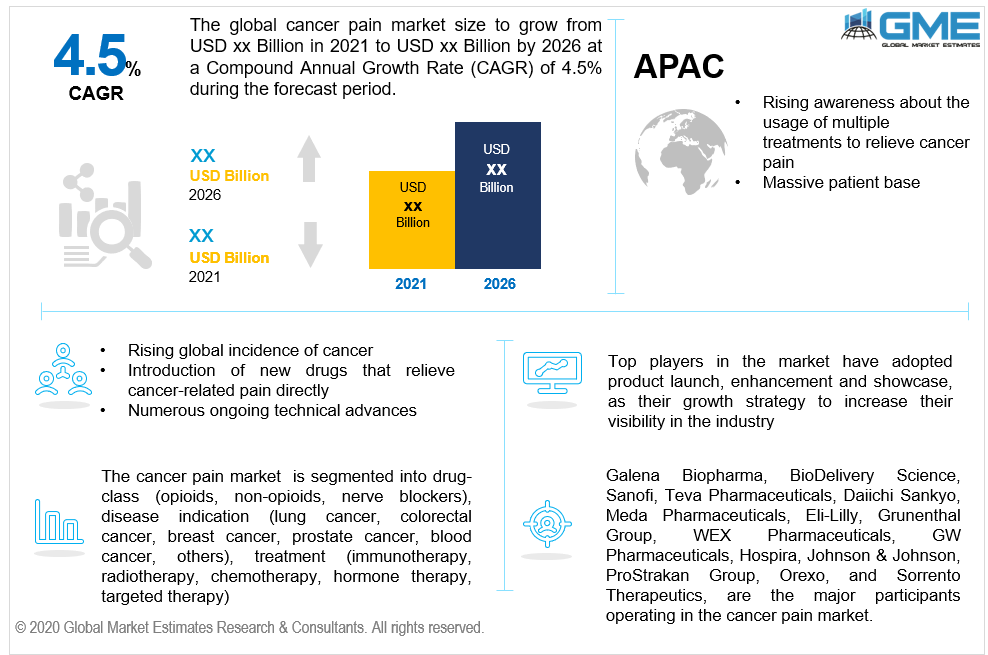

Global Cancer Pain Market Size, Trends, and Analysis - Forecasts To 2026 By Drug-Class (Opioids, Non-Opioids, Nerve blockers), By Disease Indication (Lung Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Blood Cancer, Others), By Treatment (Immunotherapy, Radiotherapy, Chemotherapy, Hormone therapy, Targeted Therapy), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Cancer pain is a symptom of a cancer diagnosis, and since the disease is persistent and progressive, cancer pain is a common source of chronic pain. Cancer pain is caused by tissue damage caused by the disease or by treatment. The medications and equipment used to treat pain caused by different forms of cancers are included in the cancer pain industry. Mixed system cancer pain is a nuanced, temporally evolving symptom that includes inflammatory, neuropathic, ischemic, and compression pathways at several locations. Cancer pain may be linked to radiation treatment, chemotherapy, and others. Cancer pain may also be triggered by the tumor rubbing against the body's bones, nerves, or other organs. Cancer pain is classified as chronic or acute depending on when cancer first appears and how long it lasts.

The majority of chronic pain stems from disease, and the majority of acute pain stems from surgery or diagnostic tests. Chemotherapy and radiotherapy can cause debilitating side effects that last well after therapy gets over. The intensity of pain is mostly determined by the cancer's stage and site. Cancer causes pain at all times, and 2/3rds of people with advanced cancer have pain so severe that it interferes with their emotions, sleeping, social relationships, and everyday activities.

The rising global incidence of cancer is driving the cancer pain industry. During the projected timeframe, the global cancer pain industry is projected to expand at a phenomenal pace. The consistent growth of this industry can be due to the introduction of new drugs that relieve cancer-related pain directly. Similarly, numerous ongoing technical advances aimed at mitigating pain caused by surgical procedures would have an impact on the industry's progress. Furthermore, the fast supply of painkiller medications would drive the cancer pain relief industry forward. Furthermore, an increasing elderly population and rising healthcare costs are two factors influencing the market for cancer pain medications. Among all of medicine's realms, cancer research has been recognized as a game-changing field. In recent years, this trend has also performed a significant role in the development of the worldwide cancer pain industry. The importance of pain relief during cancer procedures has been stressed by a variety of medical practitioners and researchers. The medical community's request has been accepted by academic institutions focused on the development of new medicines. As a result, the worldwide cancer pain industry is expected to generate significant sales over the forecast timeframe.

However, adverse factors related to the usage of medications used as a favored cancer pain treatment, as well as a lack of knowledge about the usage of new technologies for pain management, could stymie industry development.

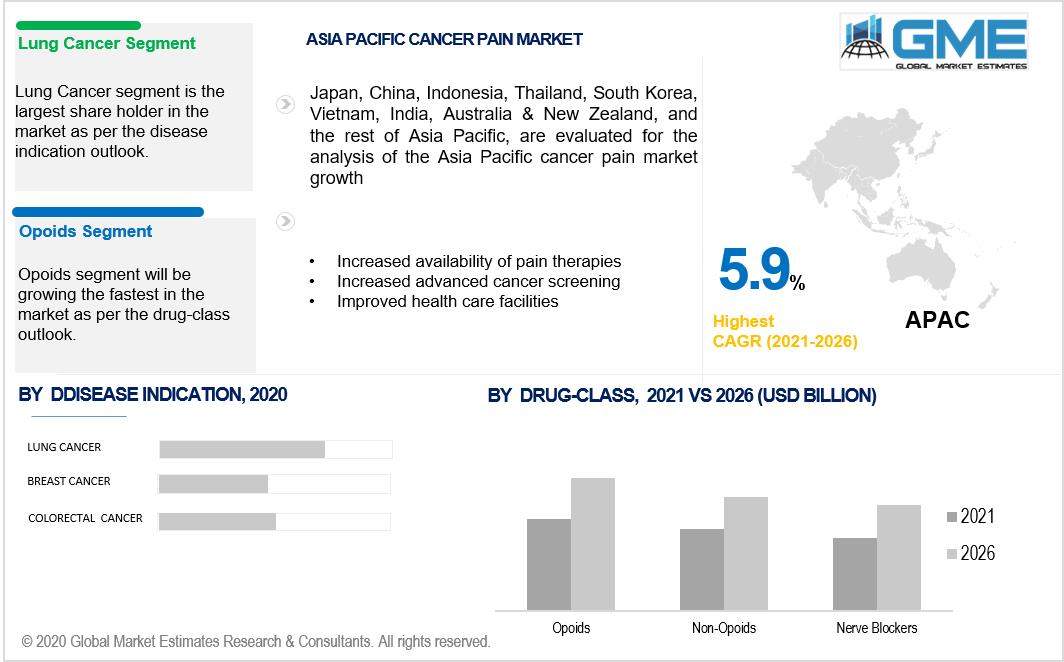

Because of their ability to successfully relieve cancer pain, opioids are predicted to be the most popular drug class category of the cancer pain industry. This is due to the increased use of opioids for cancer pain relief, as well as the fact that they are FDA-approved first-line medications for managing mild to serious debilitating cancer pain. To induce morphine-like results, opioids bind to ovoid receptors. The most common use of opioids is for pain relief. Opioids include drugs like oxycodone, hydrocodone, and as well as antagonists like naloxone, and endogenous peptides like endorphins.

The lung cancer division dominated the industry by disease indication in 2018, accounting for approximately 1/4th of the overall market share, and is predicted to continue to do so over the projected timeframe. Furthermore, during the predicted timeframe, this category will rise at the rapid CAGR. Due to the increased incidence of lung cancer and the use of cancer pain relievers, a rise in the cigarette smoking demographic, and the availability of modern diagnostic tools, this is a profitable industry. Furthermore, the world industry is projected to benefit from a surge in the elderly population.

During the projected timeframe, the targeted therapy category is predicted to rise at the highest rate. Targeted therapy is a form of treating cancer in which medications are designed to target certain proteins or genes found in cancerous cells. Targeted therapies include apoptosis inducers, hormone therapies, signal transduction inhibitors, angiogenesis inhibitors, gene expression modulators, and a variety of other cancer treatments. Physicians also use targeted treatment in combination with chemotherapy and other treatments. The US Food and Drug Administration (FD) has approved targeted therapies for a number of cancers.

Geographically, North America is estimated to have the largest share of the overall cancer pain industry over the projected timeframe. The key factors driving the development of the cancer pain relief industry in this area are producers' ongoing efforts to produce new products, technological advances, the growing incidence of cancer, the ease with which pain therapies are available, the steady rise in the incidence of various forms of cancers, the emergence of premier chemotherapy therapies and increased healthcare spending by governments and individuals.

Due to enhanced treatment facilities for treating cancer pain, Europe has the second-biggest share of the cancer pain relief industry. In addition, there is an increasing pattern of producer acquisition to tap into this rising demand.

Due to rising awareness about the usage of multiple treatments to relieve cancer pain, the Asia Pacific cancer pain relief industry is expected to expand significantly over the anticipated timeline. Owing to a massive patient base, increased availability of pain therapies, increased cancer prevalence, increased advanced cancer screening, and improved health care facilities, Asia Pacific offers attractive prospects for major participants operating in the cancer pain medication industry. The high incidence of cancer in India, Japan, and China is estimated to fuel potential growth for the cancer pain industry. Healthcare insurance companies, on the other hand, do not bear any of the costs associated with cancer therapy. The demand in the Asia-Pacific region is expected to be hampered by this aspect.

Galena Biopharma, BioDelivery Science, Sanofi, Teva Pharmaceuticals, Daiichi Sankyo, Meda Pharmaceuticals, Eli-Lilly, Grunenthal Group, WEX Pharmaceuticals, GW Pharmaceuticals, Hospira, Johnson & Johnson, ProStrakan Group, Orexo, and Sorrento Therapeutics, are the major participants operating in the cancer pain market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Cancer Pain Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Type Overview

2.1.4 Regional Overview

Chapter 3 Cancer Pain Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of cancer

3.3.1.2 Growing in the number of R&D initiatives taken by various pharmaceutical companies

3.3.2 Industry Challenges

3.3.2.1 High costs of a few drugs

3.4 Prospective Growth Scenario

3.4.1 Drug-Class Growth Scenario

3.4.2 Disease-Indicaton Growth Scenario

3.4.3 Treatment Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cancer Pain Market, By Drug Class

4.1 Product Type Outlook

4.2 Opoids

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Non- Opoids

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Nerve Blockers

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Cancer Pain Market, By Disease Indication

5.1 Distribution Channel Outlook

5.2 Lung Cancer

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Colorectal Cancer

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Breast Cancer

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Prostate Cancer

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Blood Cancer

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

5.7 Others

5.7.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Cancer Pain Market, By Treatment

6.1 Treatment Outlook

6.2 Immunotherapy

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Radiotherapy

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Chemotherapy

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Hormone therapy

6.5.1 Market Size, By Region, 2019-2026 (USD Billion)

6.6 Targeted Therapy

6.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Cancer Pain Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.3 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.2.4 Market Size, By Treatment, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.3 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.3.4 Market Size, By Treatment, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Treatment, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.3 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.4.4 Market Size, By Treatment, 2019-2026 (USD Billion)

7.4.4.1 China

7.4.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.4.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.4.4.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.4.5 India

7.4.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.4.6 Japan

7.4.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.4.7 Australia

7.4.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.8.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.3 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.5.4 Market Size, By Treatment, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Billion)

7.6.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.6.3 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.6.4 Market Size, By Treatment, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.6.5.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.6.5.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.6.7.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.6.7.3 Market Size, By Treatment, 2019-2026 (USD Billion)

7.6.8 South Africa

7.6.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.6.8.2 Market Size, By Disease Indication, 2019-2026 (USD Billion)

7.6.8.3 Market Size, By Treatment, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 BioDelivery Science

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info-Graphic Analysis

8.3 ProStrakan Group

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Teva pharmaceuticals

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Daiichi Sankyo

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Eli-Lilly

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Galena Biopharma

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Sanofi

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Johnson & Johnson

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Sorrento Therapeutics

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

The Global Cancer Pain Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cancer Pain Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS