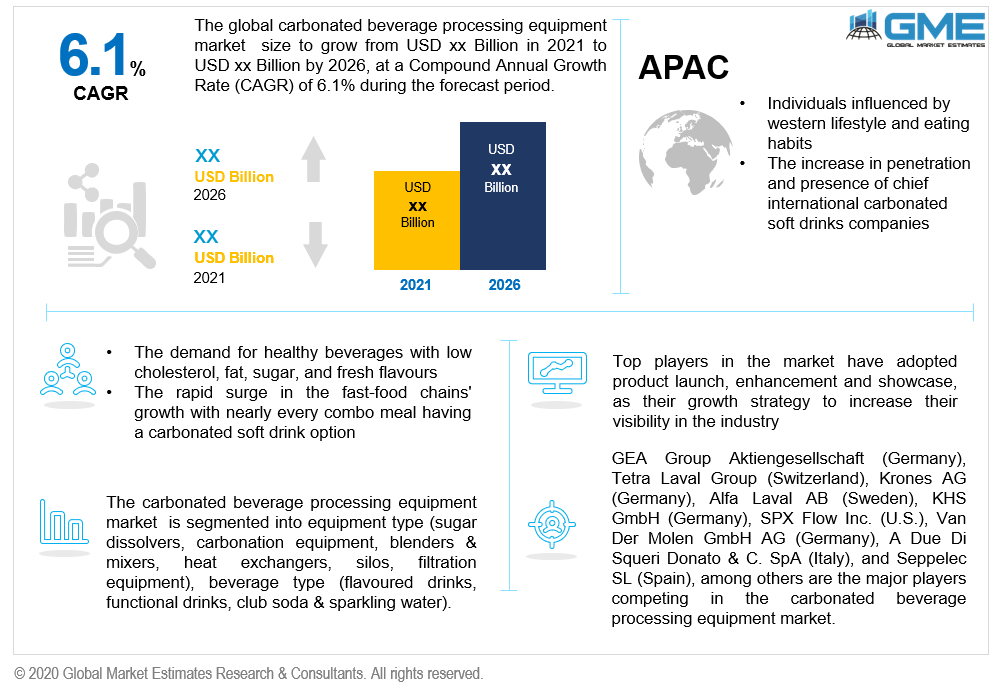

Global Carbonated Beverage Processing Equipment Market Size, Trends & Analysis - Forecasts to 2026 By Equipment Type (Sugar Dissolvers, Carbonation Equipment, Blenders & Mixers, Heat Exchangers, Silos, Filtration Equipment), By Beverage Type (Flavoured Drinks, Functional Drinks, Club Soda & Sparkling Water), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Tonic water, sparkling mineral water, club soda, and other carbonated beverages are popular. Carbonated beverages are typically made out of carbonated sweeteners, colours, water, and tastes.

Beverage processing equipment like mixing tanks is used to mix sugar, water and concentrate on the beverage industry's essential proportions. Soda fountain machine dispensers for carbonated soft drinks are widely seen in restaurants, convenience stores, and concession stands. This device combines carbon dioxide and flavoured syrup with chilled water in diverse flavours. Many flavour syrups like herbal and fruit are contained within the soft drinks to make their appearance more effervescent. The containers or jars produced by moulding machines are used as storing items in the beverage industry. Also, printed labels are used on packaging materials like vials, containers, ampoules, and bottles. These extensive applications of the carbonated beverage processing equipment market are thriving in the marketplace globally.

Consumers are moving towards a more health-conscious lifestyle and are demanding healthy beverages with low cholesterol, fat, sugar, and fresh flavours. To meet these expectations, beverage industry market players concentrate on developing processed drinks with high nutrition content and the necessary energy balance. The demand for carbonated beverages has been boosted by the rapid rise of fast-food restaurants, with practically every combination meal offering a carbonated soft drink choice. As a result, adopting such affordable options becomes an unavoidable habit.

Nowadays, consumers worldwide are spending significantly on soft drinks due to improved living standards, which incite the carbonated beverage processing equipment market. They offer numerous health benefits like reducing stomach ache, improving constipation, and curing nausea owing to their hydrating nature.

The carbonated beverage processing equipment market is determined by factors like amplified consumption of carbonated soft drinks, mainly depending on the humid and hot weather conditions. Beverage manufacturers are anticipated to implement beverage manufacturing/processing technology that is automated and allows for less labour participation in the coming years. Improving the infrastructure of beverage production facilities is expected to stimulate demand for technologically sophisticated carbonated beverage processing equipment.

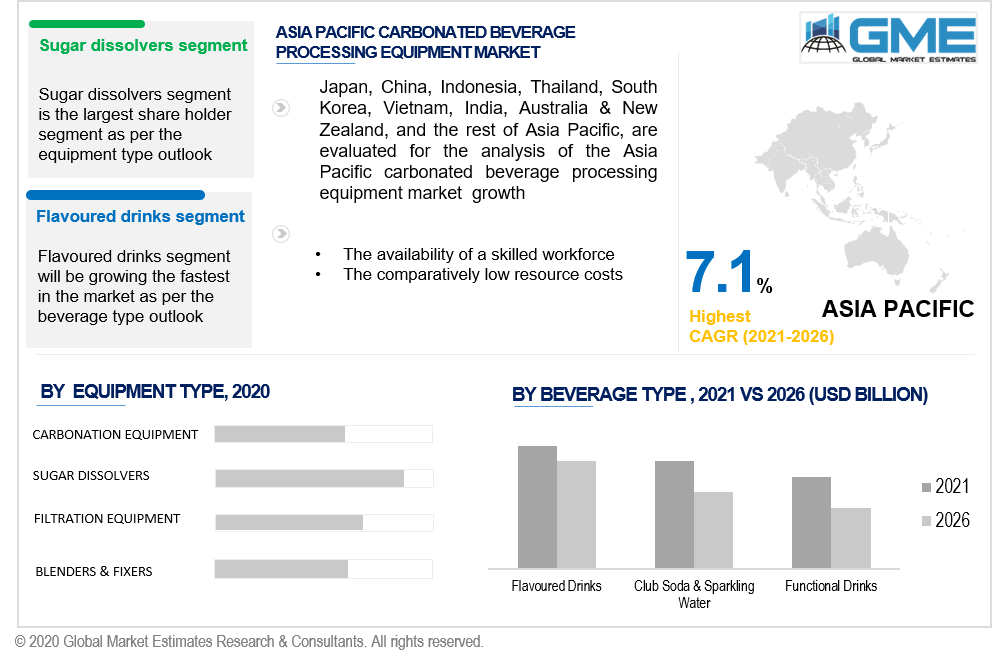

Based on the equipment type the market is segmented into six segments including sugar dissolvers, carbonation equipment, blenders & mixers, heat exchangers, silos, and filtration equipment. Among these segments, sugar dissolvers will hold the largest market share in the forecast period. One of the vital stages in processing carbonated soft drinks is the treatment and sugar dissolving. Instead of using readymade liquid sugar, a more economical option for the manufacturers of carbonated soft drinks is to dissolve the sugar crystals and then use them for syrup applications. Hence, because of this reason, the demand for sugar dissolvers will be increasing in the next few years.

Based on the beverage type the market is segmented into three segments including flavoured drinks, functional drinks, and club soda & sparkling water. Among these segments, flavoured drinks will be the fastest-growing segment followed by the club soda & sparkling water segment in the estimated time frame. The most popular carbonated soft drinks are flavoured carbonated soft drinks. Along with traditional flavours, consumer demand is more inclined to more authentic, regional, and tropical flavours on a large scale. The market players in this beverage industry are incessantly thriving for innovations in packaging, ingredients, planning to increase their products’ sales, brand value, and flavours. The demand for more innovative flavours in the beverage sector is rising, driving the need for flavoured drinks. The technological advancements in the flavour processing industry are mounting, which assists to innovate various flavoured beverages.

North America Carbonated Beverage Processing Equipment market will dominate the overall industry revenue share. Caffeine used as an element in soft drinks helps stimulate the human nervous system, which acts as a protection against Parkinson’s disease and several liver diseases, including colon cancer and cirrhosis. The increased consumption of carbonated soft drinks in this region is owing to their high caffeine content, which mostly appeals to the millennial population.

Furthermore, key market participants in North America include PepsiCo, Inc. and The Coca-Cola Company. The rising consumption of sports drinks such as Powerade by The Coca-Cola Company boosts the market’s growth. These drinks are high in sugar, which boosts athletic performance and provides quick energy. In addition, iced tea and ready-to-drink beverages are gaining traction in North America's carbonated beverages market. These drinks even contain antioxidants, which help in better brain function, thus targeting health-conscious consumers.

However, the Asia-Pacific region also can exhibit a high CAGR in the next few years. This is due to rapid urbanization in the various areas and the surge in consumption of carbonated beverages among individuals influenced by western lifestyle and eating habits. Other drivers include the availability of a trained workforce, as well as the relatively inexpensive costs of resources. The expansion of manufacturing plants by many companies has augmented the demand for carbonated beverage processing equipment. The increase in penetration and presence of chief international carbonated soft drinks companies like Coca-Cola and Pepsi Co. are the crucial factors that are stimulating the Asia Pacific region's market growth.

GEA Group Aktiengesellschaft (Germany), Tetra Laval Group (Switzerland), Krones AG (Germany), Alfa Laval AB (Sweden), KHS GmbH (Germany), SPX Flow Inc. (U.S.), Van Der Molen GmbH AG (Germany), A Due Di Squeri Donato & C. SpA (Italy), and Seppelec SL (Spain), are some of the identified market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2018, a France-based carbonated mineral water supplier, Perrier, had launched a peach flavour drink in addition to its existing products of carbonated mineral water. This new product incorporates natural flavours, which have zero calories and is sugar-free. Such innovations have fuelled the market growth of carbonated beverage processing equipment.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Carbonated Beverage Processing Equipment Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Equipment Type Overview

2.1.3 Beverage Type Overview

2.1.4 Regional Overview

Chapter 3 Global Carbonated Beverage Processing Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for carbonated functional drinks

3.3.1.2 Technological innovation with the objective of energy conservation

3.3.2 Industry challenges

3.3.2.1 Increasing costs of energy and power

3.4 Prospective Growth Scenario

3.4.1 Equipment Type Overview

3.4.2 Beverage Type Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Carbonated Beverage Processing Equipment Market, By Equipment Type

4.1 Equipment Type Outlook

4.2 Sugar Dissolvers

4.2.1 Market Size, By Region, 2016-2026 (USD Billion)

4.3 Carbonation Equipment

4.3.1 Market Size, By Region, 2016-2026 (USD Billion)

4.4 Blenders & Mixers

4.4.1 Market Size, By Region, 2016-2026 (USD Billion)

4.5 Filtration Equipment

4.5.1 Market Size, By Region, 2016-2026 (USD Billion)

4.6 Heat Exchangers

4.6.1 Market Size, By Region, 2016-2026 (USD Billion)

4.7 Silos

4.7.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 5 Global Carbonated Beverage Processing Equipment Market, By Beverage Type

5.1 Beverage Type Outlook

5.2 Flavoured Drinks

5.2.1 Market Size, By Region, 2016-2026 (USD Billion)

5.3 Functional Drinks

5.3.1 Market Size, By Region, 2016-2026 (USD Billion)

5.4 Club Soda & Sparkling Water

5.4.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 6 Global Carbonated Beverage Processing Equipment Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Billion)

6.2.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.2.3 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.2.4.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.2.5.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Billion)

6.3.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.3 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.4.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.5.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.6.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.7.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.8.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.3.9.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Billion)

6.4.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.4.3 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.4.4.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.4.5.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.4.6.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.4.7.2 Market size, By Beverage Type, 2016-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.4.8.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Billion)

6.5.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.5.3 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.5.4.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.5.5.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.5.6.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Billion)

6.6.2 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.6.3 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.6.4.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.6.5.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Equipment Type, 2016-2026 (USD Billion)

6.6.6.2 Market Size, By Beverage Type, 2016-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 GEA Group Aktiengesellschaft

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 Tetra Laval Group

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Krones AG

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Alfa Laval AB

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 KHS GmbH

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 SPX Flow Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Van Der Molen GmbH AG

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 A Due Di Squeri Donato & C. SpA

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Seppelec SL

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 TCP Pioneer Co. Ltd

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Carbonated Beverage Processing Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Carbonated Beverage Processing Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS