Global Catalyst Fertilizers Market Size, Trends & Analysis - Forecasts to 2026 By Fertilizer Application (Nitrogenous fertilizers, Phosphatic fertilizers), By Metal Group (Base metals [Iron, Nickel, Vanadium, Other base metals], Precious metals [Platinum, Rhodium, Other precious metals]), By Fertilizer Production Process (Haber-Bosch Process, Contact Process, Other Processes), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

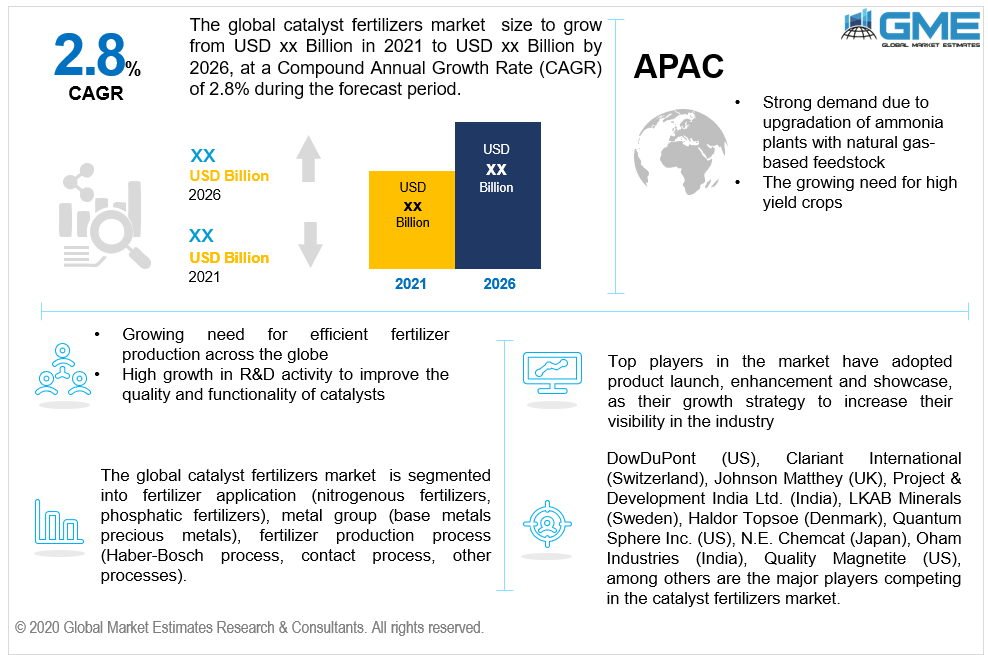

The global catalyst fertilizers market is anticipated to grow exponentially in the next few years due to the catalyst industry's current developments. Catalysts are critical components in industrial manufacturing. Catalyst is used in over 60% of all consumer and commercial products, including fertilizer, batteries, polymers, and pharmaceuticals. They are strongly preferable in chemical processes since they aid to speed up the process without changing the final product. A catalyst increases the output level and improves efficiency level at lower costs. Thus, strong emphasis is given to the development of catalysts with higher activity capabilities to increase longevity and lessen environmental impact.

The benefits offered by catalyst fertilizers over the traditionally used ones are strengthening the growth of the market. A catalyst fertilizer is highly in demand because it helps to upsurge the crop's productivity, which is further boosting its demand. They offer sustainable agricultural benefits to growers, farmers, consumers, and the environment on the whole. The rising demand for food due to the steeply growing population is an important factor positively inducing the market for catalyst fertilizers.

The expansion of the agricultural industry is a crucial factor strengthening the catalyst fertilizers market’s growth. Growth in this industry has led to the rise in the need for fertilizers contributing to the increase in catalyst fertilizers' production. Additionally, the development of selective catalytic reduction technology has caused a significant decrease in greenhouse emissions. This has led to the expansion of the consumer base and will lead to substantial growth in the global catalyst fertilizers market. Growing awareness among farmers to enhance crop yields has contributed to developing the worldwide catalyst fertilizers market.

Ideally, the growth of crops vastly relies on the use of decent fertilizers, which has contributed considerably to the growth of the catalyst fertilizers market. On top of this, the growing installation of ammonia plants and technological advancements across the globe has caused a surge in demand. Various protocols laid down by the governments for pollution control have given rise to the increase in catalyst fertilizers' adoption, thus leading to a spur in the market. Also, the governments' subsidies to promote the use of catalyst fertilizers have added more push to the market.

The sale of fertilizer catalysts is sustained by increasing adoption in numerous processes, like formaldehyde production, methanol production, syngas production, and ammonia production. Fertilizer catalysts have a considerable impact on feedstock yield and conversion, so fertilizer plant operators must select an appropriate catalyst for the reforming process to optimize maximum production. Therefore, the market is fast-tracking on the back of mounting demand for high-quality feedstock. Additionally, continuous R&D efforts to develop better, more efficient variations may help to propel the catalyst fertilizer market forward.

The highly competitive fertilizer catalyst market drives the stakeholders to adopt unique marketing strategies to attract a larger pool of customers, thus growing their revenues. The expansion of production facilities has gained momentum as an essential strategy to uphold a company’s position in the fertilizer catalyst market.

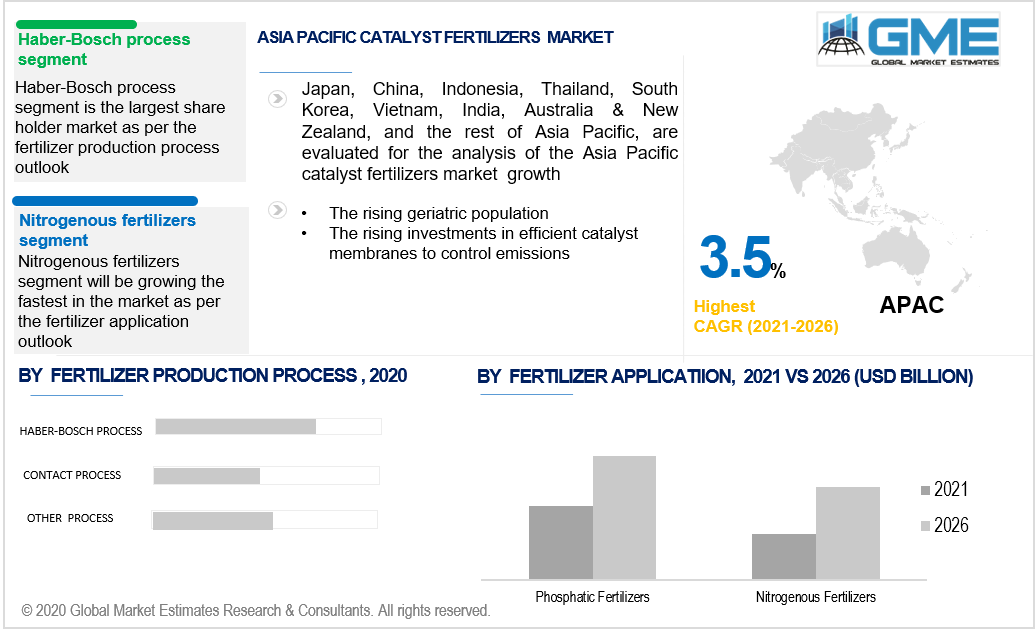

Based on the fertilizer application, there are two segments: nitrogenous fertilizers and phosphatic fertilizers. The nitrogenous fertilizers segment is expected to show the fastest CAGR in the next few years. Compared to phosphatic fertilizers, urea and ammonia production output in Asian countries has increased rapidly. With the rise in ammonia plant emissions, emission control catalysts are in high demand in the market to meet government criteria.

Based on the metal group, the market is segregated into two segments: base metals and precious metals. Base metals include iron, nickel, vanadium, and other base metals like copper, zinc, cobalt, and chromium. Precious metals include rhodium, platinum, other precious metals like palladium and ruthenium.

The base metals segment is anticipated to show a high growth rate in the estimated time frame. Key market players develop metal catalysts for fertilizer production, in which iron catalysts are the most favoured ones among ammonia fertilizer manufacturers. In the Asia Pacific region, on the other hand, vanadium and nickel are widely used in the manufacturing of sulphuric acid. Raw materials are over 70% of the total production cost. As phosphate and ammonia fertilizer production are majorly found in Asian countries these countries would opt for cheaper catalysts to reduce the fertilizer cost.

Based on the fertilizer production process the market is segmented into contact process, Haber-Bosch process, and other processes like catalytic reforming of organic wastes, partial oxidation process, and plasma catalysis.

The Haber-Bosch process segment will lead the market in the forecast period. It is an artificial nitrogen fixation procedure and is one of the leading industrial methods for producing ammonia, having a high conversion rate. The Haber-Bosch process depends on catalysts to fast-track the hydrogenation of Nitrogen. The demand for Haber-Bosch process catalyst fertilizers is increasing as the chemical industry develops. Ammonia is one of the most essential basic ingredients used in fertilizers. It's a key component in the production of compounds including urea, ammonium sulphate, and calcium ammonium nitrate.

Asia Pacific Catalyst Fertilizers market will dominate the overall industry revenue share, both in terms of consumption and production. This is attributed to the rising population, growing demand for food, rapidly expanding agricultural industry, growing need for high yield crops, and increasing fertilizers production. Fertilizer catalyst demand is expected to be driven by the presence of large-scale urea and ammonia manufacturing plants in China, as well as considerable capital investments in countries like India, Vietnam, Indonesia, and Thailand. Prominent market development is the installation of strict regulations on the fertilizer sector due to environmental concerns.

Moreover, the Central and South American region is a major supplier of food and agricultural commodities, with a large amount of undeveloped agricultural area. Argentina is the region's agriculture leader, due to its innovative farming practices.

DowDuPont (US), Clariant International (Switzerland), Johnson Matthey (UK), Project & Development India Ltd. (India), LKAB Minerals (Sweden), Haldor Topsoe (Denmark), Quantum Sphere Inc. (US), N.E. Chemcat (Japan), Oham Industries (India), Quality Magnetite (US), among others, are some of the key market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2020, Johnson Matthey and ThyssenKrupp have renewed their agreement for world-class ammonia manufacturing.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Catalyst Fertilizers Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Fertilizer Application Overview

2.1.3 Metal Group Overview

2.1.4 Fertilizer Production Process Overview

2.1.5 Regional Overview

Chapter 3 Global Catalyst Fertilizers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing need for efficient fertilizer production across the globe

3.3.1.2 Strong R&D activities to reduce the cost of catalysts

3.3.2 Industry Challenges

3.3.2.1 Uncomplimentary commodity prices and lower farm incomes

3.4 Prospective Growth Scenario

3.4.1 Fertilizer Application Growth Scenario

3.4.2 Metal Group Growth Scenario

3.4.3 Fertilizer Production Process Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Catalyst Fertilizers Market, By Fertilizer Application

4.1 Fertilizer Application Outlook

4.2 Nitrogenous Fertilizers

4.2.1 Market Size, By Region, 2016-2026 (USD Billion)

4.3 Phosphatic Fertilizers

4.3.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 5 Global Catalyst Fertilizers Market, By Metal Group

5.1 Metal Group Outlook

5.2 Base Metals

5.2.1 Market Size, By Region, 2016-2026 (USD Billion)

5.3 Precious Metals

5.3.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 6 Catalyst Fertilizers Market, By Fertilizer Production

6.1 Fertilizer Production Process Outlook

6.2 Haber-Bosch Process

6.2.1 Market size, By Region, 2016-2026 (USD Billion)

6.3 Contact Process

6.3.1 Market size, By Region, 2016-2026 (USD Billion)

6.4 Other Processes

6.4.1 Market size, By Region, 2016-2026 (USD Billion)

Chapter 7 Global Catalyst Fertilizers Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Billion)

7.2.2 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.2.3 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.2.4 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.2.5.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.2.5.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.2.6.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.2.6.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Billion)

7.3.2 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.3.3 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.3.4 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.2.5.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.2.5.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.3.6.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.3.6.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.3.7.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.3.7.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.3.8.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.3.8.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.3.9.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.3.9.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.3.10.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.3.10.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Billion)

7.4.2 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.4.3 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.4.4 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.4.5.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.4.5.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.4.6.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.4.6.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.4.7.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.4.7.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.4.8.2 Market size, By Metal Group, 2016-2026 (USD Billion)

7.4.8.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.4.9.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.4.9.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Billion)

7.5.2 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.5.3 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.5.4 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.5.5.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.5.5.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.5.6.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.5.6.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.5.7.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.5.7.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Billion)

7.6.2 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.6.3 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.6.4 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.6.5.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.6.5.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.6.6.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.6.6.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Fertilizer Application, 2016-2026 (USD Billion)

7.6.7.2 Market Size, By Metal Group, 2016-2026 (USD Billion)

7.6.7.3 Market Size, By Fertilizer Production, 2016-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Clariant International.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info-Graphic Analysis

8.3 Johnson Matthey

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 DowDuPont

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Lkab Minerals

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Quantumsphere Inc.

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Haldor Topsoe

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 N.E.Chemcat

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Quality Magnetite

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Oham Industries

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.11 Projects & Development India Limited (PDIL)

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Catalyst Fertilizers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Catalyst Fertilizers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS