Global Cancer Diagnostics Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Laboratory Tests Genetic Tests, Imaging, Biopsy, Endoscopy, Others), By Application (Breast Cancer, Colorectal Cancer, Cervical Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Blood Cancer, Kidney Cancer, Pancreatic Cancer, Ovarian Cancer, Others), By End User (Hospitals, Diagnostic Centers), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

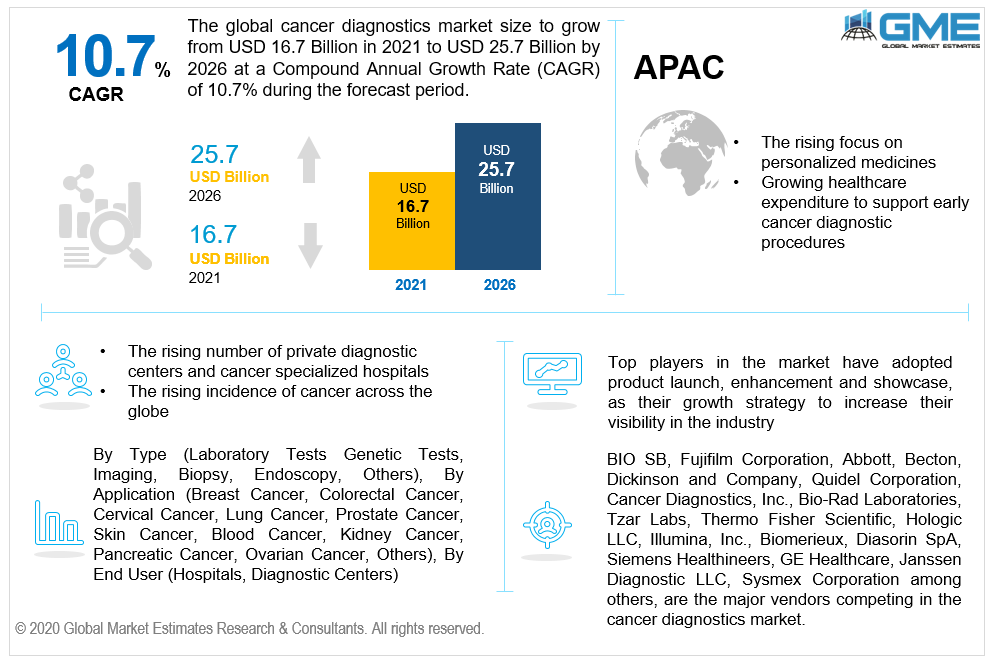

The global cancer diagnostics market is predicted to grow from USD 16.7 billion in 2021 to reach USD 25.7 billion by 2026 with a CAGR of 10.7% from 2021-2026. The cancer diagnostics market size is increasing owing to factors such as rising incidence of cancer across the globe. Rising consumption of unhealthy diet containing high fat and sugar content, as well as low physical activity amongst younger generation has helped increase the incidence of diabetes and other lifestyle disorders. The impact of covid on cancer diagnostics market has resulted negatively on the market size and value of cancer diagnostics. Due to rising COVID-19 cases the entire healthcare ecosystem’s priorty was shifted to virus detection, analysis and testing. Hence, the market witnessed a slight de-growth in the intial months of 2020.

Cancer is the second biggest cause of mortality rate worldwide, and as per the WHO, there were more than 10 million deaths recorded in 2020. As a result of this, cancer diagnostics market value have gained high importance in order to avoid complications in the later stage of cancer. The rising geriatric patient population is also another major factor affecting the growth of the cancer diagnostics market growth positively. According to the 2019 World Ageing Report, as of 2019, the global geriatric population (those aged 65 and above) was estimated to be around 702.9 million, with a projected growth to 1,548.9 million by 2050.

Furthermore, the development of new technologies such as biomarkers and point-of-care testing has also helped the cancer diagnostics market growth. Increasing preference for advanced non-invasive and highly efficient diagnostic testing over conventional methods, increased healthcare spending capacity by the government, rising awareness regarding early-stage cancer diagnosis, and rising government support are few more factors driving cancer diagnostics market growth.

Cancer diagnostics is the process of recognizing various biomarkers, proteins, and symptoms that lead to the existence of a malignant tumor in individuals. The discovery of specific biomarkers and proteins that are common in cancer illnesses leads to the diagnosis procedure. The procedure of diagnosing cancer necessitates the use of specific technologies and equipment. Hence, the increasing demand for technically advanced cancer diagnostic modalities will help expand the cancer diagnostics market size.

Rising technological developments, as well as increasing initiatives supported by government and global health organizations to raise cancer awareness, increasing number of private diagnostic centers, and rapidly increasing public-private partnerships to improve diagnostic imaging center infrastructure, are among the major factors driving the cancer diagnostics market growth.

Furthermore, the augmentation of cell- and bead-based Flow Cytometry techniques, expanding healthcare infrastructure in emerging nations, and increasing demand for miniaturized and technologically advanced devices will create new opportunities for the cancer diagnostics market over the forecasted year 2021-2026.

Many companies are engaging in launching point of care diagnostic devices, and one of the global leader in cancer diagnostics market is GE Healthcare. GE Healthcare retained the market leadership position in 2020 as they are one of the top players in the global cancer diagnostics market and offer top notch devices. The corporation has a large geographic footprint in Asia, United States, and Europe, among others. Furthermore, the company's primary strength in the cancer diagnostics market is its strong brand recognition and diverse product portfolio. With the rising peneteration rate of top cancer diagnostic companies, the cancer diagnostics market size is ought to be increasing rapidly.

The cancer diagnostics market forecast study involves the analysis of application, technology, end-user and region/ country level impact by the augmentation of latest and advanced cancer diagnostics tools. The cancer diagnostics market forecast study also includes end-user perception analysis which explaines how the tools are rendering effortless support to point of care application.

The cancer diagnostics market growth saw a major slowdown in growth as a result of the COVID-19 epidemic. As the number of COVID-19 cases increased, the healthcare system turned its priority to containing the disease, delaying the identification and treatment of other chronic disorders such as cancer. As a result, the pandemic scenario is projected to have a negative influence on the cancer diagnostics market value.

The global cancer diagnostics market report includes exhaustive research study on the application segment, type segment, technological advancements, competitive landscape, end-user analysis, four quadrant matrix and detailed company analysis. The global cancer diagnostics market report also offers in-depth insights on the the cancer diagnostics market size at regional and country level. It also gives a descriptive understanding of impact of covid on cancer diagnostics market.

As per the cancer diagnostic market analysis for type, the study can be segmented into laboratory tests genetic tests, imaging, biopsy, and endoscopy, among others. During the forecast period, the imaging segment is projected to hold the largest share in the global cancer diagnostics market. Computed Tomography scans and Magnetic Resonance Imaging are two imaging modalities that are rapid, non-invasive, cost-effective diagnostic options. In diagnosing a range of cancer types, these imaging modalities are utilized in conjunction with other laboratory and genetic studies to assess the location and severity of the problem. The number of private diagnostic centres is rising globally as demand for diagnostic imaging treatments rises and public hospitals struggle to keep up with the restricted number of imaging modalities at their disposal.

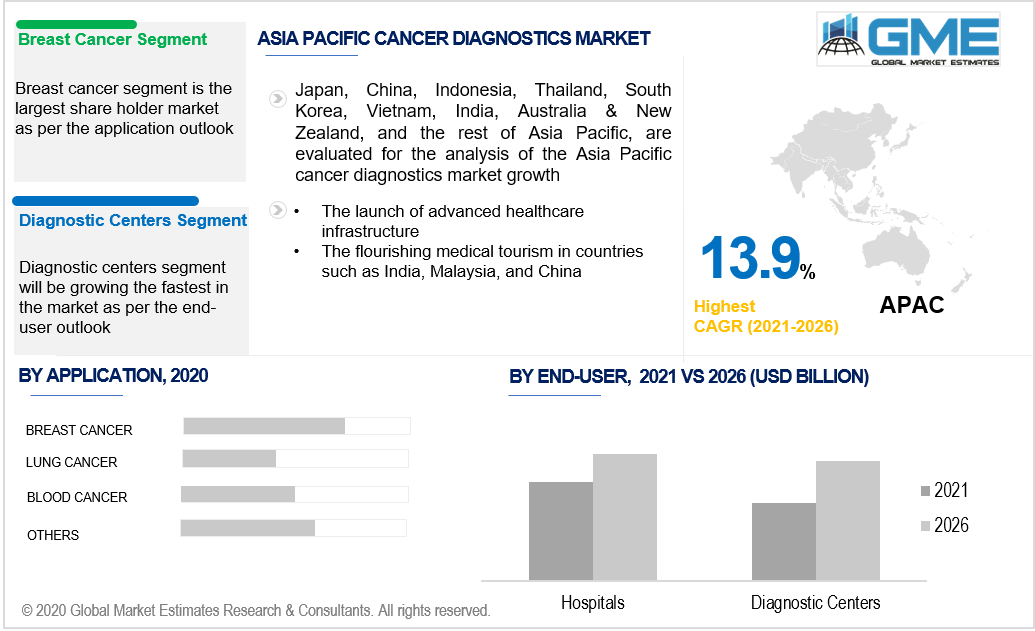

As per the cancer diagnostic market analysis for application, the study can be split into breast cancer, colorectal cancer, cervical cancer, lung cancer, prostate cancer, skin cancer, blood cancer, kidney cancer, pancreatic cancer, ovarian cancer, others. During the forecast period, the breast cancer segment is expected to dominate the global cancer diangostics market. Hormone replacement medication, obese, restricted childbearing, and age-related hazards are the main causes of the high prevalence of breast cancer across the globe. Changing lifestyles and alcohol abuse are linked to an increase in oestrogen levels in the body, which increases the risk of breast cancer.

As per the cancer diagnostic market analysis for end-user, the study can be segmented into hospitals and diagnostic centers. In 2020, the hospital sector held the greatest share of the market. The increasing number of patients visiting hospitals the rising number of in-house diagnostic procedures, and increased awareness about early diagnosis of cancer are all driving forces that helped this segment attain a dominant position in the market. Hospitals have a high rate of acceptance of technologically sophisticated imaging modalities and other instruments used in cancer detection. According to the National Health Expenses, hospital care accounts for 32 percent of total healthcare expenditures are for cancer treatments.

As per the cancer diagnostic market analysis for region, the study can be segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Central & South America. The global cancer diagnostics market is dominated by North America. The cancer diagnostic market value will be the largest for US followed by Canada. The region's high demand for the availability of low-cost tests has boosted the cancer diagnostics market growth. One of the primary factors propelling the diagnostics sector in the region is the existence of various biotechnology and medical device firms. Because of factors such as increased research and development initiatives and high adoption of innovative technologies, North America is likely to maintain its dominant position during the forecast period. Furthermore, in developed nations, inadequate living standards, as well as rising cigarette and alcohol consumption, all of which lead to various types of cancer, are driving up diagnostic demand. Also, industry players' extensive foothold in the region, together with favourable R&D initiatives by these corporations, will favour market size expansion.

As per the cancer diagnostic market analysis the APAC region is expected to grow at the fastest rate during the forecast period. The cancer diagnostic market size for Asia Pacific will be growing rapidly. The growing presence of cancer patients, the availability of qualified personnel at a reduced cost, and a well-defined regulatory system that favours fast product approvals are some of the factors contributing to cancer diagnostics market growth. Additionally, the growing medical tourism industry in countries like India, China, and Malaysia is expected to increase the demand for oncological screening. Cancer diagnostics in India is growing rapidly and helping the cancer diagnostic market size increase exponentially. Many research and academic firms are involved in studying the importance of cancer diagnostic tools to identify rare and silent genes that cause cancer and chronic diseases. Activities related to cancer diagnostics in India will help the entire Asia Pacific cancer diagnostic market size expand rapidly.

BIO SB, Fujifilm Corporation, Abbott, Becton, Dickinson and Company, Quidel Corporation, Cancer Diagnostics, Inc., Bio-Rad Laboratories, Tzar Labs, Biomerieux, Diasorin SpA, Siemens Healthineers, GE Healthcare, Janssen Diagnostic LLC, Sysmex Corporation among others, are the global leaders in cancer diagnostics market. These players have a significant share in the market and have helped increase the cancer diagnostic market value.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2021, Tzar Labs collaborated with Epigeneres Biotechnology (global leader in cancer diagnostics market) announced the launch of a new blood-based test that can be used for early cancer detection. This helped the company increase its visibility in the global cancer diagnostics market.

In January 2021, Fujifilm Corporation (a global leader in cancer diagnostics market) established its new medical screening center NURA that focuses on cancer screening in Bengaluru, India. This helped the company expand its offerings to developing country and expect to achieve a considerable growth in the global cancer diagnostics market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cancer Diagnostics Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 End-User Overview

2.1.3 Type Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Global Cancer Diagnostics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising number of private diagnostic centers

3.3.1.2 Growing incidence of cancer

3.3.2 Industry Challenges

3.3.2.1 Inadequate infrastructure and low awareness in middle- and low-income countries

3.4 Prospective Growth Scenario

3.4.1 End-User Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cancer Diagnostics Market, By End-User

4.1 End-User Outlook

4.2 Hospitals

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Diagnostic Centers

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Cancer Diagnostics Market, By Type

5.1 Type Outlook

5.2 Laboratory Tests

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Genetic Tests

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Imaging

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Endoscopy

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Biopsy

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Cancer Diagnostics Market, By Application

6.1 Application Outlook

6.2 Breast Cancer

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Lung Cancer

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Colorectal Cancer

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Cervical Cancer

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Prostrate Cancer

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

6.7 Skin Cancer

6.7.1 Market Size, By Region, 2020-2026 (USD Billion)

6.8 Blood Cancer

6.8.1 Market Size, By Region, 2020-2026 (USD Billion)

6.9 Kidney Cancer

6.9.1 Market Size, By Region, 2020-2026 (USD Billion)

6.10 Pancreatic Cancer

6.10.1 Market Size, By Region, 2020-2026 (USD Billion)

6.11 Ovarian Cancer

6.11.1 Market Size, By Region, 2020-2026 (USD Billion)

6.12 Others

6.12.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Cancer Diagnostics Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.3 Market Size, By Type, 2020-2026 (USD Billion)

7.2.4 Market Size, By Application, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.3 Market Size, By Type, 2020-2026 (USD Billion)

7.3.4 Market Size, By Application, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Type, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Billion)

7.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.3 Market Size, By Type, 2020-2026 (USD Billion)

7.4.4 Market Size, By Application, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Type, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Type, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.3 Market Size, By Type, 2020-2026 (USD Billion)

7.5.4 Market Size, By Application, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.3 Market Size, By Type, 2020-2026 (USD Billion)

7.6.4 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Type, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Fujifilm Corporation

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Abbott Laboratories

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 InfoGraphic Analysis

8.4 Becton, Dickinson and Company

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 InfoGraphic Analysis

8.5 Quidel Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 InfoGraphic Analysis

8.6 Thermo Fisher Scientific

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 InfoGraphic Analysis

8.7 Siemens Healthineers

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 InfoGraphic Analysis

8.8 Tzar Labs

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 InfoGraphic Analysis

8.9 Bio-Rad Laboratories

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 InfoGraphic Analysis

8.10 Sysmex Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 InfoGraphic Analysis

8.11 GE Healthcare

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 InfoGraphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 InfoGraphic Analysis

The Global Cancer Diagnostics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cancer Diagnostics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS