Global Building Wool Insulation Market Size, Trends & Analysis - Forecasts to 2026 By Product (Glass, Stone, Sheep), By Application (Wall, Roof, Floor), By End-Use (Residential, Commercial, Industrial), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Increasing demand for ecological construction material to attain sustainability in infrastructure has reinforced Building Wool Insulation Market growth. Wool being a natural, eco-friendly, non-toxic, and renewable source makes it suitable for the construction industry. Each year a huge amount of money is spent on construction material residual management which makes it hard for industry manufacturers to operate. Thus, building wool insulation is an alternative that is economical in the long term and also safe for workers to use without the fear of toxin breakout.

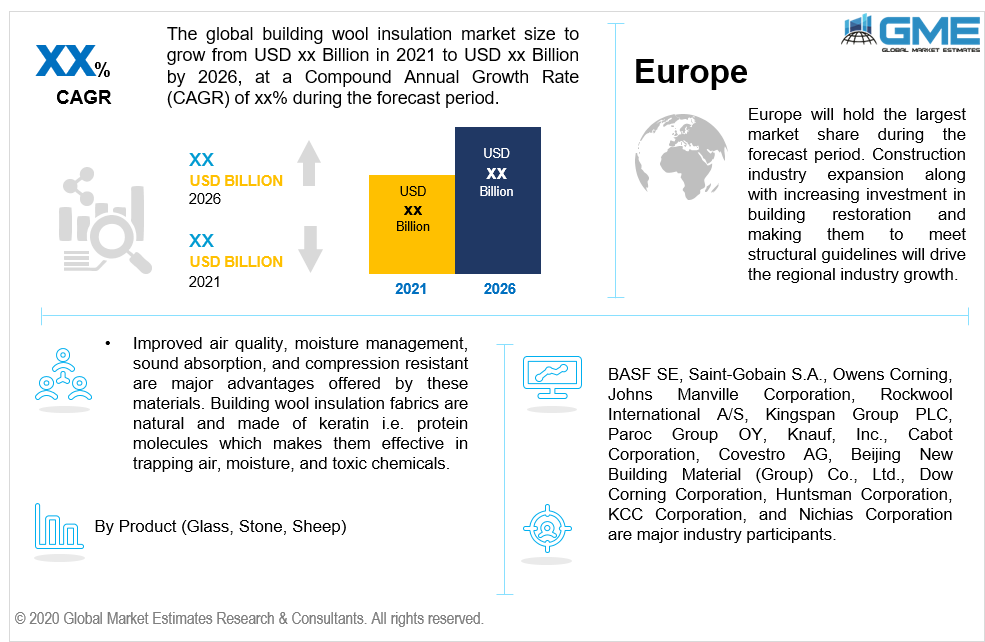

Improved air quality, moisture management, sound absorption, and compression resistance are major advantages offered by these materials. Building wool insulation fabrics are natural and made of keratin i.e. protein molecules which makes them effective in trapping air, moisture, and toxic chemicals. The material is highly preferred in home construction due to their improved indoor air quality features which makes the interior warm in winter and cool during the summer.

The growing adoption of biodegradable and compostable construction material will influence the Building Wool Insulation demand. The material is resilient, elastic, sound-absorbing, and effective in retaining airborne dust. Other factors meeting the construction material guidelines regarding the thermal conductivity, fire resistance, moisture control, and renewability makes the material highly preferable in commercial and residential structure.

The rising requirement of energy-efficient structures owing to the increasing government intervention to curb pollution and residual from construction will impose the deployment of wool insulation materials. However, high initial cost as compared to traditional fiberglass may impact the industry price trend. The toxin outbreaks during the construction can end up very expensive in terms of lawsuits, compensation, and workers’ safety. Thus, it is essential to take precautionary measures and invest in advance over long-term cost-effective materials.

Rock, stone, and sheep are three major products in the Building Wool Insulation market. A rising preference for non-toxic, renewable, and sustainable material has reinforced the demand for sheep wool insulation material. The segment is expected to witness the highest gains in the coming years. These materials are abundant in supply due to their natural products and are highly preferred in the construction industry. Properties such as absolute acoustic insulation, moisture control, and improved indoor air quality are major advantages offered by these materials.

Rock and stone are the conventional material used in the construction industry. Cost-effectiveness and wide product availability are two key reasons to drive demand in this segment. Government regulations to replace conventional and harmful materials with renewable and chemical-free construction material will drive the industry growth.

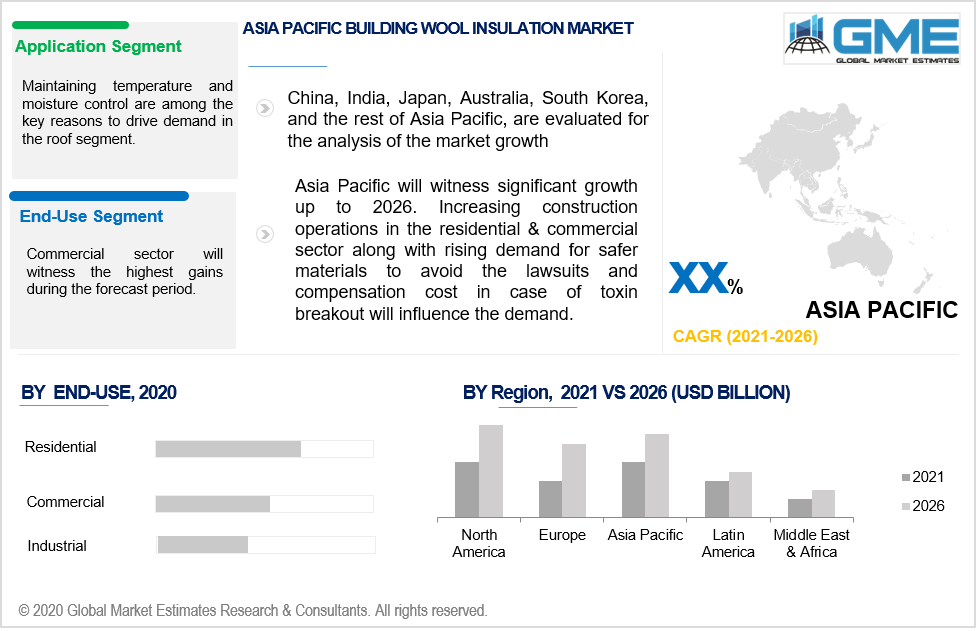

Building wool insulation materials are deployed in the walls, roofs, and floors of the construction structure. Roof applications are expected to gain maximum share during the forecast period. Maintaining temperature and moisture control are among the key reasons to drive demand in the roof segment.

Walls are projected to attain the highest gains in the coming years due to their high efficiency in combating cavity and decay. Also, reducing energy cost by trapping heat and making the indoor environment suitable in winter and summer makes the material highly effective in the structure. The air cavity solution provided to the wall not only makes the structure more strong but also helps in elongated lifespan by creating a thermal barrier.

Residential, commercial, and industrial are three key identified end-users in the building wool insulation market. The residential sector will dominate the market share and continue to hold its dominance up to 2026. The rising demand for eco-friendly construction material along with the presence of high-quality features and R rating in the material makes it suitable for residential construction. Also, increasing expenditure on residential housing will inculcate the demand.

The commercial sector will witness the highest gains during the forecast period. Rapid commercialization and the necessity to invest in commercial buildings will stimulate the growth in this segment. Industrial sector growth is highly influenced by the interference of foreign investments and needs to facilitate large-scale construction sustainably and meeting government guidelines regarding the green housing solution.

Europe will hold the largest market share during the forecast period. Construction industry expansion along with increasing investment in building restoration and making them meet structural guidelines will drive the regional industry growth. High investment in green construction material to achieve sustainability will influence the Europe Building Wool Insulation demand.

The Asia Pacific region will witness significant growth up to 2026. Increasing construction operations in the residential & commercial sector along with rising demand for safer materials to avoid the lawsuits and compensation cost in case of toxin breakout will influence the demand. The region has also witnessed a high number of construction mishap cases, which will induce the demand.

BASF SE, Saint-Gobain S.A., Owens Corning, Johns Manville Corporation, Rockwool International A/S, Kingspan Group PLC, Paroc Group OY, Knauf, Inc., Cabot Corporation, Covestro AG, Beijing New Building Material (Group) Co., Ltd., Dow Corning Corporation, Huntsman Corporation, KCC Corporation, and Nichias Corporation are major industry participants.

Other key players include Fletcher Building Limited, Ode Industry and Trade Inc., Ursa, S.A., and CertainTeed, Sika AG.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Building wool insulation industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Product overview

2.1.3 Application overview

2.1.4 End-Use overview

2.1.5 Regional overview

Chapter 3 Building Wool Insulation Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Application growth scenario

3.4.2 End-Use growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Building Wool Insulation Market, By Product

4.1 Product Outlook

4.2 Glass Wool

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Stone Wool

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 Sheep Wool

4.4.1 Market size, by region, 2016-2026 (USD Million)

4.5 Others

4.5.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Building Wool Insulation Market, By Application

5.1 Application Outlook

5.2 Wall

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.3 Roof

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.4 Floor

5.4.1 Market size, by region, 2016-2026 (USD Million)

Chapter 6 Building Wool Insulation Market, By End-Use

6.1 End-Use Outlook

6.2 Residential

6.2.1 Market size, by region, 2016-2026 (USD Million)

6.3 Commercial

6.3.1 Market size, by region, 2016-2026 (USD Million)

6.4 Industrial

6.4.1 Market size, by region, 2016-2026 (USD Million)

Chapter 7 Building Wool Insulation Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2016-2026 (USD Million)

7.2.2 Market size, by product, 2016-2026 (USD Million)

7.2.3 Market size, by application, 2016-2026 (USD Million)

7.2.4 Market size, by end-use, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by product, 2016-2026 (USD Million)

7.2.5.2 Market size, by application, 2016-2026 (USD Million)

7.2.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by product, 2016-2026 (USD Million)

7.2.6.2 Market size, by application, 2016-2026 (USD Million)

7.2.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2016-2026 (USD Million)

7.3.2 Market size, by product, 2016-2026 (USD Million)

7.3.3 Market size, by application, 2016-2026 (USD Million)

7.3.4 Market size, by end-use, 2016-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by product, 2016-2026 (USD Million)

7.2.5.2 Market size, by application, 2016-2026 (USD Million)

7.2.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by product, 2016-2026 (USD Million)

7.3.6.2 Market size, by application, 2016-2026 (USD Million)

7.3.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by product, 2016-2026 (USD Million)

7.3.7.2 Market size, by application, 2016-2026 (USD Million)

7.3.7.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by product, 2016-2026 (USD Million)

7.3.8.2 Market size, by application, 2016-2026 (USD Million)

7.3.8.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market size, by product, 2016-2026 (USD Million)

7.3.9.2 Market size, by application, 2016-2026 (USD Million)

7.3.9.3 Market size, by end-use, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market size, by product, 2016-2026 (USD Million)

7.3.10.2 Market size, by application, 2016-2026 (USD Million)

7.3.10.3 Market size, by end-use, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2016-2026 (USD Million)

7.4.2 Market size, by product, 2016-2026 (USD Million)

7.4.3 Market size, by application, 2016-2026 (USD Million)

7.4.4 Market size, by end-use, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by product, 2016-2026 (USD Million)

7.4.5.2 Market size, by application, 2016-2026 (USD Million)

7.4.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by product, 2016-2026 (USD Million)

7.4.6.2 Market size, by application, 2016-2026 (USD Million)

7.4.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by product, 2016-2026 (USD Million)

7.4.7.2 Market size, by application, 2016-2026 (USD Million)

7.4.7.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by product, 2016-2026 (USD Million)

7.4.8.2 Market size, by application, 2016-2026 (USD Million)

7.4.8.3 Market size, by end-use, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by product, 2016-2026 (USD Million)

7.4.9.2 Market size, by application, 2016-2026 (USD Million)

7.4.9.3 Market size, by end-use, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2016-2026 (USD Million)

7.5.2 Market size, by product, 2016-2026 (USD Million)

7.5.3 Market size, by application, 2016-2026 (USD Million)

7.5.4 Market size, by end-use, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by product, 2016-2026 (USD Million)

7.5.5.2 Market size, by application, 2016-2026 (USD Million)

7.5.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by product, 2016-2026 (USD Million)

7.5.6.2 Market size, by application, 2016-2026 (USD Million)

7.5.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market size, by product, 2016-2026 (USD Million)

7.5.7.2 Market size, by application, 2016-2026 (USD Million)

7.5.7.3 Market size, by end-use, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2016-2026 (USD Million)

7.6.2 Market size, by product, 2016-2026 (USD Million)

7.6.3 Market size, by application, 2016-2026 (USD Million)

7.6.4 Market size, by end-use, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by product, 2016-2026 (USD Million)

7.6.5.2 Market size, by application, 2016-2026 (USD Million)

7.6.5.3 Market size, by end-use, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by product, 2016-2026 (USD Million)

7.6.6.2 Market size, by application, 2016-2026 (USD Million)

7.6.6.3 Market size, by end-use, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by product, 2016-2026 (USD Million)

7.6.7.2 Market size, by application, 2016-2026 (USD Million)

7.6.7.3 Market size, by end-use, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Saint-Gobain S.A.

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 BASF SE

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Owens Corning

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Kingspan Group PLC

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Johns Manville Corporation

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Rockwool International A/S

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Paroc Group OY

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Beijing New Building Material (Group) Co., Ltd.

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Knauf Insulation, Inc.

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Cabot Corporation

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Covestro AG

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Dow Corning Corporation

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Fletcher Building Limited

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Huntsman Corporation

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 KCC Corporation

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 Nichias Corporation

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 Ode Industry and Trade Inc.

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 Ursa Insulation, S.A.

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 CertainTeed

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 Sika AG

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

The Global Building Wool Insulation Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Building Wool Insulation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS