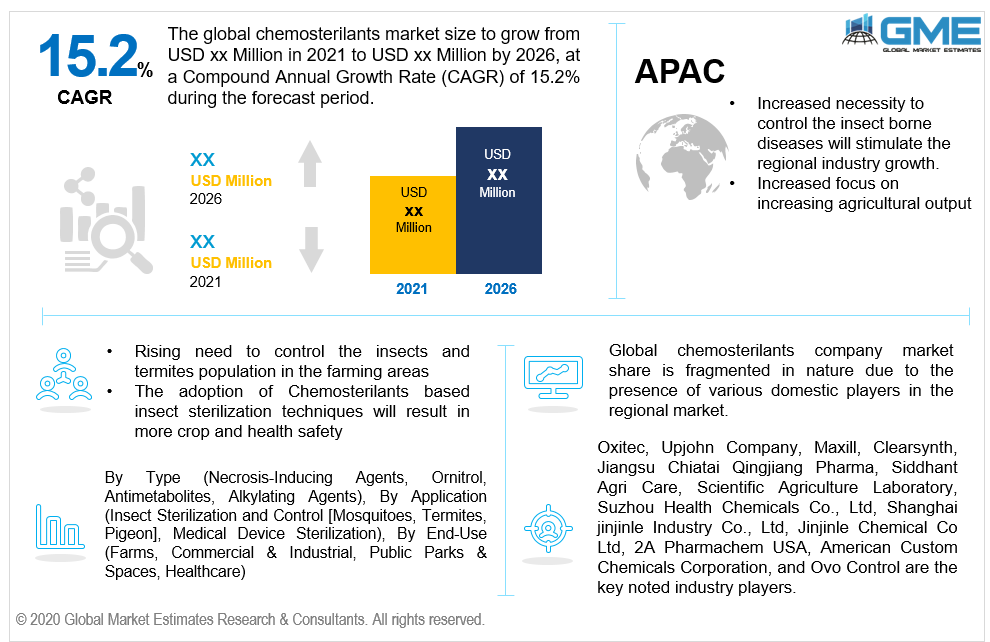

Global Chemosterilants Market Size, Trends & Analysis - Forecasts to 2026 By Type (Necrosis-Inducing Agents, Ornitrol, Antimetabolites, Alkylating Agents), By Application (Insect Sterilization and Control [Mosquitoes, Termites, Pigeon], Medical Device Sterilization), By End-Use (Farms, Commercial & Industrial, Public Parks & Spaces, Healthcare), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The rising need to control the insect and termites population in the farming areas to prevent the crop from damages and diseases will drive the Chemosterilants Market Growth. The different breeds of mosquitoes are responsible for crop damage, illness, and severe diseases in humans. Thus, the adoption of Chemosterilants-based insect sterilization techniques will result in more crop and health safety. However, the chemical is hazardous and prone to go through multiple approvals before usage. It can only be used for sterilizing a group of insects and can not be applied directly to the crop.

Another key crucial factor in the industry is the animal law pertaining to the population control of the pigeons. Thus, the manufacturer has to undergo various laws and regulations before making the final product commercialization and implementation.

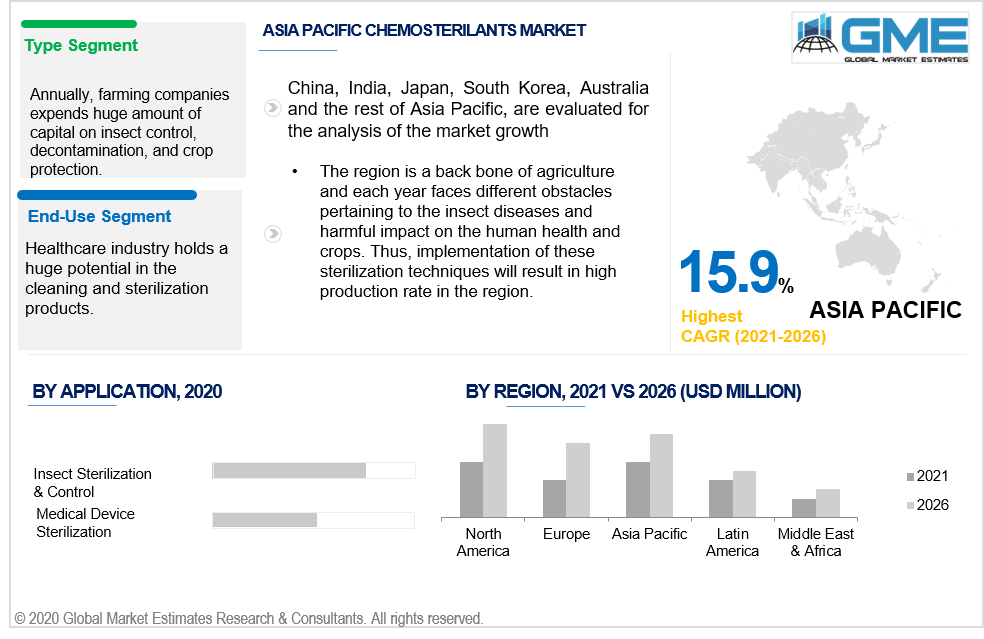

Necrosis-inducing agents, ornitrol, antimetabolites, and alkylating agents are major identified chemosterilant types used in the insect control industry. Annually, farming companies expends a huge amount of capital on insect control, decontamination, and crop protection. The industry implements diversified products and types to serve the purpose. The chemosterilants are proven to be an effective way to biocontrol the insects and protect the farm from crop damage and diseases. Thus, necrosis-inducing agents will lead the type segment in the coming years. The ornitol is responsible for pigeon birth control. The segment is gaining attention from the industrial sector.

By application, the market is categorized into insect sterilization & control and medical device sterilization. Insect sterilization & control is likely to lead the market due to its early and high adoption. The concept is not new for biocontrolling of insects but is gaining high popularity in recent years specifically for pigeon birth control. The medical sterilization process is proven to be effective in the healthcare sector. The segment will witness the fastest growth up to 2026.

By end-use, the industry is segmented into farms, commercial & industrial spaces, public parks & spaces, and healthcare. Farms will lead the end-use segment during the forecast period. Rapid overproduction of mosquitoes and termites along with their adverse impact on the farming output and human health are major factors to drive product demand in this segment. Another key factor is the safety from insect-borne diseases such as malaria and dengue. Overpopulation of mosquitoes and other termites is responsible for crop destruction and water contamination. Therefore, it is necessary to control the spread by adopting effective sterilization techniques.

Commercial & industrial spaces will observe the fastest growth by the end of 2026. Rising necessity to control the interference of the pigeons in the industrial spaces to avoid vigorous cleaning maintenance, accidents from slipping, and disease will support the growth in this segment.

The Healthcare industry holds a huge potential in cleaning and sterilization products. Chemosterilants are widely used in various medical devices. The segment will witness significant growth.

The North American Chemosterilants will dominate the regional market during the forecast period. Heavy spending on insect sterilization to control the population and protect the crops will be the key factors to drive the regional demand. Each year the farming industry faces an adverse impact on production due to the overpopulation of harmful insects to exploit the farmland. Thus, the introduction of termites, mosquitoes, and other insect sterilization will ease the farming process. However, strict guidelines from FDA regarding the chemical usage, quantity, and labeling may restrict the new market entrants.

The European Chemosterilants market will witness notable growth in the coming years. The increasing need to control the pigeon population in various industrial areas to keep the vicinity clean, prevent accidents, and diseases may result in demand for ornitol based control solutions. These chemicals are proven to be effective in controlling birth rates. Another key driving factor in the region is the increasing sterilization activities in healthcare facilities. Germany, UK, France, and Spain are major identified countries to gain maximum share during the forecast period.

The Asia Pacific Chemosterilants Market is projected to foresee high growth upto 2026. Increased farming activities along with the necessity to control the insect-borne diseases will stimulate the regional industry growth. The region is a backbone of agriculture and each year faces different obstacles pertaining to insect diseases and harmful impacts on the human health and crops. Thus, the implementation of these sterilization techniques will result in a high production rate in the region. China, India, Malaysia, and Thailand are major output contributing countries.

Global Chemosterilants Company Market Share is fragmented in nature due to the presence of various domestic players in the regional market. Regulatory approval and clearance from the respective organizations pertaining to the insects and birds are prime concerns to be noted by the industry manufacturers. Product advancement along with less impact on the environment are key strategies noted in the industry.

Oxitec, Upjohn Company, Maxill, Clearsynth, Jiangsu Chiatai Qingjiang Pharma, Siddhant Agri Care, Scientific Agriculture Laboratory, Suzhou Health Chemicals Co., Ltd, Shanghai jinjinle Industry Co., Ltd, Jinjinle Chemical Co Ltd, 2A Pharmachem USA, American Custom Chemicals Corporation, and Ovo Control are the keynoted industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Strategic partnerships with the agricultural or farming companies to create long-term collaborations with the end-users accompanied by product innovation to meet the new requirements will be key success factors in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Chemosterilants industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Application overview

2.1.4 End-Use overview

2.1.5 Regional overview

Chapter 3 Chemosterilants Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Chemosterilants Market, By Type

4.1 Type Outlook

4.2 Necrosis-inducing agents

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Ornitrol

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Antimetabolites

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Alkylating agents

4.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Chemosterilants Market, By Application

5.1 Application Outlook

5.2 Insect sterilization and control

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.2 Mosquitoes

5.2.2.1 Market size, by region, 2019-2026 (USD Million)

5.2.3 Termites

5.2.3.1 Market size, by region, 2019-2026 (USD Million)

5.2.4 Pigeon

5.2.4.1 Market size, by region, 2019-2026 (USD Million)

5.2.5 Others

5.2.5.1 Market size, by region, 2019-2026 (USD Million)

5.3 Medical device sterilization

5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Chemosterilants Market, By End-Use

6.1 End-Use Outlook

6.2 Farms

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Commercial & Industrial

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Public parks & spaces

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Healthcare

6.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Chemosterilants Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by type, 2019-2026 (USD Million)

7.2.3 Market size, by application, 2019-2026 (USD Million)

7.2.4 Market size, by end-use, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by application, 2019-2026 (USD Million)

7.2.5.3 Market size, by end-use, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by type, 2019-2026 (USD Million)

7.2.6.2 Market size, by application, 2019-2026 (USD Million)

7.2.6.3 Market size, by end-use, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by type, 2019-2026 (USD Million)

7.3.3 Market size, by application, 2019-2026 (USD Million)

7.3.4 Market size, by end-use, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by application, 2019-2026 (USD Million)

7.2.5.3 Market size, by end-use, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by type, 2019-2026 (USD Million)

7.3.6.2 Market size, by application, 2019-2026 (USD Million)

7.3.6.3 Market size, by end-use, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by type, 2019-2026 (USD Million)

7.3.7.2 Market size, by application, 2019-2026 (USD Million)

7.3.7.3 Market size, by end-use, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by type, 2019-2026 (USD Million)

7.3.8.2 Market size, by application, 2019-2026 (USD Million)

7.3.8.3 Market size, by end-use, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by type, 2019-2026 (USD Million)

7.4.3 Market size, by application, 2019-2026 (USD Million)

7.4.4 Market size, by end-use, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by type, 2019-2026 (USD Million)

7.4.5.2 Market size, by application, 2019-2026 (USD Million)

7.4.5.3 Market size, by end-use, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by type, 2019-2026 (USD Million)

7.4.6.2 Market size, by application, 2019-2026 (USD Million)

7.4.6.3 Market size, by end-use, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by type, 2019-2026 (USD Million)

7.4.7.2 Market size, by application, 2019-2026 (USD Million)

7.4.7.3 Market size, by end-use, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by type, 2019-2026 (USD Million)

7.4.8.2 Market size, by application, 2019-2026 (USD Million)

7.4.8.3 Market size, by end-use, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by type, 2019-2026 (USD Million)

7.4.9.2 Market size, by application, 2019-2026 (USD Million)

7.4.9.3 Market size, by end-use, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by type, 2019-2026 (USD Million)

7.5.3 Market size, by application, 2019-2026 (USD Million)

7.5.4 Market size, by end-use, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by type, 2019-2026 (USD Million)

7.5.5.2 Market size, by application, 2019-2026 (USD Million)

7.5.5.3 Market size, by end-use, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by type, 2019-2026 (USD Million)

7.5.6.2 Market size, by application, 2019-2026 (USD Million)

7.5.6.3 Market size, by end-use, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by type, 2019-2026 (USD Million)

7.6.3 Market size, by application, 2019-2026 (USD Million)

7.6.4 Market size, by end-use, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by type, 2019-2026 (USD Million)

7.6.5.2 Market size, by application, 2019-2026 (USD Million)

7.6.5.3 Market size, by end-use, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by type, 2019-2026 (USD Million)

7.6.6.2 Market size, by application, 2019-2026 (USD Million)

7.6.6.3 Market size, by end-use, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by type, 2019-2026 (USD Million)

7.6.7.2 Market size, by application, 2019-2026 (USD Million)

7.6.7.3 Market size, by end-use, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Oxitec

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Upjohn Company

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Maxill

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Clearsynth

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Jiangsu Chiatai Qingjiang Pharma

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Siddhant Agri Care

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Scientific Agriculture Laboratory

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Suzhou Health Chemicals Co., Ltd.

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Shanghai jinjinle Industry Co., Ltd

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 JINJINLE CHEMICAL CO LTD

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 2A Pharmachem USA

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 American Custom Chemicals Corporation

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Ovo Control

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

The Global Chemosterilants Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Chemosterilants Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS