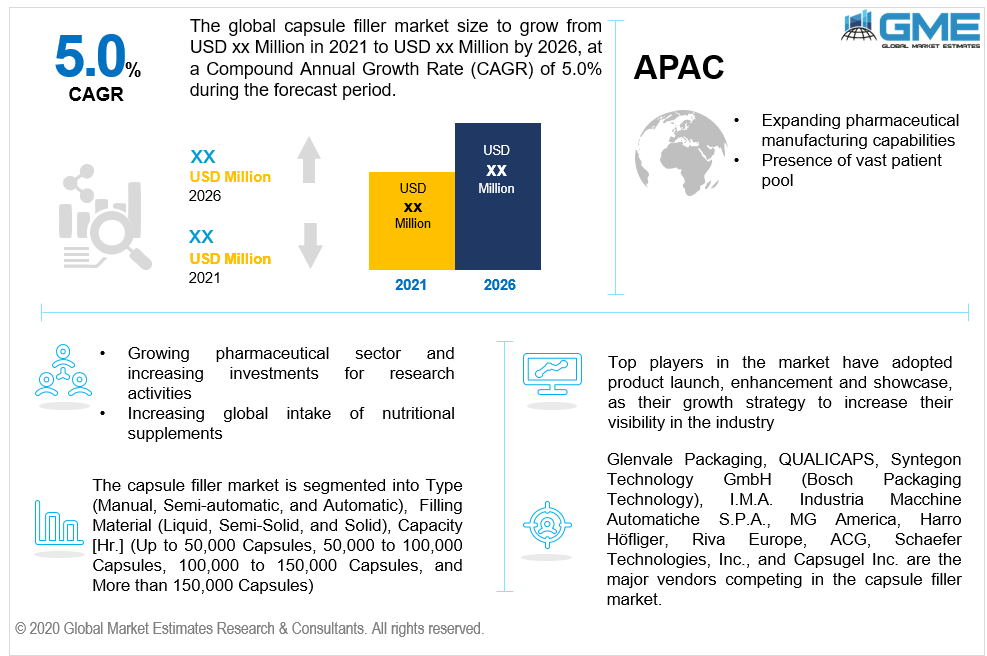

Global Capsule Filler Market Size, Trends, and Analysis- Forecasts To 2026 By Type (Manual, Semi-automatic, and Automatic), By Filling Material (Liquid, Semi-Solid, and Solid), By Capacity (Up to 50,000 Capsules, 50,000 to 100,000 Capsules, 100,000 to 150,000 Capsules, and More than 150,000 Capsules), By Application (Pharmaceuticals, Cosmetics, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Capsules are made by using a number of capsule filling machines to fill different types of formulas or powders containing active ingredients and their mixtures, as well as variations of excipients. Physicians recommend these tablets for the treatment of a variety of diseases or illnesses of patients.

Capsule fillers are commonly used in the pharmaceutical sector to fill capsules with active pharmaceutical ingredients (APIs) or a combination of APIs and excipients. Capsule fillers, also recognized as encapsulation machines or encapsulators, are machines that use semi-solids, powder, granules, or liquid drugs to fill hollow hard or soft gelatin capsules. It is essential in the manufacturing of pharmaceutical drugs. To increase manufacturing efficiency, pharmaceutical companies are focused on the implementation of fast and precise capsule fillers. The growing pharmaceutical industry in developing economies is driving the market for capsule fillers. Active ingredient producers are increasingly engaged in developing pharmaceutical manufacturing facilities in developing economies, which is expected to fuel the capsule filler demand in the forthcoming years.

During the forecast period, growing biopharmaceutical manufacturing investment is projected to create substantial opportunities for capsule filler producers. Manufacturers of capsule fillers are concentrating on the manufacture of innovative goods that implement precision control technology in order to increase the per-hour capsule filling capacity for high-speed capsule processing. During the forecast period, this is expected to boost the global capsule filler market's performance. The global capsule filling equipment market is being driven by the technical advances in capsule equipment with automated filling, as well as growing demand for effective capsules due to the rising incidence of diseases. Aside from that, large-scale capsule manufacturing offers manufacturers low-cost benefits and allows them to maximize their annual revenue.

Because of the ease of packing and formulation, nutritional supplements are often packaged in capsules. Supplement intake is expected to continue to increase in the projected timeline as global health consciousness increases. During the predicted timeframe, this world further pushes up demand for capsule filling machines.

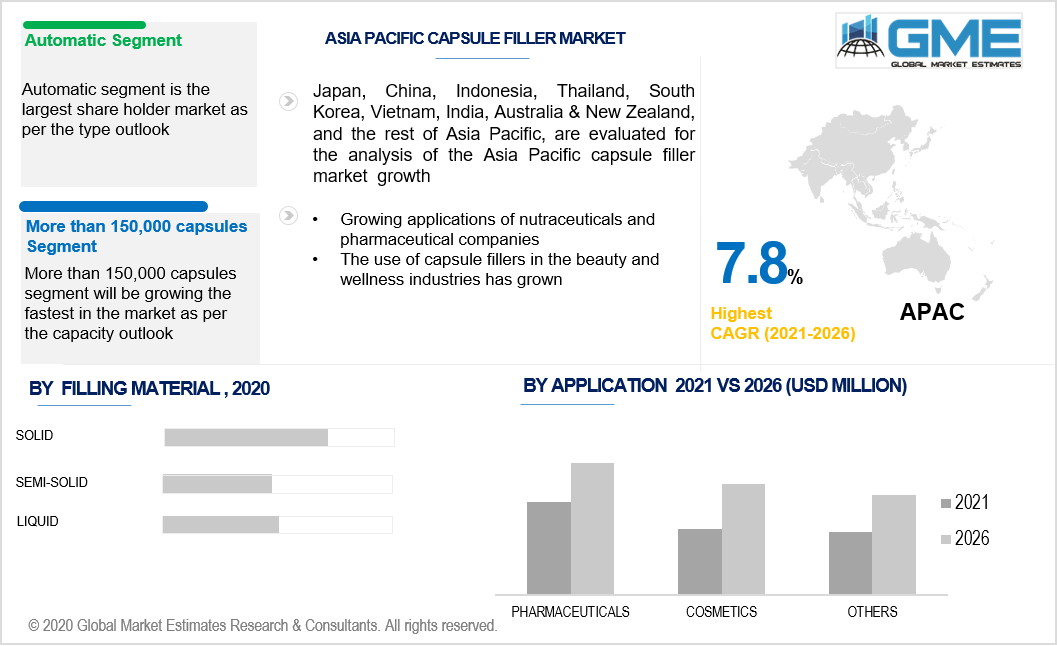

In recent times, the use of capsule fillers in the beauty and wellness industries has grown significantly. In recent decades, the demand for effective cosmetic products and capsules that can potentially enhance skin tone has risen, propelling market development and expansion. Nevertheless, the FDA's strict laws concerning capsule approval can limit the market growth.

On the basis of the type, the market has been categorized into automatic, semi-automatic, and manual. Semi-automatic capsule fillers accounted for a significant portion of the global demand in 2020 and are projected to continue to expand. Due to the high operating throughput propelled by the introduction of new technology and increasing demand from developing economies, automatic capsule fillers are expected to be the fastest-growing capsule fillers. Several companies have implemented robotics technology, necessitating the use of automatic capsule fillers in the pharmaceutical and cosmetic sectors.

In terms of filling material, the global capsule filler market has been classified into solid, semi-solid, and liquid. Attributed to the growing demand for granule and powder form in medicines due to their faster dissolution rate, solid filling content held the larger stake in 2020 and is predicted to maintain the same position based on profits generation during the forecasted period. Furthermore, they facilitate the filling of granules into capsules, avoiding any leakage or contamination both pre and post-capsules are filled.

Based on the capacity, the market has been classified into up to 50,000 capsules, 50,000 to 100,000 capsules, 100,000 to 150,000 capsules, and more than 150,000 capsules. The highest market share belongs to the capsules with a capacity of more than 150,000 capsules, which are mainly used in commercial applications that require high speed and accuracy. Fully automated capsule filling machines are in demand. Machines capable of producing up to 300,000 capsules each hour are commercially available, allowing for high-volume capsule production.

In 2020, the pharmaceutical application led the overall capsule filler market, and it is expected to expand at the fastest rate over the forecast period. The COVID-19 pandemic is predicted to have a beneficial effect on pharmaceutical manufacturing. The global capsule filler market is expected to expand faster in the upcoming years as a result of this. Because of innovations in technology, industrial processes, and integration, the global pharmaceutical industry is growing at a fast pace. This has led to improvements in capsule production procedures, which has resulted in a rise in demand for new capsule filling machines. Capsule production on a large scale necessitates the use of more automated capsule fillers, which propels the capsule filler market forward. In both advanced and emerging markets, rising health consciousness among the people is leading to increased demand for health supplements, which is boosting the capsule filler market.

The global capsule filling market was dominated by North America in 2020. The region's supremacy can be attributed to the growing use of capsules within inhalers to treat the region's high prevalence of respiratory problems. During the projected timeline, North America is predicted to have the highest market share in the empty capsules market, followed by Europe. The presence of a large number of capsule producers with massive production capacities, as well as a number of pharmaceutical companies with huge manufacturing capacities using these capsules, can also be credited to the largest market share. Empty capsules are in higher demand due to the rising focus on superior pharmaceutical products and generics.

Various factors are anticipated to boost APAC's incredible growth, including the region's substantial growth in the pharmaceutical industry in recent years. The expanding pharmaceutical manufacturing capabilities and the vast patient pool in the region are two of the reasons. Growing applications of nutraceuticals and pharmaceutical companies are driving the capsule filler market in the Asia Pacific. Consumer preference for capsule-based formulations is expanding, as is spending power. These are two major factors likely to propel market growth in the near future. Europe is also expected to maintain a constant growth rate over the forecast period. The capsule filler market has grown in response to rising health consciousness in the region, which is fueling the pharmaceutical sector's expansion. As a result, the market for capsule fillers in the region is increasing.

Glenvale Packaging, QUALICAPS, Syntegon Technology GmbH (Bosch Packaging Technology), I.M.A. Industria Macchine Automatiche S.P.A., MG America, Harro Höfliger, Riva Europe, ACG, Schaefer Technologies, Inc., and Capsugel Inc. are the major vendors competing in the capsule filler market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2017, Capsugel (US) extended its development and manufacturing capabilities for specialized drug products using the liquid-filled hard capsules (LFHC) technology at its Edinburgh facility in Scotland. In addition, the company added new Xcelodose-based micro-dosing capabilities to its clinical trial capacities at the same location.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Capsule Filler Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Filling Material Overview

2.1.5 Capacity Overview

2.1.6 Regional Overview

Chapter 3 Capsule Filler Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The growing pharmaceutical industry in developing economies

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated laboratory systems in third world countries

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Filling Material Growth Scenario

3.4.4 Capacity Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Capacity Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Capsule Filler Market, By Type

4.1 Type Outlook

4.2 Manual

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Semi-Automatic

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Automatic

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Capsule Filler Market, By Application

5.1 Application Outlook

5.2 Pharmaceuticals

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Cosmetics

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Other Applications

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Capsule Filler Market, By Filling Material

6.1 Liquid

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Semi-Solid

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Solid

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Capsule Filler Market, By Capacity

7.1 Up to 50,000 Capsules

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 50,000 to 100,000 Capsules

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 100,000 to 150,000 Capsules

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 More than 150,000 Capsules

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Capsule Filler Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By Filling Material, 2016-2026 (USD Million)

8.2.5 Market Size, By Capacity, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.4.3 Market Size, By Filling Material, 2016-2026 (USD Million)

Market Size, By Capacity, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.5 Market Size, By Capacity, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By Filling Material, 2016-2026 (USD Million)

8.4.5 Market Size, By Capacity, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By Filling Material, 2016-2026 (USD Million)

8.5.5 Market Size, By Capacity, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By Filling Material, 2016-2026 (USD Million)

8.6.5 Market Size, By Capacity, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Capacity, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Filling Material, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Capacity, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Glenvale Packaging

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 QUALICAPS

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Syntegon Technology GmbH

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Industria Macchine Automatiche S.P.A.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 MG America

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Harro Höfliger

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Riva Europe

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 ACG

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

The Global Capsule Filler Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Capsule Filler Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS