is responsible for preventing the illegal transport of drugs, weapons, and contraband across borders. Lasers, cameras, and radar are used in border defence networks. The implementation of border security systems improves surveillance capability, real-time target photographs, and accurate target location capabilities. Also, border defence forces track data daily to develop improved security tactics and provide a higher degree of protection to its people, thus acting as a key driver.

The market's expansion is being propelled by cross-border illegal operations as a result of increasing geopolitical instabilities and territorial conflicts. Military and defence services are quickly deploying unmanned defence systems, highlighting the need for advanced border security.

Due to technical advances, military organisations are increasingly using automated structures. The advancement of drone and UGV (unmanned ground vehicle) technology has allowed countries to collect valuable intelligence without deploying army members. Over the last decade, the United States has used automated systems in the Middle East. Israel and India are partnering on the production of UAV (unmanned aerial vehicle) technologies. This development is expected to fuel the expansion of the border security systems market.

The market's restraining factors include stringent government regulations governing the manufacture of border security systems and limiting military spending by developing countries. Failure to comply has resulted in legal, criminal, and regulatory penalties. These factors have stifled the market’s expansion. Other challenges in this sector include cross-border infiltration, traditional global tensions, smuggling, illicit immigration, and other types of criminal crime, the need for sensitive infrastructure to validate surveillance measures, and the high cost of R&D.

Despite these impediments, the border security system is expected to expand at a reasonable rate due to the up-gradation of existing border security system infrastructure and the rising defence budgets of developing countries. Furthermore, the increased development of border defence monitoring aircraft surveillance, ground apache helicopters, attack helicopters, armoured aircraft, naval vessels, and submarines is expected to fuel demand growth throughout the forecast period.

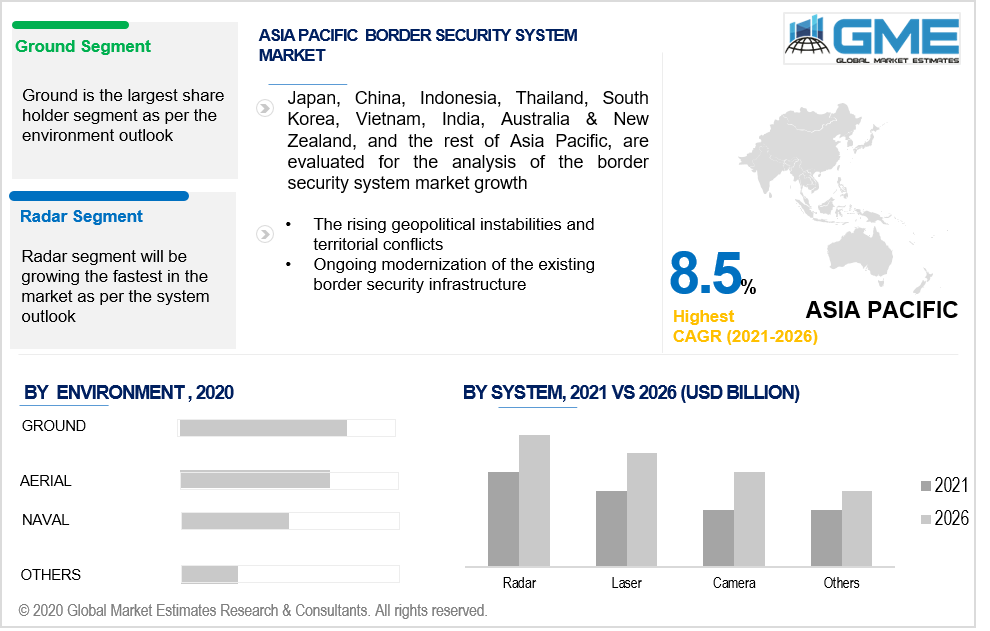

Based on the environment, the market is categorized as ground, aerial, and naval. The ground segment had the largest market share and is projected to grow at a significant rate throughout the forecast period. Radar, laser, and video systems are examples of ground-based border control systems. The rising capital expenditure made by emerging economies such as China and India in producing and acquiring sophisticated ground-based border defence systems to provide improved protection to citizens is catapulting the segment ahead. Moreover, the adoption of land border control systems to deter illegal activity across borders, piracy, and other such activities are one of the factors driving the growth of this market. The transformation of current border defence technology creates new growth prospects for the ground-based border security market.

Border security systems are classified into laser, radar, camera, wideband wireless communication, perimeter intrusion, unmanned vehicles, c2c, and biometric systems depending on the system. The radar segment is leading because the growing use of radar systems to detect criminal activity in countries such as the United States and the United Kingdom is driving segment development. The expansion of the global radar system market can be attributed to an uptick in extremist attacks around the world, as well as territorial tensions, which have forced countries to demand sophisticated border security technologies. Moreover, owing to its ability to operate beside transparent structures, radar offers an OEM with tremendous packaging versatility. Radar detects objects by using electromagnetic waves rather than light, and it performs best under rain, cloud, snow, and smoke. As a consequence, it is suitable for a wide range of applications.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. North America reportedly accounts for a substantial share of sales and is predicted to hold its position throughout the forecast period. Higher military budgets and the existence of sophisticated technologies in the defence sector, particularly in the United States, are factors driving the development of the targeted market in this region. Another trend that is expected to fuel demand in the targeted market of North America is massive spending in research and development activities in the defence sector.

The Asia Pacific market is projected to rise significantly in terms of market share throughout the forecast period, owing to increased defence budgets in countries such as China and India. Likewise, increased spending in sophisticated border control measures to combat drug laundering, human tariffing, and uncontrolled immigration is a trend promoting the development in the core demographics market in the Asia Pacific.

Raytheon Company, Northrop Grumman Corporation, Lockheed Martin Corporation, Thales Group, BAE Systems PLC, FLIR Systems, Inc., Elbit Systems Ltd, Cobham PLC, Leonardo SpA, and General Dynamics Corporation are the major players in the border security system market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Border Security System Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Environment Overview

2.1.3 System Overview

2.1.4 Regional Overview

Chapter 3 Border Security System Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Need for Advanced Border Security Solutions Technology

3.3.1.2 Rising Territorial Conflicts and Geopolitical Instabilities

3.3.1.3 Increasing Adoption of Unmanned System Solutions By Military and Defense Forces

3.3.2 Industry Challenges

3.3.2.1 Stringent Regulatory Environment

3.4 Prospective Growth Scenario

3.4.1 Environment Growth Scenario

3.4.2 System Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Border Security System Market, By Environment

4.1 Environment Outlook

4.2 Ground

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Aerial

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Naval

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Border Security System Market, By System

5.1 System Outlook

5.2 Laser

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Radar

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Camera

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Wide Band Wireless Communication

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Perimeter Intrusion

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Unmanned Vehicles

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

5.8 C2C

5.8.1 Market Size, By Region, 2019-2026 (USD Million)

5.9 Biometric Systems

5.9.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Border Security System Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Environment, 2019-2026 (USD Million)

6.2.3 Market Size, By System, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Environment, 2019-2026 (USD Million)

6.2.4.2 Market Size, By System, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Environment, 2019-2026 (USD Million)

6.2.5.2 Market Size, By System, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Environment, 2019-2026 (USD Million)

6.3.3 Market Size, By System, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Environment, 2019-2026 (USD Million)

6.2.4.2 Market Size, By System, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Environment, 2019-2026 (USD Million)

6.3.5.2 Market Size, By System, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Environment, 2019-2026 (USD Million)

6.3.6.2 Market Size, By System, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Environment, 2019-2026 (USD Million)

6.3.7.2 Market Size, By System, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Environment, 2019-2026 (USD Million)

6.3.8.2 Market Size, By System, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Environment, 2019-2026 (USD Million)

6.3.9.2 Market Size, By System, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Environment, 2019-2026 (USD Million)

6.4.3 Market Size, By System, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Environment, 2019-2026 (USD Million)

6.4.4.2 Market Size, By System, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Environment, 2019-2026 (USD Million)

6.4.5.2 Market Size, By System, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Environment, 2019-2026 (USD Million)

6.4.6.2 Market Size, By System, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Environment, 2019-2026 (USD Million)

6.4.7.2 Market size, By System, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Environment, 2019-2026 (USD Million)

6.4.8.2 Market Size, By System, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Environment, 2019-2026 (USD Million)

6.5.3 Market Size, By System, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Environment, 2019-2026 (USD Million)

6.5.4.2 Market Size, By System, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Environment, 2019-2026 (USD Million)

6.5.5.2 Market Size, By System, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Environment, 2019-2026 (USD Million)

6.5.6.2 Market Size, By System, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Environment, 2019-2026 (USD Million)

6.6.3 Market Size, By System, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Environment, 2019-2026 (USD Million)

6.6.4.2 Market Size, By System, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Environment, 2019-2026 (USD Million)

6.6.5.2 Market Size, By System, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Environment, 2019-2026 (USD Million)

6.6.6.2 Market Size, By System, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Raytheon Company

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Northrop Grumman Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Lockheed Martin Corporation

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Thales Group

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 BAE Systems PLC

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 FLIR Systems, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Elbit Systems Ltd

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Cobham PLC

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Leonardo SpA

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 General Dynamics Corporation

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Border Security System Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Border Security System Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS