Global Botanical Ingredients Market Size, Trends & Analysis - Forecasts to 2026 By Source (Fruits, Herbs, Spices, Flowers, and Others), By Form (Powder, Liquid, and Others), By Application (Food & Beverages {Food [Bakery & Confectionery, Sauces & Dressings, and Others]} and {Beverages [Energy Drinks, Sports Drinks, Functional Juices, and Others]}, Dietary Supplements, Cosmetics & Personal Care, Pharmaceuticals, and Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Botanical products are obtained from plants that produce bioactive substances, such as flowers, stems, and leaves. These drugs are derived from the solvent extraction of organic raw materials. They are medicinal and can be semi-solid, solid, or liquid. These additives are in strong demand for the manufacture of formulations to improve their consistency. Furthermore, they are gaining popularity in the packaged food processing industry, as a means of increasing nutritional benefit. Herbal drugs, nutritional herbal supplements, phytomedicines, and phytotherapeutic agents are some of the other names for these drugs. Botanicals, unlike pharmaceuticals, are not heavily purified or chemically engineered drugs, and they do not require the recognition of active constituents or the characterization of biological activity. Thus, globally, they are in high demand.

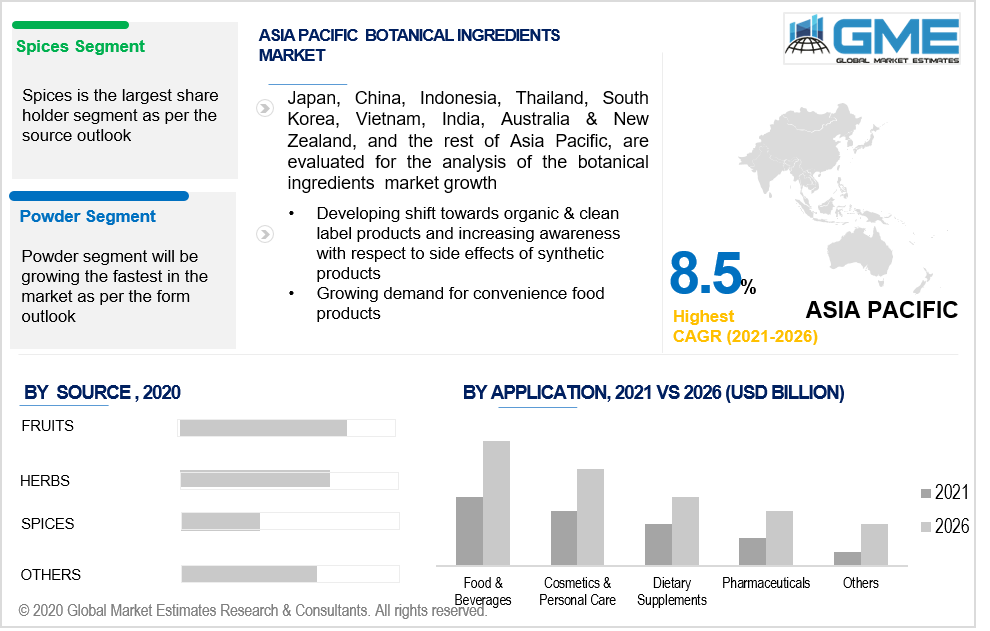

Increasing demand for ready meals, a transition through sustainable and green-labeled products, and increased knowledge about the adverse effects of synthetic product lines are envisioned to drive the growth of the botanical extract market throughout the forecast period. A range of producers in the nutrition and cosmetics industries are substituting natural products for those that customers consider being artificial. Furthermore, customers' tastes for organic and herbal products are changing, which is likely to benefit the botanical extract demand throughout the forecast period. This is a vital move towards achieving the proper blend between wellbeing and flavor.

Manufacturers of botanical skincare products use natural ingredients that meet the highest quality requirements and are suitable for consumers because, nowadays, customers prefer natural ingredients-based makeup and skincare products. Numerous cosmetics firms are constantly researching newer and natural herbal ingredients-based formulations which are creating skyrocketing demand in the botanical ingredients market. Increased market recognition, as well as expanded product information on different social media platforms and e-commerce websites, are putting pressure on suppliers to include more comprehensive information about ingredients of skin-care products. Thus, boosting demand in the botanical ingredients market.

Botanical extracts are implemented as additives in the food & beverage industries to improve taste, scent, and nutritional quality. Botanical additives have many health benefits for food products, as well as improved taste and flavor. These additives also have upsides, such as improved taste, better shelf life, as well as a reduction in microbial spoilage. Thus, they are in high demand. Moreover, due to rising health consciousness, consumers are increasingly preferring natural flavors in their food rather than processed additives, which has helped the market to propel. The intensified utilization of botanical extracts, including spice and herbs isolates, in conjunction with certain additives, improves the flavor of different food items and drives the botanical ingredients market forward.

Additionally, fruits & vegetables are expected to grow at a substantial pace during the forecast period, owing to their widespread use in the food & beverage and personal care product manufacturing sectors. Growth in air pollution, dietary adulteration, and increased consumption of high-carbohydrate fast foods have resulted in skin issues requiring more top-tier skincare and management, necessitating a greater need for botanical skincare ingredients.

Consequently, as the COVID-19 epidemic has progressed, customers have become more cautious and wary of the use of artificial chemical-based nutrition and cosmetic products, preferring organic colorant-based plant extract products, which offer greater and longer-lasting resistance from microbial pathogens. As a result, the demand for botanical ingredients is slated to expand significantly throughout the forecast period.

Based on the source, the market of botanical ingredients is categorized as fruits, herbs, spices, flowers, and others. The spice segment is leading in this market. Spices are becoming increasingly ubiquitous as a result of evolving diets and a rise in the trend of trying new foods. Developing a new flavor variety by changing customer tastes is essential for spice concentrate manufacturers. Among several botanical component outlets, spices are the most commonly employed and which leads to its supremacy in this segment.

Based on the form of botanical ingredients, the market is categorized as powder, liquid, and others. The powder type segment is presumed to hold the largest market share. This is due to its widespread use in a variety of applications, including baking & confectionaries, sauces & dressings, beef, wheat, dairy, nutritional supplements, and prescription drugs. There is an increasing need to improve various methods for managing plant diseases. Botanical plants collected as powder are extensively used to improve the digestibility of foods and liquids as well as their preservation properties. Because of its long storage cycle and ease of use, the category is expected to have a significant effect on the demand for botanical ingredients in mainstream personal care and skincare items.

Based on the type of application in the market, botanical ingredients are divided into food & beverages, dietary supplements, cosmetics & personal care. The food & beverage application segment is likely to lead in this market. The segment is envisioned to expand significantly as the demand for ready-to-eat food rises, resulting in an improvement in the processing field. Botanical additives are used in a variety of nutritional foods, including baking & cereal grains, wheat products, milk products, beef, fish & poultry, and vegetable oils. Furthermore, as technology advances, these products are likely to be used in a variety of specialized applications like nutritional supplements.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. North America is likely to experience elevated demand over the forecast period due to a rise in the consumption of goods with low cholesterol content and higher nutritious content. Moreover, the nutritional product usage perception in Mexico as a result of innovative product releases is foreseen to expand the market reach throughout the forecast period. Increasing nutritional supplementation understanding amongst employed professionals in the United States and Canada for ensuring healthy nutrition in the human body is projected to increase intake of dietary supplements. Furthermore, high acceptance levels for herbal supplements amongst consumers in the United States and Canada as a result of growing worries about the harmful effects of traditional pharmaceutical drugs are projected to drive market growth throughout the forecast period. Through the forecast period, Asia Pacific is likely to report the highest CAGR. Beneficial federal policies in agricultural exports to improve nutrition and encourage investments in the demand for botanical ingredients have generated a wide range of opportunities for growth in the country. Growing customer information about the advantages of consuming products containing natural plant-derived products without sacrificing flavour and taste is anticipated to contribute to the growth of the botanical extracts market throughout the forecast period.

PT. Indesso Aroma, New Directions Aromatics Inc., The Herbarie at Stoney Hill Farm, Inc., Lipoid Kosmetik AG, Bell Flavors & Fragrances, Frutarom Ltd, Rutland Biodynamics Ltd, Ambe Phytoextracts Pvt Ltd, Prakruti Products Pvt. Ltd., Umalaxmi Organics Pvt. Ltd, The Green Labs LLC, Berje Inc., Saba Botanical, amongst others, are the major players in the botanical ingredients market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Botanical Ingredients Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Form Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Botanical Ingredients Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Demand for Convenience Food Products

3.3.1.2 Increasing Use in Personal Care Products

3.3.2 Industry Challenges

3.3.2.1 Limited Availability and Fluctuating Prices of Raw Materials

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Form Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Botanical Ingredients Market, By Drug

4.1 Source Outlook

4.2 Fruits

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Herbs

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Spices

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Flowers

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Botanical Ingredients Market, By Form

5.1 Application Outlook

5.2 Powder

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Liquid

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Botanical Ingredients Market, By Application

6.1 Application Outlook

6.2 Food & Beverages

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.1 Food

6.2.1.1.1 Bakery & Confectionery

6.2.1.1.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.1.2 Sauces & Dressings

6.2.1.1.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.1.3 Others

6.2.1.1.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.2 Beverages

6.2.1.2.1 Energy Drinks

6.2.1.2.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.2.2 Sport Drinks

6.2.1.2.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.2.3 Functional Juices

6.2.1.2.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.2.1.2.4 Others

6.2.1.2.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Dietary Supplements

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Cosmetics & Personal Care

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Pharmaceuticals

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Others

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Botanical Ingredients Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Source, 2016-2026 (USD Million)

7.2.3 Market Size, By Form, 2016-2026 (USD Million)

7.2.4 Market Size, By Application, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Form, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Form, 2016-2026 (USD Million)

7.2.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Source, 2016-2026 (USD Million)

7.3.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.4 Market Size, By Application, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Form, 2016-2026 (USD Million)

7.3.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Form, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Form, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Form, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Form, 2016-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Source, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Form, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Source, 2016-2026 (USD Million)

7.4.3 Market Size, By Form, 2016-2026 (USD Million)

7.4.4 Market Size, By Application, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Form, 2016-2026 (USD Million)

7.4.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Form, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Form, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.8.2 Market size, By Form, 2016-2026 (USD Million)

7.4.8.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Source, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Form, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Source, 2016-2026 (USD Million)

7.5.3 Market Size, By Form, 2016-2026 (USD Million)

7.5.4 Market Size, By Application, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Form, 2016-2026 (USD Million)

7.5.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Form, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Form, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Source, 2016-2026 (USD Million)

7.6.3 Market Size, By Form, 2016-2026 (USD Million)

7.6.4 Market Size, By Application, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Source, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Form, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Source, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Form, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Source, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Form, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 PT. Indesso Aroma

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 New Directions Aromatics Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 The Herbarie at Stoney Hill Farm, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Lipoid Kosmetik AG

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Bell Flavors & Fragrances

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Frutarom Ltd

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Rutland Biodynamics Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Ambe Phytoextracts Pvt Ltd.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Prakruti Products Pvt. Ltd.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Umalaxmi Organics Pvt. Ltd.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 The Green Labs LLC

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Berje Inc.

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Saba Botanical

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 Other Companies

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

The Global Botanical Ingredients Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Botanical Ingredients Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS