Global Cardiopulmonary Stress Testing Devices Market Size, Trends & Analysis - Forecasts to 2026 By Product (Cardiopulmonary Exercise Testing (CPET) Systems, Stress ECG, Pulse Oximeters, Stress Blood Pressure Monitors, Single-Photon Emission Computed Tomography (SPECT)), By End-User (Hospitals, Specialty Clinics/Cardiology Clinics, Ambulatory Surgical Centers, Diagnostic Centers, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

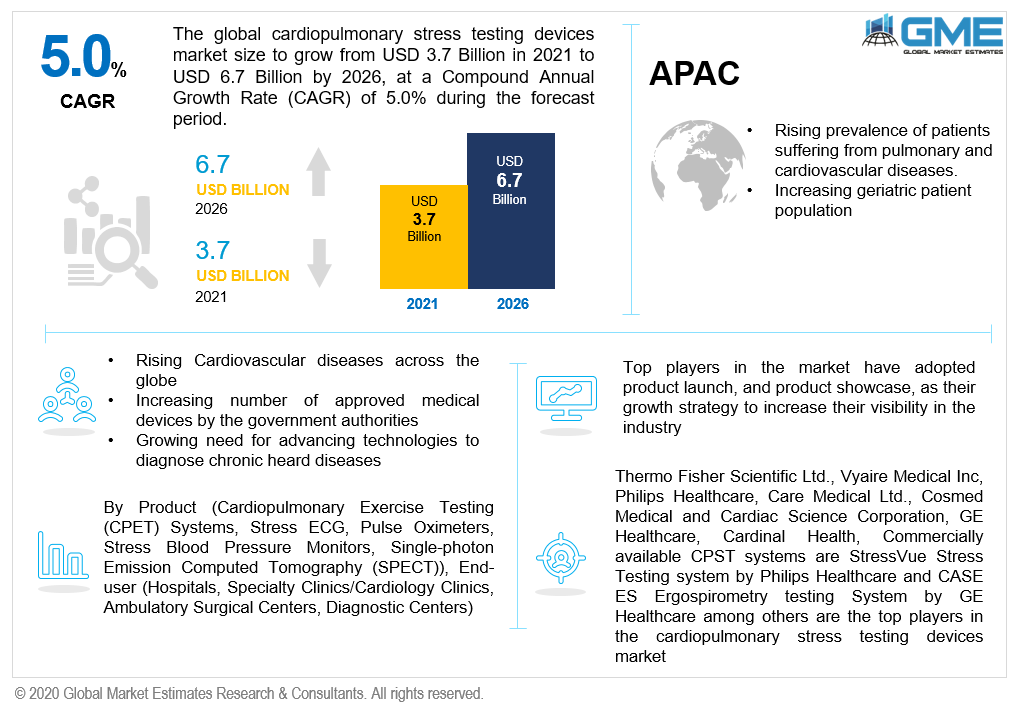

The global cardiopulmonary stress testing devices market will reach USD 6.7 billion from USD 3.7 billion with a CAGR value of 5% from 2021 to 2026.

The factors which contribute to the cardiopulmonary stress testing devices market growth include the increasing incidence of heart and lung disorders such as arrhythmia and heart valve imbalance, rapidly changing lifestyle, high incidence of cardiovascular and pulmonary diseases, launch of point of care diagnostic devices, rising global patient population, and launch of FDA approved medical devices.

Healthcare workers use cardiopulmonary stress testing instruments to check if a person's heart and lungs are working normally during any physical activity. Cardiopulmonary stress test in patients with heart failure is used to assess exercise potential and predict the possible risk of heart attacks. It's a non-invasive, highly responsive stress and hence the market is witnessing and an increasing demand for such devices. Ischemic heart disease, asthma, shortness of breath, heart failure, and other respiratory problems can all be detected using the CPST. The primary aim of cardiac stress testing is to determine coronary artery disease (CAD) risk stratification, which is one of the leading causes of death worldwide. It's a disease that causes blood vessels in the arteries that supply blood to the heart muscles to become clogged.

Low- and middle-income countries accounted for roughly three-quarters of those who die annually due to heart diseases. Hence these countries are opportunity pockets for manufacturers to penetrate with their FDA approved devices. The lack of access to CVD monitoring and diagnosis has contributed to the increasing death rate. The COVID-19 pandemic that has swept the globe is exacerbating the situation. Fortunately, during this global crisis, a slew of public awareness campaigns have been initiated by national and regional governments, in collaboration with international non-profit organizations, to educate people about how to accurately diagnosed CVD can prevent lower the risk of death of individuals.

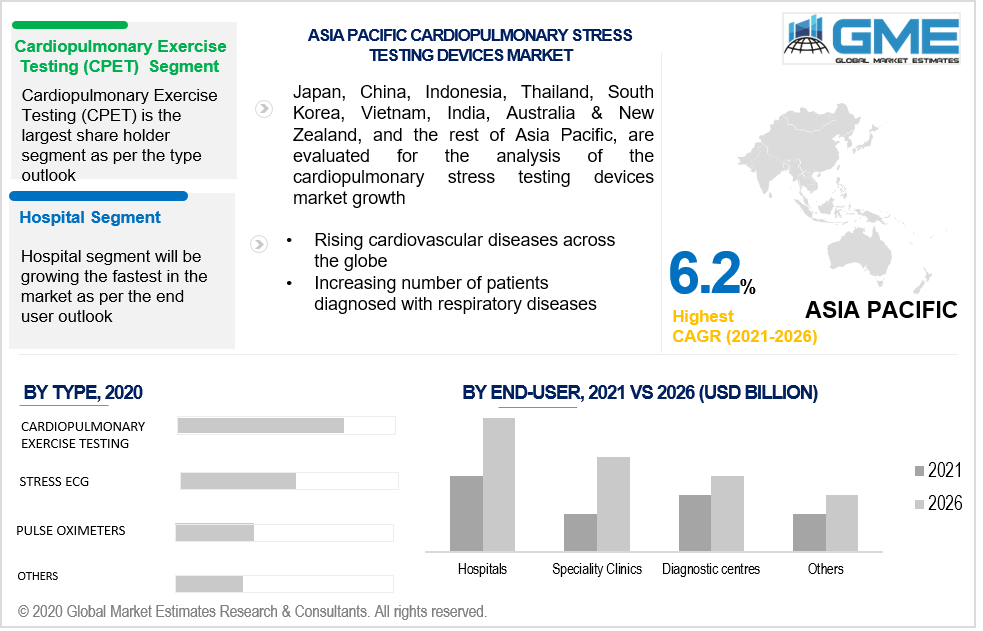

Based on the product, the market is segmented into cardiopulmonary exercise testing (cpet) systems, stress ECG, pulse oximeters, stress blood pressure monitors, single-photon emission computed tomography (SPECT). Due to the precision and short TAT (turnaround time) of these instruments, exercise testing systems segment has the largest share of the market.

Moreover, the rising adoption of these devices by physicians and patients' due to its cost-efficient feature and varied applications, the segment will grow rapidly during the forecast period. The overall demand is anticipated to increase by launch of technically advanced and FDA approved products in the market. Moreover, rising cardiac diagnostic research activities for echocardiography testing devices the segment is ought to grow exponentially.

The second-most profitable segment is likely to be the stress EGC segment. Growth prospects for ECG devices are expected to be boosted by a growing pool of cardiovascular patients in emerging nations, low-cost product options, and high market penetration of local manufacturers.

Based on the end-user, the market is segmented into hospitals, specialty clinics/cardiology clinics, ambulatory surgical centers, and diagnostic centers. The cardiopulmonary stress monitoring systems market is likely to be dominated by hospitals segment. The adoption of advanced technologies by hospitals in developed countries is expected to drive the global cardiopulmonary stress testing devices market over the forecast period, with diagnostic centers likely to be the fastest growing segment from 2021 to 2026.

Because of the large patient population and the growing preference of hospital based treatment for early detection of cardiovascular diseases, the segment of hospitals will be fastest growing during the forecast period. This end-user segment will expand due to increased demand for CSTDs in developing countries, product expansion, and increased awareness of early CVD diagnosis.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, UAE) and Central & South America (Brazil, Peru, and Rest of South America).

Because of the growing pool of cardiopulmonary patients and the presence of a large number of healthcare facilities implementing innovative products, North America held the largest share of the global CPST systems market, followed by Europe. The region's market is likely to grow due to the availability of sophisticated cardiac care services, a rise in investment supporting medical treatment, and the increasing prevalence of cardiovascular diseases. According to the Centers for Disease Control and Prevention (CDC), heart disease is responsible for one out of every four deaths in the United States. Coronary heart disease is the most prevalent form of heart disease, causing more deaths in the United States.

The Asia Pacific CPST devices market, on the other hand, is anticipated to rise at a double-digit pace over the next few years, thanks to rising disposable income, increasing geriatric patient population, and increasing acceptance of advanced diagnostic and monitoring devices. Asia Pacific is estimated to be a highly profitable market for cardiopulmonary stress testing devices, from 2021 to 2026.

Thermo Fisher Scientific Ltd., Vyaire Medical Inc, Philips Healthcare, Care Medical Ltd., Cosmed Medical, TouchPoint, Nihon Kohden Corporation, W.L. Gore & Associates, Cardiac Science Corporation, GE Healthcare, and Cardinal Health, among others are the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In Aug 2019, Vyaire Medical Inc bagged FDA approval for its two novel pulmonary function testing devices, namely Vyntus ONE and Vyntus BODY, which were added to their existing Vyntus product line, which runs on the simple SentrySuite software.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cardiopulmonary Stress Testing Devices Industry Overview, 2020-2026

2.1.1 Product Overview

2.1.2 End-User Overview

Chapter 3 Global Cardiopulmonary Stress Testing Devices Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing number of approval of the new product by the government authorities

3.3.1.2 Growing prevalence of cardiopulmonary disorders

3.3.2 Industry Challenges

3.3.2.1 Higher challenges during the development stage and expensive testing procedures

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cardiopulmonary Stress Testing Devices Market, By Product

4.1 Product Outlook

4.2 Cardiopulmonary Exercise Testing (CPET) Systems

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Stress ECG

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Pulse Oximeters

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Stress Blood Pressure Monitors

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Single-Photon Emission Computed Tomography (SPECT)

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Cardiopulmonary Stress Testing Devices Market, By End-User

5.1 End-User Outlook

5.2 Specialty Clinics/Cardiology Clinics

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Ambulatory Surgical Centers

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Hospitals

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Diagnostic Centers

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Cardiopulmonary Stress Testing Devices Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By End-User, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Thermo Fisher Scientific Ltd.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Medtronic Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Vyaire Medical Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Philips Healthcare

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 Care Medical Ltd

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 Cosmed Medical

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 TouchPoint

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 GE Healthcare

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Cardinal Health

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Cardiac Science Corporation

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Cardiopulmonary Stress Testing Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cardiopulmonary Stress Testing Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS