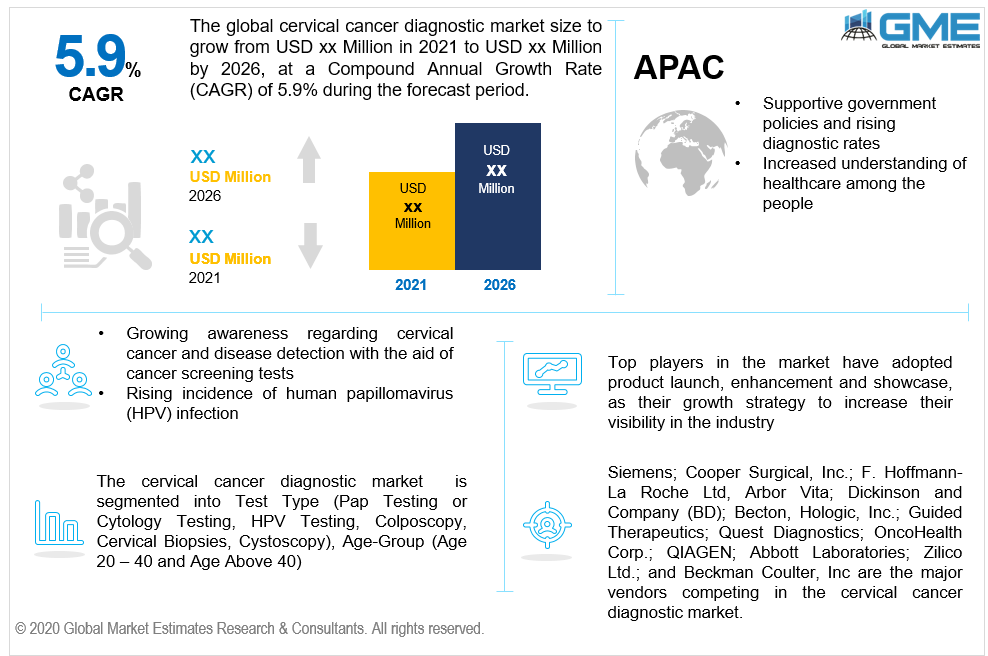

Global Cervical Cancer Diagnostic Market Size, Trends, and Analysis - Forecasts To 2026 By Test Type (Pap Testing or Cytology Testing, HPV Testing, Colposcopy, Cervical Biopsies, Cystoscopy), By Age-Group (Age 20 – 40 and Age Above 40), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Cervical cancer is a type of cancer that develops in the cervix portion of the female reproductive tract. Cervical cancer is often described by the irregular development of cancer cells in the cervix's tissue. Cervical cancer may also progress to adenocarcinoma or squamous cell carcinoma. HPV (Human Papillomavirus) infection is the most common source of cervical cancer.

The cervical cancer diagnostic industry will experience substantial development owing to the growing awareness regarding cervical cancer and disease detection with the aid of cancer screening tests during the projected period. The cervical cancer diagnosis industry will be driven by the rising incidence of human papillomavirus (HPV) infection, which is the major reason for cervical cancer. The cervical cancer death rate has decreased by around 50 percent as a result of the emergence of multiple predisposition diagnosis tests. Government agencies have taken a number of steps, including the United Kingdom government's ‘Be Clean on Cancer’ campaign, which aims to raise awareness about cancer and disease diagnosis.

Technical advances in screening techniques and diagnostic instruments will propel the market forward. The cervical cancer diagnostic industry will be driven by rising demand for biomarkers and minimally invasive screening techniques to improve disease detection results over the projected timeline. Supportive reimbursement programs would boost demand for cervical screening examinations, resulting in market size expansion.

The reduced immunity of women in emerging nations owing to a shortage of adequate dietary intake, increased transmission of human papillomavirus (HPV), and excessive usage of oral contraceptive pills by females are among the major drivers of cervical cancer diagnostics tests industry. Factors associated with one's lifestyle like having more than one sexual partner and smoking are both linked to an increased risk of cervical cancer in women, which is fueling the cervical cancer diagnostics tests industry.

Overtreatment and overdiagnosis are two big roadblocks to the cervical cancer diagnostic industry's development. In recent times, the PAP screening test has had an increased rate of false desirable outcomes and a poor sensitivity rate in the diagnosis of cervical cancer. Furthermore, HPV tests' failure to differentiate between self-limiting infection and pre-cancer has been a source of uncertainty in recent times, restricting their prominence.

In the near future, the cervical cancer diagnostic test industry is anticipated to expand due to advancements in computer-guided cervical cancer testing that reduce false-negative results and increase precision. Some of the important barriers for the development of the cervical cancer diagnostic test industry include a lack of knowledge about the signs of cervical cancer due to low women literacy rates in emerging economies, as well as female's refusal to undergo cervical cancer diagnosis.

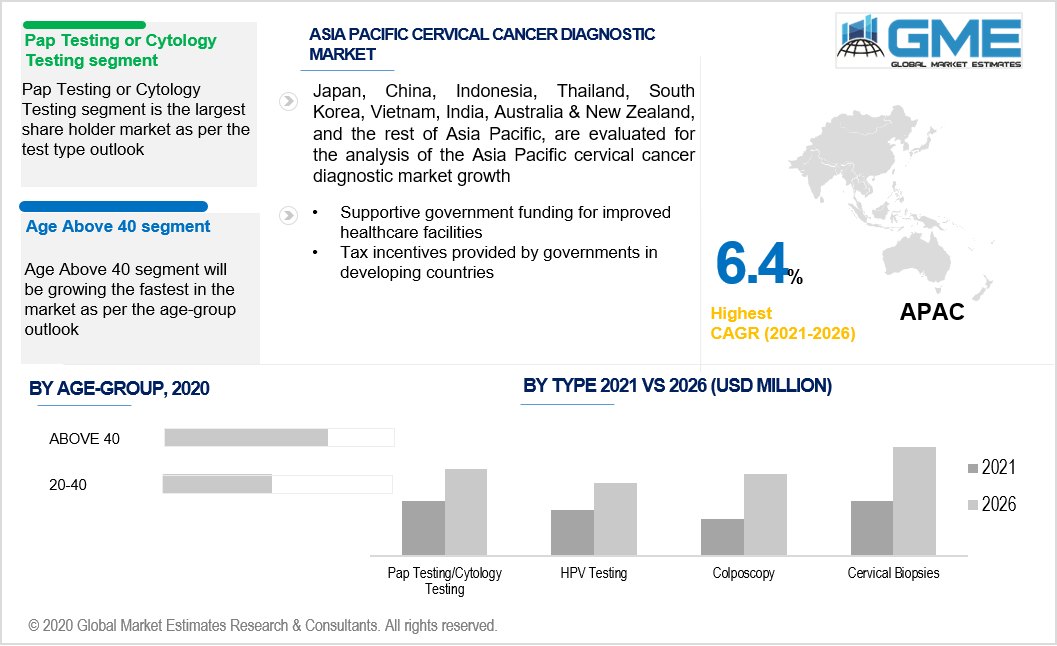

In 2020, PAP tests accounted for a larger share in the form of sales revenue. The PAP test is used to detect irregular cells in the cervix that may eventually turn into cancer. Due to the high reliability of this exam, it accounts for a significant chunk of the industry. Additionally, the growing understanding of timely detection among consumers leads to the development of this category.

Owing to an increase in demand for technically sophisticated diagnostics techniques at reasonable prices, as well as further advances in the usage of multiple biomarkers in conjunction with regular screening procedures, HPV testing is projected to expand at an attractive CAGR. As a result, one of the key drivers expected to drive development in the near future is the increased sensitivity and precision of screening procedures.

The age group segment is divided into two sub segments namely, aged 20 to 40 and aged over 40. Cervical cancer is most common in females aged 40 and over, and testing must be done at least once a year for females in this age range. At most one test, or a variety of tests, like HPV and pap smear, should be performed quite often in this age category. Cervical cancer is more likely to develop as people grow older.

The United States is the most powerful industry, accounting for the largest share in the global market. Cervical cancer therapeutics and diagnostics dominated the industry in North America. The increased levels of disease control awareness amongst females in the region, as well as the numerous programs, were undertaken to avoid cervical cancer, have broadened the spectrum of healthcare coverage for cervical diagnostic tests, particularly for low-income females.

The rapidly growing market for cervical cancer diagnostic testing is the Asia-Pacific market, which is attributed to rising cervical cancer incidence in emerging nations such as India, South Korea, Malaysia, Japan, China, and Australia. The demand in the area is anticipated to rise as a result of supportive government policies and rising diagnostic rates. Owing to increasing customer demand, supportive government funding for improved healthcare facilities, and increased understanding of healthcare among the people in the region's emerging economies, the Asia Pacific industry is increasing at a rapid pace. Furthermore, tax incentives provided by governments in numerous countries are projected to drive the Asia-Pacific cervical cancer diagnostics and therapies industry forward.

Cooper Surgical, Inc.; Siemens; F. Hoffmann-La Roche Ltd, Dickinson Becton and Company; Hologic, Inc.; Arbor Vita; Guided Therapeutics; OncoHealth Corp.; Quest Diagnostics; QIAGEN; Beckman Coulter; Zilico Ltd.; and Abbott Laboratories are the major vendors competing in the cervical cancer diagnostic market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2018, Qiagen released the QIAscreen HPV PCR Test, with a CE-IVD-certification.

In April 2017, the U.S. Food and Drug Administration approved Roche's CINtec Histology test, which is a p16 biomarker test designed to be used with hematoxylin and eosin (H&E) staining to assess treatment need in women with pre-cervical cancer incidence.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cervical Cancer Diagnostic Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Test Type Overview

2.1.3 Age Group Overview

2.1.4 Regional Overview

Chapter 3 Cervical Cancer Diagnostic Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Cervical Cancer Diagnostic Tools

3.3.1.2 The Rising Prevalence of Cervical Cancer

3.3.2 Industry Challenges

3.3.2.1 High Cost Associated With Laboratory Testing and Lack of Awareness Regarding Cervical Cancer Screening Tests

3.4 Prospective Growth Scenario

3.4.1 Test Type Growth Scenario

3.4.2 Age Group Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Cervical Cancer Diagnostic Market, By Test Type

4.1 Test Type Outlook

4.2 PAP Testing

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 HPV Testing

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Colposcopy

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Cervical Biopsies

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Cystoscopy

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Cervical Cancer Diagnostic Market, By Age Group

5.1 Age Group Outlook

5.2 Age 20-40

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Age Above 40

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Cervical Cancer Diagnostic Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Test Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Age Group, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Age Group, 2019-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.4.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Test Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Age Group, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Age Group, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Test Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Age Group, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Test Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Age Group, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Age Group, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Age Group, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Siemens

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Cooper Surgical

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 F. Hoffmann-La Roche Ltd

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Arbor Vita

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Dickinson Becton and Company

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Hologic, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Guided Therapeutics

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Quest Diagnostics

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 OncoHealth Corp

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Cervical Cancer Diagnostic Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cervical Cancer Diagnostic Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS