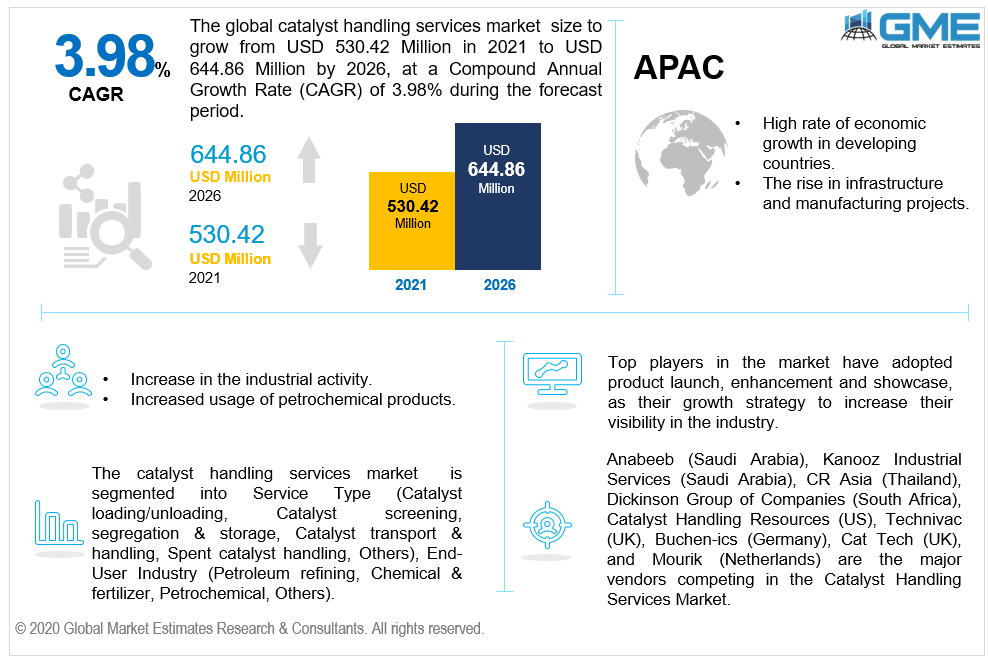

Global Catalyst Handling Services Market Size, Trends, and Analysis - Forecasts To 2026 By Service Type (Catalyst loading/unloading, Catalyst screening, segregation & storage, Catalyst transport & handling, Spent catalyst handling, Others), By End-User Industry (Petroleum refining, Chemical & fertilizer, Petrochemical, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The market will register a peak growth rate between 2021-2026. The systems are widely preferred in petrochemicals, and petroleum refining, other industrial processing industries. The development of the catalyst handling services market is also being boosted by the growing use of petrochemical products. Moreover, the growth of the market is driven by an expanding industrial base in countries such as India, Brazil, Australia, South Korea, China, Argentina, and others. The factors driving the growth of the market are growth in macroeconomic patterns, such as population expansion, combined with increasing economic development in developing markets, tight environmental regulations on vehicle pollution, and a rise in the number of applications in end-user industries. Petrochemical products have been an important component of industrial civilization. For the manufacturing of tires, plastics, medical supplies, electronic devices, packaging materials, fertilizers, clothes, detergents, among others, petrochemical products are used. It is also anticipated that the use of petrochemicals in the modern energy grid, including wind turbine blades, solar panels, building thermal insulation batteries, and electric car components, would have a favorable effect on demand. However, the increasingly growing recycling of plastic waste and the reduction of dependency on single-use plastics other than important non-substitutable functions are expected to reduce the effect of plastics on the environment and thus maintain the demand for petrochemical products. The global electric vehicle (BEV) battery has grown exponentially. Factors such as growing issues about air emissions and global warming and funding from the federal and state governments to minimize pollution levels are increasing the need for electric cars. The increasing demand for BEVs affects the use of fuels such as petrol and diesel and hence limits the growth of the industry.

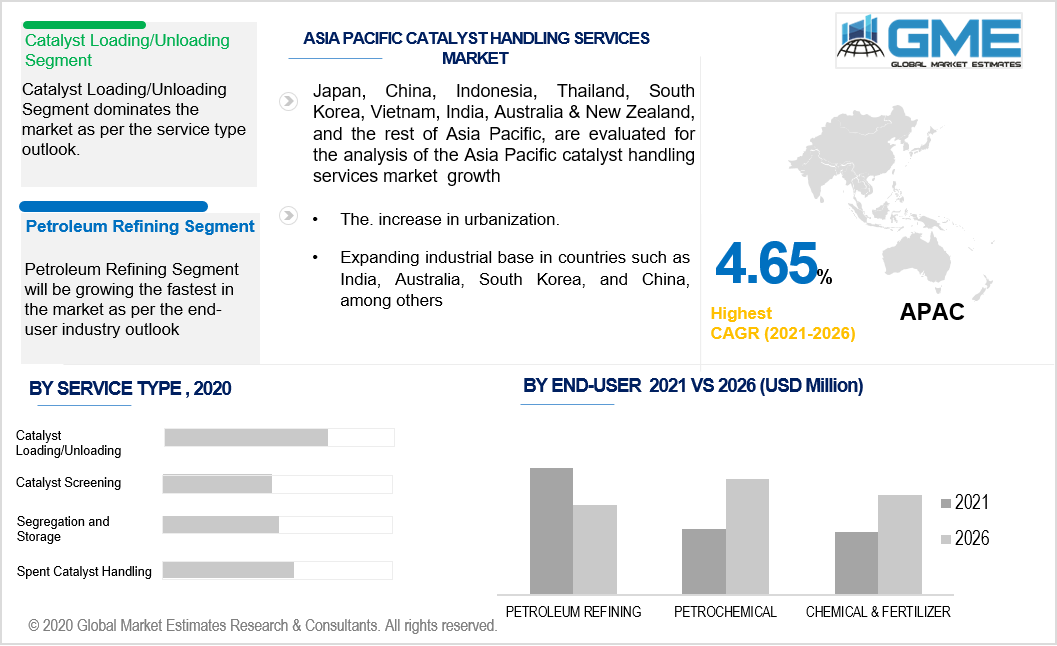

Based on the service type, the market is categorized into catalyst screening, catalyst loading/unloading, segregation & storage, spent catalyst handling, catalyst transport & handling, and others. It is projected that the catalyst loading/unloading segment dominates the overall demand for catalyst handling services. The method of moving the catalyst from ground level to within the reactor is catalyst loading. The unloading of catalysts is a system in which the spent catalysts are unloaded by proper operational procedures, such as testing hot spots, creating coke, and inspecting for contamination.

By end-use analysis, the market is explained as petroleum refining, petrochemical, and chemical & fertilizer, among others. The biggest catalyst handling service consumption market is projected to be petroleum refining. Owing to the growing demand for polymer related products, liquid fuels, and others in industries such as food & beverage, manufacturing, automobile, aerospace, are driving the petrochemical segment. In modern society, petrochemical goods have become an important part of life. For the manufacturing of plastics, packing materials, digital gadgets, detergents, medical supplies, tires, clothes, fertilizers, among others, petrochemical products are used. High industry figures are also responsible for the rising demand for catalyst handling services to achieve the maximum degree of protection and performance when charging and discharging reactors and for using specialized procedures to treat pyrophoric catalysts.

The Asia Pacific region will hold the maximum share and continue the trend between the forecast period. APAC region is composed of major developing countries, such as India, China, Thailand, South Korea, Singapore, and Indonesia among others. Asia- Pacific has the largest market share. The region's growth is attributed to the presence and high rate of economic growth in developing countries, the rise in infrastructure and manufacturing projects, and the increase in urbanization. Furthermore, the supply of low-cost raw materials and manpower, combined with distinctive domestic consumer demand, makes APAC an enticing investment option for players in the petrochemical, chemical and refining industries.

Anabeeb (Saudi Arabia), Kanooz Industrial Services (Saudi Arabia), CR Asia (Thailand), Dickinson Group of Companies (South Africa), Catalyst Handling Resources (US), Technivac (UK), Buchen-ics (Germany), Cat Tech (UK), and Mourik (Netherlands) are the major vendors competing in the Catalyst Handling Services Market.

Please note: This is not an exhaustive list of companies profiled in the report.

Mourik is one of the world's biggest companies in catalyst handling services and has built its footprint worldwide in 31 countries and emphasizes the expansion of its global presence through collaborations. Mourik has developed branches in Europe and North America, collaborations in APAC and the Middle East & Africa, and many catalyst handling ventures have been conducted around the world. The firm provides the petrochemical, pharmaceutical, agrochemical, processing, and food sectors with catalyst handling facilities for refining. It highlights development through industrial alliances with external partners and processing, technical, and equipment advancements.

Mourik released the M-Lance technology in February 2019. This technology helps simplify the process of unloading, leading to a secure work environment and a more effective and predictable change-out of the tubular catalyst.

Anabeeb is a significant player in the brownfield construction and turnaround of services, including services for pre-commissioning, catalyst handling, and mechanical works. The business is in strategic partnership with CR Asia, TubeMaster, CTP Environment, and has a strong presence in countries such as Saudi Arabia, Qatar, the UAE, Oman, and Kuwait. In general, these partnerships have assisted the company with comprehensive Research & Development (R&D), effective planning of capital, and the use of technological knowledge.

CR Asia began using a hydraulic drum tipper in November 2020 that can lift four drums of varying weights and sizes to transport material safely and securely into bulk bins or loading hoppers. Compared to traditional ways of unloading containers, this breakthrough has improved security and shortened time by 20 percent. This technology helps to minimize manual handling, exhaustion, working at height and is less dependent on cranes and forklifts.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Catalyst Handling Services Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Catalyst Handling Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS