Global Cellulose Derivative Excipient Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Cellulose Ether Derivatives, Methyl Cellulose, Ethyl Cellulose, Hydroxyl Ethyl Cellulose, Carboxy Methyl Cellulose, Hydroxypropyl Methyl Cellulose, Cellulose Acetate, Cellulose Acetate Pthalate, Cellulose Acetate Butyrate, Cellulose Acetate Propionate, Hydroxypropyl Methyl Cellulose Pthalate, and Others), By Application (Bio-Adhesives, Pharmaceutical Coatings, Drug Delivery Systems, Gelling Agents, Stabilizing Agents, Binders, and Others), By End-User (Pharmaceutical, Food, and Cosmetics & Personal Care), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

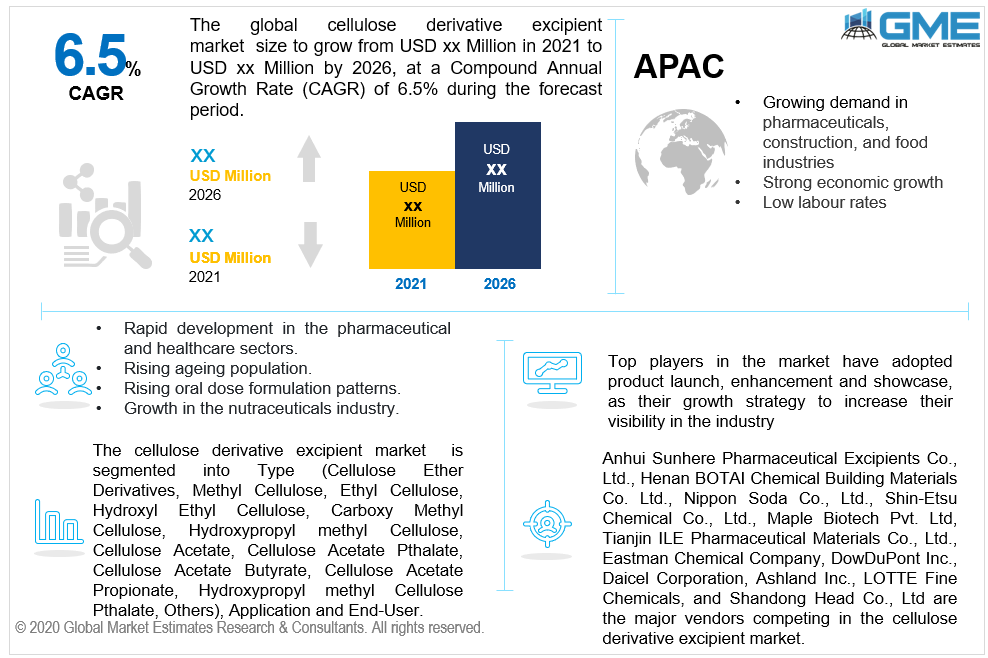

The overall cellulose derivative excipient market is likely to develop at a rapid pace in the foreseeable future. This development can be due to the growing use of cellulose derivatives by enterprises in various industries. Cellulose derivatives are used in a variety of sectors, including cosmetics & personal care, food, and pharmaceuticals. As a result, a rising requirement from all of such industries is likely to propel the global cellulose derivative excipient market forward throughout the forecast period.

Cellulose derivatives are widely employed for osmotic drug delivery systems, bio-adhesives, binding agents, and stabilizing agents. The rising utilization is mostly due to an improved understanding of the applicability and cost-effectiveness of cellulose derivatives. Aside from that, the market for cellulose derivative excipients is projected to have attractive growth opportunities as the manufacture of capsules and pharmaceuticals increases.

Rapid development in the pharmaceutical and healthcare sectors, owing to an aging population and developments in pharmaceutical technologies, has resulted in a rise in demand for drugs and medical services, positively affecting the cellulose derivative excipient market. Oral formulations including delayed and extended-release dissolving pills, capsules, and tablets are predicted to rise in popularity, pushing up demand for disintegrants and binders and spurring the cellulose derivative excipient market ahead. Furthermore, rising oral dose formulation patterns affected the excipient industry substantially. Oral solid dose form (OSDF) drugs have become highly prevalent in the pharmaceutical industry, with oral dosage being the most common, requiring a greater proportion of cellulose derivative excipient in comparison to existing dosage types. Dose dumping is restraining the development of the cellulose derivative excipient market. Dose dumping is a drug metabolism phenomenon in which environmental conditions may cause a drug's release to be premature and inflated. Dose dumping will significantly increase a drug's concentration in the bloodstream, resulting in harmful side effects or even drug-induced toxicity. The most common source of dose dumping is medications ingested orally and absorbed in the gastrointestinal tract. The cellulose derivative excipient market is projected to expand rapidly due to increased R&D activities in developing markets.

Based on derivative type, the global market is classified into hydroxypropyl methyl cellulose pthalate, methyl cellulose, ethyl cellulose, cellulose acetate butyrate, hydroxyl ethyl cellulose, cellulose acetate, cellulose acetate propionate, carboxy methyl cellulose, cellulose ether derivatives, hydroxypropyl methyl cellulose, cellulose acetate pthalate, and others.

These types of derivatives are widely used in liquid soaps, toothpaste, and shampoos, to achieve representative thickness reliability. In the cellulose derivative industry, carboxymethyl cellulose is commonly used in the industrial, food and beverage, pharmaceutical, and personal care industries. Throughout the forecast period, the carboxymethyl cellulose segment is projected to rise steadily, with the largest market share. This is due to cellulose ether's surface-active characteristics, which cause it to thicken and stabilize aqueous solutions, making it a valuable component in a broad range of commercial products and industries.

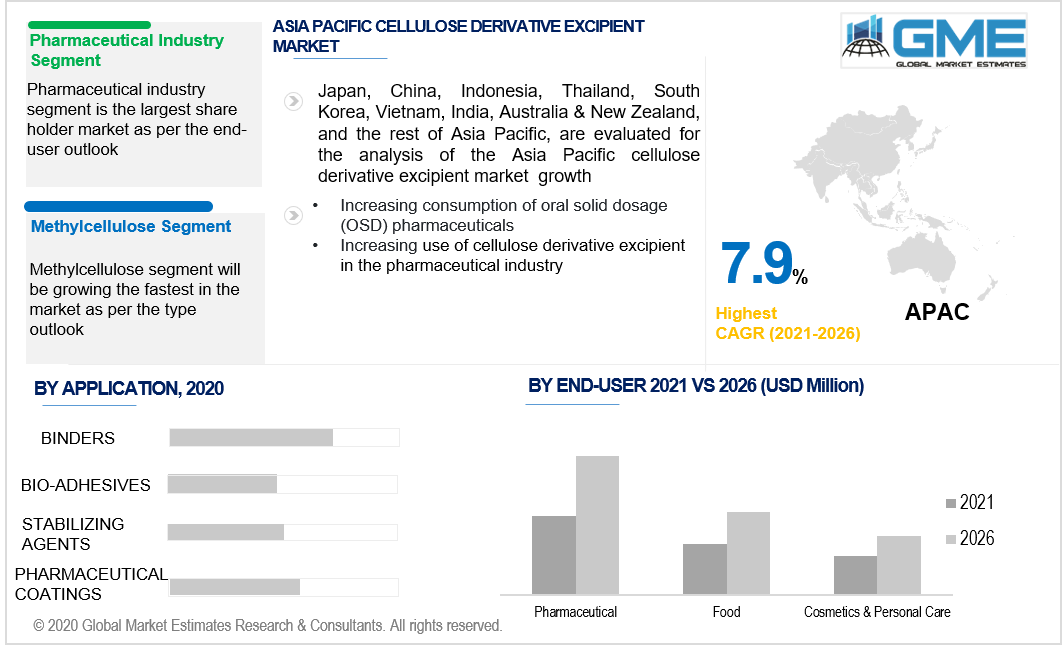

Among the various cellulose ether product forms, the methylcellulose derivatives market is expected to be the fastest-growing segment. This is a thermally gelling polymer that is commonly used in industrial applications as a thickener, emulsifier, or binder but it is also gaining popularity in biomedical applications such as drug delivery and cell culture.

Based on application, the market has been segmented into drug delivery systems, gelling agents, pharmaceutical coatings, stabilizing agents, bio-adhesives, binders, and others. Binders are foreseen to predominate. Binders are critical ingredients of wet granulation-produced solid medication formulations. The drug material is mixed with various excipients and treated with a solution (aqueous or organic), followed by drying and milling to form granules in the aqueous granulation process. In the wet granulation process, cellulose and certain derivatives have high binding properties. A variety of MCC grades, including PH-101, are commonly employed as a binder in wet granulation. Additional cellulose derivatives, including MC, HPMC, and HPC, have high wet granulation binding characteristics. Low substituted cellulose ethers (L-HPC) are often employed as a binder in the wet granulation. Even though low substituted cellulose ethers have reduced hydrophobicity than standard grades, they have extremely strong binding effectiveness. Cross-linked cellulose (CLC) and cross-linked cellulose derivatives, including cross-linked NaCMC, are effective pharmacological binders.

Based on the end-user, the market has been bifurcated into food, cosmetics & personal care, and pharmaceutical. In terms of revenue, the pharmaceutical segment is foreseen to dominate the cellulose derivative market. The growth in demand for advanced drugs is pushing the demand for cellulose derivatives in pharmaceutical companies; The personal care and construction segment, on the other hand, is expected to rise steadily throughout the forecast period due to global population growth and increasing consumer living standards.

In terms of volume and revenue, the Asia Pacific except Japan had the largest proportion of the share in the cellulose derivatives market. This was attributed to growing demand in a variety of industries, including pharmaceuticals, construction, and food, as well as a strong economic growth rate, low labor rates, and competitive manufacturing costs.

Throughout the forecast period, North America and Europe are projected to rise at a faster CAGR. These economies lack domestic demand and are saturated. As a result, production units in these two regions are shutting to grow in Asia Pacific's emerging markets. The rapid growth in the cosmetics and personal care sector in Africa and the Middle East over the projected timeframe is expected to improve the RoW in terms of value and volume growth.

Anhui Sunhere Pharmaceutical Excipients Co., Ltd., Henan BOTAI Chemical Building Materials Co. Ltd., Nippon Soda Co., Ltd., Shin-Etsu Chemical Co., Ltd., Maple Biotech Pvt. Ltd, Tianjin ILE Pharmaceutical Materials Co., Ltd., Eastman Chemical Company, DowDuPont Inc., Daicel Corporation, Ashland Inc., LOTTE Fine Chemicals, and Shandong Head Co., Ltd are the major vendors competing in the cellulose derivative excipient market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Types

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Cellulose Derivative Excipient Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Global Cellulose Derivative Excipient Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Consumption of Oral Solid Dosage (OSD) Pharmaceuticals

3.3.1.2 Increasing Demand from Cosmetics & Personal Care, And Food Sectors

3.3.2 Industry Challenges

3.3.2.1 Cellulose Derivative Excipient Dose Dumping

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cellulose Derivative Excipient Market, By Type

4.1 Type Outlook

4.2 Cellulose Ether Derivatives

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Methyl Cellulose

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Ethyl Cellulose

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Hydroxyl Ethyl Cellulose

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Carboxy Methyl Cellulose

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Hydroxypropyl Methyl Cellulose

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

4.8 Cellulose Acetate

4.8.1 Market Size, By Region, 2016-2026 (USD Million)

4.9 Cellulose Acetate Pthalate

4.9.1 Market Size, By Region, 2016-2026 (USD Million)

4.10 Cellulose Acetate Butyrate

4.10.1 Market Size, By Region, 2016-2026 (USD Million)

4.11 Cellulose Acetate Propionate

4.11.1 Market Size, By Region, 2016-2026 (USD Million)

4.12 Hydroxypropyl Methyl Cellulose Pthalate

4.12.1 Market Size, By Region, 2016-2026 (USD Million)

4.13 Others

4.13.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Cellulose Derivative Excipient Market, By Application

5.1 Application Outlook

5.2 Bio-Adhesives

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Pharmaceutical Coatings

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Drug Delivery Systems

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Gelling Agents

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Stabilizing Agents

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Binders

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.8 Others

5.8.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Cellulose Derivative Excipient Market, By End-User

6.1 End-User Outlook

6.2 Pharmaceutical

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Food

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Cosmetics & Personal Care

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Cellulose Derivative Excipient Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country, 2016-2026 (USD Million)

7.2.2 Market Size, By Type, 2016-2026 (USD Million)

7.2.3 Market Size, By Application, 2016-2026 (USD Million)

7.2.4 Market Size, By End-User, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.5.3 Market Size, By End-User, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.2.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country, 2016-2026 (USD Million)

7.3.2 Market Size, By Type, 2016-2026 (USD Million)

7.3.3 Market Size, By Application, 2016-2026 (USD Million)

7.3.4 Market Size, By End-User, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.5.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.8.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country, 2016-2026 (USD Million)

7.4.2 Market Size, By Type, 2016-2026 (USD Million)

7.4.3 Market Size, By Application, 2016-2026 (USD Million)

7.4.4 Market Size, By End-User, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.5.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.8.2 Market size, By Application, 2016-2026 (USD Million)

7.4.8.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Application, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country, 2016-2026 (USD Million)

7.5.2 Market Size, By Type, 2016-2026 (USD Million)

7.5.3 Market Size, By Application, 2016-2026 (USD Million)

7.5.4 Market Size, By End-User, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.5.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country, 2016-2026 (USD Million)

7.6.2 Market Size, By Type, 2016-2026 (USD Million)

7.6.3 Market Size, By Application, 2016-2026 (USD Million)

7.6.4 Market Size, By End-User, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.5.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Anhui Sunhere Pharmaceutical Excipients Co., Ltd.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Henan BOTAI Chemical Building Materials Co. Ltd.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Nippon Soda Co., Ltd.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Shin-Etsu Chemical Co., Ltd.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Maple Biotech Pvt. Ltd

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Tianjin ILE Pharmaceutical Materials Co., Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Eastman Chemical Company

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 DowDuPont Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Daicel Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Ashland Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 LOTTE Fine Chemicals

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Shandong Head Co., Ltd

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Cellulose Derivative Excipient Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cellulose Derivative Excipient Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS