Global Clinical Laboratory Services Market Size, Trends & Analysis - Forecasts to 2029 By Test Type (Clinical Chemistry, Immunology, Cytology, Genetics, Microbiology, Hematology, and Other Test Types), By Service Provider (Hospital-based Laboratories, Stand-alone Laboratories, and Clinic-based Laboratories), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

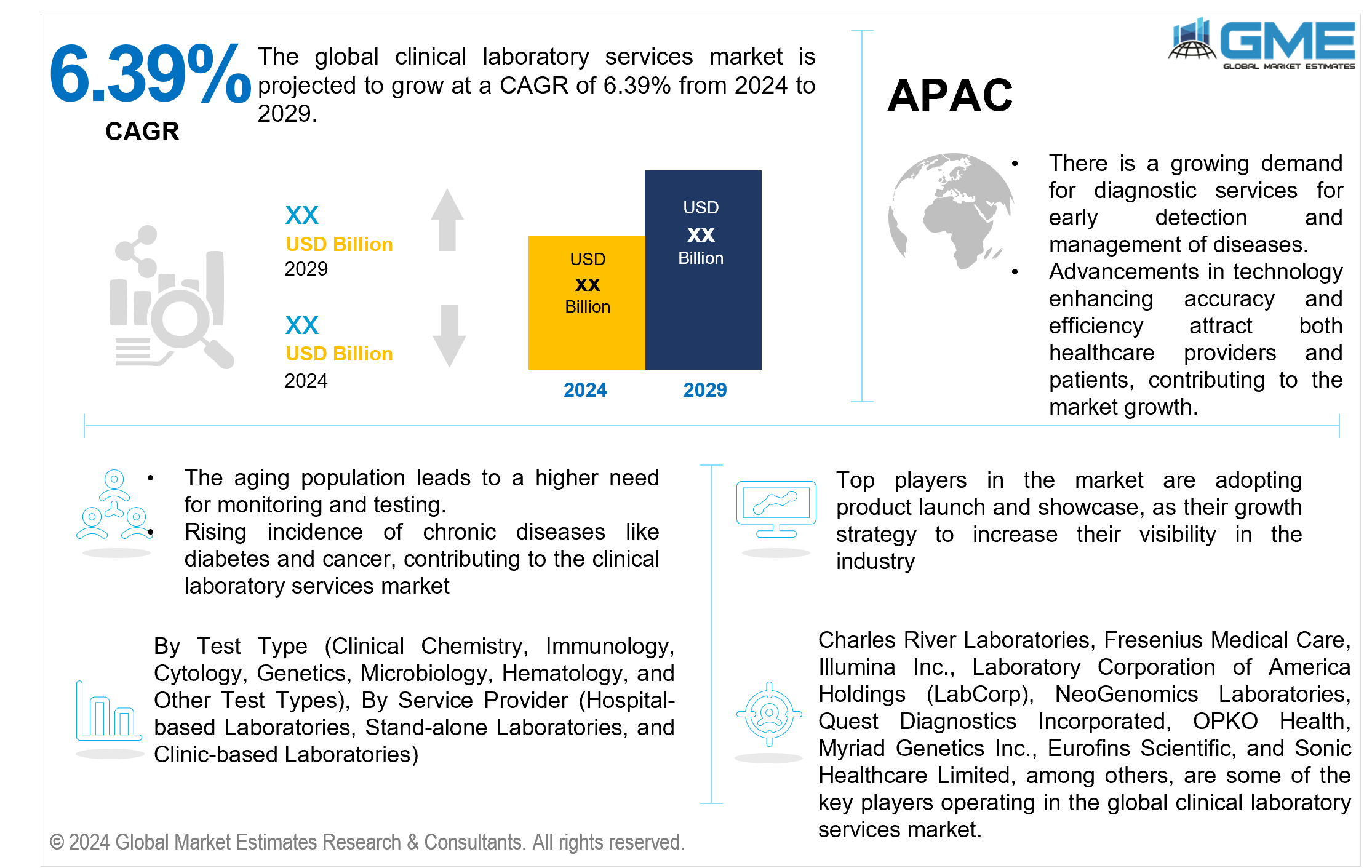

The global clinical laboratory services market is projected to grow at a CAGR of 6.39% from 2024 to 2029.

Advances in medical diagnostics technology are driving market growth. They allow for more precise and efficient clinical testing services across several disciplines, including clinical chemistry testing, hematology services, microbiology laboratory services, immunology testing market, and genetics. These developments have not only increased the number of tests accessible, but also improved the speed and accuracy of results, resulting in better patient outcomes.

The rising cases of chronic diseases such as cancer, diabetes, and cardiovascular disease increase the demand for diagnostic testing and monitoring in the medical diagnostics industry. This trend is mostly observed among aging populations and areas with a high incidence of these diseases.

Moreover, the growing need for healthcare laboratory services, particularly in emerging nations, has fueled the growth of laboratory testing solutions. As populations age and develop, so does the demand for diagnostic testing, increasing the number of tests performed. Furthermore, growing awareness of preventive healthcare measures and the necessity of early disease identification has increased demand for screening and diagnostic tests, accelerating market expansion.

The rise in personalized medicine and precision healthcare has increased the demand for specialized diagnostic laboratory services such as histopathology services and genetic testing services. Furthermore, the introduction of point-of-care testing (POCT) has transformed the delivery of diagnostic services by allowing for rapid testing and real-time decision-making at the patient's bedside or in remote locations, fueling future market expansion. In conclusion, a combination of technology developments, rising healthcare demand, and a shift toward personalized treatment is propelling the global clinical laboratory services market growth, with prospects for future expansion and innovation.

The merger of reference laboratory services and blood bank services also contributes to the clinical laboratory services market. These specialised services improve diagnostic accuracy and efficiency, addressing complicated testing and transfusion requirements, propelling market growth, and improving patient care results worldwide.

Navigating the complicated and changing regulatory landscape presents a significant challenge. Laboratories must follow severe standards imposed by several authorities (for example, the FDA in the United States and the EMA in Europe), which vary significantly by area. Changes in rules can increase expenses and necessitate constant adjustments to methods and technologies.

The clinical chemistry segment is expected to hold the largest share of the market. The segment's growth is due to its wide range of monitoring, disease diagnosis, and management applications. Clinical research laboratories, which examine blood and bodily fluids for signs of health and disease, are critical for assessing organ function, diagnosing metabolic abnormalities, and monitoring therapeutic interventions. The rising prevalence of chronic diseases and the growing need for preventative healthcare services are driving the segment's growth.

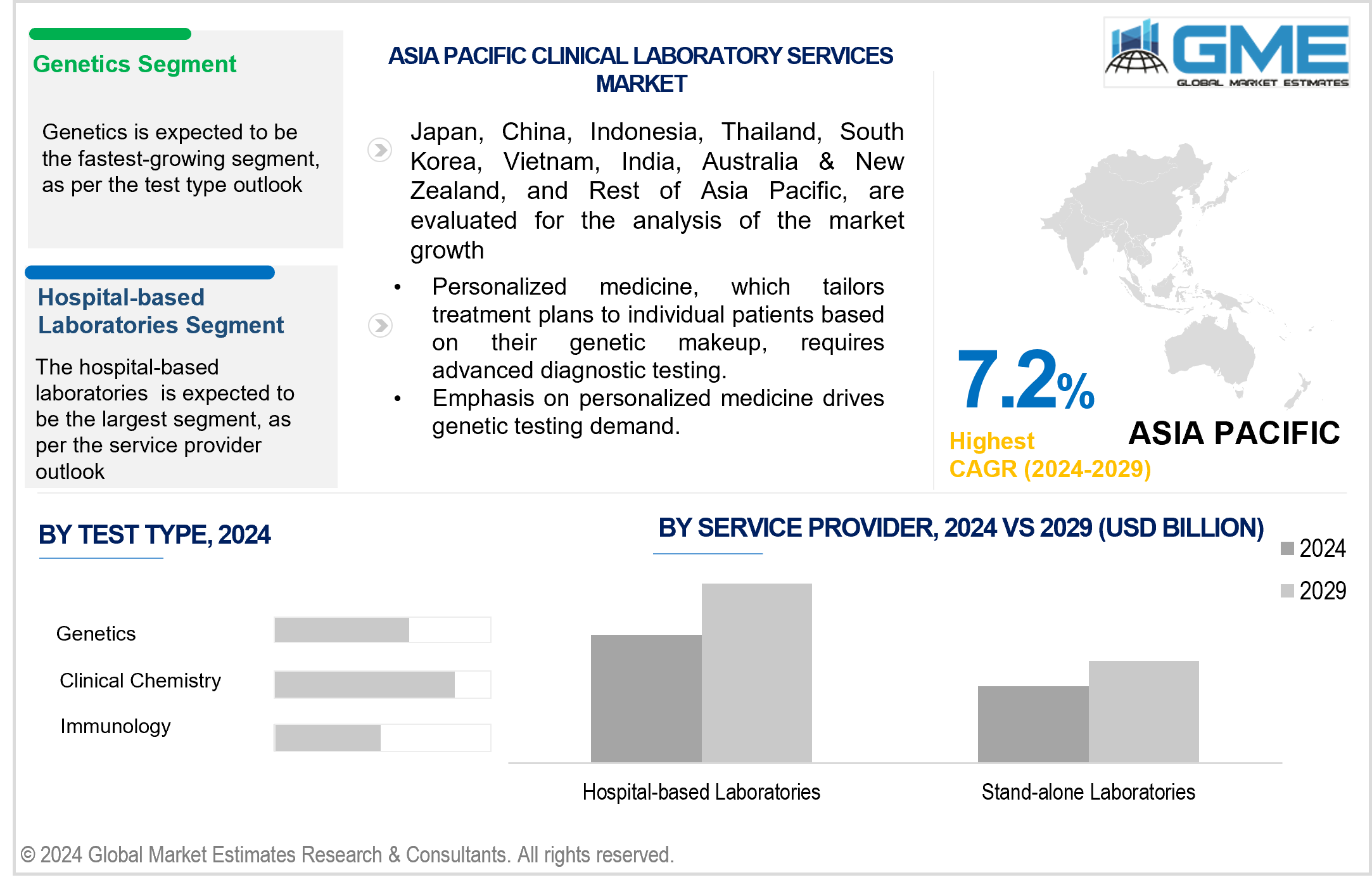

The genetics segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is attributed to the advances in genetic testing technologies and their growing applications in customized medicine. Clinical research laboratories use genetic tests to discover genetic abnormalities, cancer, and other inherited problems as early as possible. Rising consumer awareness, lowering genetic testing prices, and a growing emphasis on preventive healthcare all contribute to this segment's strong expansion, satisfying the demand for precise and tailored diagnostic solutions.

The stand-alone laboratories segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The growth of the segment is due to its cost-effectiveness, and capacity to quickly adapt new technologies. These laboratories frequently offer specialized services, faster turnaround times, and convenient locations in response to the growing consumer need for accessible and efficient diagnostic testing.

The hospital-based laboratories segment is expected to hold the largest share of the market. The growth of the segment is due to their integrated healthcare infrastructure, which enables instant access to a diverse variety of diagnostic services. Their ability to handle large patient numbers, provide specialist diagnostics, and facilitate timely clinical judgments strengthens their market position. Furthermore, the trust and dependability associated with hospital-based services, together with comprehensive healthcare delivery and ongoing advances in diagnostic technologies, contribute to the segment dominance in the market.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include advanced healthcare infrastructure, high healthcare spending, and extensive adoption of novel diagnostic technologies. The region's strong focus on early disease identification, robust R&D activity, and advantageous reimbursement policies contribute to market growth. Furthermore, the increased frequency of chronic diseases and a well-established regulatory framework contribute to North America's dominance in the market.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the increased expanding healthcare infrastructure, healthcare investments, and rising awareness about early disease detection. The rising incidence of chronic diseases and the large aging population have increased the demand for diagnostic services. Furthermore, economic development, technology developments, and government attempts to increase healthcare access and affordability all contribute to the region's market expansion.

Charles River Laboratories, Fresenius Medical Care, Illumina Inc., Laboratory Corporation of America Holdings (LabCorp), NeoGenomics Laboratories, Quest Diagnostics Incorporated, OPKO Health, Myriad Genetics Inc., Eurofins Scientific, and Sonic Healthcare Limited, among others, are some of the key players operating in the global clinical laboratory services market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Charles River Laboratories International, Inc. announced a strategic agreement with Wheeler Bio, Inc., an antibody contract development and manufacturing organization (CDMO). This partnership aims to accelerate the transition from discovery and CMC (Chemistry, Manufacturing, and Controls) development to manufacturing for early-stage biotechnology companies.

On 13th May 2024, Quest Diagnostics and PathAI announced a collaboration to accelerate the adoption of digital and AI pathology innovations for diagnosing cancer and other diseases.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL CLINICAL LABORATORY SERVICES MARKET, BY TEST TYPE

4.1 Introduction

4.2 Clinical Laboratory Services Market: Test Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Clinical Chemistry

4.4.1 Clinical Chemistry Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Immunology

4.5.1 Immunology Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Cytology

4.6.1 Cytology Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Genetics

4.7.1 Genetics Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Microbiology

4.8.1 Microbiology Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Hematology

4.9.1 Hematology Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Other Test Types

4.10.1 Other Test Types Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL CLINICAL LABORATORY SERVICES MARKET, BY SERVICE PROVIDER

5.1 Introduction

5.2 Clinical Laboratory Services Market: Service Provider Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Hospital-based Laboratories

5.4.1 Hospital-based Laboratories Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Stand-alone Laboratories

5.5.1 Stand-alone Laboratories Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Clinic-based Laboratories

5.6.1 Clinic-based Laboratories Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL CLINICAL LABORATORY SERVICES MARKET, BY REGION

6.1 Introduction

6.2 North America Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Test Type

6.2.2 By Service Provider

6.2.3 By Country

6.2.3.1 U.S. Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Test Type

6.2.3.1.2 By Service Provider

6.2.3.2 Canada Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Test Type

6.2.3.2.2 By Service Provider

6.2.3.3 Mexico Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Test Type

6.2.3.3.2 By Service Provider

6.3 Europe Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Test Type

6.3.2 By Service Provider

6.3.3 By Country

6.3.3.1 Germany Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Test Type

6.3.3.1.2 By Service Provider

6.3.3.2 U.K. Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Test Type

6.3.3.2.2 By Service Provider

6.3.3.3 France Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Test Type

6.3.3.3.2 By Service Provider

6.3.3.4 Italy Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Test Type

6.3.3.4.2 By Service Provider

6.3.3.5 Spain Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Test Type

6.3.3.5.2 By Service Provider

6.3.3.6 Netherlands Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Test Type

6.3.3.6.2 By Service Provider

6.3.3.7 Rest of Europe Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Test Type

6.3.3.6.2 By Service Provider

6.4 Asia Pacific Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Test Type

6.4.2 By Service Provider

6.4.3 By Country

6.4.3.1 China Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Test Type

6.4.3.1.2 By Service Provider

6.4.3.2 Japan Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Test Type

6.4.3.2.2 By Service Provider

6.4.3.3 India Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Test Type

6.4.3.3.2 By Service Provider

6.4.3.4 South Korea Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Test Type

6.4.3.4.2 By Service Provider

6.4.3.5 Singapore Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Test Type

6.4.3.5.2 By Service Provider

6.4.3.6 Malaysia Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Test Type

6.4.3.6.2 By Service Provider

6.4.3.7 Thailand Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Test Type

6.4.3.6.2 By Service Provider

6.4.3.8 Indonesia Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Test Type

6.4.3.7.2 By Service Provider

6.4.3.9 Vietnam Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Test Type

6.4.3.8.2 By Service Provider

6.4.3.10 Taiwan Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Test Type

6.4.3.10.2 By Service Provider

6.4.3.11 Rest of Asia Pacific Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Test Type

6.4.3.11.2 By Service Provider

6.5 Middle East and Africa Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Test Type

6.5.2 By Service Provider

6.5.3 By Country

6.5.3.1 Saudi Arabia Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Test Type

6.5.3.1.2 By Service Provider

6.5.3.2 U.A.E. Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Test Type

6.5.3.2.2 By Service Provider

6.5.3.3 Israel Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Test Type

6.5.3.3.2 By Service Provider

6.5.3.4 South Africa Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Test Type

6.5.3.4.2 By Service Provider

6.5.3.5 Rest of Middle East and Africa Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Test Type

6.5.3.5.2 By Service Provider

6.6 Central and South America Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Test Type

6.6.2 By Service Provider

6.6.3 By Country

6.6.3.1 Brazil Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Test Type

6.6.3.1.2 By Service Provider

6.6.3.2 Argentina Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Test Type

6.6.3.2.2 By Service Provider

6.6.3.3 Chile Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Test Type

6.6.3.3.2 By Service Provider

6.6.3.3 Rest of Central and South America Clinical Laboratory Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Test Type

6.6.3.3.2 By Service Provider

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Charles River Laboratories

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Fresenius Medical Care

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Illumina Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Laboratory Corporation of America Holdings (LabCorp)

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 NeoGenomics Laboratories

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Quest Diagnostics Incorporated

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 OPKO Health

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Myriad Genetics Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Eurofins Scientific

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Sonic Healthcare Limited

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

2 Clinical Chemistry Market, By Region, 2021-2029 (USD Mllion)

3 Immunology Market, By Region, 2021-2029 (USD Mllion)

4 Genetics Market, By Region, 2021-2029 (USD Mllion)

5 Microbiology Market, By Region, 2021-2029 (USD Mllion)

6 Cytology Market, By Region, 2021-2029 (USD Mllion)

7 Hematology Market, By Region, 2021-2029 (USD Mllion)

8 Other Test Types Market, By Region, 2021-2029 (USD Mllion)

9 Global Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

10 Hospital-based Laboratories Market, By Region, 2021-2029 (USD Mllion)

11 Stand-alone Laboratories Market, By Region, 2021-2029 (USD Mllion)

12 Clinic-based Laboratories Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

15 North America Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

16 North America Clinical Laboratory Services Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

18 U.S. Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

19 Canada Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

20 Canada Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

21 Mexico Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

22 Mexico Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

23 Europe Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

24 Europe Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

25 Europe Clinical Laboratory Services Market, By Country, 2021-2029 (USD Mllion)

26 Germany Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

27 Germany Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

28 U.K. Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

29 U.K. Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

30 France Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

31 France Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

32 Italy Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

33 Italy Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

34 Spain Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

35 Spain Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

36 Netherlands Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

37 Netherlands Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

38 Rest Of Europe Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

39 Rest Of Europe Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

40 Asia Pacific Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

41 Asia Pacific Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

42 Asia Pacific Clinical Laboratory Services Market, By Country, 2021-2029 (USD Mllion)

43 China Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

44 China Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

45 Japan Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

46 Japan Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

47 India Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

48 India Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

49 South Korea Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

50 South Korea Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

51 Singapore Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

52 Singapore Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

53 Thailand Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

54 Thailand Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

55 Malaysia Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

56 Malaysia Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

57 Indonesia Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

58 Indonesia Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

59 Vietnam Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

60 Vietnam Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

61 Taiwan Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

62 Taiwan Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

63 Rest of APAC Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

64 Rest of APAC Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

65 Middle East and Africa Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

66 Middle East and Africa Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

67 Middle East and Africa Clinical Laboratory Services Market, By Country, 2021-2029 (USD Mllion)

68 Saudi Arabia Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

69 Saudi Arabia Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

70 UAE Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

71 UAE Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

72 Israel Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

73 Israel Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

74 South Africa Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

75 South Africa Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

78 Central and South America Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

79 Central and South America Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

80 Central and South America Clinical Laboratory Services Market, By Country, 2021-2029 (USD Mllion)

81 Brazil Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

82 Brazil Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

83 Chile Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

84 Chile Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

85 Argentina Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

86 Argentina Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Clinical Laboratory Services Market, By Test Type, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Clinical Laboratory Services Market, By Service Provider, 2021-2029 (USD Mllion)

89 Charles River Laboratories: Products & Services Offering

90 Fresenius Medical Care: Products & Services Offering

91 Illumina Inc.: Products & Services Offering

92 Laboratory Corporation of America Holdings (LabCorp): Products & Services Offering

93 NeoGenomics Laboratories: Products & Services Offering

94 QUEST DIAGNOSTICS INCORPORATED: Products & Services Offering

95 OPKO Health : Products & Services Offering

96 Myriad Genetics Inc.: Products & Services Offering

97 Eurofins Scientific, Inc: Products & Services Offering

98 Sonic Healthcare Limited: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Clinical Laboratory Services Market Overview

2 Global Clinical Laboratory Services Market Value From 2021-2029 (USD Mllion)

3 Global Clinical Laboratory Services Market Share, By Test Type (2023)

4 Global Clinical Laboratory Services Market Share, By Service Provider (2023)

5 Global Clinical Laboratory Services Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Clinical Laboratory Services Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Clinical Laboratory Services Market

10 Impact Of Challenges On The Global Clinical Laboratory Services Market

11 Porter’s Five Forces Analysis

12 Global Clinical Laboratory Services Market: By Test Type Scope Key Takeaways

13 Global Clinical Laboratory Services Market, By Test Type Segment: Revenue Growth Analysis

14 Clinical Chemistry Market, By Region, 2021-2029 (USD Mllion)

15 Immunology Market, By Region, 2021-2029 (USD Mllion)

16 GeneticsMarket, By Region, 2021-2029 (USD Mllion)

17 Microbiology Market, By Region, 2021-2029 (USD Mllion)

18 Cytology Market, By Region, 2021-2029 (USD Mllion)

19 Hematology Market, By Region, 2021-2029 (USD Mllion)

20 Other Test Types Market, By Region, 2021-2029 (USD Mllion)

21 Global Clinical Laboratory Services Market: By Service Provider Scope Key Takeaways

22 Global Clinical Laboratory Services Market, By Service Provider Segment: Revenue Growth Analysis

23 Hospital-based Laboratories Market, By Region, 2021-2029 (USD Mllion)

24 Stand-alone Laboratories Market, By Region, 2021-2029 (USD Mllion)

25 Clinic-based Laboratories Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Clinical Laboratory Services Market: Regional Analysis

28 North America Clinical Laboratory Services Market Overview

29 North America Clinical Laboratory Services Market, By Test Type

30 North America Clinical Laboratory Services Market, By Service Provider

31 North America Clinical Laboratory Services Market, By Country

32 U.S. Clinical Laboratory Services Market, By Test Type

33 U.S. Clinical Laboratory Services Market, By Service Provider

34 Canada Clinical Laboratory Services Market, By Test Type

35 Canada Clinical Laboratory Services Market, By Service Provider

36 Mexico Clinical Laboratory Services Market, By Test Type

37 Mexico Clinical Laboratory Services Market, By Service Provider

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Charles River Laboratories: Company Snapshot

41 Charles River Laboratories: SWOT Analysis

42 Charles River Laboratories: Geographic Presence

43 Fresenius Medical Care: Company Snapshot

44 Fresenius Medical Care: SWOT Analysis

45 Fresenius Medical Care: Geographic Presence

46 Illumina Inc.: Company Snapshot

47 Illumina Inc.: SWOT Analysis

48 Illumina Inc.: Geographic Presence

49 Laboratory Corporation of America Holdings (LabCorp): Company Snapshot

50 Laboratory Corporation of America Holdings (LabCorp): Swot Analysis

51 Laboratory Corporation of America Holdings (LabCorp): Geographic Presence

52 NeoGenomics Laboratories: Company Snapshot

53 NeoGenomics Laboratories: SWOT Analysis

54 NeoGenomics Laboratories: Geographic Presence

55 Quest Diagnostics Incorporated: Company Snapshot

56 Quest Diagnostics Incorporated: SWOT Analysis

57 Quest Diagnostics Incorporated: Geographic Presence

58 OPKO Health : Company Snapshot

59 OPKO Health : SWOT Analysis

60 OPKO Health : Geographic Presence

61 Myriad Genetics Inc.: Company Snapshot

62 Myriad Genetics Inc.: SWOT Analysis

63 Myriad Genetics Inc.: Geographic Presence

64 Eurofins Scientific, Inc.: Company Snapshot

65 Eurofins Scientific, Inc.: SWOT Analysis

66 Eurofins Scientific, Inc.: Geographic Presence

67 Sonic Healthcare Limited: Company Snapshot

68 Sonic Healthcare Limited: SWOT Analysis

69 Sonic Healthcare Limited: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Clinical Laboratory Services Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Clinical Laboratory Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS