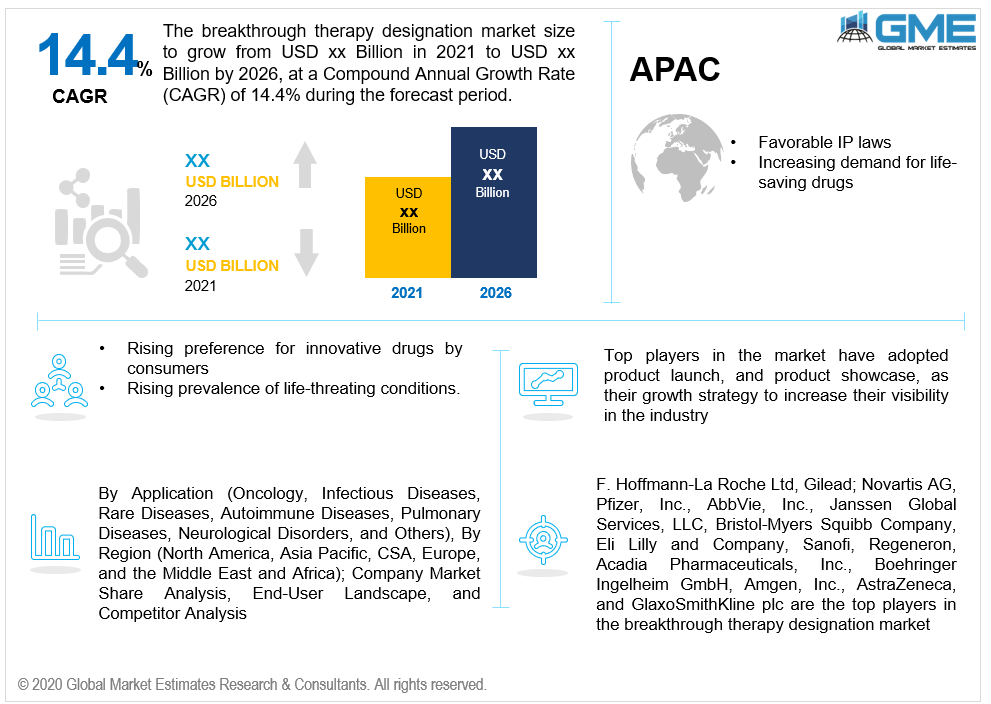

Global Breakthrough Therapy Designation Market Size, Trends & Analysis - Forecasts to 2026 By Application [Oncology, Infectious Diseases, Rare Diseases, Autoimmune Diseases, Pulmonary Diseases, Neurological Disorders, and Others], Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Drugs used in breakthrough medicine are used to cure debilitating and life-threatening illnesses. The FDA designates a medication as a transformative therapy when limited scientific data suggests that the medication is a significant advancement over currently available & approved conventional medication treatment. The extent of the therapeutic outcome and the reported functional improvement from the existing medication are two considerations that assess the efficacy of breakthrough therapy drugs.

Since breakthrough therapy considers morbidity and mortality for medication authorization, the criteria for breakthrough therapy drug approval differs from standard drug approval. They can be used on their own or in conjunction. Drug production for breakthrough therapies is less expensive due to the FDA's quicker acceptance of medicines based on limited evidence. For other reimbursements and consumer entry, manufacturers of breakthrough therapy drugs must generate extra post-marketing surveillance results. Currently approved breakthrough therapy pharmaceutical drugs on the market represent oncology, infectious disorders, respiratory problems, and other treatment classes. When a drug is in the first or second stage of clinical trials, it is assigned this classification.

The key driver for the breakthrough therapy drug market is the rising prevalence of life-threatening conditions and the need for rapid development of pipeline drugs. This is due to the high-unfulfilled need for currently available severe condition treatment. Because of the expedited market access and higher yields on their investments, manufacturing companies pay more attention when a drug is designated as a breakthrough. Breakthrough therapy drugs are correlated with less comprehensive clinical developments as a result of their market. The FDA's increased support for small-scale industries in R&D, including increased money and faster drug approval, is fuelling the market for breakthrough therapy drugs. All of these factors are driving the breakthrough therapy drug market forward.

Increasing healthcare spending in developed countries, as well as the advancement of Intellectual Property (IP) rules, are presumed to fuel the market for innovative therapy for the treatment of life-threatening disorders. In the coming years, the demand for breakthrough therapy classification is expected to expand due to increased use of orphan medicines and widespread acceptance of the breakthrough therapy designation in medications.

Moreover, the spike of contagious diseases and epidemics such as Swine Flu, COVID-19, Ebola, and Bird Flu will establish new growth opportunities for the breakthrough therapy (BT) classification market in the coming years. Nevertheless, the high costs of BT-designated drugs would limit the industry's expansion. The fast supply of generic drugs seems to be putting further controls on the market's growth in the coming years. Breakthrough therapy designation necessitates additional preparation for valuations, access to markets, and reimbursements, all of which act as market restraints. Uncertainty surrounding breakthrough therapy drugs is a major challenge for pharmaceutical companies.

Over the projected period, the market is predicted to be propelled by a growing number of molecules acquiring BT status, as well as an increase in demand for cancer therapies & medicines for rare diseases. Market expansion is also projected to be supported by rising chronic disease incidence and increased healthcare spending. The number of medicines granted BT status in the United States has been steadily increasing. This is also projected to increase the number of applicants for the same, resulting in overall market expansion.

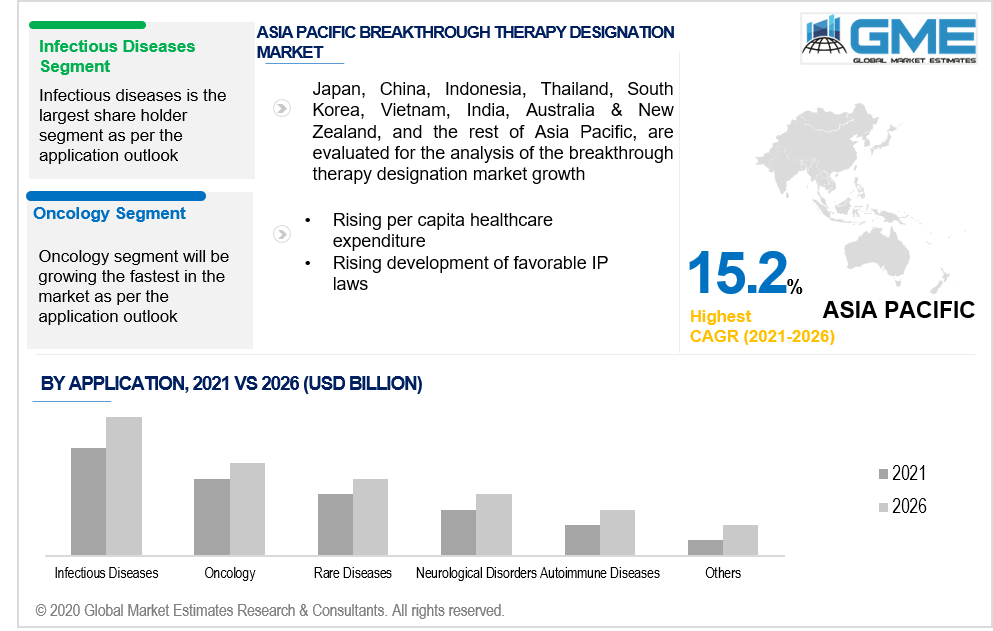

Based on application, the breakthrough therapy designation market is classified as oncology, infectious diseases, rare diseases, autoimmune diseases, pulmonary diseases, neurological disorders, and others. The infectious diseases segment is likely to lead in the global market. This is due to a surge in sales of bestselling drugs like Harvoni and Sovaldi. Furthermore, a large number of anti-infective medicines are acquiring BT designation. For example, PolyPid received Breakthrough Therapy Designation from the FDA in 2020 for D-PLEX100 for the Preventive measures of Surgical Site Infections in Colorectal Surgery. Conversely, the infectious disease category is projected to be restrained over the forecast timeframe due to a fall in breakthrough drug sales and increased rivalry in the hepatitis C market.

Due to the extreme increase in the volume of anticancer drugs achieving BT designation, the oncology segment is projected to overtake the infectious disease segment over the forecast era. Anticancer drugs were the most common of the drugs granted BT status as of 2020. For instance, In 2020, Futibatinib, a conjugated FGFR inhibitor, has been issued Breakthrough Therapy Designation by the FDA for the management of patients with a history of diagnosed and clinically progressed or metastatic cholangiocarcinoma harboring FGFR2 gene rearrangements, namely gene fusions. Moreover, the global increase in cancer incidence is expected to improve the oncology market.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Due to the appropriate IP laws and administrative framework that resulted in innovation in patent and data security, North America dominates the breakthrough therapy classification market. High per capita income, improved adherence to healthcare, increasing chronic disease incidences, and a rise in consumers' preference for innovative drugs are expected to fuel the growth of the breakthrough therapy designation market in the area.

Due to various infrastructure and repayment programs, Europe is expected to see substantial growth in the breakthrough therapy (BT) classification market. Throughout the forecast period, users' enthusiasm for innovative medicine is expected to drive the breakthrough therapy (BT) designation market in the area.

Due to the establishment of favorable government laws and an increase in per capita healthcare spending in these areas, the APAC region, and Latin America are projected to experience profitable growth during the forecast period. One of the big obstacles to the development of novel drugs is the preference for conventional drugs in countries like India and China.

F. Hoffmann-La Roche Ltd., Gilead; Novartis AG, Pfizer, Inc., AbbVie, Inc., Janssen Global Services, LLC, Bristol-Myers Squibb Company, Eli Lilly and Company, Sanofi, Regeneron, Acadia Pharmaceuticals, Inc., Boehringer Ingelheim GmbH, Amgen, Inc., AstraZeneca, and GlaxoSmithKline plc are the top players in the breakthrough therapy designation market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Breakthrough Therapy Designation Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Regional Overview

Chapter 3 Breakthrough Therapy Designation Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Favourable IP Laws

3.3.1.2 Appropriate Government Laws

3.3.2 Industry Challenges

3.3.2.1 Easy Availability of Generic Medicines

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Breakthrough Therapy Designation Market, By Application

4.1 Application Outlook

4.2 Oncology

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Infectious Diseases

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Rare Diseases

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Autoimmune Diseases

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Pulmonary Diseases

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

4.7 Neurological Disorders

4.7.1 Market Size, By Region, 2019-2026 (USD Million)

4.8 Others

4.8.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Breakthrough Therapy Designation Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2019-2026 (USD Million)

5.2.2 Market Size, By Application, 2019-2026 (USD Million)

5.2.3 U.S.

5.2.3.1 Market Size, By Application, 2019-2026 (USD Million)

5.2.4 Canada

5.2.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.3 Europe

5.3.1 Market Size, By Country 2019-2026 (USD Million)

5.3.2 Market Size, By Application, 2019-2026 (USD Million)

5.3.3 Germany

5.2.3.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.4 UK

5.3.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.5 France

5.3.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.6 Italy

5.3.6.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.7 Spain

5.3.7.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.8 Russia

5.3.8.1 Market Size, By Application, 2019-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2019-2026 (USD Million)

5.4.2 Market Size, By Application, 2019-2026 (USD Million)

5.4.3 China

5.4.3.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.4 India

5.4.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.5 Japan

5.4.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.6 Australia

5.4.6.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.7 South Korea

5.4.7.1 Market Size, By Application, 2019-2026 (USD Million)

5.5 Latin America

5.5.1 Market Size, By Country 2019-2026 (USD Million)

5.5.2 Market Size, By Application, 2019-2026 (USD Million)

5.5.3 Brazil

5.5.3.1 Market Size, By Application, 2019-2026 (USD Million)

5.5.4 Mexico

5.5.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.5.5 Argentina

5.5.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.5 MEA

5.5.1 Market Size, By Country 2019-2026 (USD Million)

5.5.2 Market Size, By Application, 2019-2026 (USD Million)

5.5.3 Saudi Arabia

5.5.3.1 Market Size, By Application, 2019-2026 (USD Million)

5.5.4 UAE

5.5.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.5.5 South Africa

5.5.5.1 Market Size, By Application, 2019-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 F. Hoffmann-La Roche Ltd.

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Gilead; Novartis AG

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Pfizer, Inc.

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 AbbVie, Inc.

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 Janssen Global Services, LLC

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 Bristol-Myers Squibb Company

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Eli Lilly and Company

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Sanofi

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Regeneron

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

6.11 Acadia Pharmaceuticals, Inc.

6.11.1 Company Overview

6.11.2 Financial Analysis

6.11.3 Strategic Positioning

6.11.4 Info Graphic Analysis

6.12 Boehringer Ingelheim GmbH

6.12.1 Company Overview

6.12.2 Financial Analysis

6.12.3 Strategic Positioning

6.12.4 Info Graphic Analysis

6.13 Amgen, Inc.

6.13.1 Company Overview

6.13.2 Financial Analysis

6.13.3 Strategic Positioning

6.13.4 Info Graphic Analysis

6.15 AstraZeneca

6.15.1 Company Overview

6.15.2 Financial Analysis

6.15.3 Strategic Positioning

6.15.4 Info Graphic Analysis

6.16 GlaxoSmithKline plc

6.16.1 Company Overview

6.16.2 Financial Analysis

6.16.3 Strategic Positioning

6.16.4 Info Graphic Analysis

6.17 Other Companies

6.17.1 Company Overview

6.17.2 Financial Analysis

6.17.3 Strategic Positioning

6.17.4 Info Graphic Analysis

The Global Breakthrough Therapy Designation Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Breakthrough Therapy Designation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS